WHY INVEST?

Give Your Money A Chance To Grow.

Are you doing all you can to maintain—and grow—your wealth? Investing can be a smart way to do both, but it takes experience, a well-executed strategy, and a deep understanding of your short-and long-term goals. With a good plan and trusted expertise, through investing you can:

Pursue financial independence

Investing can make your existing assets work for you, helping you take charge of your financial future as you pursue your goals.

Manage opportunity cost

In simplest terms, where you choose to put your money can actually cost you over time in terms of missed opportunities. For example, let's compare spending $50,000 on a new car versus earning interest, compounded, on that same $50,000.

Compound Interest vs. Depreciation

With compounding, your money has the opportunity to grow over time. If not invested, your money can lose value.

With compounding, the value of your principal can increase over time when you reinvest any capital gains and interest, period over period. Compounding may enable your wealth to grow on itself.

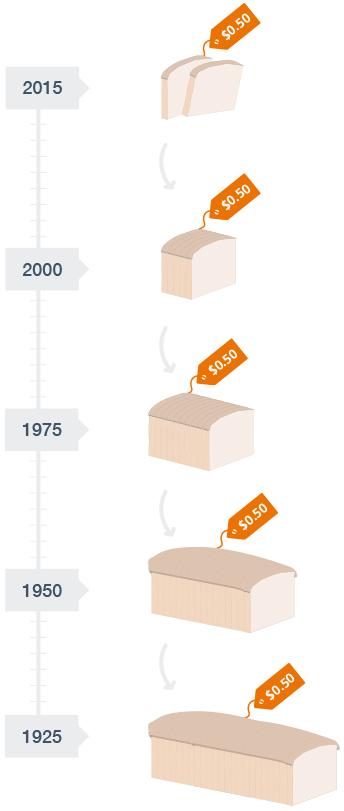

Stay ahead of inflation

Historically, inflation has driven up the costs of every category of goods and services over time. How will your wealth keep pace? The chart below illustrates the relative buying power of a dollar over a 90-year period, using a loaf of bread to depict value changes over time.

Inflation

Inflation is the sustained increase in the price of goods and services over time, as illustrated here by a loaf of bread.

Benefits of a fiduciary

A fiduciary’s loyalty is to the client and the client’s best interests. So your fiduciary should manage your money prudently, in a way that can help your assets grow in line with your comfort level and risk appetite. With a trusted fiduciary, you can count on:

- A high standard of responsibility

- An alignment of interests that fosters sound decision making

- An investing approach based on solving for your investment needs rather than trying to sell a product or service

- Your funds being invested in a manner that is consistent with applicable law

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.