Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

It finally appears that the economic soft landing is firmly within reach. Inflation is declining while the economic engine is slowing. The Fed has taken additional rate hikes off the table and could begin easing policy as early as next month. The equity market is on the ascent, despite taking a bit of a breather in May.

It seems as if, after a vicious fight against inflation, the Fed achieving the ultimate goal should result in a simpler investing environment than we have experienced over the last two years. In some ways, that is true. However, in reality, a backdrop of declining inflation, slowing consumer activity, and still-elevated interest rates can be challenging for many companies to manage profitability, requiring a more nuanced investment strategy than in many other economic scenarios. In our client portfolios, we are leaning into risk, balancing sector and factor exposures, and utilizing active management to sift through the likely winners and losers in the year ahead.

Overweight risk

The economic soft landing means a continuation of the economic cycle for at least the next 12 months. Inflation has slowed while economic activity is also moderating, striking the “Goldilocks” balance needed to usher in rate cuts from the Fed. As discussed in our recent economics note, the labor market is showing some cracks that we think will prod the Fed to cut rates as early as July. Whether the Fed begins easing policy in July, later in the year, or even early 2025 is unlikely to materially impact long-term equity returns. Importantly, we believe the Fed’s first cut would begin a cycle of normalizing policy, relieving some of the squeeze on companies and consumers carrying larger debt loads.

We are overweight to U.S. large and small cap versus our strategic asset allocation benchmark. Large cap is the asset class that has been carrying the most positive momentum, as it gives the greatest exposure to the tremendous earnings growth potential behind the artificial intelligence (AI) trade. However, small cap arguably stands to benefit the most from Fed rate cuts, as this asset class has three times the debt burden as large cap[1] and a lower quality score. Importantly, global equities have returned more than 20% over the last year,[2] so while we are constructive on the equity market, we anticipate more muted gains going forward.

Our view is that central banks globally are embarking on a synchronized easing cycle to at least recalibrate policy, if not ease in a more material way consistent with a traditional easing cycle. This should support global economic activity and equity returns—one reason we brought our international developed equity exposure to neutral in April. We continue to hold a modest overweight to fixed income but could use that for a funding source into equities if rates decline further, as we expect.

Balance sector and factor exposures

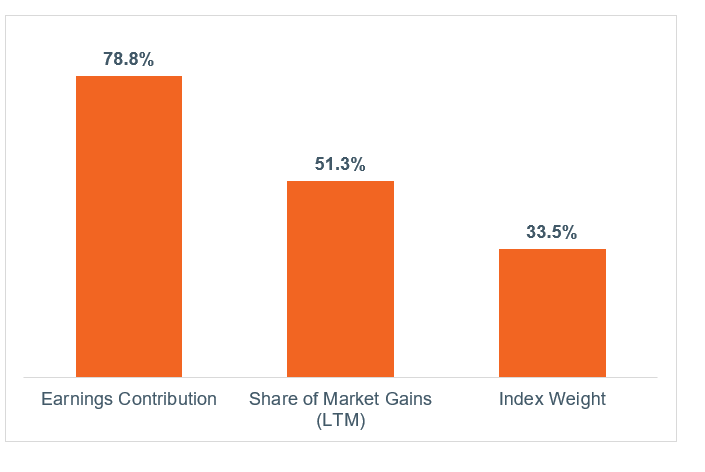

The narrowness of the equity market leadership, which is to say the degree to which just a few stocks have been generating most of the market’s returns, is the subject of much debate and analysis. The fact is that over the last 12 months, the top 10 stocks (by market cap weight) have generated 51% of the market’s return and account for nearly 80% of the index’s earnings[3] (Figure 1). This is in large part due to the robust demand for AI infrastructure (chips, cloud, data centers) and dominant market share position of U.S. megacap tech companies. Contrast that with high rates and a manufacturing recession muting earnings growth of more cyclical sectors, and the rest of the market has failed to keep up.

Figure 1: The market has been driven by the largest stocks

Top 10 index weights’ share of market return and earnings contributions over the last 12 months (LTM)

Data as of May 31, 2024. Sources: Bloomberg, Strategas. Magnificent 7 includes Nvidia, Microsoft, Amazon, Meta, Alphabet, Apple, and Tesla. Leftmost bar represents Magnificent 7’s contribution to the overall return of the S&P 500 in the last 12 months.

Going forward, we expect a broadening of leadership both across and within asset classes. U.S. small cap is poised to play catch up with large cap given the debt considerations mentioned above. The asset class also offers attractive relative valuations, trading in the 24th percentile compared to U.S. large cap going back 25 years. We continue to expect outperformance of U.S. over non-U.S. equities, but stabilization in China and more supportive monetary policy in Europe, the UK, and some emerging markets economies should allow international equities to deliver solid returns. We are allocated with a neutral exposure to international equities.

We also expect a broadening of leadership across sectors. Earnings growth for 2023 and the first quarter of 2024 was dominated by the technology and communications sectors. For first quarter 2025, analysts expect a more evenly distributed pace of earnings growth, with tech-related companies projected to deliver slower earnings growth of 16%–20%, while other sectors are expected to deliver 9%–10% (compared to just 1% in the first quarter of 2024[4]). We continue to position portfolios with a healthy exposure to high-growth, high-momentum companies, but are also allocating to some of the sectors that have been left behind like financials, utilities, and industrials. We carefully track factor exposure across asset classes to mitigate risk.

Pick your spots

The last few years of monetary policy have tended to be either “all or nothing.” The Fed was first incredibly accommodative to support the Covid recovery, but then quickly shifted gears to rapidly increasing interest rates at the fastest rate in decades. We expect a gradual normalization of Fed policy over the next 18 months. By this time next year, the Fed’s policy rate will be around 4.25% or lower, one that is obviously well below the current rate of 5.5% but also higher than that of the Fed’s post-GFC, easy-money era. This has implications for investment strategy and means investors should continue to seek out higher-quality companies generating solid, steady profits with manageable leverage. We continue to prioritize high-quality companies in our portfolios, especially in U.S. small cap, where approximately 40% of the Russell 2000 index is not profitable (compared to just 6% for the S&P 500).

Slowing inflation and moderating economic growth is constructive for Fed policy and equity valuations. (Interest rates tend to be negatively correlated with equity valuations.) However, this environment can be challenging for corporate profitability. Rising inflation and a robust consumer makes it easier for companies to raise prices and pad their profit margins. When inflation is declining and consumers are being more discerning with their spending, companies must be laser focused on efficiency, competition, and profitability. We anticipate greater dispersion in the market, meaning companies in the same industry may perform very differently based on management and execution. For every Chipotle delivering continued upside surprises to earnings there will be a Starbucks struggling to attract consumers. Active management, especially in less market efficient asset classes like small-cap and international equities, is poised to add value in such an environment.

The deep research and fundamental analysis performed by many active managers is also key for identifying the second-order beneficiaries of AI. It has so far been pretty obvious that the major chip designers and cloud providers with dominant market share positions stand to benefit from the adoption of AI. What is far more complicated is discerning the major winners in the second stage of the AI trade. In other words, who will see the greatest increase in productivity and earnings growth from using AI? This is an important long-term investment opportunity that transcends sectors. We are finding opportunities in industrials, materials, real estate investment trusts (REITs), and utilities that all stand to benefit from the AI secular growth story.

Core narrative

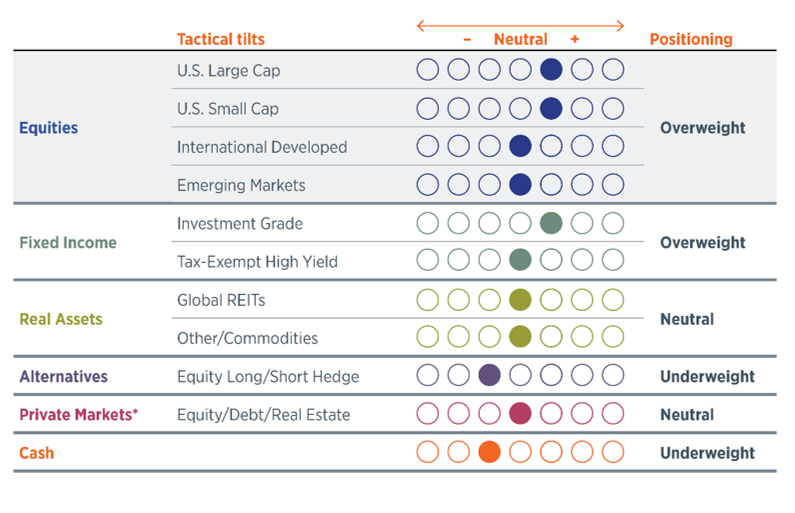

We expect the U.S. economy to glide into a soft landing, as inflation continues to decelerate, growth slows, and the Fed normalizes policy by cutting rates. We are leaning into risk in this environment—favoring U.S. equities over international (Figure 2)—and being careful to manage factor risk. Across equities we are balancing growth and value and seeking exposure to high-quality companies. We are also looking to maintain adequate exposure to both megacap tech and more cyclical sectors. We expect market leadership to broaden and dispersion to increase, which should allow skilled active managers to add value.

Figure 2: Asset class positioning

Data as of May 31, 2024. Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

*Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets we do not tactically adjust this asset class.

[1] As measured by net debt divided by EBITDA and refers to the Russell 2000 vs the S&P 500. Source: Bloomberg.

[2] Defined as the MSCI ACWI Index, as of June 5, 2024.

[3] Source: WTIA. Calculated based on year-over-year earnings growth for the most recent filing period. Earnings represent adjusted and diluted earnings from continuing operations (excluding stock based compensation).

[4] Source: UBS US Equity Strategy, June 4, 2024.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Any positioning information provided does not include all positions that were taken in client accounts and may not be representative of current positioning. It should not be assumed that the positions described are or will be profitable or that positions taken in the future will be profitable or will equal the performance of those described.

Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High-Net- Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income.

Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing.

Allocations: Each strategy group is constructed with target policy weights for each asset class. Wilmington Trust periodically adjusts the policy weights’ target allocations and may shift from the target allocations within certain ranges. Such tactical allocation adjustments are generally considered on a monthly basis in response to market conditions.

The asset classes and their current proxies are: • Large–cap U.S. stocks: Russell 1000® Index • Small–cap U.S. stocks: Russell 2000® Index • Developed international stocks: MSCI EAFE® (Net) Index • Emerging market stocks: MSCI Emerging Markets Index • U.S. inflation-linked bonds: Bloomberg US Treasury Inflation Notes TR Index Value Unhedged* • International inflation-linked bonds: Bloomberg World ex US ILB (Hedged) Index • Commodity-related securities: Bloomberg Commodity Index • U.S. REITs: S&P US REIT Index • International REITs: Dow Jones Global ex US Select RESI Index • Private markets: S&P Listed Private Equity Index • Hedge funds: HFRX Global Hedge Fund Index • U.S. taxable, investment-grade bonds: Bloomberg U.S. Aggregate Index • U.S. high-yield corporate bonds: Bloomberg U.S. Corporate High Yield Index • U.S. municipal, investment-grade bonds: S&P Municipal Bond Index • U.S. municipal high-yield bonds: 60% Bloomberg High Yield Municipal Bond Index / 40% Municipal Bond Index • International taxable, investment-grade bonds: Bloomberg Global Aggregate ex US • Emerging bond markets: Bloomberg EM USD Aggregate • Cash equivalent: 30-day U.S. Treasury bill rate.

Index Descriptions

The Bloomberg U.S. Aggregate Index measures the performance of the entire U.S. market of taxable, fixed-rate, investment-grade bonds. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $250 million.

The Bloomberg U.S. High Yield Corporate Index, formerly known as Lehman Brothers U.S. High Yield Corporate Index, measures the performance of taxable, fixed-rate bonds issued by industrial, utility, and financial companies and rated below investment grade. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $150 million.

The Bloomberg World Government Inflation-Linked Bond (WGILB) Index measures the performance of investment grade, government inflation-linked debt from 12 different developed market countries.

Bloomberg Commodity Index measures the performance of 19 futures contracts on physical commodities. As of the annual reweighting of the components, no related group of commodities (for example, energy, precious metals, livestock, and grains) may constitute more than 33% of the index and no single commodity may constitute less than 2% or more than 15% of the index.

The Dow Jones Global ex-U.S. Index is an equal-weighted stock index composed of the stocks of 150 top companies from around the world (excluding the U.S.) as selected by Dow Jones editors and based on the companies' long history of success and popularity among investors. The Global Dow is designed to reflect the global stock market and gives preferences to companies with global reach.

The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is composed of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

The MSCI All-Country World Index ex USA measures the performance of large- and mid-capitalization stocks in approximately 50 developed and emerging equity markets, excluding the United States.

The MSCI EAFE® (net) Index measures the performance of approximately 20 developed equity markets, excluding those of the United States and Canada. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to nonresident investors.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 26 emerging markets countries. With 1,198 constituents, the index covers approximately 85% of the free-float-adjusted market capitalization in each country.

Russell 1000® Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $309 billion.

The S&P 500 Index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

The S&P Composite Stock Price Index (noted on slide 8) refers to the data series made popular in recent years by Yale Professor Robert Shiller, not to be confused with the S&P Composite 1500, an index that combines the S&P 500, the S&P Mid Cap 400, and the S&P Small Cap 600. Investing involves risks and you may incur a profit or a loss.

The S&P Developed Property defines and measures the investable universe of publicly traded property companies domiciled in developed markets.

The S&P Municipal Bond High-Yield Index consists of bonds in the S&P Municipal Bond Index that are not rated or are rated below investment grade.

The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market.

The S&P United States REIT Index measures the investable U.S. real estate investment trust market and maintains a constituency that reflects the market’s overall composition.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today