Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

The path for tariffs and trade policy may have taken a couple steps forward by way of the U.S.-China and U.S.-U.K. trade agreements, but it took several steps back following a court decision last week that deemed President Trump lacked the legal authority to impose most of the tariffs the administration had put in place. The administration is appealing this decision and the tariffs remain in place for now. It is also ruminating alternative strategies should the legal challenge fail. We have not changed our outlook from the 50:50 coin flip probability of a recession we had established in the wake of the agreement with China, but we think the additional dose of uncertainty is a net negative on the margin. After reducing equity risk early in the year, we have ridden through the tariff-induced volatility with a full allocation to equities, and we still think that positioning is appropriate. After all, the markets remain highly sensitive to two-way, headline-driven risk. The S&P 500 is within reach of its February all-time high, and we see a new all-time high as attainable in the coming months but it will be dependent on the path forward on tariffs, tax policy, and the ability of businesses to adapt in the face of significant policy change.

A setback in the courts

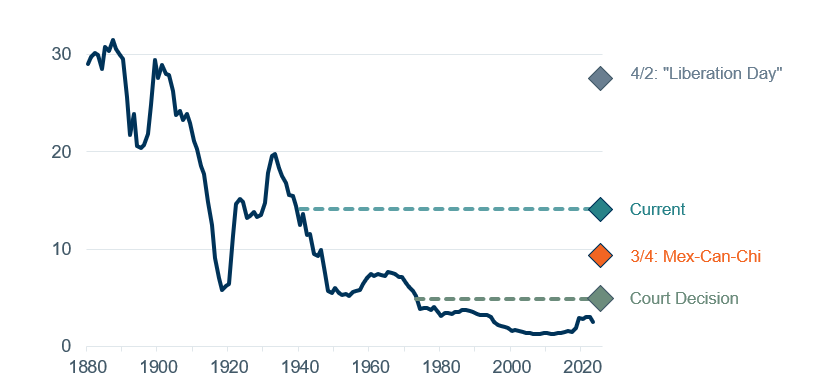

The Trump Administration’s trade policy was dealt a blow on Wednesday, May 28 when the U.S. Court of International Trade found the law cited for most tariffs imposed so far does not give a president authority to implement tariffs in the manner that President Trump has levied the “reciprocal” tariffs with most trading partners, nor the tariffs on Canada, Mexico, and China linked to the threat of fentanyl. The administration is appealing this decision, and the tariffs will remain in place for now, so importers, businesses, and consumers continue to face an estimated 14% effective tariff rate (ETR). This is still well below the peak announced on April 2 in the Rose Garden, but if the tariffs were removed, it would eliminate roughly 80% that have been put into place this year, dropping the ETR to just 5% (Figure 1).

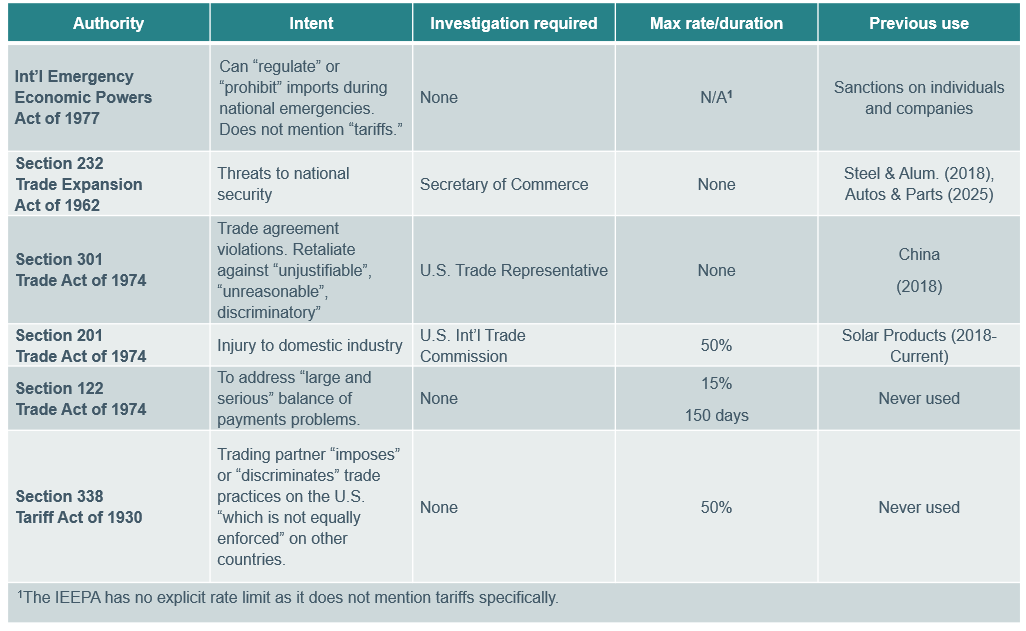

That would be a boon for the outlook but is not likely to hold. The administration has already publicly floated its plans to pursue the use of other tariff authorities to keep driving its agenda. The problem they are facing is that none of the other options are a straightforward replacement to put pressure on the long list of individual countries to negotiate trade deals. Section 232 of the Trade Expansion Act of 1962 is meant to deal with specific industries, as is Section 201 of the 1974 law, and both require formal investigations, which can be time consuming. Section 122 of the 1974 law does not require an investigation but is meant for “large and serious” balance of payments problems, which is a much broader consideration than just the balance of trade. Also, it limits tariffs to 15% and 150 days. There is some speculation that the Trump Administration could use Section 338 of the Tariff Act of 1930, which has never been used, but the law points to usage in response to discriminatory behavior, which might not hold up in court if the U.S.’s trade partners are levying tariffs and non-tariff barriers equally across all their trading partners. The challenges in using any of the other options is perhaps the best explanation as to why the administration chose to use the International Emergency Economic Powers Act (IEEPA) of 1977, even though it does not specifically mention tariffs.

Figure 1: Court decision could reduce tariffs, but maybe only temporarily

U.S. effective tariff rate (%)

Data as of June 3, 2025. Sources: Yale Budget Lab, WTIA.

Dragging out the uncertainty

One of our key concerns, along with the direct price hit to consumers, continues to be the impact of uncertainty for businesses. Firms are not likely to engage in capital expenditures (capex) to move supply chains or production to the U.S. as it can take years to decades to pay off. Right now, it’s not clear what tariff rates will be next month or even at the end of the year, let alone over a multi-year period. A survey conducted in late April showed businesses were planning to scale back hiring and capex due to policy uncertainty.

Additionally, trading partners are well aware of the unfolding situation and, in our view, are unlikely to give concessions for new, long-lasting trade deals when the U.S.’s main point of leverage is in legal limbo. In the meantime, U.S. consumers sharply slowed their spending to start the year and measures of sentiment and confidence remain low. We expect the tariffs in place combined with uncertainty to be a drag on economic growth for the remainder of 2025 with a 50% chance of slipping into recession.

On the brighter side

There are upsides for the economy that help mitigate the challenges we see from tariffs and the associated uncertainty. First, we are quite cognizant that the U.S. economy has continuously surprised to the upside for the past several years. We attribute that outperformance to dynamic U.S. firms driving productivity gains, nicely filling the void left by pandemic-era government stimulus programs. That productivity is alive and well, and could continue to drive growth.

Second, passage of the One Big Beautiful Bill Act could provide some stimulus to support further growth. While most of the personal income tax provisions are mere extensions of current tax rates, there are a few (no taxes on tips, higher SALT deduction) that are new and give a bit of a boost. We view the provisions to stimulate capex as more likely to boost growth, and firms could be putting more weight on those benefits than they are the costs of current tariff uncertainty.

Last, inflation data continue to support our view of rate cuts from the Federal Reserve (Fed) coming in the second half of 2025. The most recent reading of the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index registered just 2.1% year over year (y/y), essentially at target, while the unemployment rate is also at their target. An increasing number of Fed officials are talking about tariffs as only giving inflation a temporary boost, which argues for rate cuts this year.

Positioning amid uncertainty

Equities quickly discounted the de-escalation of trade tensions, posing some near-term risk to continued gains. We think markets will continue to exhibit volatility but will ultimately look through a short growth slowdown to stronger economic growth in 2026. By the end of this year, we expect less tariff-related uncertainty, allowing businesses to re-engage in capex and consumers to feel comfortable spending again. Our expectation for an increase in the unemployment rate to 5% is still low by historical standards, and both consumer and business balance sheets are in good shape. As the calendar turns, we should start to see some of the short-term stimulus from the Republican tax and spending bill, assuming it is passed by a narrow majority in coming months, as we expect.

The corporate earnings outlook is critical, and we are reminded that the economy and equity markets can behave quite differently in the short term. Despite a negative GDP print in the first quarter, we saw very strong first-quarter earnings results from companies, with S&P 500 earnings growing just shy of 13% y/y. As with most of the data today, we must take this with a grain of salt, as the environment completely changed following the April 2 tariff announcements. It is challenging to parse tariff front running from real economic activity, and corporate executives are giving us little in the way of guidance, for obvious reasons.

However, we continue to see very strong results from the biggest constituents in the market—mega-cap tech companies. In fact, following the earnings report from Nvidia last week, the Magnificent 7 grew earnings by a collective 27.7%[1]--just slightly below the prior three-quarter average of 32% and 15% higher than expectations for the quarter. Businesses face considerable uncertainty and are likely to pare both capex and hiring, but we continue to hear that the one area companies are reticent to cut spending is technology. Companies that have a tech edge want to maintain that advantage, and those that do not are working hard to catch up. Earnings for the tech sector will likely slow from here, but we expect these companies to maintain an earnings growth premium to the rest of the market. Tech companies also source a larger share of revenues from overseas than the rest of the market, meaning the weaker U.S. dollar should start to play through into an earnings boost.

This brings us to a potential leadership shift as we move into the second half of the year. Through April, and for the first time in several years, we saw the benefits of diversification across asset classes and within the U.S. equity market. In stark contrast to the prior two years, leadership broadened, U.S. equities trailed international, and non-tech stocks outperformed. Should growth slow over the coming months as we anticipate, we would expect investors to place a greater premium on the high, durable earnings growth presented by tech companies and high-growth, “high-quality”[2] companies in other sectors. This would also give an edge back to U.S. equities, due to the higher allocation to tech relative to international equity indices.

The wild card when it comes to technology leadership lasting is—you guessed it—tariffs. Semiconductor and hardware companies are vulnerable to tariffs, trade restrictions, and retaliation. For this reason, we are maintaining a benchmark allocation to the growth factor (of which tech is heavily represented), while favoring companies that are high quality and larger in size.

The bond market could spoil the party

Also critical for investors is what has been transpiring in the bond market. Concerns are mounting regarding the U.S. debt trajectory, and this is contributing to higher interest rates on long-dated U.S. Treasuries. In the last month, the yields on the 10-year and 30-year Treasuries have increased roughly 20 basis points (bps), now sitting at or uncomfortably close to what many deem a psychological threshold (4.5% and 5%, respectively). This is not just a U.S. phenomenon, as yields for European and Japanese government debt have also increased. As it relates to U.S. yields, investors are closely monitoring the deliberations in Washington and the cost of the One Big Beautiful Bill Act. Our read on the market is that some level of deficit expansion over the 10-year window is tolerable, but if that figure creeps much above $2.5-2.75 trillion on a static basis, Treasury auction demand for longer maturities could falter. Higher rates would be expected to pressure equity market returns and add to volatility.

Core narrative

Our outlook for the economy has improved at the margin in recent weeks, but we expect economic slowing and place 50-50 odds of a recession this year. The equity market has been supported by strong earnings growth, particularly from tech stocks. Equities face a number of significant short-term risks, including tariffs and interest rate volatility. While we are grateful for the strong rally in markets since mid-April, we expect continued elevated volatility. Still, we expect the market to look through a short-term slowdown or recession and price in better growth in 2026. We are positioning portfolios with a neutral allocation across equities and fixed income, but with a preference for investment-grade over high-yield fixed income.

[1] Source: FactSet, as of June 2, 2025.

[2] Defined as companies with low leverage and consistent, above-trend earnings growth.

Descriptions

The S&P 500 index is a stock market index that tracks the performance of the 500 largest U.S. companies listed on stock exchanges.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today