Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Last week was one chock-full of U.S. economic data, and I have a hard time remembering a period when so many data releases were in agreement, pointing in the same direction. In this case, pointing to slowing—yet still solid—growth and an easing of inflation pressure. A week before, Federal Reserve Chair Jerome Powell gave his eagerly anticipated address at the Jackson Hole conference. It was broadly received as hawkish, because he said he wanted to see additional measured inflation readings, more labor market normalization, and a slower economy, or else the Fed would need to raise rates more. This week, all three boxes were checked. We expect the economy to slow further but avoid a recession, referred to as the “soft landing” scenario. We recognize lingering risks of recession and place an approximately 40% chance on that outcome.

Inflation slows

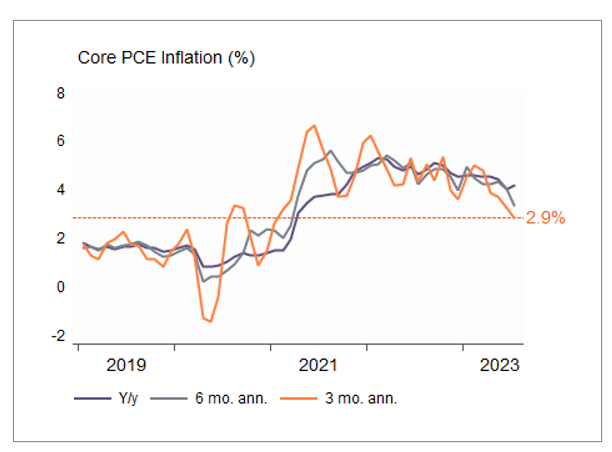

In his Jackson Hole speech, Chair Powell very clearly brought the focus to Core Personal Consumption Expenditure (PCE) inflation, saying it was too high and had essentially been stuck at roughly 4.5%, while acknowledging two good readings in June and July. His main message was he needed to see more good readings to be convinced it was coming down. Fair enough. Last week’s report showed just a 0.2% increase. That brought the lowest 3-month and 6-month annualized rates in two and a half years, since the first quarter of 2021 (Figure 1).

In the nitty gritty detail of the report, the dispersion of inflation pressure continues to collapse, with very few categories showing much pressure at all, which bodes very well for future readings. The year-over-year Core PCE rate is now 4.2%, not much down from the 4.5% Powell is fretting about, but his characterization is borderline disingenuous. In truth, the year-over-year measure has trended down consistently since peaking at 5.4% in March 2022. Check the first box, Mr. Powell.

Labor market cools sharply

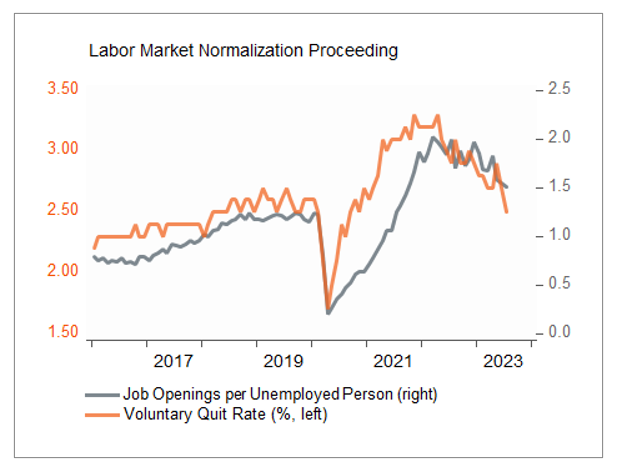

The imbalance of supply and demand in the labor market is a key concern for markets and the Fed. At Jackson Hole, Powell recognized some loosening, with labor demand (i.e., job openings) coming down and labor supply (labor force) picking up, but then cautioned “[e]vidence that the tightness in the labor market is no longer easing could also call for a monetary policy response.” Well, the data delivered. Firms cut their posted job openings significantly in July and the original estimate for June was revised down by 400,000. The oft-used gauge of job openings per unemployed person fell to 1.5, after being as high as 2 at the peak of tightness (Figure 2). Now it’s not far off the prepandemic level.

Moreover, the frustrating problem of workers leaving for greener pastures (voluntary quit rate) collapsed below the prepandemic rate. That gauge is shown to be a good predictor of wage pressure. Then we closed out the week with solid job growth numbers, a surge in the labor force, and mild wage growth. Check another box.

Slower economic growth

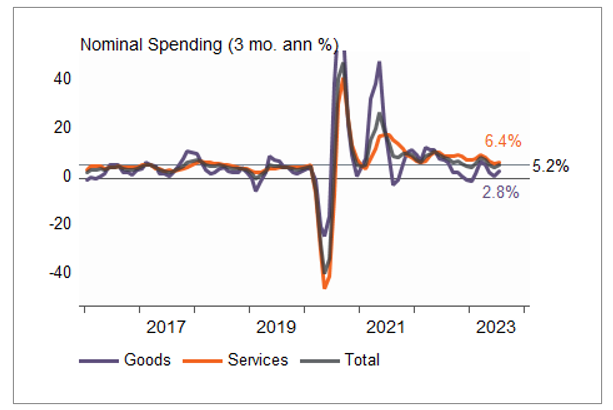

Chair Powell’s main forward-looking concern is that the economy has not slowed enough. He and the other Fed officials want to see a weakened economy, growing below trend (of roughly 2%) to alleviate inflation pressure. He noted GDP has surprised to the upside this year and that consumer spending has been “especially robust.” As if on cue, economic growth for 2Q 2023 was revised down from 2.4% to 2.1%. Consumer spending surprised to the upside in July, prompting some commentators to warn of inflation pressure. But the strong July reading is on the heels of weaker readings. Looking at 3-month growth rates across a broad array of consumer spending data, the data convincingly show growth that has been cut in half from the torrid paces of 2021 and 2022, and is now running at normal, pre-Covid rates (Figure 3). Check that third box.

Looking ahead

Uh oh, here comes the “on the other hand” statement. Not really, there are too many (bad) economist jokes out there for me to use that phrase. But as good as the data were this week, it can always turn. Inflation could reaccelerate, or growth could tail down into negative territory. I expect inflation to keep slowing and the labor market to keep improving. There will be two more PCE inflation reports before the Fed’s meeting on November 1, and if they continue to show slower inflation there is no need for the Fed to hike again. Then the conversation turns to “how long at this level?” We’ll need some new checkboxes.

Figure 1

Data as of July 2023. Sources: Bureau of Economic Analysis, and Wilmington Trust Investment Advisors.

Figure 2

Data as of June 2023. Sources: Bureau of Labor Statistics and Wilmington Trust Investment Advisors.

Figure 3

Data as of July 2023. Sources: Bureau of Economic Analysis, and Wilmington Trust Investment Advisors.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

The gold industry can be significantly affected by international monetary and political developments as well as supply and demand for gold and operational costs associated with mining.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today