Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

The chutes and ladders framing we laid out in our Capital Markets Forecast (CMF) remains quite relevant as we pass the midpoint of 2025Q2. In recent weeks the Trump Administration shortened the tariff “chute” by striking preliminary agreements with the U.K. and China, while the Republican-controlled Congress put the fiscal policy “ladder” into full view by clearing another hurdle for the much-anticipated tax bill. Financial markets have been buoyed by progress on both the tariff and tax fronts, with the S&P 500 index of domestic large-cap stocks moving into positive territory YTD, and only 3% below all-time highs at the end of last week.

We are encouraged by the developments and have upgraded our outlook, though we still anticipate economic stagnation in the year ahead. We think there is a 50:50 chance, a coin flip, of whether the weakness translates to an official “recession” or just a dramatic slowdown.

That said, we expect the market to “look through” short-term economic weakness to a resumption of strength on the other side. The recent rally in equities and improvement in investor sentiment helps the stock market’s momentum but also leaves the upside and downside risks more balanced from here. As long-term investors, we remain neutral to equities versus our long-term strategic benchmark while favoring investment-grade fixed income over high yield.

A shorter tariff chute, but still a chute

In March and April the economy and markets were riding a chute that seemed to have no end, dragging down the outlook for growth, taking equities along for the ride. The news on May 8 of a trade agreement between the U.S. and U.K. was a positive signal but hardly a breakthrough. This was always the lowest hanging fruit, as the U.S. runs a trade surplus with the U.K. (trade deficits are a main source of ire for President Trump) and the U.K. mostly had similar-to-lower tariff rates than the U.S., according to World Trade Organization data. It was the May 12 announcement of a détente with China, dramatically reducing bilateral tariffs for 90 days, that changed the game.

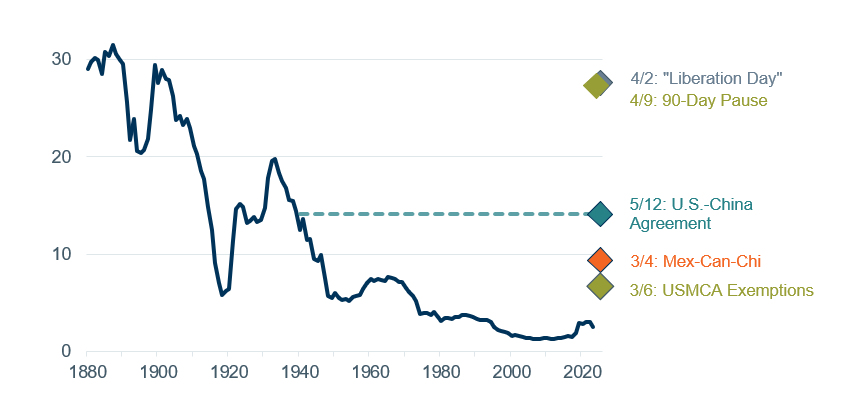

We are encouraged by the reduction of tariffs but had not expected the U.S.’s 145% levy on China’s products (nor China’s tariffs of 125% on U.S. products) to endure. With the U.S. maintaining a 30% tariff on China, along with an apparent floor of 10% with any other trading partner (the outcome of the U.K. agreement), we estimate the effective tariff rate (ETR) at 14%, shown below in Figure 1. When applied to import levels from 2024, that would be a tax hike of $460 billion, equivalent to 1.6% of gross domestic product (GDP), a strikingly contractionary policy. As we have argued before, we don’t think the consumer is in strong enough shape to handle such a sharp tax hike and that economic weakness will ensue.

Figure 1: Some Relief but Tariffs Still High

U.S. Effective Tariff Rate (%)

Data as of May 12, 2025. Sources: Yale Budget Lab, WTIA.

The hit to business

We also see challenges for businesses. In his Meet the Press interview, President Trump signaled businesses, even small business, would not need any kind of relief from tariffs, saying, “They’re not going to need it,” and, “Remember, there are no tariffs if you build your product here.” While the U.S. could shift to more domestic production, that could take years if not decades, and we are most focused on the near-term risks, where the U.S. relies significantly on imports, nearly all of which are facing at least a 10% tariff.

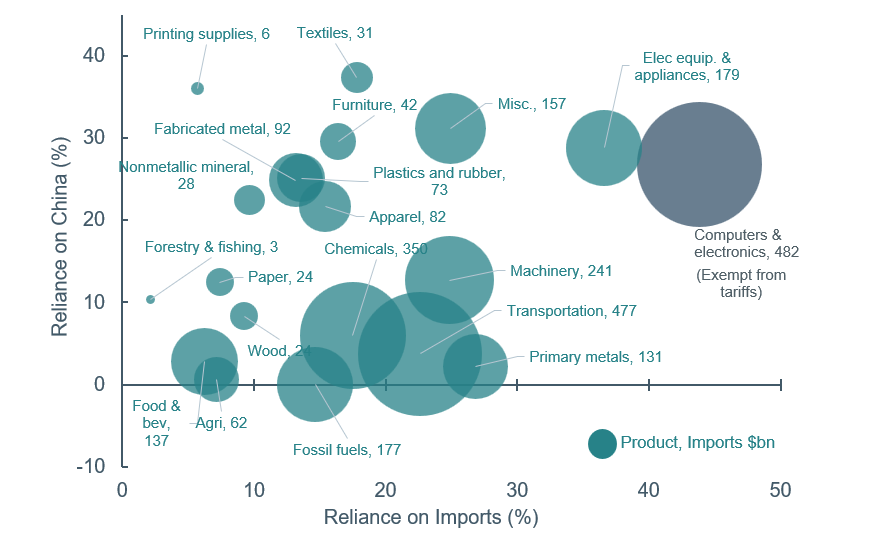

Figure 2 shows the degree to which U.S. businesses rely on imports. Items that are further to the right on the x-axis rely more on imports, and items that are higher up on the y-axis have a larger share that are imported from China. U.S. consumers and businesses purchased a total of $484 billion electrical equipment and appliances, and 37% of them ($179 billion) were imported. Of the $179 billion of imports, 29% came from China. There is some ability for firms to source products away from China but are facing at least a 10% increased tariff unless they find domestic sources, but the capacity does not currently exist.

In addition to the higher cost, there is also heightened uncertainty. Businesses, like investors, are in wait-and-see mode during these 90-day negotiation periods, and uncertainty leads to less capital expenditures and less hiring. A survey taken in the second half of April, fully after the initial tariff developments earlier in the month, showed firms on net are planning to “scale back”, which would drag on economic activity. We see the direct cost of tariffs and the uncertainty for businesses as likely to drag on business spending and hiring, weighing on GDP growth.

Figure 2: U.S. economy relies on imports, at least for now

U.S. reliance on imports (x axis), reliance on China (y axis), and volume of imports (circle size)

Data as annual from 2023.

Sources: Bureau of Economic Analysis, U.S. Census Bureau, WTIA.

Reliance on China: The percent of total imports that were imported from China.

Reliance on Imports: The percent of domestic consumption of each good type that was imported.

The emerging ladder

President Trump and the Republican-led Congress are moving forward in earnest to extend the personal tax cuts of the 2017 Tax Cuts and Jobs Act (TCJA, expiring at the end of this year), as well as implement additional consumer- and business-friendly tax policies put forth during the presidential campaign. This is an important “ladder” for the economy and markets, as it could serve to neutralize some of the tariff headwinds and thaw business investment.

The machinations of getting the budget reconciliation bill through Congress are beyond the scope of this note, and there are several big hurdles to go that could change the shape of the bill. Republicans are looking to complete the bill by the summer, ahead of the debt ceiling “X” date (August), as an extension of the debt ceiling is also wrapped into the bill. The details of the bill will change between now and then. That said, it’s looking likely that all personal tax cuts of the TCJA will be extended at a cost of $3.5T over 10 years, with an additional $600B of personal tax provisions on the table including an increase in the state and local tax (SALT) deduction, no tax on tips or overtime, an increased deduction for seniors and children, and deduction of auto loan interest.

The corporate tax cuts of the TCJA were made permanent at the time, but Republicans are looking for additional pro-business tax policies at a cost of around $335B, to be implemented retroactively to the beginning of 2025. These include 5 years of bonus depreciation and immediate expensing of research & development investment, as well as increased deductibility of interest expenses and an increase in the qualified business interest deduction.

We characterize the tax bill as a ladder, as the fiscal stimulus to consumers and businesses will hopefully provide some economic offset to the contractionary tariff policy while unlocking business investment and mergers & acquisitions—both of which are stalling in the first half of the year. However, there are two main issues that are shortening this ladder relative to the tariff chute. First, there is a timing mismatch. The tariffs are a tax hike that will be felt this year, while the benefits of the tax provisions will mostly start to be realized in 2026 and spread over future years. Second, the Republican tax bill is currently calling for a deficit expansion of approximately $2.5T. On the heels of Moody’s downgrade of the U.S. debt rating, this could contribute to higher Treasury yields, thereby increasing borrowing for consumers and businesses and mitigating some of the stimulus.

Weakness on the horizon

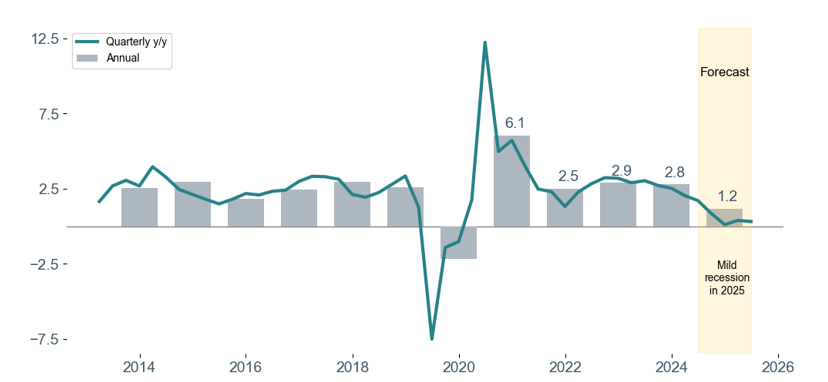

In response to these developments we are upgrading our forecast, but it remains on the weaker side. We expect two negative quarters for GDP in 2025, modest job losses, and for the unemployment rate to move up closer to 5%. Technically this would likely be deemed to be a recession. But it is so mild that annual growth for the U.S. in 2025 would come to 1.2% (Figure 3).

Figure 3: Mild Recession Expected This Year

U.S. Gross Domestic Product Growth and Forecast (%)

Data as of May 16, 2025. Sources: Bureau of Economic Analysis, WTIA.

Markets choosing the glass half full

The S&P 500 has now climbed more than 19% from the April 8 low, bringing the index into positive territory for the year and within 3% of the February all-time high. With our recession odds at 50%, it’s reasonable to question if equity investors are being complacent. The answer: possibly, but not necessarily. The market is now trading back above 21x forward earnings estimates, and those estimates have been revised down only modestly—in line with the normal trajectory of earnings estimates but not pricing in recessionary conditions. We typically would expect earnings estimates to contract 10-15% and the price-to-earnings multiple to trough around 15 in a recession scenario, posing downside risk to the market.

However, this could be a case where the market looks through a mild recession. After all, we came into the year expecting a slowing economy but observing solid balance sheets on the part of consumers and businesses. Tariff uncertainty could paralyze business investment and consumer spending, but we expect resolution to this tariff uncertainty in the second half of this year. In this case, we could see a recession that is more of a short-lived stalling out of the economy, rather than a deeper retrenchment or deleveraging of some portion of the economy typically associated with deeper equity market drawdowns. We doubt the market will climb straight up from here, but we recommend a full allocation to equities. For anyone with excess cash on the sidelines, the inevitable pockets of volatility could serve as strategic opportunities to get invested.

Core Narrative

Our outlook for the economy has improved at the margin in recent weeks, but we expect economic slowing and possible recession. The market has made a stunning recovery from the April 2 tariff announcements and is now looking fairly optimistic. We acknowledge both the upside and downside risks facing investors and are maintaining a neutral allocation to equities and fixed income in portfolios, with a preference for investment-grade over high-yield fixed income. The unemployment rate will likely climb into 2026, with the default rate increasing, as well. It is prudent to maintain vigilance when it comes to credit research, skewing toward higher quality in fixed income. We also retain a preference for higher quality within equities, preferring companies with durable earnings and low leverage. There is still an incredible amount of uncertainty regarding the chutes and ladders, and we will continue to update as our views evolve.

Descriptions

The S&P 500 index is a stock market index that tracks the performance of the 500 largest U.S. companies listed on stock exchanges.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today