Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

The Trump administration took an extraordinary and unprecedented step in its ongoing pressure campaign on the Federal Reserve (Fed) and Chair Powell. Over the weekend Chair Powell announced the Fed received grand jury subpoenas from the Justice Department on Friday, January 9. On its surface, the subpoena and investigation point toward cost overruns for the multi-year renovation of the Fed’s buildings in Washington. Late Sunday the Fed released a video statement by Chair Powell that characterized the investigation as a pretext to put pressure on the Fed to reduce interest rates.

The development is remarkable in two respects. First, it is the first known time that a Fed Chair has been under a criminal investigation. Second, Powell’s video statement was notable is the first time he has characterized the administration’s actions as an attempt to pressure the Fed. He has previously declined to speak to events or plainly stated that the Fed would await legal outcomes.

The risk to markets is the loss of Fed independence. If bond market investors perceived the Fed as being captive to the administration’s desires, it would likely lead to rising long-term rates (the exact opposite of President Trump’s goal). The market impact thus far has been muted, partly because Republican lawmakers are pushing back, providing some assurance to markets that Fed independence is not at risk. Additionally, President Trump has very little ability to shape the Fed to his liking because only two seats are slated to open for the remainder of his term.

Very little leverage for Trump

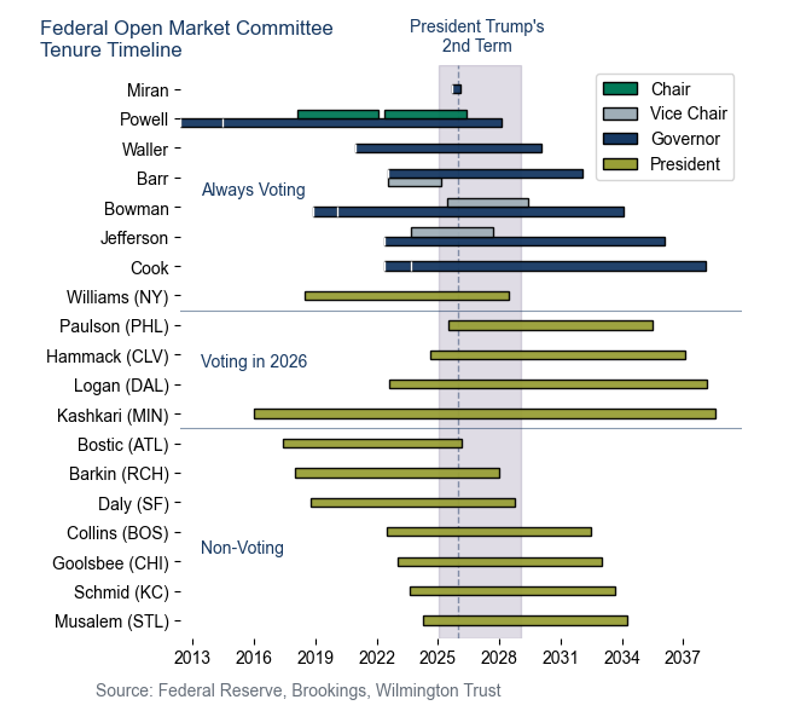

The inability of President Trump to affect the Fed’s makeup is due to the built-in independence of the Fed. Preventing any president from having significant impact on monetary policy is an intentional feature of the structure of the Fed from its design in 1913. The graphic below shows that nearly all Federal Reserve officials can remain in office beyond the end of President Trump’s second term.

The president only chooses Federal Reserve Board Governors (blue) who must then be confirmed by the Senate. Those seven positions are set in fixed, 14-year terms that overlap such that one ends every two years (on even-numbered years in January). For example, President Trump nominated Stephen Miran who filled a seat that had just 5 months of its 14 years remaining. Miran’s term ends on January 31. Should President Trump renominate Miran, it would be for a full 14-year term.

President Trump’s options for naming the new Chair of the Fed include are few, and only one of them is likely available before the end of Powell’s term as Chair in May:

Powell might hang around

Before the criminal investigation, Chair Powell was widely expected to leave his Governor position once his term as Chair ended on May 15, 2026. The position of Chair is a 4-year term. Only one other Fed Chair in history remained at the Fed once losing the position as chair. Marriner Eccles stayed on as Governor after President Truman replaced him as Chair, but in part because Truman asked him to stay.

Powell’s defiant video statement suggests he could stay on as Governor to stymie President Trump’s ability to nominate someone else to the Board. The Polymarket betting odds that Powell would exit by May 30 reached as high as 74% earlier this month, but plunged to as low as 35% this week, and now sit at roughly 45%. The betting market follows our expectations. If Chair Powell is concerned about the Fed becoming too politicized, remaining in the seat would leave President Trump with just one seat to fill (currently Miran’s) for the remainder of his term. Trump would need to choose the Chair from the existing seven Governors. The regional Federal Reserve Bank Presidents (yellow) are not chosen by the president, but by local boards of directors in the regional districts.

Risk to long-term yields

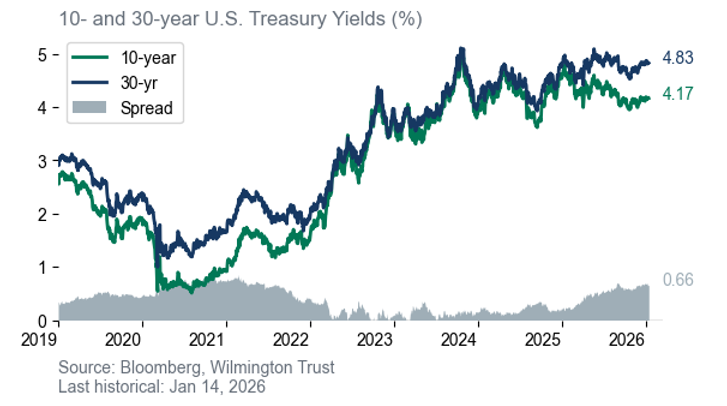

The most serious risk to markets is to long-term yields. If investors perceived the Fed’s independence was being eroded, fears of excessive money printing and higher inflation would drive bond premiums higher. This happens routinely in emerging market economies with non-independent central banks such as Argentina, Venezuela, and Türkiye. This would manifest as a yield curve steepening as the Fed kept short-term interest rates low while longer-term premiums rose.

We have recently pointed out a rising term premium at the longest portion of the curve, from the 10-year yield to the 30-year yield, shown in the chart below. We attribute this recent increase primarily to pure fiscal concerns about rising U.S. deficits, but a loss of Fed independence would likely exacerbate the steepening, in our view. We would expect such a development to also be harmful to equity performance. As stated above, though, we do not expect the Fed to lose its independence as there has been significant pushback on the administration’s actions and due to the Fed’s structure.

Core Narrative

The increasing pressure from the Trump administration is generating fears of a loss of Fed independence, which has understandably rippled through markets to some degree. The impact has been muted, which we attribute to safeguards built into the Fed’s structure that make it very challenging for any president to have significant influence on monetary policy. Additionally, the pushback from lawmakers, especially Senate Republicans, are offering the markets some comfort. In portfolios we remain neutral to equities, and within fixed income we have a slight preference for investment grade over high yield. We expect market performance to be driven by the evolution of the economy, not by the back-and-forth machinations between the administration and the Fed.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today