Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

The longest government shutdown in U.S. history had far-reaching impacts, with the most tangible for the economy and markets being the delay of official government statistics. Investors use this data to gauge the path of the economy and then try to divine the direction of markets. As we head into the final month of the year, we have received a couple of key reports and await many more.

So far our outlook has not changed. Considering signals from private data sources and incorporating official releases thus far, we still see an economy that is adjusting to the tax hikes (in the form of tariffs) implemented this spring, the tax cuts from the One Big Beautiful Bill Act (OBBBA), and the pervasive uncertainty regarding future policy. We place a 45% probability on a recession within the next 12 months, with the deteriorating labor market as the key signal. But we would expect a recession, if it occurred, to be short and shallow. On the bright side, data on overall economic growth is tracking for a strong figure in Q3.

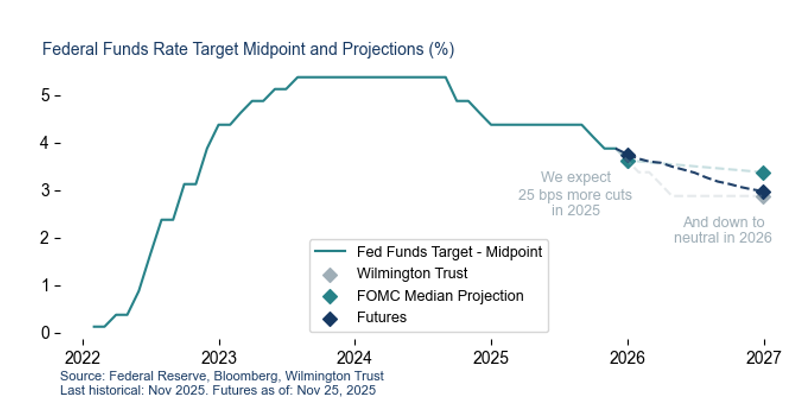

We expect the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) to continue cutting interest rates in light of the weakening labor market and only mild inflation pressures. We maintain a neutral positioning in equities, as well as an underweight to high yield fixed income and overweight to investment grade fixed income.

Official statistics coming soon, better late than never

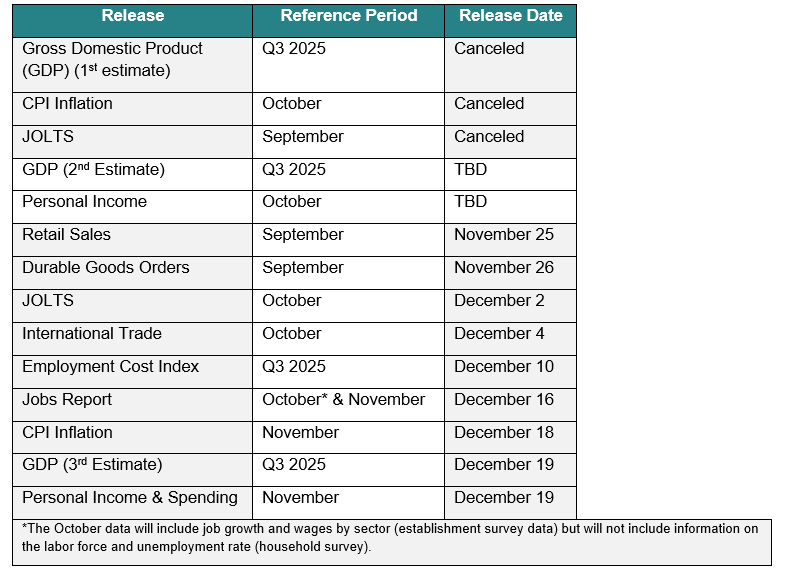

The recent government shutdown delayed several key economic releases, including payrolls, trade, and inflation. These reports are the backbone of how markets and policymakers assess economic conditions. Several data releases have been canceled, including the Job Openings and Labor Turnover Survey (JOLTS), a key reading on firms’ appetite for hiring. Government agencies have released updated schedules for upcoming releases (see the table below). The main takeaways are threefold:

Labor Market at the Center of Policy

Starting with Chair Powell’s speech in Jackson Hole and on through the rate cuts in September and October, the Fed has turned their focus to the labor market. Inflation is still part of the conversation, but the Fed now sees labor market conditions as the primary driver of its next moves. This isn’t a sudden pivot; it reflects progress on inflation and growing concern that employment is softening. In recent communications, policymakers acknowledged that risks have tilted toward the labor side. With official data delayed, they – and we – are watching alternative indicators closely to gauge whether weakness is temporary or structural.

Roundup of Alternative Data

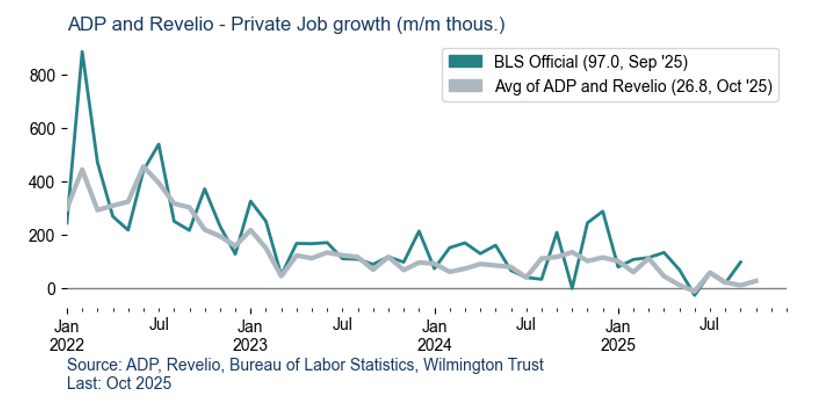

Private jobs data: ADP, the nationwide payroll processor, produces monthly job growth estimates meant to mirror the official data. The most recent ADP data showed modest gains on a monthly basis, but the rolling weekly data turned negative late in October. The details of ADP’s data reveal a “two-speed” dynamic: large firms continue to add jobs while small and mid-sized businesses are cutting back. This matters because small firms account for roughly one-third of U.S. employment, and their retrenchment can weigh on aggregate job growth and consumer spending. Revelio, a newcomer to the alternative data scene, is also showing weak job growth. A simple average of the ADP and Revelio estimates tracks the government data fairly closely (see figure below) and suggests we are likely to see a slowdown when official data is released on December 16.

Indeed and LinkUp: These sources measure firms’ appetite for hiring and have historically tracked closely with the official JOLTS data. In the alternative data, job openings have declined steadily across both platforms, signaling softer demand for labor. The drop is broad-based, spanning sectors that had previously been resilient. This trend suggests employers are pulling back on expansion plans, which aligns with the weakness we see in small business hiring and points to a slower pace of job creation ahead.

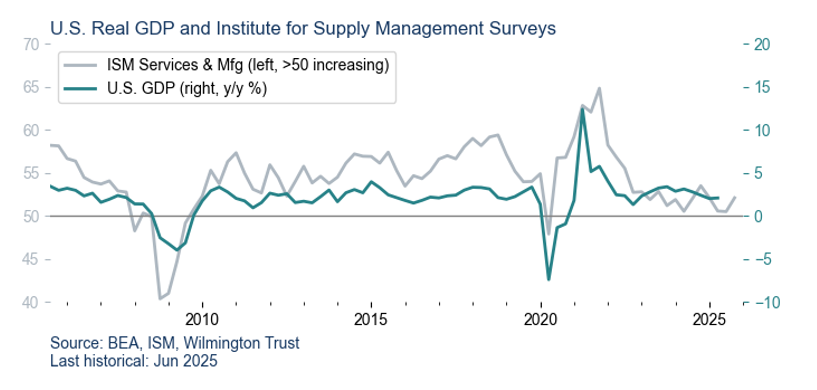

Business Surveys: Private surveys of business activity offer a bit of optimism, relative to the labor market signals. The Institute for Supply Management (ISM) conducts separate surveys of the manufacturing and services sector, asking firms about various items such as new orders, current production, pricing, and hiring. Combining the overall ISM indices for both manufacturing and services yields a series that track overall GDP growth fairly well (figure below). The most recent readings from ISM suggest the economy has held its head above water, despite the weakening labor market.

Inflation Matters in the Longer-Term

While the labor market is currently the key focus for the outlook and for Fed policy, further progress in inflation is critical to the path of interest rates in 2026 and onwards. We have long contended that while tariffs would lead to upward pressures in goods prices, this would be counterbalanced by a reduction in overall economic activity via lower discretionary services spending, and we believe that the weakening labor market is a reflection of our view. The data fog has seriously impeded our ability to see whether inflation data have softened along with the labor market, although the recent release of the shutdown-delayed September CPI was encouraging. It showed under-control core inflation as well as deceleration in core services. We expect that core services will lead inflation lower as we head into next year, driven by household spending that softens in response to the weaker labor market, as well as continued easing in shelter.

Expecting the Fed to Keep Cutting Rates

Based on these signals, we expect the Fed to cut rates at its December meeting and follow with three additional cuts in 2026. After the second rate cut of the year in October, Chair Powell warned markets against baking in another cut this year as a “forgone conclusion.” That hawkish signal was followed by a slew of Fed officials indicating a desire to hold rates, wary of inflation risks. But the September jobs data led two of the most influential voices (FOMC Vice Chair John Williams and Governor Chris Waller) to publicly support another rate cut.

Inflation progress has been encouraging, but the labor market is losing momentum. Without a strong jobs backdrop, the Fed is likely to prioritize supporting the labor market with another cut. The recent FOMC communication acknowledged the uncertainty created by missing data and reinforced the message that policy will remain flexible. In our view, the combination of softer labor indicators and fading inflation pressures makes a compelling case for easing.

Core Narrative

The next Jobs Report, slated for December 16th will feature payrolls data for both October and November, while the next CPI reading on December 18th will entirely exclude October and jump straight to November. The release of these two major reports nearly back-to-back could result in a potentially significant update on the state of the domestic economy in a short span. This clearing of the backlog of official data has the potential to create market volatility if it substantially changes the economic picture. We remain positioned neutrally in equities, with an underweight to high yield and overweight to investment grade fixed income, and an overweight to quality and to growth at the portfolio construction level. This positioning reflects our recognition of the counterbalancing forces of potential tailwinds from Artificial Intelligence (AI), tax incentives, and the rate-cutting cycle heading into 2026, versus risks to the economy emanating from the softening labor market.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today