Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Financial markets exulted when President Trump walked back his “reciprocal tariffs” on Wednesday just hours after they had gone into effect. Domestic equity indices posted historic gains with the tech-heavy Nasdaq jumping 12%, the S&P gaining 9.5% and the Russell 2000 index of small cap companies leaping 8.7%. The relief was palpable in offices and on trading floors, punctuated by a sea of green numbers scrolling on business channel chyrons.

But how much has really changed? On a country-by-country level, there was a significant shift. President Trump said “[w]e don’t want to hurt countries that don’t need to be hurt, and they all want to negotiate” when he issued a 90-day delay of the punitively high, extra tariffs on the special list of trading partners revealed in the Rose Garden just a week before. He simultaneously turned the screws on China raising the tariff on their goods to 145%.

For the overall tariff hikes, as dimensioned by the U.S. effective tariff rate, very little changed. The tariffs on all trading partners only came down to the global minimum of 10% which had gone into effect on April 5 and is starkly higher than import duties have been for a generation. However, tariffs on China have been increased dramatically in just a few days. Additionally, businesses are facing at least another 90 days of uncertainty, which can have a chilling effect on capital expenditures and hiring.

On the plus side, the President revealed that he does in fact care about the spillover effects of a stock market in free fall, and he has shown through negotiations with trade partners (other than China, so far) “off ramp” from the trade war highway. To us, this appears to have taken the worst case scenario off the table--a market positive. The main questions now are whether the current rates represent a “ceiling” or a “floor,” how long negotiations will take, and his appetite for a deal with China. Chief Investment Officer Tony Roth will consider these in his quarterly Capital Perspectives letter to clients next week.

We are reducing our probability of recession to 55%, from the 60% we established after the Rose Garden announcements, citing the still-high tariff levels, which reflect an historic tax hike as well as still-pervasive uncertainty. We did not react to market convulsions over the past week, as derisking would have meant investors would have missed out on one of the largest bounces in history. But risk remains and we continue to hold a neutral position to long term benchmarks across portfolios.

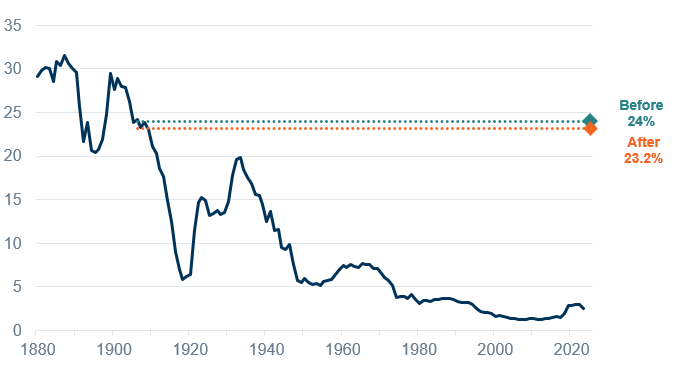

Figure 1: Before and After Trump Paused and China Escalation

U.S. Effective Tariff Rate (%)

Data as of April 9, 2025. Sources: Yale Budget Lab, WTIA.

Historically high tariff rates (Yes, still)

Perhaps the most surprising outcome from Wednesday is the overall tariff burden barely budged. When President Trump announced the pause we had just concluded a client webinar where we had estimated the effective tariff rate (ETR) would be 24%, a tax hike of $795B based on 2024 import levels. The tariff reductions for nearly all nations reduces that estimate by $192bn but the escalation with China - an increase of $92bn - cancels much of that out. Our updated calculations show an ETR of 23.2%, still the highest since 1909. Underneath the hood, the profile of goods has shifted, which is material for specific industries and companies, but the overall tariff load remains a burden for a consumer that we still view as vulnerable to such a shock.

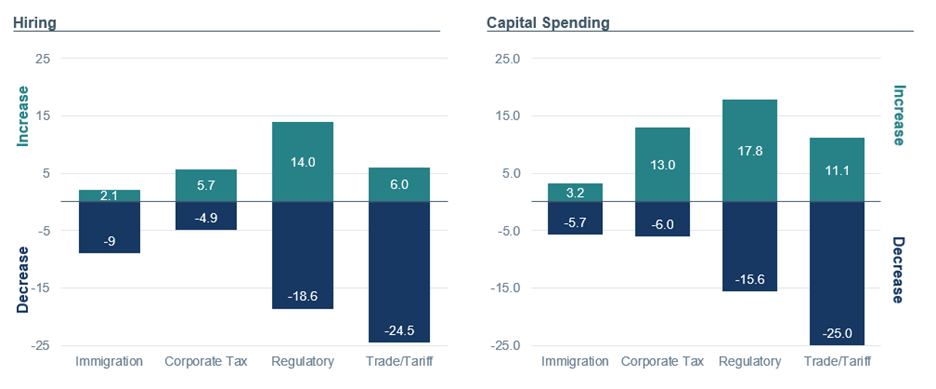

As we said last week, the deleterious impacts of uncertainty are harder to see and predict, and very little has changed on that front. The 90-day reprieve extends the period of uncertainty and decreases the likelihood that firms will make long-term investments or expand their workforce. A survey of CFOs showed government policies thus far in 2025 have weighed on plans for hiring and capital expenditures this year.

We think the historic tariff hike will be passed on to U.S. consumers and firms. Those tax hikes combined with uncertainty will weigh on growth, in our view, and make a recession in 2025 more likely than not.

Figure 2: Firms Cutting Back on Hiring and Capital Expenditures (Capex)

How have your company’s 2025 plans changed?

Data as of March 26, 2025. Sources: The CFO Survey (Duke, Federal Reserve Banks of Atlanta and Richmond), WTIA.

Optimism is still an option

Despite our expectation of a recession there remain several reasons to remain optimistic. They include President Trump’s reaction to markets, the U.S. and trading partners willingness’ to negotiate, and possible reprieves for China. Longer term, there is a possibility of more open trade than before Inauguration Day.

Trump acknowledged the role of markets and businesses in his decision to pause tariffs. When asked why he did it he said “I thought people were jumping a little bit out of line, a little bit ‘yippy’”, likely referencing golfers who get the ‘yips’ when putting. News reports indicate he leaned more towards Treasury Secretary Scott Bessent in the critical hours as bond yields kept drifting higher, the opposite of what one might expect in a risk-off trade. He reportedly told advisors he is willing to risk recession but not a depression. In any case, the events show a willingness to change course as opposed to an immutable, dogmatic approach to economic policy.

Many countries publicly stated their willingness to negotiate trade terms, and the White House reported an even longer list that had contacted them. Such an open dialogue could extend the 90-day delays, lead to tariffs lower than the 10% global minimum, and lead to better trade relationships down the line.

There was even softer language about China. President Trump said late Wednesday that he “can’t imagine” raising tariffs higher than the 145% now in place, appearing to set a ceiling. That is a very high and expensive ceiling, but the sentiment conveys a softening of rhetoric, and it was accompanied by flattering remarks about President Xi, calling him “a very smart man” and anticipates getting on a call with him then it’s “off to the races.”

In summary, President Trump’s posture and language changed significantly to the positive on Wednesday alongside his pause of the punitive tariffs. That points to the possibility of brighter days ahead.

Core Narrative

We remain cautious on both the upside and downside risks facing investors and are maintaining portfolios as neutral to long-term benchmarks across asset classes. We described those two way risks as Chutes and Ladders in our Capital Market Forecasts, and so far have experienced the worst of the chutes that we had anticipated. But the S&P 500 is down about 15% as of midafternoon April 10, 2025, from its record high, well within the range of a historical corrections and along the lines we expected given the lofty tech valuations at the start of the year. We still see downside risks but cannot ignore the possible upside risks of an improved trade environment, fiscal stimulus, and strong productivity that could boost the economy in markets.

Descriptions

Nasdaq is an online global marketplace for buying and trading securities—the world's first electronic exchange. It operates 29 markets, one clearinghouse, and five central securities depositories in the United States and Europe.

The S&P 500 index is a stock market index that tracks the performance of the 500 largest U.S. companies listed on stock exchanges.

The Russell 2000 Index is a stock market index that tracks the performance of approximately 2,000 of the smallest publicly traded companies in the U.S., serving as a benchmark for small-cap stocks.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today