Asset Classes

When investing, you may hear references to "asset classes." Assets are various types of securities available to you to choose from as an investor, each with its own characteristics, as well as ranges of risk and reward. Each "class" is a group of securities with similar characteristics. When building a portfolio, there are five basic asset classes you should be familiar with:

Stocks

Stock represents fractional ownership of a company. Sometimes stocks are referred to as equities, similar to equity in a home. They are priced based on the valuation of the company.

Pros

Cons

Bonds

A company or government can raise capital by borrowing and incurring debt. They can do this by issuing bonds or other debt instruments to investors.

Pros

Cons

Stocks vs Bonds

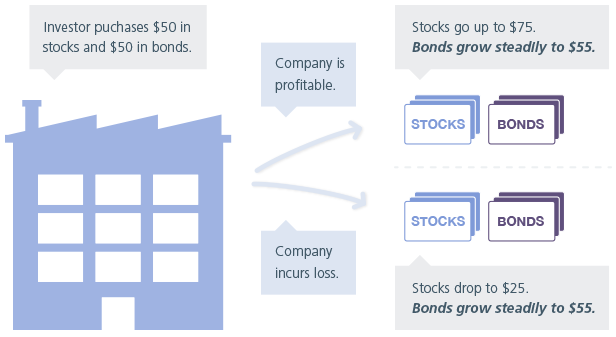

If a company grows, stock prices would be expected to increase, while bondholder participation is fixed at the return of their principal plus the agreed-upon interest rate. If the company loses value, stock prices would be expected to drop. Meanwhile, as long as the company does not file for bankruptcy, bondholders would still receive the amount of funds they lent, plus interest.

Cash equivalent securities

Cash equivalent investments include savings accounts, money market certificates, and commercial paper.

Pros

Cons

Real assets

Real assets are interests in tangible assets, which have value due to their substance and properties and have been favored during inflationary times. Real assets can play an important part in an investment portfolio—including conservative and income-oriented portfolios. Real asset exposures tend to represent an ownership interest (real estate investment trusts, mutual fund, or possibly futures or other derivatives) and include:

- Commodities, including precious metals (gold, silver, etc.), industrial metals (steel, iron, etc.), agricultural products (wheat, sugar, etc.)

- Real estate, including Real Estate Investment Trusts (REITs) and other property interests

- Inflation-linked bonds, including domestic and foreign issued bonds

Nontraditional assets

Typically used to help diversify a portfolio, nontraditional investments are generally grouped broadly into two categories—hedged strategies and private markets.

-

Hedge

Funds:

A range of strategies that seek to earn a return that is not solely

dependent on markets increasing in value

- “Liquid” hedge funds are mutual funds, offering next-day liquidity

- Hedged strategies are often accessed through private funds (covered in our next module), which may offer some liquidity, though often with significant limitations, such as 1 or 2 year lock ups, gates, and only quarterly redemptions.

- Private Markets: A long-term investment in assets that may not be traded in public markets and do not provide the ability for investors to liquidate

Hedge strategies are offered in relatively liquid mutual fund investments that can be available to all investors and also in private fund structures that are only available to qualified investors who are deemed sufficiently sophisticated to assess, or engage a professional to assess, the potential benefits and risks of such offers. Private markets are typically available only to qualified investors via private funds. To qualify for private placements, investors must meet the accredited investor standard and often also the qualified purchaser standard, both of which are imposed by regulators based on income and investable asset thresholds, among other considerations, as a proxy for sophistication.

Important considerations while investing in asset classes

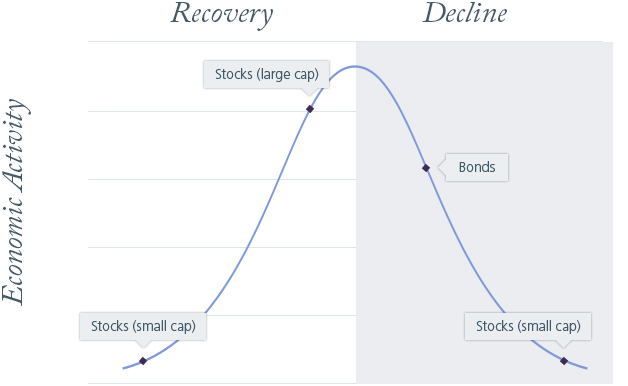

Investing in business cycles

One of the reasons why investment managers spend time analyzing and forecasting economic trends

is that

certain asset classes have historically performed better in certain economic conditions.

As you can see from this graph, stocks are preferred when the economy is expanding, but bonds are preferred when the economy is declining. Also, particular types of stock have performed better at different stages in the cycle.

Different Types of Investments

Have performed better at different stages of the economic cycle.

Costs associated with investing

Depending on the asset class or investment type, some institutions may charge various fees. These include:

- Account set-up and annual maintenance costs

- Fees for not maintaining a minimum balance

- Commissions to brokers as a percentage of the products sold

- Markup on shares purchased through a middle-man

- Borrowing for short-sale or margin purchases

- Asset management fees

- Capital gains taxes

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.