The Importance of Estate Planning

What is Estate Planning?

Provide for children and immediate family:

Consider This

Are you certain your family will be financially secure if something happens to you?

In the midst of emotional distress, your loved ones shouldn’t have to face the additional burden of worrying about how to pay funeral costs, the mortgage, or day-to-day expenses. Estate planning helps to ensure that assets are allocated, expenses are taken care of, and stress and guesswork are reduced for your family.

Ease the burden on your family in case of an unexpected life event:

Consider This

Who do you think is responsible for settling your estate? Have you set them up for success?

In simplest terms, having a plan ahead of time prepares your family to understand and execute your wishes without doubt and confusion. It also means that your assets are managed how you want and, most importantly, by someone you trust.

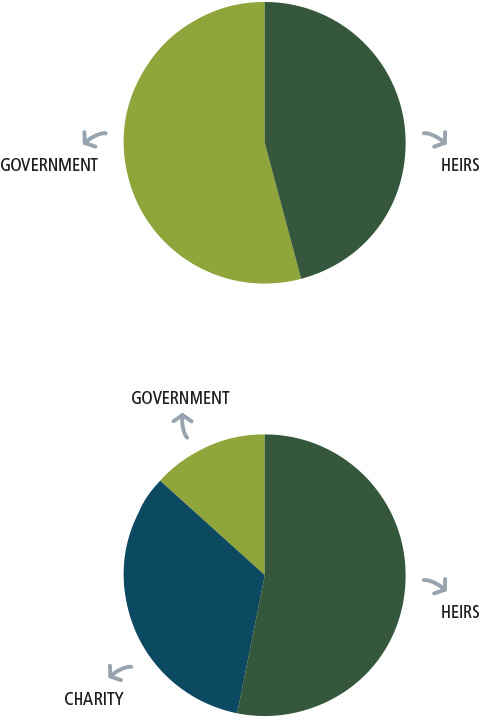

Reduce tax burden:

Consider This

Do you know how much you owe in taxes if something happens to you? How is someone going to pay these taxes?

Estate taxes, especially if unplanned for, can significantly reduce the amount your family actually receives from your estate. Planning helps you determine ahead of time what your potential tax burden is and develop a strategy for paying taxes while minimizing the impact on your heirs.

Control asset division:

Consider This

Do you have a plan for who gets which assets if something happens to you? How much control do you want over this?

Without a plan in place, the division of your assets is out of your hands and can put significant stress on your family. Even a basic will solidifies who gets what, who controls your estate, and how your assets will be divided. Whether it’s top level or very specific, having a plan also minimizes any confusion among your family members.

Common estate planning myths

-

It’s really expensive to plan your estate.

Debunked: While there are costs and fees involved in developing and executing an estate plan, it’s likely worth every cent. Having no plan at all can be much more stressful and expensive for your loved ones, especially with estate taxes as high as 40%.

-

It’s hard to think about awful situations like death and disability.

Debunked: While it’s an uncomfortable topic, death is a fact of life. However, lack of preparation for death or disability can make things extraordinarily difficult for those you leave behind. An estate plan can ensure your wishes are met and provides peace of mind for you and your loved ones.

-

It’s a cumbersome process.

Debunked: Estate planning can be as simple or complex as you choose, depending on how much control you want to have. Whether you simply meet with a lawyer to draw up a straightforward will, or open a trust and delve into how you title your assets, even the most basic plan provides needed protection for your family and assets.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.