Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

In January, President-elect Donald Trump returns to the White House, and a Republican Congress will be seated. As discussed in Election Aftermath: Impacts on the Economy and Markets, the markets are already reacting but the full economic implications will emerge over time. Between the incoming administration's deregulatory agenda and the Supreme Court's recent elimination of "Chevron deference"—the precedent that lower courts should defer to detailed agency rules when laws passed by Congress contain ambiguities[1]—the rules that govern companies’ operational safety, labor management, environmental practices and more could change significantly. In this commentary, we will discuss how government actions could influence climate and energy policy, corporate disclosures, and corporate sustainability commitments, as well as the implications for investors pursuing sustainable investment solutions.

Climate change and energy policy

Investors and others concerned about climate change may view the election results as a significant setback for global climate action and U.S. leadership in the energy transition. The incoming administration promises to withdraw the U.S. from the Paris Agreement, the landmark global climate accord to keep global temperature rise well below 2 degrees Celsius as the first Trump administration did. Moreover, the incoming administration has indicated that the Inflation Reduction Act (IRA)—which provides grants and tax incentives to promote climate change mitigation, adaptation, and environmental justice—could be at risk. Changes may range from hindering implementation of certain tax credits to a full repeal. Meanwhile, the president-elect has expressed strong support for expanding domestic fossil fuel production. His pick for Secretary of Energy, Chris Wright, is an oilfield services company CEO and his pick for Environmental Protection Agency Administrator, Lee Zeldin, emphasized his focus on “U.S. energy dominance.”[2]

A reversal of climate change mitigation efforts is not a given, however. Eighteen Republican members of Congress have advocated against an overhaul of the IRA, sharing that businesses have already made investments based on expected federal support and citing a need for “business and market certainty.”[3] Exxon CEO Darren Woods used similar rationale in publicly urging President-elect Trump not to withdraw from the Paris Agreement.[4] The IRA’s grants and tax credits disproportionately benefit Republican districts, and some elements dovetail with the president elect’s priority to onshore manufacturing and create American jobs.

Investors will be watching the performance of key industries and how systemic climate-related risks play out across the market.

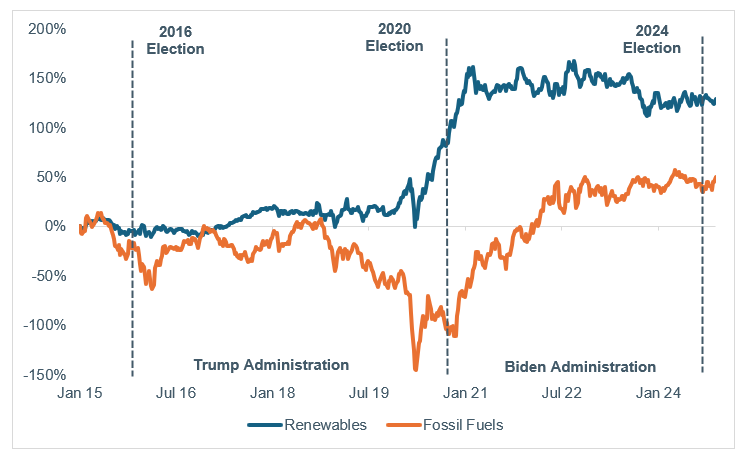

Figure 1

Relative performance of Renewables & Oil & Gas Exploration & Production

Data as of November 22, 2024. Sources: Bloomberg, Goldman Sachs, WTIA. "Renewables" represented by Goldman Sachs U.S. Renewables index and "Fossil Fuels" represented by oil and gas exploration and production select industry index. Both indices are indexed to 12/31/2014.

Sustainability disclosures diverge

Companies should expect the divergence in sustainability disclosure requirements across regulatory regimes to continue.

In recent years, the Securities and Exchange Commission (SEC) has proposed several new sustainability disclosure requirements for both corporates and investors.[5] We expect a decreased focus or even efforts to discourage disclosure. For example, the Climate Disclosure Rule, which mandates companies to report emissions, climate-related financial risks, and board oversight in a standardized manner, has been paused pending judicial review since the spring. Without defense by the new administration, the rule will not come into force.

Many companies will need to continue disclosing detailed emissions and climate risk information, however. California will require companies doing business in the state—a wide swath of companies given the size of California’s economy—to disclose information beyond what has been outlined in the SEC rule. U.S. companies operating in Europe that are subject to the Corporate Sustainability Reporting Directive (CSRD) will likely need to report on a range of sustainability metrics in the coming years. Many global regulatory jurisdictions are instituting disclosure requirements informed by the Sustainability Accounting Standards Board (SASB, now the International Sustainability Standards Board under IFRS).[6] As a result, many U.S. companies will publish audit-quality climate and sustainability information regardless of federal rules, and some investors will continue to expect access to this information.

Corporate sustainability commitments disincentivized

In communicating their approach to material sustainability issues, companies not only report backward-looking information or descriptions of current strategy, they sometimes make public commitments for future actions, such as a net zero emissions target or plan to achieve certain diversity metrics. Even before these election results, companies had already been navigating tension between two different stakeholder constituencies: those who expect companies to play a leading role in addressing era-defining environmental and social issues and those who perceive corporate involvement in these areas as overreaching or unfair to certain industries and groups.

Republican state officials have been particularly focused on restricting the use of environmental, social, and governance (ESG) factors in investment decision-making, prohibiting discrimination based on ESG scores and identifying industry boycotts.[7] And since the Supreme Court’s 2023 decision prohibiting affirmative action in college admissions, Republican lawmakers and conservative activists have issued legal challenges to corporate diversity, equity, and inclusion (DEI) programs, leading some companies to backtrack on diversity efforts or reporting.[8] The extent to which this becomes an animating focus at the federal level remains to be seen, but it’s clear that making commitments can generate political and legal risk. In this environment, companies are likely to be cautious about making new sustainability commitments and claims.

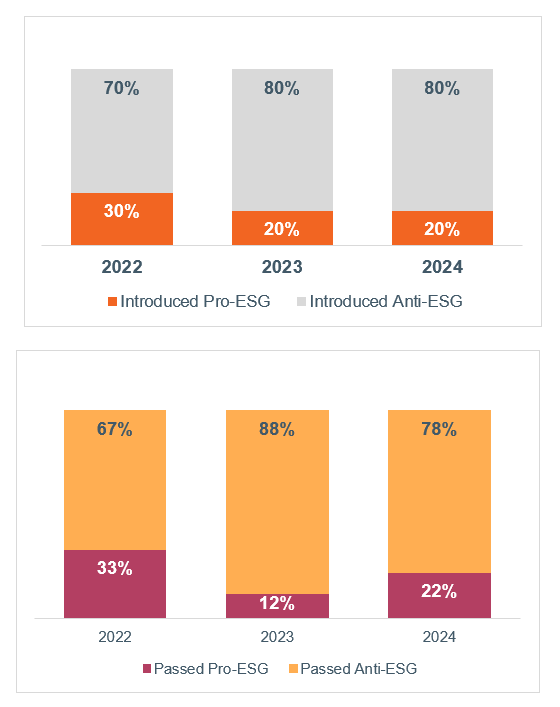

FIGURE 2

State-level "Pro" and "Anti" ESG Legislation, 2022-4

Data as of June 24, 2024. Source: Ropes & Gray, WTIA.

The value of a strategic approach to sustainability

The patchy disclosure landscape and associated legal risks may disincentivize “greenwashing”—deceptively overstating the significance of environmental or sustainability efforts. Some market participants, however, are concerned about the rise of “greenhushing”—companies limiting public information about their ongoing sustainability efforts. The election results may accelerate these trends, in our view.

The silver lining is that dedicated investors can achieve greater clarity into which companies are undertaking sustainable practices for strategic reasons. Companies that have disclosed or set commitments only to check a box may find it harder to sustain a program that lives up to scrutiny. Those that have treated disclosure as a strategic exercise engaging professionals across the firm and using information to improve their operations, will find less reason to change. For example, companies that have developed data-driven inclusive hiring and retention practices or improved product safety and reliability will not be incentivized to stop these efforts.

Therefore, even with fewer companies making commitments and fewer using sustainability efforts as marketing tools, we expect investor-oriented disclosures to continue. Standardized voluntary corporate sustainability disclosures have been building for years; more than 90% of the companies comprising S&P 500 reports in at least partial alignment with SASB standards, and the majority of those reporting ESG information obtain some level of assurance.[9] These companies may it beneficial to continue describing how their efforts support long-term value creation, providing information to investors who allocate capital based on these insights—whether a strategy is labeled “sustainable” or not.

Sustained demand for sustainable investing

We believe demand for sustainable investing solutions will continue to build due to generational wealth transfer and more mature sustainable investing capabilities that enable organizations to create mission-aligned portfolios. Private wealth (especially multigenerational wealth) and mission-driven institutions have long investment time horizons and make deliberate allocation decisions that are not dependent on one election cycle. Some investors who expect their social and environmental priorities to be ignored or restricted by the new administration and Congress may feel a greater urgency to address these issues through their investment portfolios.

We do expect to see challenges to adoption of sustainable investing strategies in retirement plans. Remember, in President-elect Trump’s first term the Department of Labor (DOL) sought to limit ESG investing by narrowly defining "pecuniary factors" under Employee Retirement Income Security Act of 1974 (ERISA), and the new DOL could take this up as a focus again. Retirement plans could possibly see a decline in demand for sustainable funds and increased litigation risks, depending on the outcome of pending cases. However, the employee voice demanding values-aligned retirement plan options is louder than it was eight years ago.

Core narrative

The election results signal a shift toward deregulation, challenges to climate policies, and a different emphasis on corporate disclosures. In this environment, companies that build sustainability programs around strategic issues rather than marketing may be well-positioned. We believe that the private sector will continue to address critical sustainability issues, and certain investors will seek exposure to leading companies now more than ever. At Wilmington Trust, we have resources committed to helping our clients navigate these changes and develop sustainable investing strategies that align with their goals. Our team can help you position your portfolio to meet your financial objectives while reflecting your personal priorities, in every political environment.

[1] Supreme Court Chevron decision: What it means for federal regulations | AP News

[2] Trump picks ex-congressman Zeldin to run Environmental Protection Agency | Reuters

[3] FINAL Credits Letter 2024.08.06.pdf

[4] ExxonMobil urges Trump not to withdraw from Paris Agreement again | Utility Dive

[5] SEC.gov | Rulemaking Activity

[6] Adoption of IFRS Sustainability Disclosure Standards by jurisdiction, Deloitte

[7] Navigating State Regulation of ESG | Ropes & Gray LLP

[9] TheCAQ.org | S&P 500 ESG Reporting and Assurance Analysis

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

There is no guarantee that integrating environmental, social, or governance (ESG) analysis will provide improved risk-adjusted returns over any specific time period. The evaluation of ESG factors will affect the strategy’s exposure to certain issuers, industries, sectors, regions, and countries and may impact the relative financial performance of the strategy depending on whether such investments are in or out of favor.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today