Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

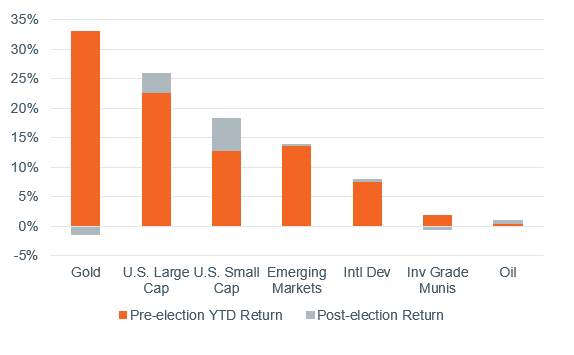

The dust is still settling on a historic election as the counting of votes for the House of Representatives is ongoing, yet the markets have moved swiftly to price in a different policy environment under President-elect Trump. As anticipated, the equity market has reacted positively to the prospects for tax and regulatory policy. The S&P 500 popped more than 3.5% in the two days after the election, bringing year-to-date gains to more than 26% (Figure 1). The Russell 2000 Small Cap Index shot up nearly 7.5%. However, the initial market reaction is not always the lasting one. Many asset classes and sectors face competing tensions created by President-elect Trump’s policy mix. In fact, we do not know the timing or magnitude of many of the policies discussed on the campaign trail. To that end, the extent to which less-business-friendly policies like tariffs or immigration restrictions present downside risks to the economic baseline will only be determined with time. We will outline that dynamic below and focus in depth on this balance of risks in our upcoming Capital Markets Forecast.

Figure 1: Post-Election Bump for Equities

Asset Class Returns (%, YTD)

As of November 7, 2024. Source: Bloomberg. Represents the S&P 500 Index, Russell 2000 Index, MSCI Emerging Market Index, MSCI EAFE Index, and S&P Municipal Bond Index, all in total returns.

Past performance cannot guarantee future results.

Navigating the Trump 2.0 Economy of Higher Highs…

The market has reacted quite positively to the election results, but, over a longer time horizon, the policy priorities of President-elect Trump suggest a wider distribution of outcomes. There is the possibility of greater upside, but also greater downside risks versus the baseline outlook. On the positive side, the President-elect Trump’s policy agenda suggests heightened business activity and corresponding spending, resulting in higher economic growth. A Republican sweep of the Senate and House (the outcome of the House is still unclear at the time of writing) would make the extension of the Tax Cuts and Jobs Act (TCJA) almost assured and will likely be a first priority, given the expiration of many provisions at the end of 2025. There is also the possibility of some icing on the cake in the form of a removal of the cap on the State and Local Tax (SALT) deduction or corporate tax cuts for companies with domestic production. While the equity market is not going to receive the same earnings boost it got when taxes were cut in 2017, consumers, businesses, and investors now have clarity that taxes are not increasing. This should unleash pent up investment, much the way it seems to be unleashing pent up investor cash that has been sitting on the sidelines.

One of the most important developments for increased economic activity will be the significant easing of the regulatory environment in the new Trump administration. This is particularly impactful for companies in the financial and energy sectors. Lighter regulation is also arriving at a critical time, given the ascent of artificial intelligence. Policymakers will need to grapple with just how much to restrain the forces of AI in the interest of safety and moral hazard. We think it likely that President-elect Trump will engage with tech leaders and take a lighter regulatory touch with this burgeoning technology, which benefits the producers and users of AI in the short term. As with any new and powerful technology, there are many risks to be considered, but a business-friendly regulatory environment has fostered U.S. economic exceptionalism and is likely to continue to do so.

…And Lower Lows

Risks that some policies could impede economic growth cannot be ignored. Higher tariffs, immigration restrictions, and mass deportations of the magnitude discussed on the campaign trail could pose significant headwinds to growth and would materially increase recession risks. However, it is too soon to determine how these policies play out. Tariffs used more as a negotiating tactic could increase prices for certain goods in the short term but could result in long-term benefits from opening foreign markets to U.S. companies. Higher tariffs on China are likely. However, more modest tariff increases on a more select group of trading partners than was discussed on the campaign trail would mute the negative impact to the overall economy, especially if the Fed chooses to look through these temporary one-time price increases rather than raising rates as it would in the case of more enduring inflation trends. We see tariffs as presenting more of a risk to 2026 than 2025, as the steps to establish new tariffs have historically taken 9-12 months, and taxes will be a first priority.

The economic impacts of immigration policy are one of the more complicated areas of analysis and we will save the more rigorous economic discussion for our year-ahead outlook. For now, we will point out that net immigration over the past 2-3 years materially increased the labor supply at a critical time, helping to alleviate overall wage increases and pass-through inflation. Now we have a labor market where demand has normalized and there are fewer openings needing to be filled. Going forward, a reduction in net immigration could be more of a demand-side than supply-side story, resulting in less aggregate demand and modestly slower growth.

Factoring Policy Into Our Baseline Economic Outlook

Our baseline economic view remains firmly in the soft-landing camp. Growth has surprised to the upside in 2024, and we have revised up our GDP growth forecast for the U.S. by more than 1% since the start of the year. At this time we expect to see 2.7% GDP growth in 2024 slowing to a below-trend rate of 1.8% in 2025.

It is worth noting that one of the few, but crucial, areas that has presented some economic doubt coming into the election was the labor market. Specifically, lower turnover in terms of quits and job openings concern us. But, just as the economic optimism of the new administration is expected to positively trigger business spending and investment, it could also pull employers off the sidelines to start hiring again. Time will tell.

Inflation has evaporated from the economy, with the exception of housing, which should continue to move lower inline with real-time indicators of home prices and apartment leases. We anticipate that Core PCE will hit the Fed’s target by the first quarter of 2025, allowing them to cut rates by 25 bps at every meeting until reaching 3%, our estimate for the neutral policy rate, in September 2025. This economic outlook has not been materially revised in the wake of the election, though there is a higher error band in light of uncertainty around the exact path of policy.

Weighing the Balance of Risks in Portfolios

The market’s reaction post-election resembles the immediate aftermath of the 2016 election, but the starting point is very different, muddying the market narrative. This time around we are arguably later in the economic cycle, as evidenced by labor market indicators. The Fed is in the early stages of an easing cycle, which is a critical piece of the story. Anything that interrupts that—including higher inflation from tariffs or immigration policy—could derail markets. Taxes were cut significantly in 2017, and the baseline expectation for markets today is an extension of those cuts, rather than another massive reduction. Valuations are now almost 5.5 turns higher for the S&P 500 and elevated across most asset classes, meaning long-term prospects for equity returns are more muted today than they were 8 years ago.

Importantly, the U.S. budget deficit has doubled in the time since President Trump first took office and is now 6.3% of GDP. The fixed income markets are unlikely to write the Trump administration a blank check, restricting further deficit spending. The 10-year yield spiked to 4.47% this week before receding. We think a sustainable move much above 4.50% without a commensurate re-rating of growth expectations would start to weigh on equities at current valuations.

The mix of policies central to the Trump administration further complicates the investment environment because many asset classes and sectors are caught between competing tensions. Take technology as an example. Lighter regulation, more M&A activity, and strength in business spending all support earnings for technology companies. But escalating trade tensions with China, where many technology companies have supply chain or revenue exposures, could hurt earnings. In addition, higher interest rates could dent valuations of more expensive tech companies.

Consumer-facing companies face a similar tension. Extending the 2017 Tax Cuts and Jobs Act TCJA for all income levels is positive for consumer discretionary and staples companies, relative to the alternative of letting those tax cuts expire. However, tariffs on consumer-facing goods could negate those benefits depending on the path of policy. Higher rates on revolving and mortgage debt would also erode purchasing power. The same push and pull exists for many other sectors and asset classes, including small caps.

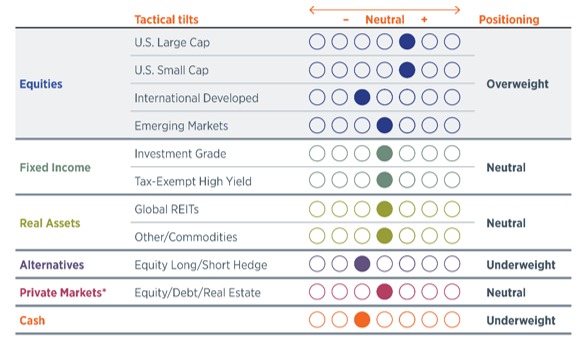

At this time, client portfolios are benefitting from an overweight to risk across U.S. large and small cap equities (Figure 2). Holding an underweight to cash and hedge funds versus our strategic asset allocation is also rewarding portfolios. We are neutral to fixed income, which suffered in October along rising rates and is likely to continue to struggle if rates move higher in November.

In sum, we are optimistic the momentum in markets could carry us higher through early 2025. At the same time, we see a definite ceiling on equities and are skeptical that over the next year markets will make it to the next milestone on the S&P 500 of 7,000. We think current valuations are already reflecting a great deal of optimism, and higher bond yields make equities less attractive, so there is more limited upside for equity returns over the next 12 months.

Figure 2: Current Positioning Overweight to Equities

High-net-worth portfolios with private markets

As of November 8, 2024. Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

*Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets we do not tactically adjust this asset class.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Wilmington Trust periodically adjusts the policy weights’ target allocations and may shift from the target allocations within certain ranges.

The asset classes and their current proxies are: • Large–cap U.S. stocks: Russell 1000® Index • Small–cap U.S. stocks: Russell 2000® Index • Developed international stocks: MSCI EAFE® (Net) Index • Emerging market stocks: MSCI Emerging Markets Index • U.S. inflation-linked bonds: Bloomberg US Treasury Inflation Notes TR Index Value Unhedged* • International inflation-linked bonds: Bloomberg World ex US ILB (Hedged) Index • Commodity-related securities: Bloomberg Commodity Index • U.S. REITs: S&P US REIT Index • International REITs: Dow Jones Global ex US Select RESI Index • Private markets: S&P Listed Private Equity Index • Hedge funds: HFRX Global Hedge Fund Index • U.S. taxable, investment-grade bonds: Bloomberg U.S. Aggregate Index • U.S. high-yield corporate bonds: Bloomberg U.S. Corporate High Yield Index • U.S. municipal, investment-grade bonds: S&P Municipal Bond Index • U.S. municipal high-yield bonds: 60% Bloomberg High Yield Municipal Bond Index / 40% Municipal Bond Index • International taxable, investment-grade bonds: Bloomberg Global Aggregate ex US • Emerging bond markets: Bloomberg EM USD Aggregate • Cash equivalent: 30-day U.S. Treasury bill rate.

Index Descriptions

The Bloomberg U.S. Aggregate Index measures the performance of the entire U.S. market of taxable, fixed-rate, investment-grade bonds. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $250 million.

The Bloomberg U.S. High Yield Corporate Index, formerly known as Lehman Brothers U.S. High Yield Corporate Index, measures the performance of taxable, fixed-rate bonds issued by industrial, utility, and financial companies and rated below investment grade. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $150 million.

The Bloomberg World Government Inflation-Linked Bond (WGILB) Index measures the performance of investment grade, government inflation-linked debt from 12 different developed market countries.

Bloomberg Commodity Index measures the performance of 19 futures contracts on physical commodities. As of the annual reweighting of the components, no related group of commodities (for example, energy, precious metals, livestock, and grains) may constitute more than 33% of the index and no single commodity may constitute less than 2% or more than 15% of the index.

The Dow Jones Global ex-U.S. Index is an equal-weighted stock index composed of the stocks of 150 top companies from around the world (excluding the U.S.) as selected by Dow Jones editors and based on the companies' long history of success and popularity among investors. The Global Dow is designed to reflect the global stock market and gives preferences to companies with global reach.

The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is composed of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

The MSCI All-Country World Index ex USA measures the performance of large- and mid-capitalization stocks in approximately 50 developed and emerging equity markets, excluding the United States.

The MSCI EAFE® (net) Index measures the performance of approximately 20 developed equity markets, excluding those of the United States and Canada. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to nonresident investors.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 26 emerging markets countries. With 1,198 constituents, the index covers approximately 85% of the free-float-adjusted market capitalization in each country.

Russell 1000® Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today