Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Thematic investments can originate from a number of different drivers: technological advancements, demographic trends, evolving consumer preferences, or changes to regional economies. Identifying these structural shifts and the associated investment opportunities can be challenging and requires a long investment lens. We believe that artificial intelligence (AI) has reached an inflection point and is poised to fundamentally change a broad segment of the economy and society over the coming decade. AI has the potential to disrupt a wide range of industries, such as health care, financial services, and retail, leading to productivity and efficiency gains for businesses. In this paper, we discuss the growing investment opportunity in AI as it becomes more ingrained into every facet of our work and lives.

AI, long the staple of science fiction, is quickly moving into the mainstream. Believe it or not, AI has been used since the 1950s to automate repetitive tasks, improve customer service, and perform predictive analysis in sectors like manufacturing, where a machine’s ability to learn complex patterns in large amounts of data enables companies to detect anomalies in factory assembly lines or aircraft engines before they fail. However, recent advancements in the cloud, computing power, and big data have been instrumental in expanding AI capabilities and making machines faster, cheaper, and more accessible, helping to accelerate adoption.

Big data refers to very large and complex data sets that can be used to discover market trends, insights, and patterns, and to help companies make better business decisions. As big data emerged, so did new cost-efficient technologies capable of storing, processing, and deriving insights from it. The onset of the pandemic in 2020 was also a pivotal moment as a limited supply of labor spurred more companies to utilize AI and automation in critical roles across the economy. The greatest increase was in health care, as the world sought more effective solutions to tackle the health crisis. The global AI market is forecast to expand from $390 billion in 2023 to $1.4 trillion in 2029 at an annualized rate of 20.1%.1

Now, the emergence of new generative AI tools, such as OpenAI’s large language model ChatGPT—able to create novel content, including audio, code, images, text, simulations, and videos—has resulted in a renewed surge of interest in AI from businesses and investors. Generative AI describes algorithms that can be used to create new outputs based on the data it is trained on rather than simply analyzing or processing existing information. Commercial applications of generative AI hold the promise of boosting productivity through the automation of a wider range of routine and more complex knowledge-based careers, such as lawyers, journalists, and architects. The time to complete tasks like drafting an article or legal document could shift from hours to just seconds, leading to greater productivity and lower costs for companies.

Generative AI could also bring immense value to a diverse range of fields that requires vast amounts of data to gain insights into their business, such as insurance, security and fraud protection, robotics, and self-driving vehicles—supporting innovation and the creation of better products and services. For instance, replacing traditional data collection methods with data generation in health care is allowing companies to train models more quickly and efficiently, helping to reduce the time and cost of developing new drugs and treatments. We believe generative AI will have far-reaching implications for the labor market, economic growth, and investors in the coming decade and beyond. At Wilmington Trust, the Investment Management team is focused on investing in the companies and industries that are capitalizing on these technologies to maintain a competitive advantage and generate sustainable, long-term returns.

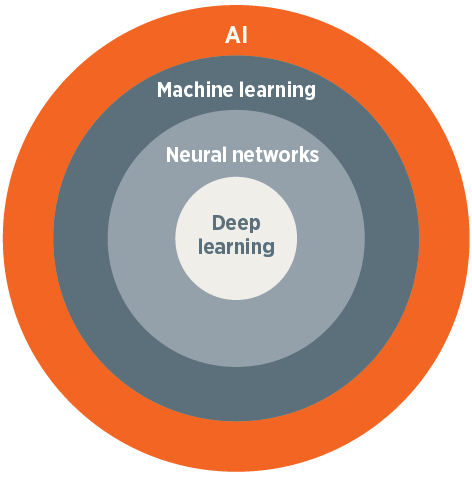

AI is a machine's capacity to perform the cognitive functions we tend to equate with human intelligence, such as perception, reasoning, learning, understanding, and decision making. The three primary components of AI machines are 1) models, 2) data, and 3) compute (computing power). Models are the algorithms that take an input and create an output. The models are trained using data. Training is the process of inputting data into specific models with the goal of recognizing patterns and/or producing a desired output. The predictive power of a model is driven by the size of the training data. Compute is the ability of models to complete the complex calculations and operations required by AI algorithms. It is important to note that although AI models can be programmed to perform specific tasks, the technology does not have any intent of its own. As with any innovation, AI’s capabilities and the associated risks and benefits lie with the humans creating these applications, not with the technology itself. Over time, AI has come to encompass several subfields (Figure 1), which will be discussed in the next section.

The term artificial intelligence was first conceived in 1956 by John McCarthy, a researcher who later founded AI labs at MIT and Stanford. From 1957 to 1974, the field of AI flourished as computers became quicker, less expensive, and more accessible. In the 1960s, computer programs were developed that could solve algebraic problems, prove geometric theorems, and learn to speak English. In the 1980s, researchers popularized deep learning (DL) techniques that allowed computers to learn using experience. Around this time, expert systems were also introduced—machines that used a series of logical rules derived from expert knowledge of various fields to automate specific tasks. By the late 1980s, U.S. companies were spending over a billion dollars a year on AI research and development, and around two-thirds of Fortune 500 companies had integrated expert systems into their business operations.2

Around the 1990s, we saw the advent of machine learning (ML), a subfield of AI focused on the training of models that enable computers to learn without explicitly being programmed. With simple AI, a programmer tells a machine how to respond to a set of instructions by hand-coding each decision. In contrast, ML uses algorithms to analyze data and make informed decisions based upon what it has learned. As the machine analyzes more data, it becomes more skilled at performing certain tasks. For example, the music streaming service Spotify uses ML to learn a user’s listening habits to make song recommendations. Each time users indicate they like a song by adding it to their libraries or listening to it entirely, Spotify updates its algorithms. Netflix and Amazon use similar ML algorithms to offer personalized recommendations.

In the 2010s, advancements in computing power and big data led to major breakthroughs in the field of DL, a subset of ML that uses artificial neural networks in many layers to train models to recognize patterns and relationships in bigger and more complex data sets. DL models aspire to replicate the structure and function of the human brain and are designed to become more efficient over time without human intervention. Critical to the development of DL during this time were graphics processing units (GPUs), which provided the enormous computing processing power needed to take AI to the next level. GPUs were created by the chip company Nvidia in the late 1990s to render high-level graphics for gaming applications. Over time, the technology became more flexible and programmable, making it perfect for AI tasks that require complex and sophisticated computations.3 Increased computing power has significantly reduced the time to train AI machines, making the technology more cost-efficient.4

Another big enabler of DL was the sudden availability of massive amounts of image and text data from social media sites, such as Facebook in the 2010s, which led to major advancements in areas like image recognition, natural language processing (NLP), and speech recognition. For instance, by analyzing thousands of online images of a celebrity, a computer could learn to detect the celebrity in a new image. Today, most people encounter DL daily using their smartphones and laptops and browsing the web. Among other applications, DL is used to create captions for YouTube videos, perform speech recognition on smartphones and speakers, translate languages using NLP, provide facial recognition for photographs, and enable self-driving cars by using real-time data from sensors to make decisions. Amazon’s Alexa and Apple’s Siri are good examples of digital assistants that can use speech recognition to answer questions. DL has also been instrumental in improving automation and analytical tasks in sectors like health care, manufacturing, and industrials.

Figure 1

Hierarchy of AI

Recent excitement around AI has been centered on generative AI, a subfield of ML in which computer algorithms are used to generate new outputs, including text, images, graphics, music, and computer code. Unlike traditional ML—which focuses on classifying or labeling data—generative AI uses deep neural networks that are trained on large data sets to recognize patterns and generate new output based on those patterns. Generative AI can assist marketers, journalists, and artists with their creative processes, such as helping to draft articles or create presentations. It can also add value to fields like oncology, where the technology is well suited to analyze patient and clinical data to generate new molecules optimized to find more effective treatments for hard-to-treat cancers.

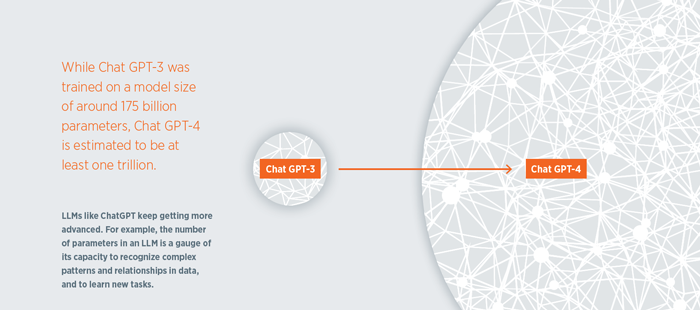

The earliest work on generative AI dates to the 1950s, when scientists began researching the idea of using algorithms to create new data. The invention of neural networks in the 1980s and generative adversarial networks in 2014 enabled AI models to create authentic images, videos, and audio of real people. Most recently, advances in natural language processing—the ability of computers to understand and generate human language—led to the development of large learning models (LLMs) that could generate written content. A few years ago, companies like Google, Microsoft, and OpenAI began building neural networks that were trained on vast amounts of text from the internet, including Wikipedia articles, digital books, and academic papers. Amazingly, these systems learned to write text and computer code and engage in conversation, setting the stage for the next wave of AI innovation, with the global generative AI market expected to hit $42.6 billion in 2023.5

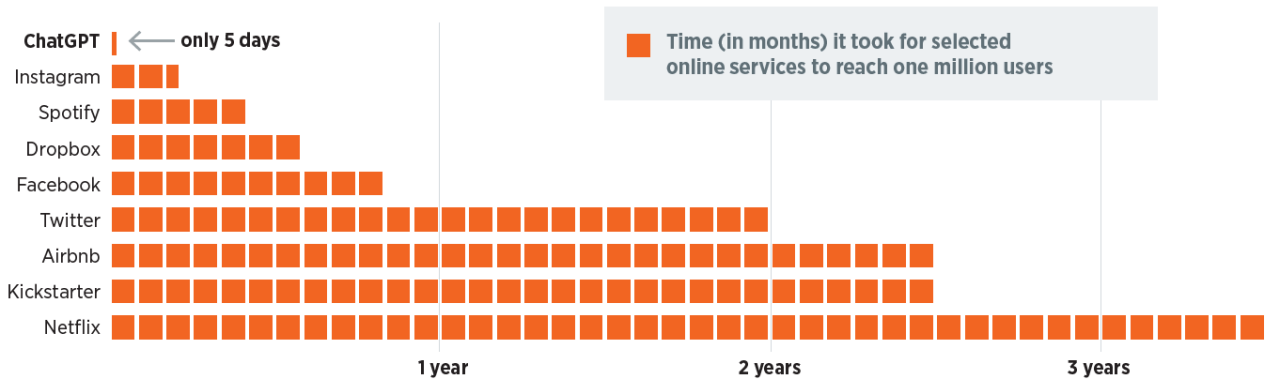

The extraordinary potential of generative AI is best illustrated in the rapid adoption of OpenAI’s ChatGPT, a general-purpose chatbot built on top of LLMs that allows its users to enter prompts to receive novel text, videos, or images. In simple terms, a chatbot is a software application that aims to simulate conversation with human users, usually over the internet. In 2020, OpenAI, in partnership with Microsoft, introduced GPT-3, a text generator able to summarize legal documents, answer customer service questions, write computer code, and create online games. OpenAI then followed up with the release of ChatGPT in November 2022. The chatbot’s adoption rate was astounding—reaching one million users in only five days and surpassing 100 million users by January of 2023, making it the fastest-growing platform in history (Figure 2). As of May 2023, ChatGPT has garnered 500 million global users.6

One of the most remarkable aspects of this new wave of generative AI tools is that users require no formal expertise with the technology, making it accessible to any number of people and companies with a laptop or smartphone. OpenAI makes money by charging individuals for access to ChatGPT and licensing its LLMs to businesses. Anyone can set up an account with OpenAI to use ChatGPT or other content generators. For example, users of generative AI tools like DALL.E 2 and Midjourney can generate a new image or create a variation of an existing image simply by inputting text prompts into an app on their mobile phone. Microsoft plans to offer OpenAI’s models across their enterprise-based software and launch other new products and services for business users.

Exploring topics that are top of mind for investors

Figure 2

ChatGPT adoption

Fastest-growing platform in history

Source: Global X ETFs. As of November 2022.

Since the introduction of ChatGPT and the subsequent popularization of generative AI, ample use cases spanning a wide range of applications across sectors have emerged, from retail to technology to health care. While in the early days of scaling, we have started to see the first set of applications:

LLMs can be trained to generate real-time customer support and recommendations, as well as answer questions. Retailers such as Amazon are increasingly using this technology on their websites.

Companies like Salesforce plan to integrate ChatGPT into its customer relationship management service (EinsteinGPT). The virtual assistant will automate more sales tasks like composing emails, scheduling meetings, summarizing past customer interactions, and preparing notes for the next meeting.

Businesses relying on contract drafting and review can benefit from LLMs that suggest contract language or identify potential issues in a contract. Users of office tools like Microsoft Teams can automate the writing of emails, meeting summaries, and other operational tasks.

IBM is using its generative models in drug design, focusing on discovering new molecules for use in targeted cancer therapy. The company Glass Health has created a generative AI tool capable of making diagnoses based on the input of symptoms.

Bloomberg recently announced it is developing BloombergGPT, an LLM that has been trained in financial data to assist with a variety of knowledge-based tasks, such as risk assessment and sentiment analysis.

New generative AI technology is enabling a broader spectrum of industries to invest in productivity-boosting automation, raising questions about how it could impact the labor market and economy. The biggest advantage generative AI offers today is enhanced productivity, which is the rate at which a company or country produces goods and services (output) based on the number of inputs used, such as capital, energy, and labor. The most common application of productivity is labor productivity, defined as economic output per hour worked, because it’s a key factor in determining long-term economic growth and living standards. As productivity rises, more goods and services are produced, lifting corporate profits and wages. Today, U.S. labor productivity growth is running well below its long-term average of 2.2%.7

From World War II until the early 1970s, productivity in the U.S. more than doubled because of new technology and increases in physical and human capital. Productivity growth then slowed for the next two decades but picked up again in the 1990s in response to another wave of innovation that included the invention of the internet and personal computer (PC). Since 2005, we have seen a noticeable slowdown in productivity in advanced economies. At the same time, labor force growth (another important driver of the economy) is falling, in part due to an aging population and declining participation rate.8 Between 2030 and 2040, annual labor supply growth is forecast to drop to zero in advanced economies from around 0.4% today, and productivity gains will be critical to maintaining GDP growth in these regions.9

One analysis conducted by Accenture and Frontier Economics estimates that labor productivity in developed countries could increase by up to 40% by 2035 through the greater adoption of AI and automation.10 While it's too soon to estimate with any certainty the degree to which AI will ultimately affect productivity, we do believe the technology holds extraordinary promise.

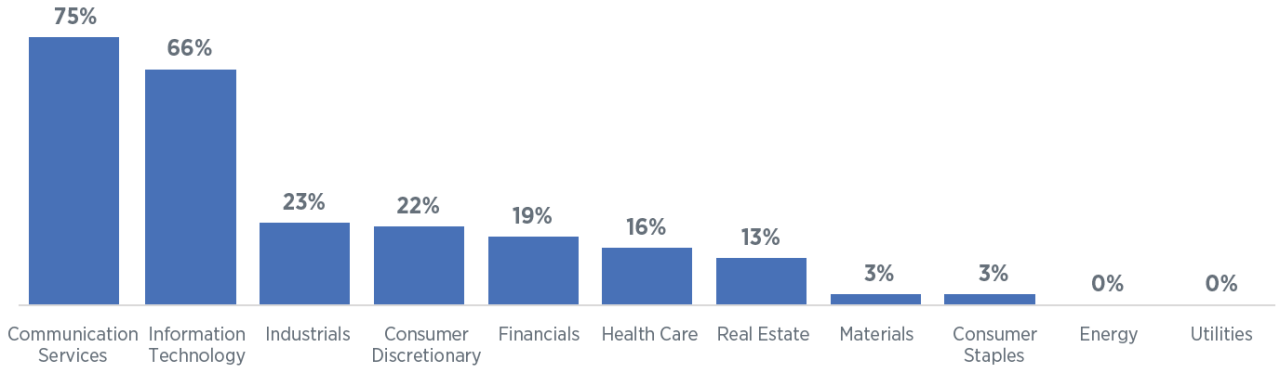

While automation has tradionally impacted blue-collar jobs in industries like manufacturing or routine back-office administrative tasks—such as recordkeeping, running payroll, and invoicing—generative AI has the potential to automate or augment a wider range of routine and complex cognitive jobs—such as writers, researchers, and designers—enabling employees to complete tasks faster and more efficiently and shift their skills to more productive roles. For example, instead of relying solely on paralegals, businesses could use AI to conduct legal research and create summaries of cases and laws. Generative applications can also help boost productivity by supporting innovation and the creation of better business models and applications. Indeed, more companies are talking about AI following the release of ChatGPT (Figure 3) that uses natural language processing to answer questions.11 Some economists believe there could be a permanent shift in labor demand as companies work more efficiently and continue to integrate AI and automation into their business models.

In a Goldman Sachs analysis, it is estimated that 25% of current work tasks could be automated by generative AI in the U.S. and Europe. Traditionally high-skill, non-routine cognitive occupations, such as writer or engineer, are most at risk, while physical or knowledge-based roles that require interpersonal skills, such as construction worker and health care practitioner, are less susceptible. The study also predicts that generative AI could increase global GDP by 7% and lift productivity growth by 1.5% over a 10-year period.12 While we view these numbers as on the high side, we do expect to see some job displacement as more companies invest in AI and automation (see sidebar to the left).

When assessing generative AI’s potential impact to the labor market, it’s helpful to look at previous waves of automation. A study conducted by the Federal Reserve demonstrated that lower-wage jobs that are intensive in both manual and knowledge-based tasks—such as secretary, bank teller, and bookkeeper—were increasingly replaced by automation during the 2000s as a result of the PC, which impacted most business operations. However, the net impact on workers was small because it led to the development of new jobs and industries with comparable pay.13

Figure3

S&P 500 earnings calls 1Q 2023

Percentage of companies talking about AI

Source: FactSet, May 26, 2023.

The World Economic Forum’s Future of Jobs annual report surveys the world’s largest employers on their outlook for the job market. In 2023, nearly 75% of companies said they plan to adopt AI, with 50% predicting that it will lead to job gains. The report also finds that training workers to use AI will be the third-highest priority between 2023 and 2027, and a focus of 42% of surveyed companies.14 IBM recently announced that 30% of its ~26,000 non-customer-facing roles could be displaced by automation or AI over the next five years; however, the company expects its adoption of AI to create more jobs than it eliminates.15 In another example, the consulting firm Accenture plans to invest $3 billion in AI and double the number of AI specialists it employs to 80,000.16

While the field of AI has made great progress toward replicating human intelligence, the technology is still young, and it will take some time before generative AI has a tangible impact on the economy and labor market. For instance, AI is effective in identifying patterns and correlations, but it lacks the ability to contextualize or understand nuances and is usually only able to complete one task or solve one problem at a time. Humans, however, have the kind of critical thinking skills that will continue to be important in the corporate world. Companies may also restrict the use of generative AI until they have a stronger understanding of the technology, its risks, and how it can boost productivity and the bottom line. Employers will also need to consider the ethical implications and how best to train employees to maximize the technology’s value add. Concerns around personal data and how it is used may limit implementation. For instance, Apple, J.P. Morgan, and Verizon have recently restricted the use of ChatGPT, citing concerns that employees may leak confidential data.17

The excitement around ChatGPT and the rally in AI-related stocks have prompted questions from clients about how they can gain exposure to this emerging investment opportunity. At Wilmington Trust, we are currently assessing opportunities across all sectors and asset classes, including key enablers of AI technology as well as companies leveraging AI to boost productivity, improve customer experiences, and lower costs. Today, digital technology is integrated into the vast majority of business operations and has the potential to impact a company’s earnings, growth prospects, and performance. AI is a key driver of the digital transformation, enabling companies to leverage data-driven insights and automation to help achieve higher operational efficiency, better decision making, improved customer experiences, and lower costs. Across sectors and asset classes, we believe companies that are effectively deploying AI technology at scale are better positioned to adapt to changing market dynamics, which supports increased revenues and market share.

The Wilmington Trust investment team believes AI technology will be transformative for businesses and productivity. Screening companies for AI exposure has become an important part of the stock selection process, along with more traditional fundamental analysis. The team analyzes the magnitude of AI risks and opportunities impacting a company’s growth prospects, brand, profitability, and value creation. The fundamental question each portfolio manager must answer is whether these factors can significantly hurt or enhance the company’s long-term investment thesis, either as an enabler or adopter of the technology. Where material and relevant, AI factors are considered along with traditional metrics—such as earnings growth, yield, financial strength, and valuation. This allows the investment team to identify opportunities it believes to possess strong growth potential and sustainable long-term performance drivers.

Importantly, we look for companies that are using AI to innovate and differentiate themselves through the development of better products and the creation of unique customer experiences that set businesses apart from their peers. It is our view that the integration of AI considerations strengthens our investment approach by adding further structure, reference, and integrity to our long-standing process, which is designed to identify reasonably priced, well-managed, high-quality companies. We expect increasing attention to AI within the context of investment research, portfolio construction, and security review as the technology evolves and becomes more ingrained into a company’s earnings potential and long-term success. In the next section, we focus on the role of three sectors in advancing the field and demonstrating AI’s value add to businesses and society.

Source: Reed Albergotti, “The secret history of Elon Musk, Sam Altman, and OpenAI,” Semafor, updated Mar 24, 2023.

Several key players in the technology sector have emerged to dominate the AI competitive landscape—all of which possess tremendous scale, access to talent, and deep pockets. Importantly, these companies have access to the massive amounts of data and computing power needed to effectively build and train AI models for commercial use. It is noteworthy that these are high-quality companies with diversified business lines, helping to reduce some of the risks associated with more pure-play AI names as the field develops.

The boom in AI is benefiting the dominant providers of GPUs that power AI applications, most notably Nvidia, which controls 80% of the global market. Shares of the company hit an all-time high in May following a huge earnings beat, sparking a rally in chip stocks and other AI companies. Nvidia’s performance was driven by soaring demand from cloud vendors as well as consumer internet businesses that use generative AI applications like ChatGPT.18 OpenAI, through its partnership with Microsoft, exclusively uses GPUs from Nvidia, which is expected to earn between $3 billion and $11 billion of revenue in ChatGPT’s first year of operation.19 Nvidia also has a full AI platform that is available via Oracle Cloud Infrastructure (OCI).20 It recently developed an AI supercomputer platform called DGX GH200 that’s expected to be used by companies like Meta, Google, and Microsoft.21

Given the number of possible use cases, an entire industry is being built around making generative AI profitable. The leading cloud companies, including Amazon, Microsoft, Meta, and Google, began building out their Al capabilities a few years ago when they realized models would need to be trained over long time periods with massive amounts of data to achieve the level of sophistication required for commercial use. As part of this effort, they spent billions of dollars on data centers to help ensure they have the most comprehensive, secure, and cost-effective platforms. Today, they have a clear advantage in terms of their access to data and resources to process complex data sets and build advanced models at scale.22

At the same time, Amazon, Microsoft, and Google, among others, are benefiting from increased demand for their cloud services. User organizations and their tech partners often create, customize, and run AI applications on cloud-based AI platforms. For instance, the technology behind OpenAI’s ChatGPT necessitates enormous amounts of computing power and data storage, expensive infrastructure controlled by a few key tech giants. GPT-4 was trained using trillions of words of text and many thousands of powerful computer chips, costing an estimated $100 million. The company is currently using Microsoft’s cloud to create applications, build chatbots, and incorporate AI-powered search. Microsoft, which initially invested $1 billion in OpenAI in 2019, provided another $10 billion in capital in 2023. Microsoft will receive 75% of OpenAI’s profits until it recoups its investment, at which time it will acquire a 49% stake in the firm.23

Generative AI has multiple applications in health care, ranging from patient care and drug discovery to personalized treatments. Today, it is finding its most impactful application by enabling precision medicine. Precision medicine involves consideration of all aspects of a patient’s genetics, exposures, behaviors, habits, and environmental context to generate a therapeutic plan that is best suited to that person. Achieving this level of precision was previously impossible because it involved the analysis of an extraordinary amount of data. Through the power of new DNA sequencingtechnology and AI, we can now manipulate the genome of a single individual and learn from these vast data sets how best to fight and prevent disease. This is a branch of scientific research referred to as genomics. The global genomics market is estimated to be worth $46 billion as of 2023 and is set to reach ~$128.75 billion by 2030.24

At 3.2 billion nucleotides, even the genome of a single individual exceeds what an average human could gather, store, and process. AI is being utilized by researchers to scan the human genome and develop novel, highly targeted therapeutics that may reduce the side effects of treatment and find cures for rare diseases. The life sciences company Illumina is an industry leader in using genomics to aid in medical research, testing, and treatment, and holds around 80% of the market for sequencing machines.25 Similarly, AI’s ability to analyze and draw conclusions from genetic data has been instrumental in helping to identify warning signs of disease. The result is a more spot-on knowledge of risk factors for certain diseases and responses to therapeutics, as well as the exact targets that are most effective for drugs, tailored to each individual patient’s needs. Nvidia has developed a set of generative AI cloud services to help researchers identify the right target, design molecules and proteins, and predict their interactions in the body to develop the best treatments for patients.26

As the U.S. sets new climate goals, electric utilities are under increasing pressure to decarbonize and invest in cleaner sources of energy while maintaining grid reliability, affordable electricity, and strong customer service. The industry is seeing tremendous growth opportunities from technological advances and cost declines in such areas as electric vehicles (EVs), smart buildings and homes, cybersecurity, and microgrids, in addition to distributed energy resources (DERs)—small-scale electricity supply or demand resources that are interconnected to the electric grid. Utilities are taking advantage of these innovations to remain competitive and profitable as a rapidly changing energy market disrupts the traditional utility business model. This trend has been reflected in a sharp increase in capital expenditures, with electric utilities on track to spend more than $150 billion in each of the next two years, at least, to modernize the grid and make other critical growth investments.27

The need for innovative solutions has never been more urgent as the industry faces unprecedented challenges that include climate change and aging infrastructure. AI is helping to enhance operational efficiency through the Internet of Things (IoT) devices and smart grid capabilities, terms that describe physical objects that can connect and exchange data with other devices and systems over the internet or other communications networks. With generative AI, the utilities industry has another tool to boost productivity, streamline processes, and cut costs. This field of AI is particularly well suited for industries that require complex data analysis, pattern recognition, forecasting, and optimization. The AI market in the energy and utilities industry is forecast to reach $4.5 billion by 2026.28

Amid accelerating global efforts to decarbonize, generative AI presents a tremendous opportunity to accelerate the transition to a low-carbon, highly efficient energy system. Due to aging infrastructure and outdated technology, climate change is expected to affect every aspect of the electric grid—from generation, transmission, and distribution to electricity demand. As a result, utilities have been investing more in DERs, which either interconnect with the grid or operate independently to ensure a secure energy supply while managing greenhouse emissions. DERs are usually situated near sites of electricity use, such as rooftop solar panels, EVs, and battery storage.

As the grid becomes more distributed, traditional methods for managing and operating the grid—such as load and generation forecasting, balancing supply with demand, and power quality management—have become outdated. Generative AI can help utilities identify patterns and insights in data, learn from experience while improving system performance over time, and perform predictive analysis. For example, it can generate model scenarios and simulate the impact of different decisions on the grid, which can help to pinpoint potential issues and problems. In renewable energy, it can optimize the design and location of solar panels and wind turbines by analyzing data on factors such as weather patterns, solar radiation, and wind speeds.

Another application is the development of new business models. Utilities can use generative models to analyze customer data and recommend new products and services. American Electric Power, for instance, uses Oracle Utilities Opower to deliver customized energy management programs, helping its customers save millions of dollars on their energy bills, as well as reduce real-world emissions.29 Leading clean energy companies like NextEra are selling energy management systems for industry-wide use as corporations look to minimize their carbon footprint. In 2022, JPMorgan implemented NextEra’s Optos software platform to help the firm optimize its energy use and reduce its emissions.30

Recent advancements in AI present both risks and opportunities to the U.S. economy and society. Generative AI implementation could increase labor force productivity, one of two engines of GDP growth. Productivity is key to economic development and higher living standards. AI also holds the promise of addressing major global challenges, such as climate change and the rising cost of health care as populations age. Whether it is creating new forms of art and expression, improving patient outcomes, or enabling the clean energy transition, the possibilities for AI are endless. However, given generative AI is in the early stages of development and the outlook is uncertain, investors need to be thoughtful in their analysis of investment opportunities. At Wilmington Trust, we incorporate AI risks and opportunities into our stock selection process, with careful consideration of how advancements in new AI technology may detract or enhance each company’s long-term earnings potential and growth prospects. This approach seeks to improve risk management and identify investment opportunities that can generate sustainable, long-term value for clients. For clients seeking greater visibility into how these themes and investment ideas are making their way into portfolios, please reach out to your investment advisor.

Tony Roth and AI expert Neil Sahota define terms, delve into the enablers of AI technology and platforms, and discuss the recent open letter signed by tech leaders demanding a pause in AI research.

Tony and AI expert Neil Sahota continue their conversation, focusing on the rapid pace of AI’s progression, its applications, and how it may enhance the quality of our lives.

Tony and Rudina Seseri, founder and managing partner of Glasswing Ventures explore AI’s unique challenges and opportunities, potential investment opportunities, and they provide practical guidance on navigating the complexities of AI investments.

This article is for educational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or as a determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situations, and particular needs. This article is not designed or intended to provide financial, tax, legal, accounting, or other professional advice since such advice always requires consideration of individual circumstances. If professional advice is needed, the services of a professional advisor should be sought.

References to company names in this article are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investments and are subject to change at any time.

The information in this article has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. The investments or investment strategies discussed herein may not be suitable for every investor. There is no assurance that any investment strategy will be successful.

Third-party trademarks and brands are the property of their respective owners. Third parties referenced herein are independent companies and are not affiliated with M&T Bank or Wilmington Trust. Listing them does not suggest a recommendation or endorsement by Wilmington Trust.

Investing involves risks, and you may incur a profit or a loss. Past performance cannot guarantee future results.

Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document, will be profitable or equal any corresponding indicated historical performance level(s).

Securities markets are volatile and the market prices of securities may decline. Securities fluctuate in price based on changes in a company’s financial condition and overall market and economic conditions.

Wilmington Trust is a registered service mark used in connection with various fiduciary and non-fiduciary services offered by certain subsidiaries of M&T Bank Corporation including, but not limited to, Manufacturers & Traders Trust Company (M&T Bank), Wilmington Trust Company (WTC) operating in Delaware only, Wilmington Trust, N.A. (WTNA), Wilmington Trust Investment Advisors, Inc. (WTIA), Wilmington Funds Management Corporation (WFMC), and Wilmington Trust Investment Management, LLC (WTIM). Such services include trustee, custodial, agency, investment management, and other services. International corporate and institutional services are offered through M&T Bank Corporation’s international subsidiaries. Loans, credit cards, retail and business deposits, and other business and personal banking services and products are offered by M&T Bank, Member FDIC.

Investment Products: | Are NOT Deposits | Are NOT FDIC Insured | Are NOT Insured By Any Federal Government Agency | Have NO Bank Guarantee

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today