Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

At the start of the year everything looked perfect. Inflation had slowed sharply in the second half of 2023 and the Federal Reserve (Fed) had made its “dovish pivot” at its final meeting of the year, ending the prospect of more rate hikes and switching the focus to rate cuts. Investors were pricing in 150 basis points, or bps (1.50%), of rate cuts in 2024 and risk assets were soaring. Powell went a step further at his January 31 press conference. He jettisoned the Fed’s multiyear stance that the committee needed to see a weaker economy and some pain in the labor market in order to get more comfortable about inflation, ending the “good news is bad news” paradigm. All that Powell and the rest of the committee needed to see was “more good data.”

As if he jinxed the situation, the Consumer Price Index (CPI) gauge of inflation surprised to the upside just 13 days later when the January data were reported. The February and March data surprised to the upside, too. Investors have recoiled each time and markets are now pricing less than 50 bps of cuts this year. Despite the sharp reaction in markets, our inflation outlook has not materially changed.

We expect headline CPI to hover around 3.5% until the end of the summer before dropping below 3% near the end of the year. Critically, the Fed’s preferred gauge of inflation is the Personal Consumption Expenditures (PCE) index, and that is running even lower than CPI. We think the PCE and overall economic environment will lead to Fed rate cuts starting by mid-2024.

Disinflation interrupted?

The critical question for the economy, and ultimately for the Fed, is whether the slowdown in inflation (known as disinflation) has truly stalled or if it will continue. We believe disinflation will continue, owing mostly to the underlying details of the data. The three consecutive disappointing CPI readings to start this year are largely attributable to the “shelter” component. It is, appropriately, the largest single category in the inflation basket because it is the largest expenditure item for the average consumer.

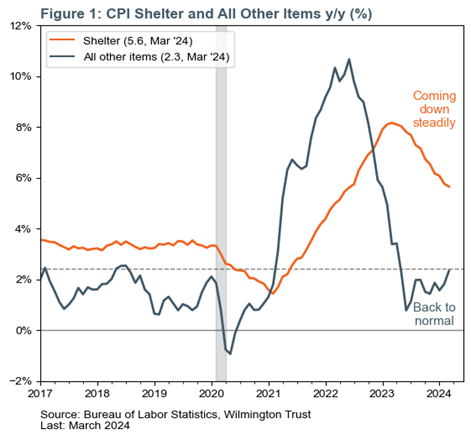

Although the shelter component came in slightly higher than expected in each of the past three months, it is still slowing quickly on a year-over-year basis (Figure 1). We expect this to continue, as the CPI shelter data are following, with a lag, all other data sources for apartment rents and home prices (not shown). Rents and home prices slowed sharply in 2023 and have returned to normal growth rates. For methodological reasons, there is a long delay for rents and home prices to show up in the official inflation data.

Critically, as shown in Figure 1, inflation for all other consumer items returned to normal rates nearly a year ago. If shelter continues to slow as we expect and there is no reacceleration for all other consumer prices, the CPI will be back to pre-Covid rates by this time next year. Part of the angst in financial markets is driven by concerns of a reacceleration, but we do not think consumers are in a strong enough position to drive inflation higher from here.

In short: the prices paid by consumers for goods and services have already been running below the Fed’s target for nearly a year, while rents and home prices have also slowed to normal. All that’s left is for those real-world rent and home price data to make their way into the convoluted government statistics.

Labor market normalization

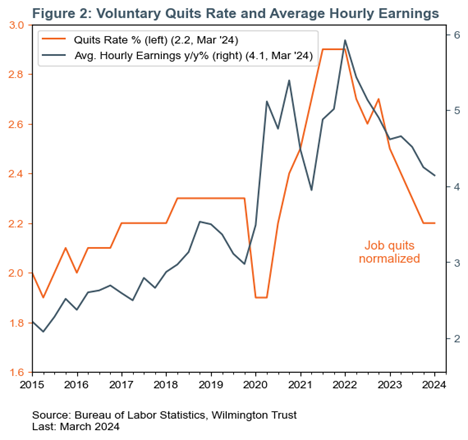

The continuing normalization of the labor market is helping economic growth and also alleviating inflation pressure. Job growth numbers have sizzled, accelerating in each of the past five months and posting a gain of 303,000 in March, the highest in nearly a year. That would be problematic if labor was still scarce, but workers have been flowing back in. Importantly, the competition for workers has dropped sharply with firms cutting the number of open positions.

The resulting normalization means workers are no longer able to job-hop and push wage growth ever higher, as was rampant in 2021 and 2022. The rate at which workers are voluntarily quitting their positions has now dropped slightly below the pre-Covid rate, easing wage growth (Figure 2). We expect this trend to continue, and we see 4% average wage growth as consistent with the Fed’s 2% inflation target.

What the Fed is looking at

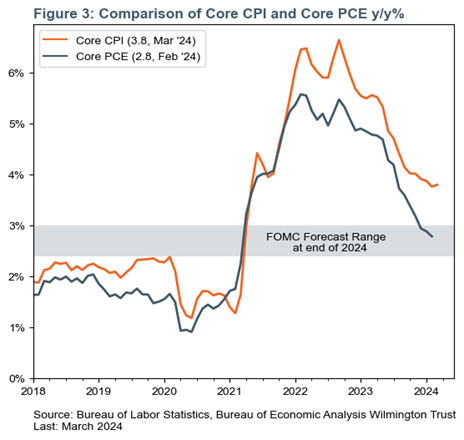

While the CPI data are important, it’s important to remember there are two major inflation gauges for the U.S., and the Fed prefers, focuses on, and explicitly targets the other one: the PCE. The CPI sometimes gets more attention because it is released first (we’re two weeks away from getting the PCE data for March). And importantly, while Core CPI looks to be stalling out a bit, Core PCE continues to decelerate (Figure 3). In fact, the Fed’s forecasts have Core PCE ending 2024 in a range of 2.3%–3.0%, and it’s already in that range as of February.

Now, we do expect the downward slope in Core PCE to slow and flatten in the middle of this year, but as long as it stays in the shaded range below without reaccelerating, it is meeting the Fed’s forecast and it is likely to proceed with the 75 bps of rate cuts in 2024 the Federal Open Market Committee has communicated. We expect Core PCE to drift into the lower range of the shaded area, leading to an additional cut in 2024. However, there is the risk of inflation coming in higher than expected and pushing rate cuts to later in the year.

Core narrative

The first three CPI inflation reports of 2024 have come in a bit higher than market expectations and have pushed out market pricing of Fed rate cuts in 2024. We think the pendulum of the market has, once again, swung too far. Our view has not changed as much as the market. At the start of the year, we expected rate cuts to start in June and for a total reduction of 125 bps by year end. We still expect a first cut in June, though it could be pushed to July, and now project a total of 100 bps of easing this year. Although CPI has surprised to the upside a bit in the past three months, the overall trend is still downward, and we expect that to continue. Critically, we expect the Fed’s preferred inflation gauge (different from the CPI) to stay in the Fed’s forecasted range.

We hold a neutral weight to equities relative to our long-term benchmarks with a slight overweight to U.S. small-cap equities and a slight underweight to international developed. If the economy and inflation play out as we anticipate, we expect it to support small-cap equities and our current positioning. There is upside risk to the inflation forecast and, by extension, risk that Fed rate cuts will be pushed to later than our expectations.

Definitions

Basis points refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today