How to Position Investor Portfolios

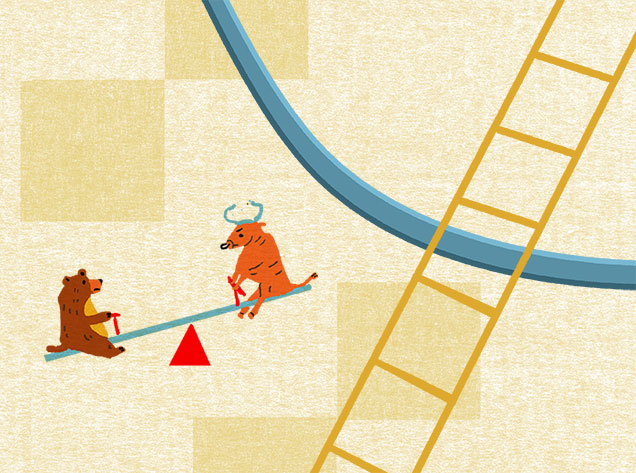

A new balance

The balance of risks has shifted in the wake of the post-election rally—so certain chutes and ladders may not be fully priced into markets.

$200B

Estimated 2025 spending on data centers and AI software creation by the biggest AI companies{{wt-d82*}}

10.7%

Average annualized return for the S&P 500 over the last 50 years{{wt-d83*}}

Talk to Us

How can the 2025 Capital Markets Forecast help you? Our team would be happy to discuss the report’s potential implications for your portfolio.

We see a cautious approach to equities—and risk overall—as the best current strategy.

There is potential upside for corporate earnings from productivity gains and fairer trade, but these dynamics can play out over multiple years.

- Market players typically focus almost exclusively on either upside or downside risks, but not both. This form of self-perpetuating recency bias is highly visible as investors continue to push equity prices higher.

- We believe the proposed tariffs could hurt the economy. But we also see potential long-term benefits to U.S. companies from fairer trade terms that provide more access to foreign markets.

- Despite our overall caution, we don’t recommend that investors stay out of the market. Doing so misses out on the power of compounding, which historically has been an irreparable mistake.

Equity Valuations Are High

As calculated by several metrics, equity valuations are currently at about the 95th percentile relative to the last 25 years—suggesting that further upside could be challenging.

An M&A Rebound?

We expect mergers and acquisitions activity to increase in 2025 as interest rates fall and the dealmaking environment becomes more favorable. If so, equities could benefit.

Meghan Shue

Head of Investment Strategy

Meet Meghan Shue, Head of Investment Strategy

Meghan oversees Wilmington Trust’s portfolio construction process—implementing a variety of asset class views through proprietary, non-proprietary, passive, active, and factor-based solutions. She is a regular CNBC contributor and is frequently quoted in financial media communicating the firm’s economic and market views.

If you’d like to talk, we’d like to listen.

Wilmington Trust has been the wealth manager of choice for many Americans since 1903.{{wt-d57*}} Whether you’re thinking about investing now or for the future, we’d be happy to discuss how we can help.

* indicates a required field