Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

After a strong multi‑year run led by mega‑cap technology, U.S. tech equities have hit a rough patch. Despite the market bounce on Friday, the S&P 500 has been lower in three out of the last four weeks. Leadership is rotating beneath the surface, as cyclical and value-oriented stocks (those that are more tied to the health of the economy and are trading at discounted valuations, respectively) outperform, but tech-related names are dragging down the overall market. The S&P 500 briefly slipped into the red for the year before the rebound into week‑end trading.

While some of the largest tech-related names have been weak, breadth outside of tech has been sturdier, consistent with a market that is repricing—not collapsing—as investors reassess spending, profitability, and the shape of the artificial intelligence (AI) build‑out. We hold a full allocation to equities and are positioning for higher volatility, a recovery in high-quality names, and a good number of innings still to go in the AI investment cycle.

Equity volatility has returned, with the VIX reaching its highest level of the year—though still well shy of “panic” territory—amid a sharp drawdown in select tech and software names. The software cohort, which includes stocks like Microsoft and Crowdstrike, has dropped roughly 30% from 2025 highs, and several well‑known names like Palantir and Service Now have been hit even harder.

A rotation out of mega‑cap tech has been building since October 2025. While top-heavy, market-cap weighted indices reflect the drag from the largest stocks falling out of favor, many non‑tech groups remain resilient and are making new highs. A larger share of stocks outside technology—in sectors like utilities, energy, industrials, and materials—are trading above long‑term trend measures (e.g., 200‑day moving averages). This helps explain why the equal‑weighted index has led the cap‑weighted benchmark by 4.5% since October, with the former moving to new highs and the latter treading water.

In our recent conversations with clients, we have emphasized three main risks to the AI investment cycle. The first two of these are very much at work in the recent bout of volatility.

For years, the hyperscalers (large companies that are building out the cloud infrastructure to support AI-related computing demands) were rewarded for their capex outlays. Since late 2025 two things have changed. First, the magnitude of the spending has increased dramatically. Second, and related to the first, more of that funding is coming from the debt markets rather than being funded from cash on these companies’ fortress balance sheets.

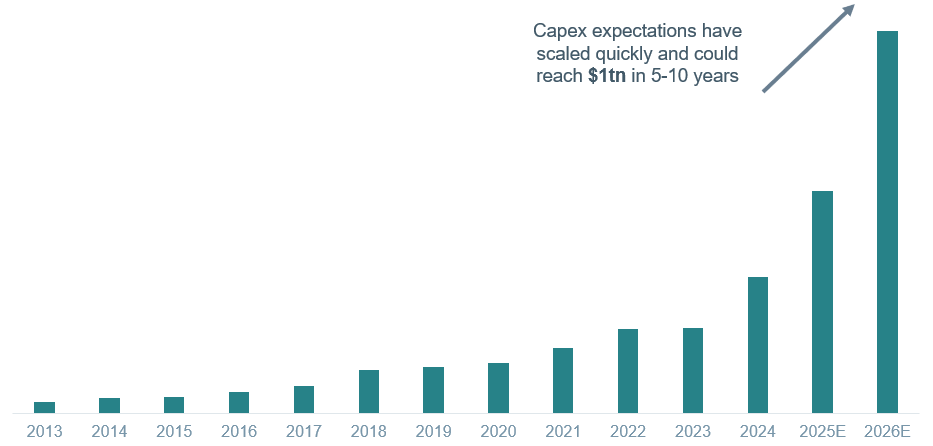

Fourth‑quarter earnings underscored that hyperscalers intend to spend much more on AI infrastructure than previously expected. Aggregate 2025 capex across the major hyperscalers (Microsoft, Meta, Amazon, Oracle, and Alphabet) was about $333B, with 2026 now projected at $566B—well above prior expectations (Figure 1). In its earnings release, Alphabet signaled $175–185B of 2026 spend (about 40% more than the $120B expected). Amazon also announced an increase in its 2026 capex outlook to ~$200B, and shares fell ~10% post‑release. Meta guided to $115–135B for 2026 capex (vs. ~$111B expected and ~$72B in 2025).

Figure 1: Capex Projections for Megacap Hyperscalers Continue to Climb

U.S. capex (in $ billions) for Microsoft, Meta, Amazon (AWS), Oracle, and Alphabet

Data as of February 6, 2026. Source: Bloomberg, WTIA. Amazon capex discounted for AWS specific spending.

Increasingly, this spending is being financed by debt, which is fueling concerns about a future debt bubble. As an example of the pace with which debt is being added to balance sheets, 2024 hyperscaler capex was funded ~10% via debt, and this figure increased to ~35% in 2025. It is likely to move higher in 2026, raising questions about future returns on investment and current valuations.

The second risk is that rapid AI progress could lead to permanent structural changes in specific industries, affecting their long-term profit projections. Recent developments rattled assumptions about the durability of software’s revenue, once thought to be incredibly “sticky”. New model‑enabled tools—such as last week’s targeted legal‑industry release from Anthropic—are stoking fears that enterprises can build or customize capable software in‑house, compressing pricing power and visibility for traditional vendors.

The current selloff of software stocks feels similar to the disruption concerns from one year ago, when the release of China’s DeepSeek model showcased how rapid innovation could potentially shrink incumbents’ moats when models get cheaper, faster, and more specialized.

Some software companies may ultimately prove beneficiaries if they harness AI to deliver more secure, all‑in‑one, compliant solutions for companies with high data sensitivity and onerous regulation. But the gap between the winners and losers could be very wide, and it is too early to know who will fall on which side.

A third concern—less dominant this week but lurking—is the risk that today’s AI chips depreciate faster than modeled, squeezing profitability if replacement cycles are shorter or performance gains of the technology are more rapid than expected. Companies have been demanding semiconductors at a pace that outstrips supply capacity, to the benefit of companies like Nvidia. But if the technology advances faster than anticipated, those chips may become obsolete, or at least less valuable, quicker than was anticipated. Accelerated depreciation of inventory would upset the profit projections and valuations for both producers and consumers of those chips.

We still believe we are in the early innings of the AI build‑out, with a durable, multi‑year opportunity across the ecosystem. But early innings are often volatile: spending plans reset, profits get pressure‑tested, and narratives swing. Importantly, volatility cuts both ways—the same week that saw notable selloffs also delivered fresh highs for the Dow.

We don’t know how far the rotation away from the prior leaders will go, and we acknowledge impaired near‑term visibility for software earnings. Yet if software platforms adopt and embed AI to deliver integrated, customizable, and secure solutions, they can emerge as net beneficiaries over time.

To the three risks mentioned above, debt is not overly concerning to us at this time. Yes, the numbers are large and rapidly increasing, but the debt being used to fund them is coming from companies with robust earnings and healthy balance sheets. They are well capitalized, and with some exceptions, this is reflected in compressed credit spreads.

Disruption is probably the biggest risk, but it also creates tremendous opportunity for new leadership in the stock market. Some sectors, such as software, appear more vulnerable at the moment. We expect to see the rapid development of AI create opportunity for a new slate of innovators, but it will take careful research on the path of innovation and the companies moving the fastest to adopt and leverage the technology.

Depreciation is a risk that could emerge further down the road, as it will eventually become clearer whether existing inventory could potentially be repurposed for other uses, even if the newest and best chips are developed at a faster pace than expected.

When it comes to the broader market, we cautioned in our 2026 Capital Markets Forecast that extreme concentration risk leaves the cap‑weighted index vulnerable when leadership stumbles—even if the median stock is healthier. The current episode could be a needed rebalancing of sorts that broadens participation and sets up a stronger runway for the remainder of the year. Corrections in the 5–10% range are normal within ongoing bull markets, even potentially multi-year “super cycles” like we believe AI represents. Investors should expect, and even use, volatility to retain or establish positions in strong companies.

In this environment, we continue to advocate staying invested and maintaining a disciplined focus on quality. While we still hold a slight preference for growth over value, the more important distinction is an overweight toward companies with strong balance sheets, durable cash‑flow characteristics, and resilient business models across both styles. These attributes tend to provide ballast when markets adjust leadership or reassess earnings visibility, as they are now. High-quality companies were also deeply out of favor in 2025, and we expect a recovery in 2026 as the economy faces headwinds.

We also expect that technology and other growth‑oriented sectors can outperform over the coming year, but likely by a narrower margin than investors have grown accustomed to in recent years. Fundamentals and valuation discipline are beginning to reassert themselves, and the extraordinary dominance of a small cluster of mega‑cap names is unlikely to repeat to the same extent. This does not negate the long‑term AI‑related opportunity set, but it does suggest a more selective, earnings‑driven phase of leadership rather than a rising‑tide‑lifts‑all‑boats environment.

The macro backdrop reinforces the need for selectivity. Recent economic data have been mixed—just this week solid ISM readings and improving consumer confidence have been counterbalanced by weaker ADP hiring, higher initial jobless claims, and another round of Challenger‑reported layoffs. The overall picture is one of an economy that is still expanding but doing so unevenly, creating both opportunity and vulnerability depending on a company’s exposure to labor conditions, pricing power, and operating leverage.

In this kind of market, active management could provide a clearer runway to add value. The S&P 500 index has become increasingly influenced by the sharp movements of a handful of mega‑caps. Improvement of market breadth and participation plays to the advantage of skilled managers who may offer more diversification than the market-cap weighted index. The ongoing rotation offers fertile ground for thoughtful security selection and portfolio construction, especially when dispersion in earnings outcomes remains elevated and visibility on the pace of technological innovation is reduced.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today