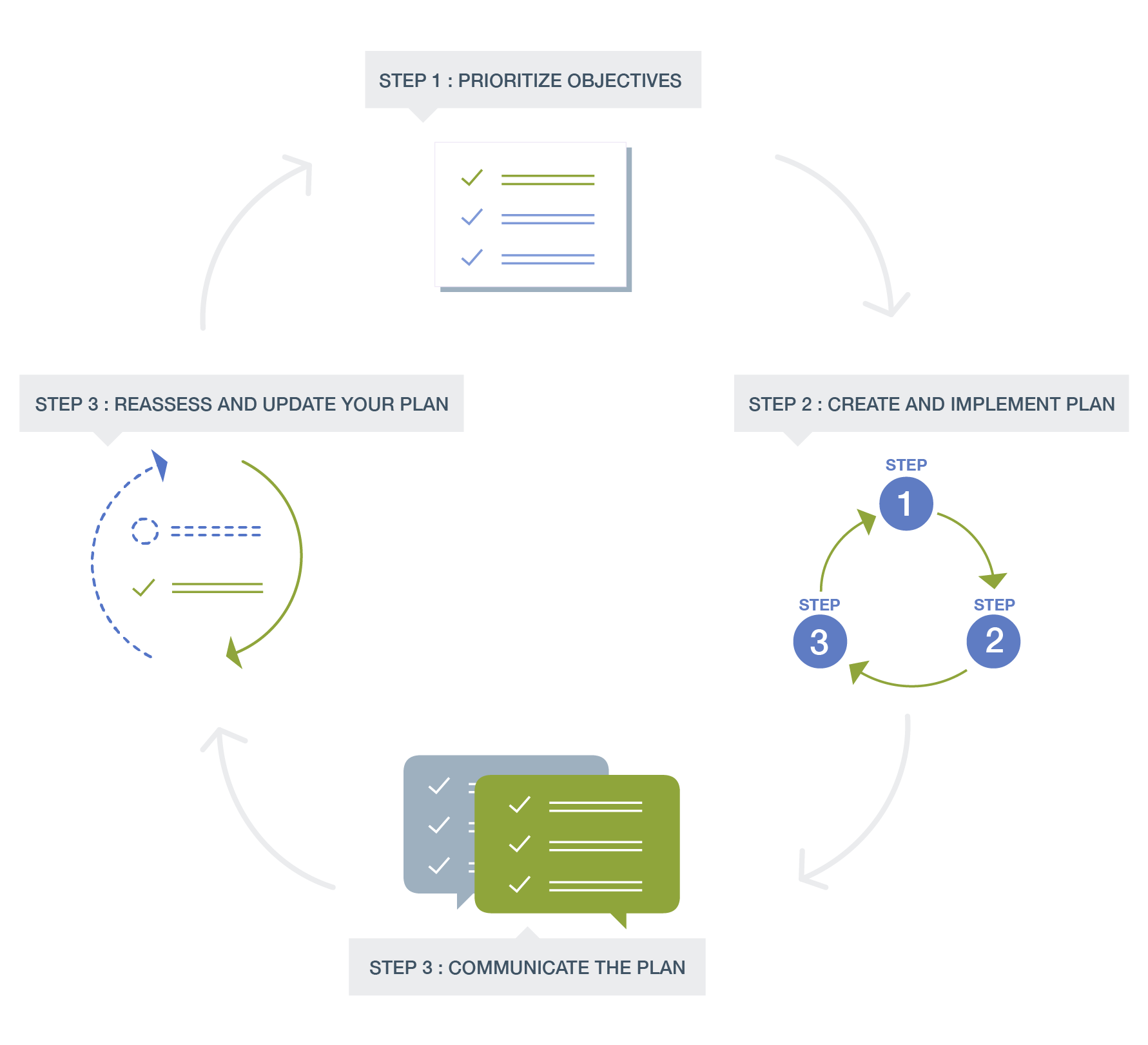

Understanding the Planning Process

Step 1: Prioritize Objectives

Before an asset is assessed, and before responsibility is assigned, you should determine the purpose of your estate plan. Understanding your goals, ensuring your final arrangements are made, even allocating your assets—they all help you to put the right plan in place to fit your needs. In this step, your family, advisors, and attorney should all be involved.

What are your hurdles in achieving these goals?

Work with your advisor and your attorney to determine how laws, procedures, and regulations may impact your plan. Also be sure to factor in the human element—family members can be unpredictable in their expectations, and you need to be as prepared as you can be for all possibilities.

What assets do you have control over today? Which will you have control over in the future?

Again, work with your advisors to account for all your assets. Determine how to access each asset and how you want to allocate it. Sharing this information with your loved ones will help them understand and execute your plan.

Who is benefiting from your estate?

Create a prioritized list of all beneficiaries of your estate, from your spouse and your favorite charity to your great-grandchildren (even if they haven’t been born yet). Not only will this help you allocate your assets, but it will also help you determine what roles you want each person to play in your estate plan.

Step 2: Create and implement a plan

Once you’ve set your objectives, your legal representative will prepare documents to pull your actual plan together. Once these legal documents are in place, your plan will be executable.

Create and assign medical and financial powers of attorney

A power of attorney is a legal document that gives a person the legal authority to act on your behalf. Based on your choices, this agent can have broad or limited ability to make decisions about your health, property, or assets if you are incapacitated. Choose your agents carefully, as they will have immense responsibility.

Draft or update and execute your will and assign executors

A will is the most fundamental piece of any estate plan, and it can be as broad or as detailed as you choose. Just as important is choosing the right individual(s) to manage (or “execute”) your affairs and asset distribution. The executor’s main responsibility is to ensure that your plan is followed, that all assets are collected, that taxes and other expenses are paid, and that your heirs and beneficiaries receive their inheritances.

Establish trusts (if relevant) and identify trustees

In simplest terms, a trust is an agreement that determines how your assets will be held and managed for another person. A trust fund is managed by a trustee on behalf of the beneficiary and, depending on the type of trust, may offer significant tax benefits. So, for example, if you want to set aside college funds for your pre-teen grandchild, you may name their parents as trustees or name a corporate trustee and include provisions that the funds can only be used for educational expenses. Talk to your advisor about the various trust classifications.

Keep beneficiary forms updated, especially after a life event

Over your lifetime, you’ve probably completed dozens of beneficiary forms at work, for your life insurance and retirement plan, even for individual assets and investments. Now’s the time to review and update your beneficiaries for all of your assets to avoid confusion and confrontation after you’re gone.

Roles, actions, and documents

Every step of the process has key players, key documents, and actions that need to be implemented.

Step 3: Communicate the plan

Explain your plan, including what will happen, who is responsible for each separate task, and how you plan on distributing your assets. This helps to ensure that your family knows your wishes and reduces confusion down the road.

Children and immediate family

Once the plan is finalized, take the opportunity to set expectations for your loved ones. Break down timing, roles and responsibilities, and asset allocation ahead of time to lessen confusion and strife after you’re gone.

Powers of attorney

Inform those you’ve named as agents that you’ve given them the power to legally act on your behalf in medical, financial, and/or property matters. Be sure that they understand and are prepared for the responsibility.

Documentation

Make sure that your executor(s), trustee(s), and power of attorney agent(s) have access to all documentation pertaining to your estate, including: deeds; bank, credit card, and brokerage logins and statements; information on any funeral prepayment plans; and insurance policies.

Step 4: Reassess and update your plan

Changes happen—and because they do, no plan is ever truly set in stone. Make time to re-evaluate your plan periodically, especially if events occur that can impact the state or value of your assets.

In case of a life event

Marital status changes, prolonged illness, or even a new grandchild can impact your estate plan. When a milestone or major event occurs, make time to look at your plan to be sure that it still makes sense and meets your goals.

Financial situation changes

Gaining new assets (or selling old ones), changing jobs, retirement, or receiving an inheritance of your own can make it necessary to reallocate your estate distributions.

Laws change

Touch base with your advisor periodically to confirm that no state or federal laws have impacted your estate plan. If so, be sure to update your plan as quickly as possible.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.