Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

As we make the final turn into the end of the calendar year, we are struck by the multitude of mixed messages on the economy. For investors, it’s a bit of a Rorschach test, with something to satisfy bulls and bears alike. The bulls can find support for their thesis in improved consumer spending, solid global domestic product (GDP) data, and robust corporate earnings. Meanwhile, the bears have plenty to work with in the dismal labor market, low consumer and business sentiment, flaring trade risks and, yes, some signs of reaccelerating inflation. For the latter, these perceptions paint a picture of a deteriorating economy with stretched market valuations.

When we look at the inkblot, we see an economy that is slowing but not rolling over as it digests tariffs. We retain a full allocation to equities but are mindful of building risks—across the political, economic, and market landscapes—that can make diversification more critical than ever.

The labor market is one of the most critical and, currently, complex pieces of the economic puzzle. What is clear is that the job market is slowing. We think it most likely, however, that the coming months will bring just that, a slowing, rather than an outright rolling over, of the labor market and broader economy.

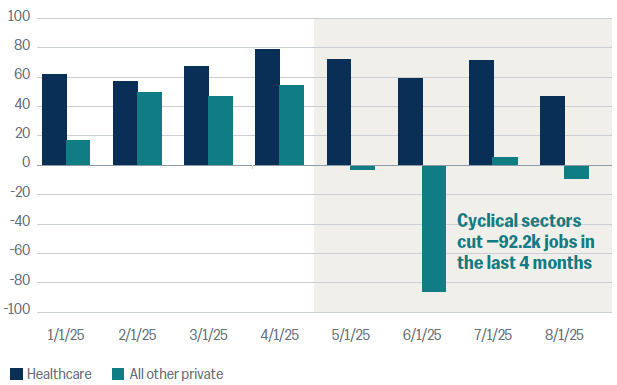

Labor demand is muted, with job openings plateauing below pre-pandemic levels. New job creation has slowed to a crawl and is being propped up by the health care sector (Figure 1). Outside of health care, the private sector has shed more than 90,000 jobs in the last four months. Data in recent months, as well as last year, have undergone significant downward revisions indicating a softer job market last year than was understood at the time.

Figure 1: Job growth slowing to a crawl

Job growth (thousands)

Data as of September 5, 2025. Source: Bureau of Labor Statistics.

The “curious” element, to use Federal Reserve (Fed) Chair Powell’s verbiage, is that jobless claims—both initial and continuing—are low and stable. In other words, companies in the aggregate are not hiring, but they’re also not firing. Low labor demand is being met with low labor supply, both from reduced immigration and aging demographics. Given significantly less growth of the labor supply in 2025 than 2024, the breakeven rate of job growth needed to keep the unemployment rate at 4.3% is probably in the range of 25,000–75,000 jobs per month. This range is above the rate of job growth we have seen since May, but given low labor supply, even a modest increase in job growth from current levels could signal a stabilization of the labor market.

We are on alert, and at 45%, our odds of a recession over the next 12 months are higher than Wall Street consensus. It would not take much to push the economy into a labor market contraction. And once the unemployment rate starts to climb, a recession is usually not far behind. It does not help that, at the time of writing, we are in the midst of a government shutdown, which will limit data availability at a critical juncture for the Fed and the economy. That said, it is important to note that we do not see the shutdown significantly increasing recession odds, provided it is resolved by early November.

Tariffs can have a stagflationary impact on the economy, but so far we are seeing more stagnation and less inflation. Higher prices of imports at the border are resulting in an elevation of core goods inflation, but after more than a year of goods deflation, the rate of price increases on a six-month moving average basis has only climbed to the Fed’s target. Core goods inflation could continue creeping higher as tariffs are digested in the supply chain, but tariffs are a one-time increase in prices rather than a persistent inflationary impulse. As such, it’s reasonable to look through these increases in anticipation of them “rolling out” of the inflation data next year.

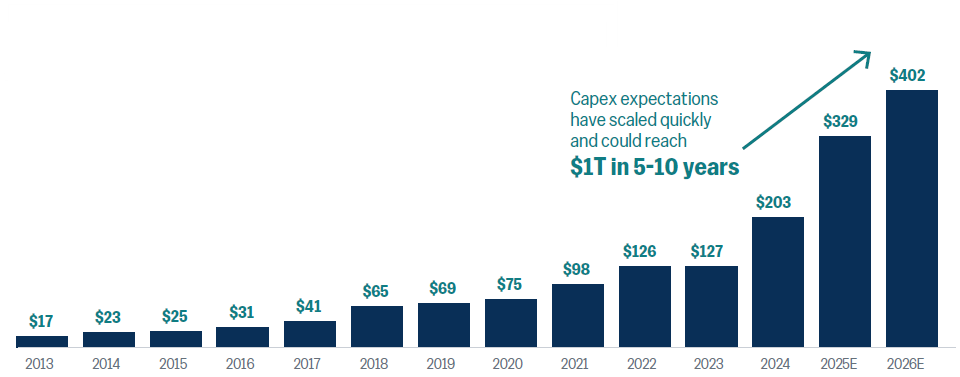

Figure 2: Hyperscalers spending aggressively on AI-related capex

U.S. capex (in $ billions) for Microsoft, Meta, Amazon (AWS), Oracle, and Alphabet

Data as of September 30, 2025. Sources: Bloomberg, WTIA. Amazon capex discounted for AWS-specific spending.

Critically, we anticipate that goods inflation will lead to weaker consumer demand for services, thereby keeping services prices in check. All of this will, in our view, keep overall core CPI undulating around, if not tolerably higher than, the Fed’s 2% target.

With inflation sticky but very close to the Fed’s target, we believe the weakening labor market will take precedence among the two sides of the Fed’s dual mandate. Our expectation is that the Fed has the green light to keep cutting rates after restarting the rate-cut cycle in September. We anticipate another 50 basis points, or bps, of cuts in 2025, followed by 75 bps of cuts in 2026. At that point, the fed funds rate would be at our estimate of “neutral” (the rate that neither stimulates nor contracts the economy). This is a slightly more dovish forecast than what is currently priced into the fed funds futures market and is predicated on inflation continuing to decelerate toward the 2% target. Lower rates should bring relief to small businesses and some of the more cyclical industries that are feeling the burden of elevated borrowing costs. What is equally important but less clear is whether longer-term rates, which are particularly vital to the housing market, will also fall materially. Lower long-term rates are, in our view, a key ingredient to GDP growth reaccelerating to the long-term trend of approximately 2% in 2026 and beyond.

After contracting in the first quarter, U.S. GDP growth rebounded to a very robust 3.8% in the second quarter, despite a slowing in the labor market. The economy is getting a nice tailwind from the frantic pace of artificial intelligence (AI) investment. About half of 2025’s GDP growth can be attributed to tech spending on fixed investment and domestic sales. In addition, the stock boom has also importantly contributed to the wealth and spending power of higher-end consumers. Capital expenditures (capex) from Microsoft, Meta, Amazon (AWS), Oracle, and Alphabet are projected to top $325B in 2025 and $400B in 2026 (Figure 2). Looking more broadly, fixed investment in just three categories—computers, software, and data centers— accounted for 25% of overall non-residential fixed investment so far in 2025.1

We expect AI-related capex to continue to ramp up through 2026 and 2027 driven by the growing demand for compute resources to support increasingly complex models and applications. The flipside of that optimistic view is the fear that AI infrastructure is in the process of being massively overbuilt. More on this in a moment.

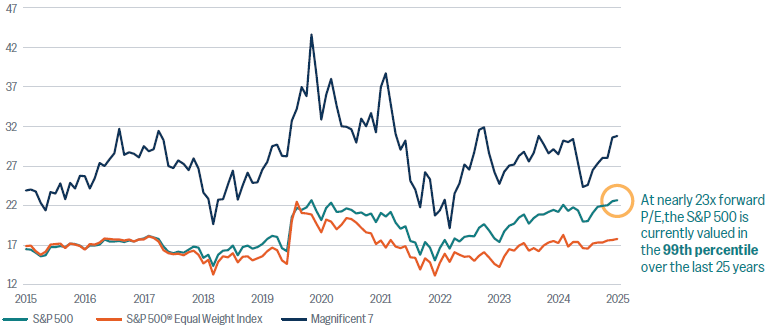

Figure 3: Equity valuations extended

Forward P/E ratio (last 10 years)

Data as of September 30, 2025. Source: Bloomberg.

The S&P 500® Equal Weighted Index uses the same 500 companies as the S&P 500, but each stock carries equal weight, reducing concentration in large-cap names and providing balanced exposure. Magnificent 7 are Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia, which dominate market performance.

The equity market has been charging ahead since the April 8 low. The 34% return of the S&P 500 since April 7 ranks in the 98th percentile of six-month returns, looking back over the last 30 years.2 Notably, prior periods of similar strength have signaled a durable bottom in the market, occurring around episodes like the bottoming of the global financial crisis and the Covid selloff.

The equity market has certainly gotten a lift from receding trade tensions, which, unfortunately, are rearing their ugly head again. We expect the Trump administration to continue to engage with Chinese trade delegations, but progress will likely not be linear. Trade restrictions on semiconductors and rare earths represent both countries’ “trump” cards, and we believe that any détente would be fragile.

As noted, the largest market support has been the AI trade, with tech, communication services, and utilities the top performers over the last three months and year to date. There are signs of life in other sectors, too. Despite the emergence of what appears at this time to be some idiosyncratic credit-related events, financials have performed well this year, as credit losses seem benign and a steeper yield improves profitability.

The biggest concern in the equity market is whether the AI trade can continue to justify very lofty valuations. The S&P 500 is trading in the 99th percentile regardless of what metric you use, looking back over the last 25 years (Figure 3). We are mindful of building concerns about AI investment generating an asset bubble and ever-increasing comparisons to the late 1990s. Studies point to relatively low adoption of AI by corporations and even less productivity growth to show for the investments that have been made thus far.

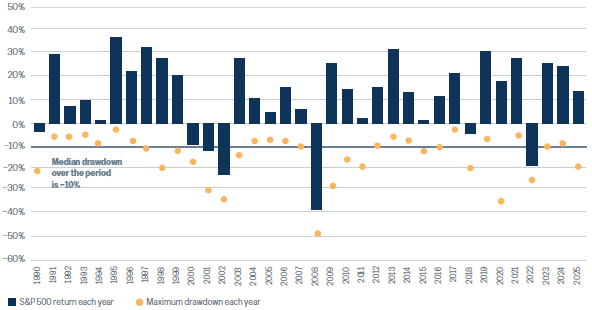

Figure 4: Market corections are the norm, even in strong years for equities

S&P 500 intra-year declines vs. calendar-year returns

Data as of September 30, 2025. Source: Bloomberg.

The challenge is predicting how the technology develops and how deeply it becomes integrated into our economy in the next 5–10 years. If AI never goes little beyond a free and fancy web search function, then the necessary return on AI infrastructure investments will never be realized. However, in our view, AI can prove far more transformative to corporate work applications, automated manufacturing, health care, and more.

We agree that productivity is not yet getting a boost from AI. To us that means there is a significant potential for improved productivity growth as AI inference applications are further developed. It also means tremendous opportunity for fresh businesses to emerge as leaders in this new economy—both producers and users of the technology applications. There is sharp debate about whether the AI investment opportunity is in the second or tenth inning. We believe that we are closer to the middle innings with room to run.

We maintain a full allocation to equities in portfolios as we monitor the slowing economy for deepening cracks. Equity market momentum has recently vacillated and a normal pullback in the market of the 5%–10% variety is now likely. These pullbacks are very typical and would represent a healthy reset for the next leg of the bull market (Figure 4). Due to the impossibility of predicting corrections such as these, and our assessment that economic slowing is more likely than recession, we favor staying fully invested and riding through near-term volatility.

In the meantime, our focus has shifted to corporate earnings, which have grown well above expectations this year. Next year is also looking constructive, with projections for double-digit earnings growth and broad-based strength across sectors. Corporate balance sheets are in sound health with elevated cash levels. All of that could, of course, change if the economic picture deteriorates, and we will be carefully scouring earnings calls to get clues for what management is seeing on the horizon. We retain a preference for larger, high-quality companies in equity portfolios and investment grade over high yield within fixed income.

In many ways we find ourselves in uncharted waters. This uncertainty is helping drive capital into unconventional asset classes like cryptocurrency and gold as potential hedges against failures in traditional stocks and bonds. We are actively considering these and other asset classes as potential diversifiers, but at this time do not believe the forward-looking returns justify prices for the risk assumed. Any number of macro factors could change that view, and we will keep you updated on developments in portfolios.

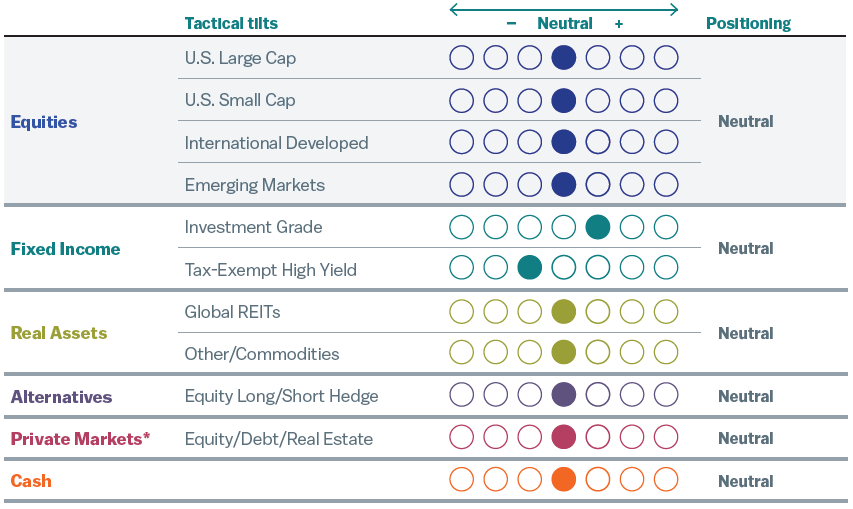

Figure 5: Asset class positioning

High-net-worth portfolios with private markets*

* Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets but do not tactically adjust this asset class.

Data as of October 15, 2025.

Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

Sources:

1. Barclays, BEA. “Computers” is represented by “computers and peripherals” in the BEA data.

2. Bloomberg.

Please see important disclosures at the end of the article.

Please complete the form below and one of our advisors will reach out to you.

* Indicates a required field.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today