Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

The September 30 deadline for an appropriations bill in Congress has passed, and non-essential governmental functions are now suspended until both parties can reach an agreement. From an economic standpoint, the impact of a shutdown is typically minimal, but that depends on the duration. In addition, we find ourselves in a period of labor market stagnation, and the threat of even modest permanent labor reductions associated with the shutdown poses an additional risk to the economy. Suspension of economic data releases provided by the government will further cloud the economic picture at a critical time. Ultimately, we think historical precedent of minimal impact on the stock market and the economy will prevail.

Length of the shutdown is key

We don’t see government shutdowns as materially impacting the economy or the markets, but the length of the shutdown is a key consideration. During a shutdown, federal workers are furloughed and sent home without pay, unless they are deemed “excepted” because they are necessary to protect “life and property,” or “exempted” because their jobs are funded in some other manner than government appropriations.

Critically, those who are furloughed and the excepted employees (who work without pay) are guaranteed their missed paychecks once the shutdown ends. During a short shutdown this should hardly be noticeable. Most federal workers were paid last Friday (September 26) and could conceivably be working again and receive pay again on October 10, not missing a beat.

During longer shutdowns, many workers may need to rely on savings or credit, but even those have had little impact. In the longest shutdown, from December 22, 2018 to January 25, 2019, the economic impact was barely a blip, with the Congressional Budget Office (CBO) estimating that spending losses were made up for immediately afterwards, and only $3 billion (0.02% of GDP) “wouldn’t be recovered.”

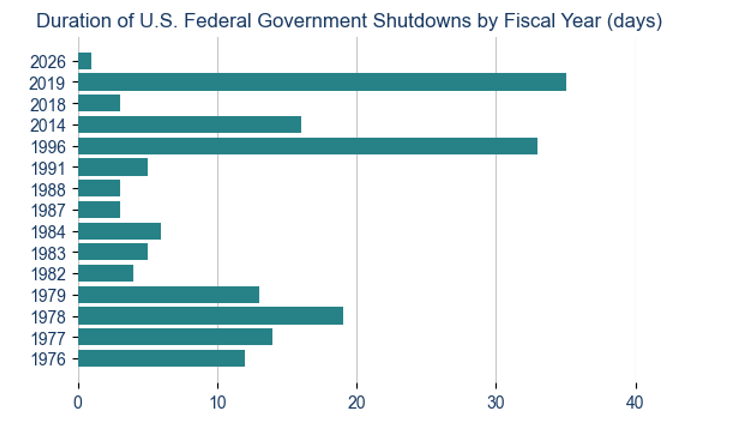

Figure 1: Shutdowns have varied in length

Sources: Bloomberg, Wilmington Trust

Employment could be the wild card this time

One factor that could make the current shutdown more impactful than previous episodes is the possibility of permanent reductions to the federal workforce. The administration issued a memo directing each government agency to consider undertaking permanent reductions in workforce simultaneously with the government shutdown for any employees that are furloughed and whose “programs, projects or activities…[are] not consistent with the President’s priorities.”

But it is unclear what the outcome might be. House Speaker Johnson said the shutdown gives the administration an opportunity to reduce the workforce, while Vice President Vance said they are not looking to “lay anybody off.” We have no way of predicting how this will turn out with so many moving parts and will need to wait and see how it transpires.

Official data shows total federal employment at 2.9 million as of August 2025. The CBO projected about 750,000 federal employees would be put on furlough, roughly 25% of all federal employees, and the daily cost of their compensation would be about $400 million, which by law would be paid to those furloughed employees once the shutdown ends.

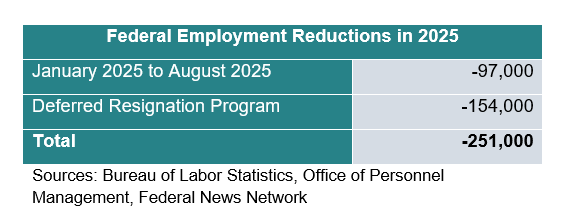

We estimate the administration has reduced federal employment by about 251,000 thus far. Official data shows total federal employment is down by 97,000 from the January 2025 level. And an estimated 154,000 federal employees opted for the Deferred Resignation Program (DRP) offered early in the year by the Department of Government Efficiency (DOGE). Those individuals remained on government payrolls until September 30, 2025 and should show up as reductions in the October jobs report, slated to be released on November 7.

Market Impact

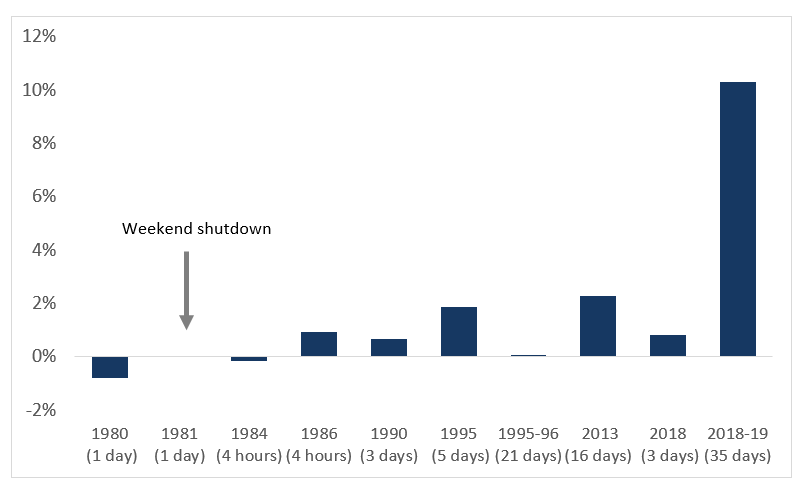

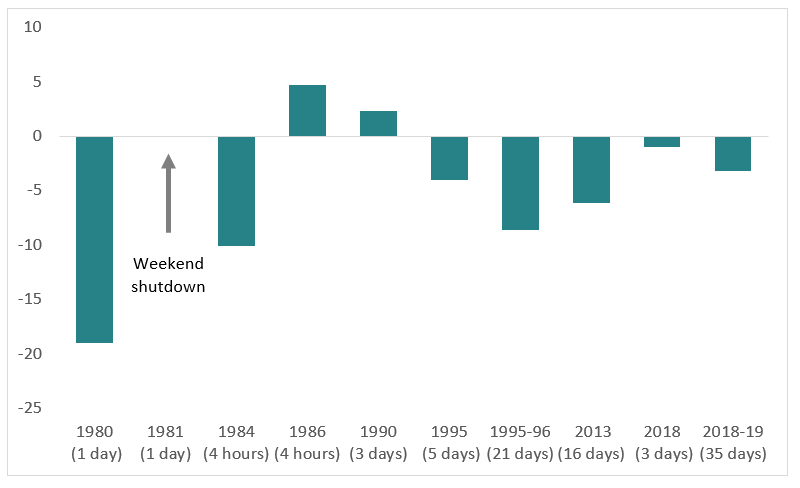

Despite the media headlines, political discord, and personal impact to those directly involved by suspension of government services and furloughed jobs, the equity market has taken its cue from the economy and typically been unfazed by government shutdowns. In fact, the S&P 500 has averaged a 0% return during all shutdowns going back to 1976, and it has been flat to positive in each of the last 6 shutdowns (Figure 2). Bonds tend to benefit slightly, with a history of a modest decline in interest rates during past shutdowns (Figure 3). At the time of writing on Day 1 of the shutdown, the S&P 500 made a new all-time high, rhyming with historical precedent.

Figure 2: Equity markets have gained during recent shutdowns

Change in S&P 500 over prior government shutdowns (%)

Data as of October 1, 2025. Sources: Bloomberg, WTIA.

Figure 3: Bonds have benefitted slightly in past episodes

Change in 10yr Treasury yield basis points (bps) over prior government shutdowns

Data as of October 1, 2025. Sources: Bloomberg, WTIA.

Could this time be different? Of course. The S&P 500 has been on an uninterrupted tear since April 8, returning 34%. Valuations are getting stretched by any measure, elevating the risk that something as economically innocuous as a short-term government shutdown could lead investors to take profits. The political divide is also significant, elevating the risk that this shutdown could be long.

The economy, the labor market in particular, is vulnerable. On the first day of the shutdown we received data from private payroll provider ADP, indicating the private sector job market contracted by 32,000 in the month of September. That is the third reported private sector job contraction in the last four months. Recent consumer confidence data has also disappointed. Any further dent to consumer and business confidence could tip us over the edge, so to speak, softening business hiring and consumer spending, and ultimately weighing on corporate earnings.

Core narrative

Historically, government shutdowns have not represented a meaningful hit to the economy, but the duration is key. We are also monitoring any measures taken by the Trump administration to use this opportunity to further scale back the size of government, which would likely be small in scale relative to the overall labor market but could be enough to lift the unemployment rate and tip the job growth figures more solidly into negative territory.

The outlook for the economy is mixed, with resilient consumer spending and GDP data being countered by a very concerning slowdown in the labor market. We place a 45% probability of recession over the next 12 months, which represents a modest improvement in our outlook over the last few months but is still more cautious than many others on Wall Street. The stock market is riding a historic wave of momentum, and stretched valuations mean we are primed for a normal, modest correction, and some caution is warranted. At this time we are retaining a full allocation to equities, expecting economic momentum to resume in early 2026 and solid earnings from corporations across sectors. We continue to favor larger, higher-quality stocks in portfolios and have a preference for investment-grade over high-yield fixed income.

Descriptions

The S&P 500 index is a stock market index that tracks the performance of the 500 largest U.S. companies listed on stock exchanges.

Glossary

Basis points refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today