Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

As the collective economic world tries to divine when the Fed will be making its first interest rate cut, there is an understandable focus on inflation data and outlook. But there should be an equal amount of attention devoted to the labor market, as it is the other half of the Fed’s “dual mandate.” In 2024, the Fed elevated the labor market to have equal importance for its interest rate decisions, following roughly two years of giving more consideration to the inflation side of the mandate. As for the inflation outlook, our view has not changed. We said in an earlier Wilmington Wire post that we expected the high readings in 1Q 2024 to give way to lower figures in 2Q, and low enough for the Fed to regain confidence in the inflation outlook and cut rates by 75 basis points, or bps (0.75%) in 2024, starting in July. Recent inflation readings support our view. If the June 12 inflation reading is higher than we expect, we would push the first cut to the September meeting, but the most important takeaway is the Fed should be starting a cut cycle soon.

The labor market is the key to rate cuts because the impact is asymmetric: A strong labor market is not prompting Fed hawkishness but a weak labor market gives it a reason to cut. On the first point, even with the strong jobs report this week, Chair Powell and the FOMC have made it clear since January 2024 that strong job growth is not a problem so long as it doesn’t cause inflation. The experience of 2023 was strong job growth that helped to bring down inflation, as more workers helped firms fill orders, deliver meals, and flip hotel rooms, a strong supply-side impact. Second, even though the labor market looks strong enough at the headline, there are several dynamics at work underneath the surface that reveal a weakening trend. They include the sharp fall in job postings by firms, the end of job hopping by workers, and a large increase in people who have lost jobs. As a kicker, recent data revealed that job growth was much weaker in 2023 than initially thought. All of these point to a strong likelihood of Fed rate cuts this year.

The Fed’s lens for the labor market

Putting the labor market on par with inflation

Some commentators refer to the December 2023 meeting as a “Fed pivot” because the committee did not make the final rate hike that had been projected and also projected a faster rate cut path in 2024. For us, the real pivot came a month later in January, not in terms of rate projections, but in how the Fed altered its approach. As we said in an earlier blog post, that was when Powell abandoned the view that the group needed to see a weak economy and a much weaker labor market in order to cut rates.

The other crucial pivot at that January 31 press conference was a very intentional message that the Fed was once again taking a balanced approach to its dual mandate of managing inflation and employment. In January, after spending roughly two years with a near-singular focus on rampant inflation, Powell said with the sharp slowdown in price pressures that “the risks to achieving our employment and inflation goals are moving into better balance.” That message, that the committee was giving equal weight to inflation and employment, has been reinforced at each subsequent meeting.

In fact, Powell has gone so far as to remind reporters—who ask more about inflation than employment—at the end of his answers about rate cuts that the Fed is “also prepared to respond to an unexpected weakening in the labor market,” even when it’s not even part of the question.

Strong job growth is good

The pivot in January included the Fed capitulating on how it views the labor market, finally taking the stance that strong job growth is a good thing. For the preceding two years, the Fed stuck to a framework that insisted a weak labor market was necessary for inflation to come down. Powell himself warned of “pain” in the labor market multiple times as a necessary condition for easing inflation. But the experience of 2023, strong job growth and a dramatic slowing of inflation, changed the central bank’s view. It recognized that strong productivity growth was helping keep firms’ production costs down, and there was a strong supply-side impact of job growth, helping firms serve more customers. That remains true nearly halfway through 2024. Even with strong job and wage growth, producer prices remain very low at just 2.2% y/y and unit labor costs in 1Q 2024 were extremely low at 0.9% y/y.

Labor market loosening

Collapse in job openings

The jobs market has changed considerably since the heyday of 2022 when firms were willing to hire any warm body they could find, hoarding workers even if business had slowed down. At the time there were two available jobs for every unemployed person (Figure 1). Since the peak in July 2022, firms have slashed open positions by 33% and the ratio to unemployed people has returned to the same level as in 2019 before the pandemic. The data on job postings are relatively short, but we believe there is an upward trend (observable in Figure 1) and the current reading is below that trend, indicating the labor market is much looser than on the eve of Covid’s arrival.

The end of job hopping

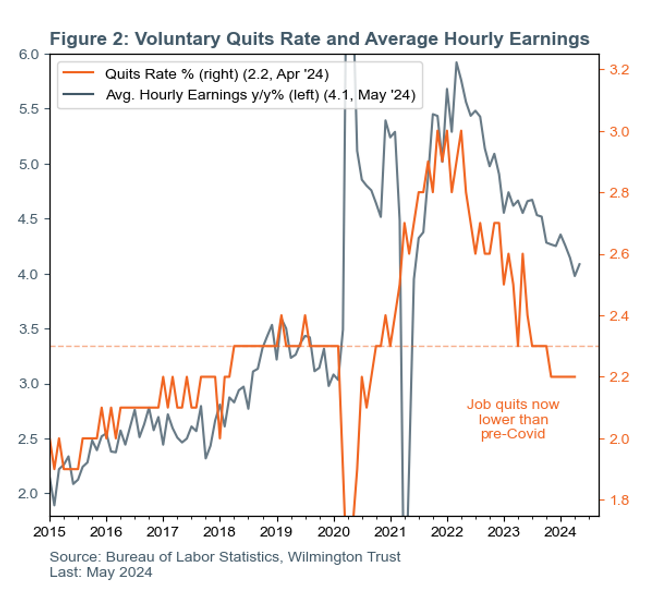

The reduction of job opportunities described above has understandably cut back on the number of workers hopping from one job to another. The labor market of 2022 was a boon for workers who could generate wage gains—spending just a short time with one employer then moving on to another. Readers will likely remember a seemingly endless stream of announcements for pay hikes from the likes of Walmart, Target, Starbucks, and J.P. Morgan, to name a few, who were trying to hire and retain workers.

But the 33% reduction in job postings eliminated that dynamic, and the share of workers voluntarily quitting their positions fell from an all-time high in early 2022 to just 2.2% now, below the average rate in 2019 (Figure 2). That has also dragged down wage pressures.

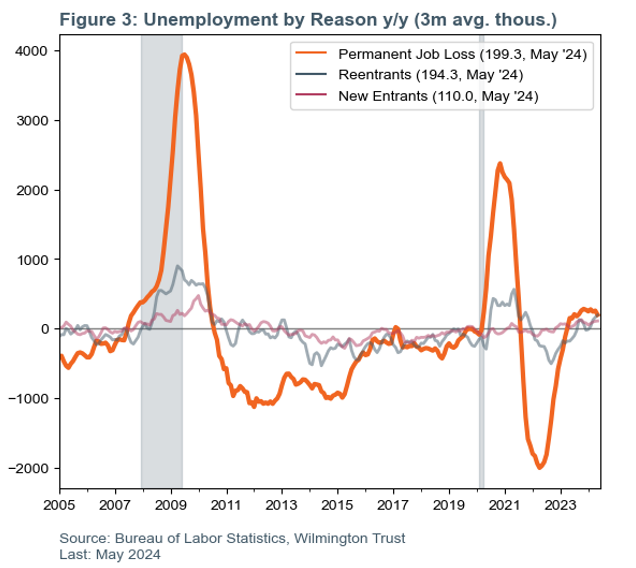

Job losses mounting

Too much focus on the headline measures of total job growth and the unemployment rate masks another signal that the labor market has slowed considerably, the steady rise in the number of unemployed. The unemployment rate is still quite low at 4.0%, but the number of people unemployed because of job loss has risen noticeably. The principal reason for unemployment is the loss of a job on a permanent basis (as opposed to a temporary layoff). People can also be unemployed as new entrants (e.g., graduates) or reentrants (returning to the labor force after a hiatus) and have a hard time finding a job, but the most pernicious and worrisome source is the firstI, stemming from job loss. The number of permanent job losers was up by 330,000 people in April 2024 compared to a year earlier (Figure 3). This indicator is rarely positive outside of recessions and is signaling a worsening job market. Yes, headline job growth remains solid, but the slowdown in opportunities mentioned above is translating to longer job searches and a more challenging environment in finding the next job.

Job growth was weaker in 2023 than initially thought

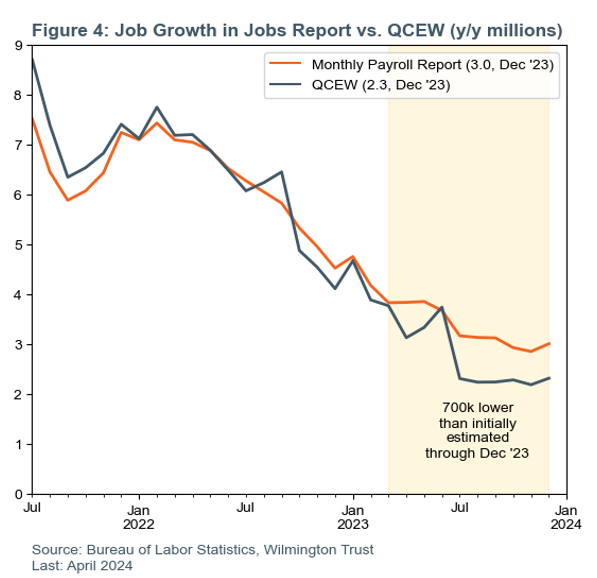

The final consideration is a pending downward revision to job growth over the past year, which will show a labor market that was not as strong as initially estimated. The familiar monthly payroll report from the Bureau of Labor Statistics (BLS) showed job growth of three million from December 2023 to December 2024. Updated data, using a fuller dataset from the Quarterly Census of Employment and Wages, shows job growth was actually 700,000 jobs slower than those initial estimates.

The monthly payroll report uses a sample of roughly one-third of all U.S. businesses, which is an extremely high and reliable sample size. But the BLS still must do the statistical work of estimating the formation of new businesses, the closing of others, and further considerations. Every year, the BLS will go back and revise the data once all tax records have been received and it has, effectively, a perfect 100% count of all jobs. Those tax records are the Quarterly Census of Employment and Wages (QCEW).

The initial release of the QCEW earlier this month shows job growth was much weaker from March 2023 to December 2023 than initially published in the monthly payrolls report. The impact will be a downward revision of roughly 700,000 jobs in y/y terms through December 2023 (Figure 4). That means monthly job growth was about 80,000 lower than initially thought from March to December, a stark change from a narrative of the surging labor market.

Core narrative

We think the inflation data for May and June will come in low enough for the Fed to regain confidence that inflation pressures have abated, enabling rate cuts this year, starting in July. Additionally, the labor market is showing enough cracks to bolster that case, and we think the Fed will cut by 75 bps this year. If the inflation data between now and the July 31 meeting come in higher, we will push the start of rate cuts to a later date, but still expect a rate cut cycle to start this year. We maintain a positive view of the labor market and expect continued growth. But the substantially lower job growth profile in 2023 contributes to an overall picture that encourages rate cuts from the Fed soon. As we say in the accompanying Wilmington Wire post, we see the current environment as supportive of risk assets and we favor U.S. equities over international equities in portfolios.

Definitions

Basis points refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today