Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

It has been a challenging year for investors, with the economy surpassing expectations at every turn. The latest evidence is the U.S. gravity-defying third quarter, which clocked the fastest GDP print since the fourth quarter of 2021. Meanwhile, the stock market took a breather in the third quarter while rates surged. Recently, equities have rallied strongly alongside bonds on signs that the economy may be slowing enough to prompt the Fed to actually start cutting rates but not so much that a recession emerges (also known as a “Goldilocks” economy). Fortunately, we are continually meeting with clients, business owners, and investors throughout our footprint. These interactions offer tremendous insight into local economic conditions and risks. With the economy and the Fed at such pivotal points, I wanted to use this month’s letter to address the most common and pressing questions on the minds of our clients.

Answer: We place a roughly 60% probability on a soft landing, given encouraging improvement in inflation and a resilient consumer. There is still an uncomfortably high 25% probability on a mild recession taking place in 2024.

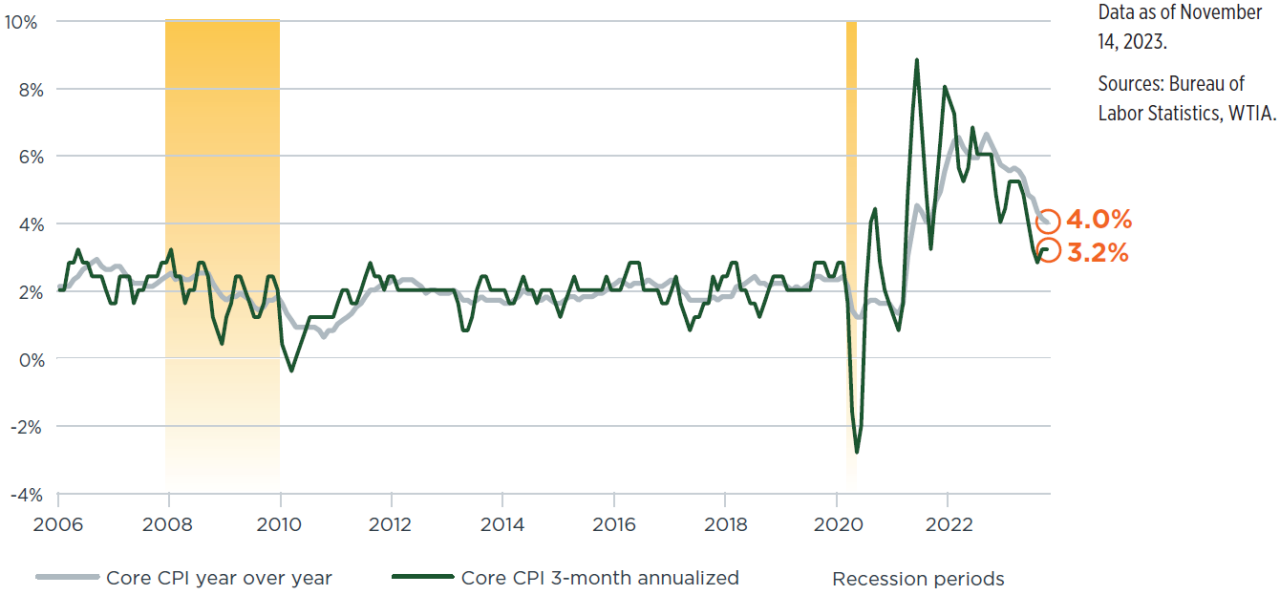

The last few months have delivered evidence of slowing inflation alongside a resilient consumer, which has shifted the narrative away from recession toward a soft landing. Of paramount importance is the trajectory of core inflation, which continues to descend toward the Fed’s target (Figure 1). The U.S. consumer delivered a stellar showing in the third quarter even as inflation slowed. Consumer activity is expected to slow considerably as the labor market normalizes and excess savings dwindle. Headwinds are now building in the form of credit costs, housing affordability, and student loan repayments.

Figure 1: Inflation descending to Fed’s target

Core CPI y/y and 3-month annualized

We feel like we can say with confidence that the 4.9% GDP print from the third quarter will not be repeated (and it may even be revised down) over the next year. We expect the next two quarters to deliver below-trend growth that supports the disinflationary trend, all while maintaining the economic expansion. The modest uptick in the unemployment rate is a function of a softening job market and increased labor market participation, which should give the Fed comfort that wage costs will not present a problem going forward.

However, there is still about a 25% probability that growth rolls over entirely, leading to a mild recession. After all, while a Goldilocks economy is possible, its attainment is a small needle to thread. We are monitoring a slowing of the services economy, as evidenced by the ISM Services PMI falling to 51.8 (above 50 indicating expansion). Credit delinquencies, on both the consumer (credit and auto loans) and business side, are increasing. While a normal part of a slowing economy, these trends also precede a recession. We will continue to monitor the credit arena closely for any signals that the trend could signal worse than a slowing economy.

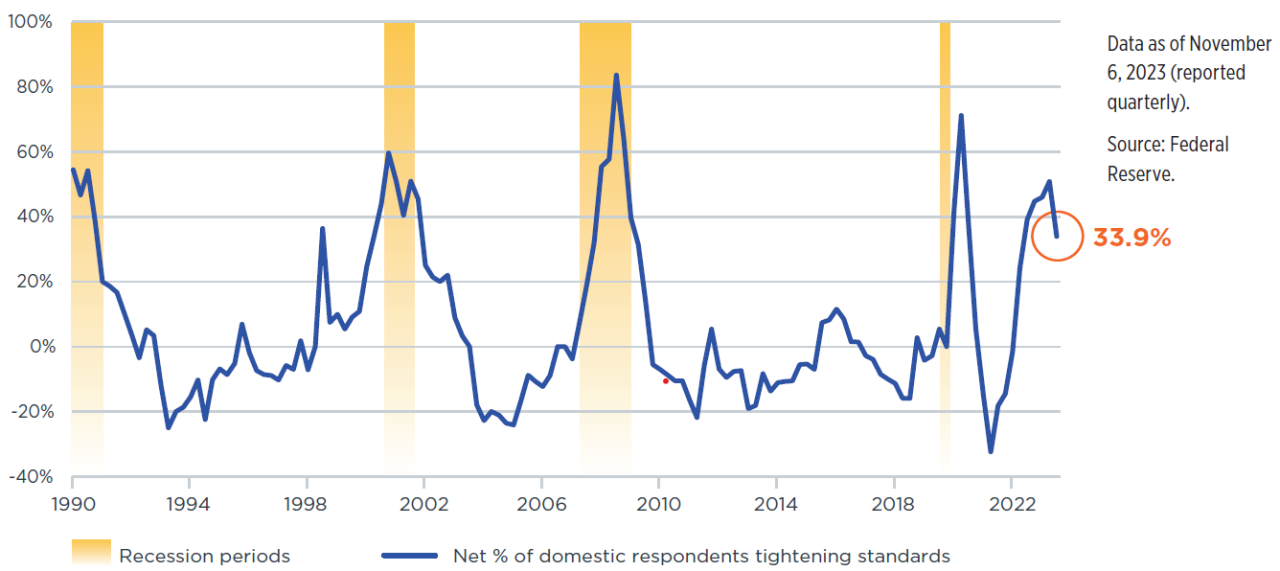

Figure 2: Banks tightening lending standards in real estate

Senior Loan Officer Survey, commercial real estate, net % of banks tightening standards

Answer: We are closely monitoring the commercial real estate (CRE) sector, with particular focus on weakness within the office sector. At this time, we see some continued headwinds for the overall asset class, but as is the case for real estate, location and quality matter. We also see some encouraging trends in non-office sectors. Last, as with all investments, each asset must be evaluated in light of its unique characteristics.

CRE concerns began to broaden during the period of bank stress earlier this year, and many banks with exposure to this sector have increased loan-loss reserves and tightened lending standards (Figure 2). What had been seen as mainly a postpandemic, urban office ground zero has started to spill over more broadly to other forms of commercial real estate. As evidence of this trend, through the third quarter of this year, CRE transaction volumes have slowed to a quarterly pace of $82 billion, a 54% y/y decline.1 Some softening is occurring in the non-multifamily CRE space, with the share of loans behind on payments increasing modestly from 0.5% to 0.8% in the span of a year (as of the third quarter of 2023).2

Office does remain the primary concern, as occupancy rates seem to be stabilizing at just 50% of prepandemic levels.3 Quality is key. The newest and highest quality office buildings in New York City (NYC), for example, are capturing record-high rents. Some estimate that class A+ buildings in aggregate will see a relatively modest price decline of 15%–20%, but lower-quality buildings in NYC and San Francisco have recently traded at 50%–80% discounts to prepandemic values. Properties in the Sun Belt, including cities like Tampa, Orlando, and Dallas, remain strong and have seen vacancy rates rise by less than 1% over the last two years. Also, only around 15% of office loans on bank balance sheets are set to mature in the next two years, helping to minimize the potential near-term impact to the overall economy.4

Within the multifamily space, a record number of new units are in development, which could weigh on property values and rents. Funding challenges have also spread from the office sector to multifamily.5 Yet fundamentals for retail, industrial, and hospitality remain relatively sound.6 U.S. consumers have proven to be resilient amid a strong labor market and they continue to spend on travel, with U.S. hotel occupancy rates expected to reach 63% in 2023, up 0.7% y/y.7 Luxury hotels, in particular, have held up, with vacancy rates declining by 6% over the last two years.8

In aggregate, CRE is an area we expect to see continued weakness. However, we do not believe the office sector will materially impair the overall economy, and we are seeing encouraging trends in other sectors. Also important to note: Bank excess capital requirements have increased considerably since the global financial crisis and we believe that the spate of bank failures earlier this year largely represents an isolated event. In our view, the market has already weeded out those banks with the greatest idiosyncratic risks that are not broadly present in the industry today. Moving forward, we expect the disorderly industry failures of 2023 to eventually give way to orderly industry consolidation which will further strengthen the overall banking ecosystem.

Answer: The traditional 60/40 stock/bond portfolio has been tested by increased correlations between stocks and bonds. We expect a higher-than-normal correlation to persist into 2024 as inflation and rates normalize. However, once the Fed’s inflation target is in reach—or the economy tips into recession—stocks and bonds should return to their typical historical relationship.

Over long periods of time, stocks and bonds have exhibited a low correlation of just 0.1,9 but the relationship is not stable. There are periods where stocks and bonds have been almost perfectly correlated and times when these asset classes are very inversely correlated. Since 2022, the correlation between stocks and bonds has averaged 0.7 and was above 0.8 as of the end of October. This means an investor has experienced a reduced diversification benefit from owning a combination of stocks and bonds. This can occur during periods of rapidly rising inflation, stagflation (low/negative growth and high inflation), or elevated interest rate volatility, when large and violent moves in rates can push stock and bond returns in the same direction.

In our base case soft landing scenario, the Fed will likely begin to cut rates in 2024. In this environment, we expect both stocks and bonds to perform well, thereby benefiting investors from increased correlations. Once inflation normalizes, the fed funds rate settles back toward the neutral rate, and economic growth slows to trend, we would expect a return to a lower correlation between stocks and bonds, delivering the diversification that investors have come to expect.

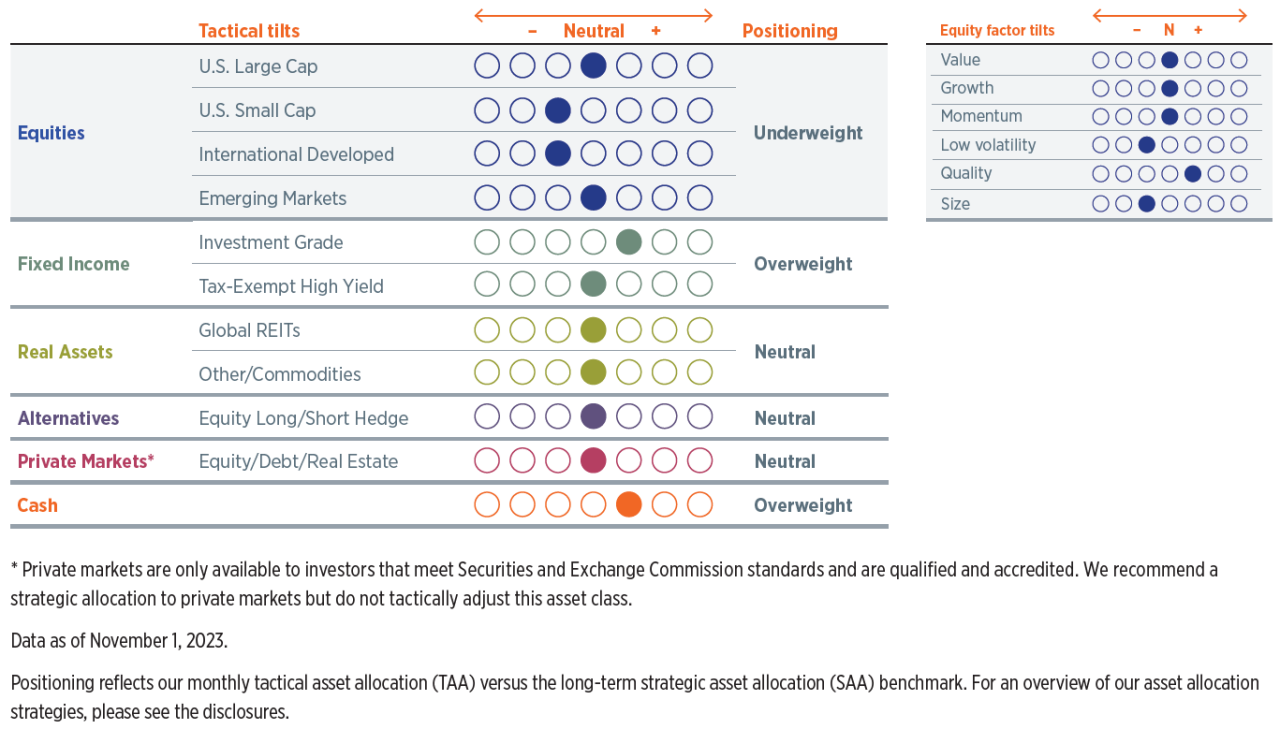

Figure 3: Current positioning

High-net-worth portfolios with private markets*

The economic outlook remains uncertain, and while we are cautiously optimistic that a soft landing will be achieved, we are not taking our eyes off the ball. We retain a slight underweight to equities across U.S. small cap and international developed (Figure 3), where valuations are attractive on an absolute and relative basis (to U.S. large cap) but the necessary catalysts for a re-rating are elusive. Further, analyst earnings expectations for U.S. large caps are optimistic when considered alongside our outlook for U.S. GDP growth of 1%–1.5% in 2024. The risk versus reward of fixed income remains attractive, given current yields and our expectations for rates to decline. We are holding slightly excess levels of cash and looking for opportunities to deploy that cash in coming months, most likely into U.S. equities if in fact the stock market reverses as softer economic data are reported in the coming months.

As our 2024 Capital Markets Forecast is expected to be released in the middle of next month, we will not publish a December issue of Capital Perspectives.

Wishing you a festive holiday season and a very happy new year.

1 “Commercial Real Estate Investment Volume Continues to Fall | CBRE,” CBRE, October 31, 2023.

2 Goldman Sachs Global Investment Research “COMMERCIAL REAL ESTATE RISKS,” October 9, 2023.

3 Kastle Systems - Data Assisting in Return to Office Plans, KASTLE, November, 2023.

4 Goldman Sachs Global Investment Research “COMMERCIAL REAL ESTATE RISKS,” October 9, 2023.

5 https://www.cbre.com/insights/briefs/cotw-debt-funding-gaparises-in-multifamily-sector, CBRE, October 25, 2023.

6 2023 U.S. Real Estate Market Outlook Midyear Review | CBRE, CBRE, September 2023.

7 US Hospitality Directions: hotel industry report: PwC, PwC, November 2023.

8 Goldman Sachs Global Investment Research “COMMERCIAL REAL ESTATE RISKS,” October 9, 2023.

9 Rolling 6-month correlation of monthly returns of the S&P 500 Total Return Index and the Bloomberg US Agg Total Return index, as of October 31, 2023. Sources: Bloomberg, WTIA.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today