Understanding Using Unique Assets as Collateral

Finding the right liquidity solution is a process, not a product.

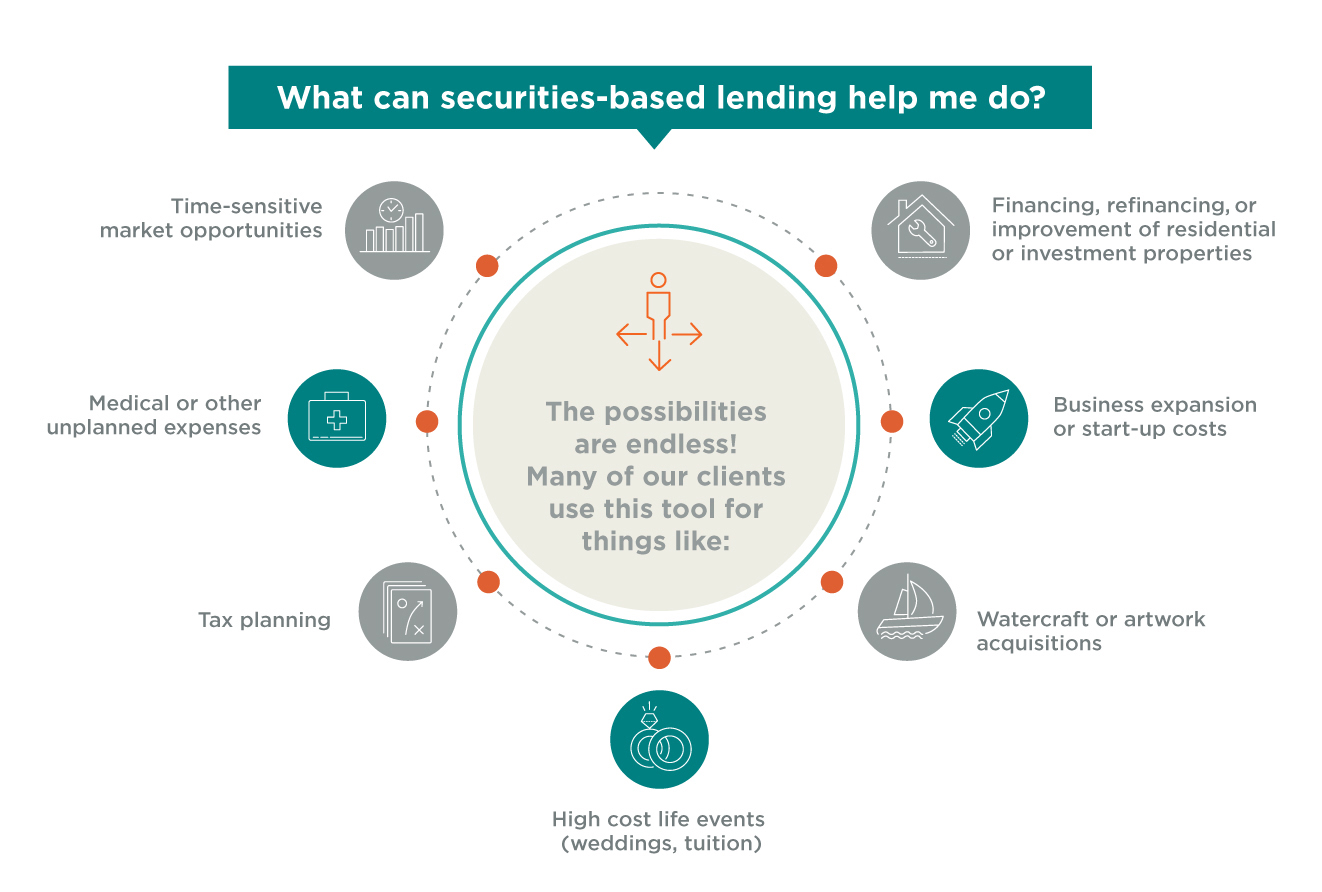

Advisory lending can provide you with a source of funding for business investments, real estate purchases, and unforeseen expenses. It’s a consultative and personalized approach to evaluating your options and providing lending solutions based on your objectives and unique assets – including specialty or illiquid holdings.

Advisory lending works hand-in-hand with your fiduciary, investment, and insurance strategies to make sure your banking approach is aligned with the rest of your financial plan. Uses for advisory lending include both short-term and long-term liquidity needs:

- Bridge financing to help with a significant purchase

- Marketable securities-backed lines of credit, including restricted and concentrated stock

- Specialized asset-backed loans secured by partnership interests, fine art, yachts, and aircraft

- Financing investor real estate

The power of leverage, securities-based lending at a glance

Using the market value of common investments like stocks, bonds, and exchange-traded funds as collateral for liquidity, or ready access to cash, can often be an efficient way to:

- Create ready cash for a variety of spending needs or smooth out intermittent/irregular cash flow

- Keep your investment strategy on track by leveraging rather than liquidating a portion of your portfolio, thus avoiding potentially taxable events caused by securities liquidation

This sounds great! Are there any risks involved?

Like many financial decisions, there are risks involved in any course of action. The biggest one to remember when thinking about securities-based lending is market volatility (sudden shifts in asset prices for things like stocks and mutual funds), which can magnify losses and even require immediate repayment of borrowed funds or covering deposits.

There are, however, many ways to manage these risks:

- Selectively borrowing against less volatile investments

- Diversifying amongst asset classes

- Careful monitoring of investments (particularly during volatile times)

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.