Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Financial markets were on a wild ride in the last three months of 2023 and have started 2024 with a good deal of volatility. The root cause has been quickly changing expectations for Federal Reserve (Fed) interest rate policy, with markets increasingly pricing in rate cuts this year. Those expectations are built on evidence of the so-called “soft landing” for the U.S. economy, where economic growth slows yet remains positive, and inflation continues its descent to the Fed’s desired target.

Our growing conviction in the soft landing scenario led to us adjust portfolios at year end, increasing our allocation to U.S. small-cap stocks and bringing overall equity exposure to neutral. But the start of 2024 has been rocky, with some investors tempering rate cut expectations, resulting in stock market declines. We still expect the economy to evolve in a manner that enables, and encourages, the Fed to cut rates. A key factor here will be the level of real (i.e., inflation-adjusted) interest rates, which we see as high enough to achieve the Fed’s goal.

Rate cut bets pared back to start 2024

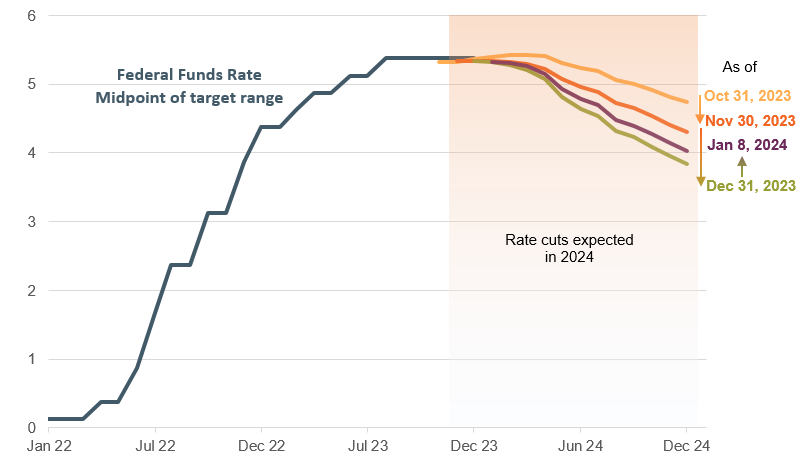

A lot of ink has been spilled documenting the Fed’s pivot to a more dovish stance at the December 13, 2023, meeting, when the committee’s members recognized they had gotten far too pessimistic about inflation and the median forecast for rates at the end of 2024 fell by 50 basis points, or bps (0.50%). All of that ink is merited but overshadows the fact that markets saw it coming. As inflation data came in lower and labor markets normalized through the fall of 2023, traders grew increasingly dubious of the Fed’s hawkishness, as did we. Figure 1 shows traders pushing down their expected path through the last three months of 2024, ahead of the Fed pivot. This should not be surprising as the Fed often finds itself reacting late at turning points.

The easing of rate cut expectations so far in 2024 is also shown but is mild when taken in full context. It was chiefly driven by yet another strong jobs report, released in the first week of this year. It showed December job growth of 216,000, higher-than-expected wage growth, and a sharp decline in the labor force, all prompting concerns. We still view the labor market as normalizing along the lines of a soft landing, as the report also showed downward revisions to previous months’ job gains. More importantly, in light of strong wage growth, firms showed themselves quite capable throughout 2023 of managing labor cost pressure without pushing those costs onto customers, a feature of U.S. economic exceptionalism that is the centerpiece of our 2024 outlook.

As of January 8, 2024, fed funds futures are showing between five and six rate cuts of 25bps each, translating to a 125–150bps decrease to a rate of roughly 4%. That is a healthy development, as markets had gotten a little too extended late in 2023, fully pricing the first cut by this coming March and pushing as high as seven cuts over 12 months. The paring back early in the year brings the market in line with our view. We expect five cuts, starting with the June 12, 2024, meeting. Importantly, Fed communications would presage those actions, with strong hints likely starting around the March 20, 2024, meeting.

Figure 1: Expectations for rate cuts have been pared a bit to start the year

Federal funds rate and market pricing of future rates (%)

Last January 8, 2024. Sources: Bloomberg, CME Group, WTIA.

Financial conditions are tight enough

An oft-cited concern by those questioning the Fed’s likelihood of cutting rates is whether financial conditions have already loosened too much for inflation to continue falling. When the committee skipped a hike at the November 1, 2023, meeting, the 10-year yield had been surging for months and briefly touched 5% a week earlier, the highest in 16 years. Chair Powell cited those higher rates as one reason the group had demurred. It has since fallen a full percentage point and also dragged down many popular metrics of overall financial conditions, leading some to argue the Fed will delay any rate cuts and possibly need to hike again.

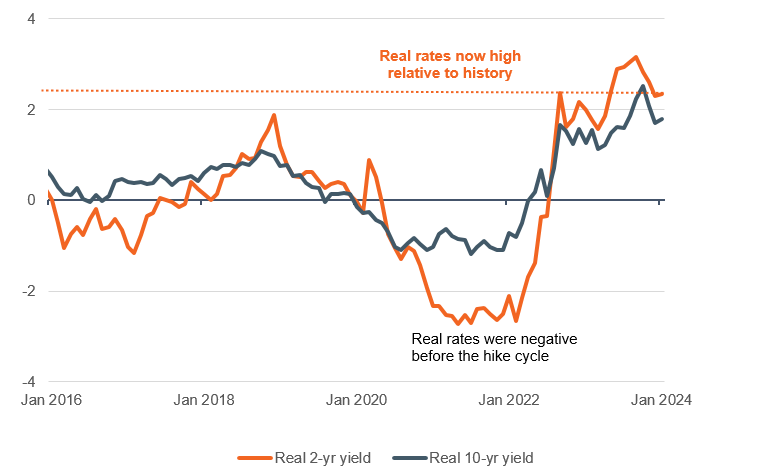

We don’t share those concerns, and see conditions as tight enough to continue weighing on inflation, leading to rate cuts by midyear. We focus on “real interest rates,” taking nominal Treasury yields and subtracting the forward-looking inflation expectations implied through the pricing of Treasury inflation-protected securities (TIPS), known as “breakevens.” We believe these to be the best measure of financial conditions and they are often cited by Powell. Real rates are the best measure because they take into account the real cost of borrowing for consumers and firms. Put simply, firms can easily borrow at 10% interest, for example, if the selling price of their product is moving up by 10% per year, all other things equal.

As shown in Figure 2, real interest rates at the 2- and 10-year maturities have indeed fallen since their peaks a few months ago but remain high relative to history. Both are higher than the pre-Covid peaks in 2018 when, importantly, inflation was running at the Fed’s target of 2% (not shown). In fact, with inflation continuing to ease, these real rates would only rise further if the Fed held nominal rates steady, a passive tightening that Powell and other committee members have flagged as undesirable.

Figure 2: Financial conditions still tight enough to bring down inflation

Real interest rates (%) Nominal rate minus forward-looking breakeven inflation rate

Last January 8, 2024. Sources: Bloomberg, WTIA.

Core narrative

We continue to expect a soft landing for the U.S. economy, with growth slowing to 1.3% in 2024 and inflation continuing down toward the Fed’s target. The first jobs report of the year and a decline in nominal Treasury rates from their October 2023 peaks have led some to pare their bets for rate cuts, but we see economic conditions as supporting some easing of monetary policy starting by midyear. The current levels of real interest rates are a key factor in our assessment. Our growing conviction in the scenario led us to increase our allocation to U.S. small-cap stocks in December 2023, bringing our overall equities allocation to neutral, and we reduced our allocations to both cash and investment-grade fixed income.

Definitions

Basis points refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today