Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

At the beginning of the year, we outlined our expectations for the economy and markets and drew an analogy to the classic boardgame, Chutes and Ladders. We identified sets of risks to the upside (ladders) and downside (chutes), but we knew that the state of play would depend greatly on details unbeknownst at the time.

As we move into the second half of the year, the gameboard is taking shape while remaining dynamic. And our views are evolving along with the gameboard. Clouds have formed on the economic horizon since the start of the year, but companies are doing what they do best—adapting and finding ways to be more efficient—and this is being reflected in strong earnings growth and an equity market at all-time highs. Volatility in the economy and markets will likely stay elevated in the second half of the year, particularly as economic activity slows, but we think the market will largely look through a possible second half of 2025 recession to a reacceleration of economic growth in 2026. For now, a full allocation to equities remains appropriate as we are mindful that further market gains in the absence of trade clarity equate to greater downside risk.

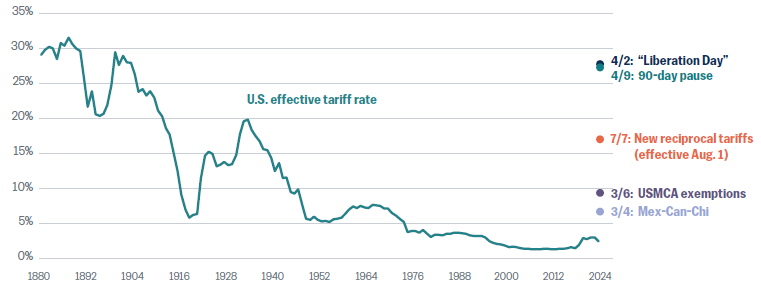

Since April, the primary chute—tariffs—had elongated, then shrunk, and now elongated again as we have passed the end of the 90-day pause on “Liberation Day” tariffs. It remains to be seen if the tariff rates announced following the 90-day pause will stick or continue to change as negotiations and trade deals emerge. In our estimation, the 10% tariff rates that were in place during the 90-day pause are likely the floor, and the Liberation Day tariff rates are the ceiling. The 17.5% effective tariff rate is based on current policy and could bleed higher unless the administration succeeds in laying new trade frameworks with our major trading partners (Figure 1).

Figure 1: The effective tariff rate could increase in absence of favorable trade deals

U.S. Effective Tariff Rate (%)

Data as of July 7, 2025. Sources: Yale Budget Lab, WTIA.

The sheer magnitude of the tariffs being issued on all major trading partners, if operative for long, will be a headwind to the economy, and we expect it to manifest more in the growth data than in inflation. In terms of growth, tariffs are hitting consumer and business confidence, which in conjunction with a slowing labor market will mute consumer spending. Potentially as damaging as the tariffs themselves is the uncertainty businesses are facing. Businesses generally will not make costly and time-intensive investments or labor expansion plans in an environment with such continuing “headline risk” at the economic level. The stop-and-go, back-and-forth nature of the tariff announcements could also undermine any goal of redirecting supply chains to the U.S. or trade allies. In other words, the tariff chute risks paralyzing business investment and economic growth as we await clarity and certainty on the end state for trade relationships.

We are seeing the impact of tariffs on the inflation data, but not in the way many expected. Since the beginning of the year, we have held the out-of-consensus view that tariffs would not be inflationary over the medium term. So far, the evidence supports our case. The June Consumer Price Index (CPI) release showed core inflation increasing 2.9% year over year but just 0.2% month over month. Underneath that headline reading, goods prices increased in tariffed categories like household furnishings and appliances, apparel, and recreation commodities. However, consumers are facing a looser job market, less savings, and significant inflation fatigue, so we anticipate that they will offset higher goods prices by pulling back on spending in services such as dining out, entertainment, and travel. Housing, another critical component of the inflation index, continues to show disinflationary pressures and is likely to drag inflation closer to the Federal Reserve’s (Fed) target, paving the way for three 25 basis point (or bps) rate cuts from the Federal Open Market Committee by year end.

So far, the market is digesting the risks presented by the chutes, and we don’t think it’s due to complacency. Rather, investors increasingly recognize the negotiating pattern of the administration and the adaptability of companies, as well as, increasingly, the fear of missing out (FOMO) on market momentum that has built since April 9.

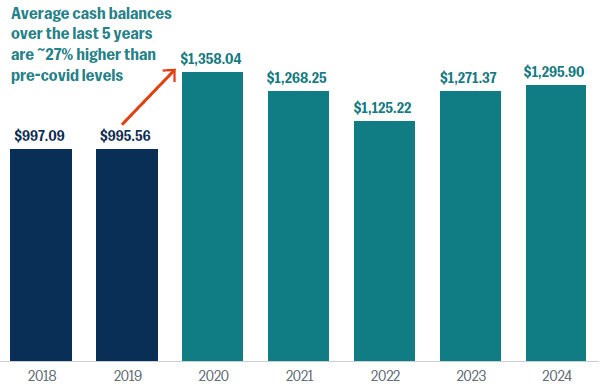

We know the economy and the market do not move in lockstep in real time. The stock market discounts economic activity in the future. Even though we place 50/50 odds of a recession over the next 12 months, if we do have a recession, we expect it to be short-lived and shallow. The market will likely look through a slowing of consumer spending in the second half of 2025 and price in reaccelerating growth in the first half of 2026. After all, corporate balance sheets are very healthy, and large companies are sitting on cash levels approximately 25% higher than pre pandemic (Figure 2).

Figure 2: Corporate balance sheets are healthy

Aggregate corporate cash balances (in $Bn)

Data as of December 31, 2024. Sources: Bloomberg, WTIA. Corporate cash includes cash equivalents. Calculation excludes companies in the financial and real estate sectors.

We are also seeing strength in technology’s secular growth story. Businesses may be forced to cut costs and slow the pace of hiring as they figure out how much of the tariff hit they can absorb in their bottom lines. At the same time, technology is one area we consistently hear companies are not willing to skimp on. Whether it’s cybersecurity, cloud infrastructure, or AI, cutting spending in these areas risks falling behind the competition. This is helping to drive earnings growth and resiliency for large-cap tech companies, making them a potentially defensive investment in an otherwise slowing economy. Since the tech sector makes up 32% of the S&P 500 and consistently outpaces earnings of the rest of the market, this group alone is contributing heavily to equity market momentum.

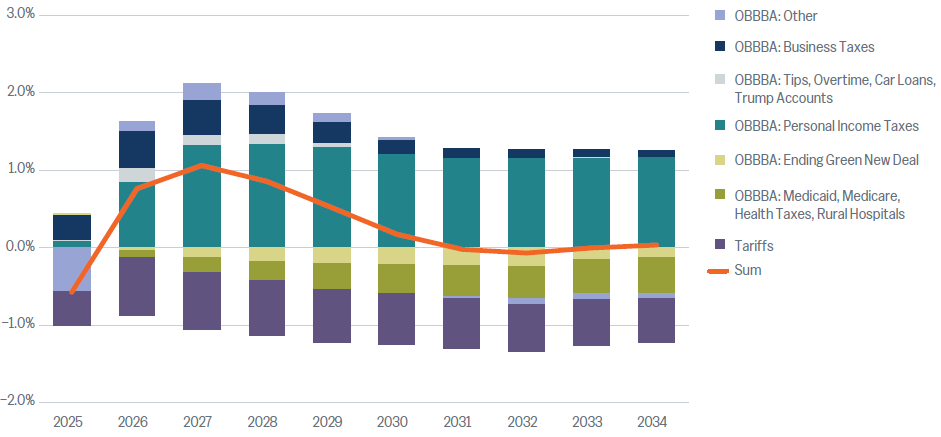

The One Big Beautiful Bill Act (OBBBA) is, in our view, a ladder, but not one that will take us all the way up the gameboard like investors may have fancied at one point. First, the new law adds stimulus to consumers and businesses in 2026, but a large chunk of the bill is dedicated to extending the 2017 tax cuts, which we believe have been priced into the market and will not result in a change in consumers’ after-tax income. There are some stimulative tax provisions such as an increased state and local income tax (SALT) deduction, an increased child tax credit, and a deduction for income earned from tips. These are partially offset by cuts to green energy credits, Medicaid, and food-assistance programs but all-in the bill is expected to provide a net positive stimulus to gross domestic product (GDP) in the initial years.

The OBBBA also adds to the deficit (Figure 3), which will place upward pressure on long rates and, over time, increase the crowding-out effect of higher deficits. When we net the cost of the tax and spending provisions against expected revenue collection from tariffs, we see the combination of the two policies adding to the deficit in years 2026-2030 (before making any “dynamic” adjustments for the impacts of economic growth or higher interest rates). The bond market has seen only modest volatility associated with the OBBBA. We assess that this is because the bulk of the cost is associated with the extension of the 2017 Tax Cuts and Jobs Act personal tax provisions, most of which were anticipated regardless of who won the 2024 election.

Figure 3: OBBBA to add stimulus, and the deficit, in early years

Net impact on deficits of One Big Beautiful Bill Act and newly-introduced tariffs (% of GDP)

Sources: Congressional Budget Office (CBO), WTIA.

Notes: GDP projections from CBO January 2025 projections. Tariffs assumed to be evenly distributed from May 2025 to end of projection period.

The OBBBA does provide longer ladders for businesses. The full, immediate, and permanent expensing of capital expenditures provides tremendous support for capital investment, a key component of GDP growth. At present, trade-related volatility and low business confidence are hindering investment, but if tariff headlines subside and clarity is obtained on final trade policy, companies will be well positioned to use these expensing provisions to invest in buildings, equipment, and software.

An additional ladder worth mentioning but not associated directly with the OBBBA is the regulatory environment. A combination of lighter and more business-friendly regulation should support heavily regulated industries like financials and energy, as well as technology. We are seeing a pickup in mergers & acquisitions (M&A) deal value, though volume remains low. We think we will see an increase in M&A deal volume and IPO activity in the second half of the year.

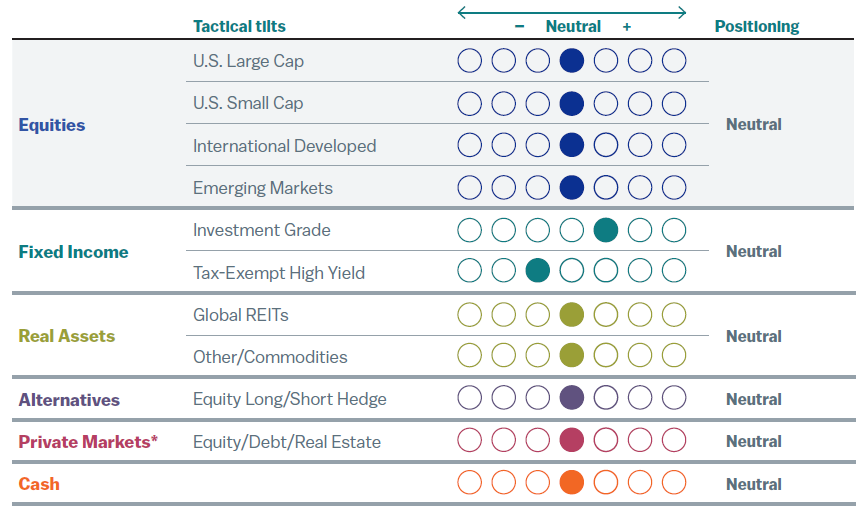

At this time, we remain fully allocated to equities in portfolios (Figure 4). Earnings growth remains solid, tech revenues look resilient, and businesses are sitting on elevated levels of cash. We also expect Fed rate cuts to ease some of the burden on consumers and small businesses.

As alluded to above, we are mindful of growing asymmetry in risk vs reward as equity valuations continue to climb in the face of a souring economic outlook. We place recession odds at 50/50 and for now expect investors to look through a short, shallow slowdown. However, the S&P 500 has rallied 26% since April 8 and is back around all-time high price levels and, for many companies, price-to-earnings valuations. It is becoming increasingly difficult to find value in the equity market.

We are willing to pay up for higher-quality stocks with sustainable earnings power, including technology stocks. International stocks outperformed U.S. stocks in the first half of the year, but we do not expect a repeat in the second half of the year. In our view, U.S. stocks are more expensive than international peers for a reason. Greater productivity and more favorable regulation should allow U.S. stocks to outshine again, particularly with a weaker dollar helping the earnings power of U.S. multinationals.

While we are making no changes to our tactical asset allocation positioning, market movements have caused portfolio allocations to drift from targets. Rebalancing can be a powerful tool when implemented in a diligent, consistent manner, as it involves trimming the “winners” and buying back the “losers.” This inherently contrarian behavior not only keeps our clients’ portfolios on target, but it can also add value in volatile markets like we are experiencing this year. Equities, specifically international developed, have performed well, and a rebalance will result in trimming back some of this exposure in many client accounts. On the flip side, fixed income has significantly underperformed equities, and that asset class has drifted below target. A rebalance will shore up this exposure. The game Chutes and Ladders, much like investing, is not a linear journey. We will certainly see additional volatility in the second half of the year, but we expect to continue making our way up the gameboard, recognizing that both chutes and ladders are just part of the game.

Figure 4: Positioning with a full allocation to equities

High-net-worth portfolios with private markets*

* Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets but do not tactically adjust this asset class.

Data as of July 21, 2025.

Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

Please see important disclosures at the end of the article.

Please complete the form below and one of our advisors will reach out to you.

* Indicates a required field.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today