Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

The U.S. economic recovery from the pandemic has been stronger and more durable than many had expected. The successful taming of inflation without a commensurate decline in economic output is partially attributable to an expansion of the labor force, of which an increase in immigration has been key. In the aftermath of the pandemic, companies struggled with unprecedented gaps in the labor supply alongside a resurgence in consumer demand. Contributions to the labor force from immigration helped offset a dearth of “natural” population growth (births minus deaths), allowing wage growth to remain contained and preventing a wage-price spiral. With the U.S. challenged by aging demographics, the direction of immigration policy will be instrumental in shaping the levels of labor supply growth, inflation, and gross domestic product (GDP).

America was a built on a foundation of immigration, one of the pillars of U.S. economic exceptionalism. However, the recent surge of migrants has highlighted cracks in the system and the need for more resources at the southern border. While both the Republicans and Democrats have acknowledged the need for comprehensive reform, Congress continues to disagree on how best to address these challenges. Immigration remains one of the most divisive political issues in America, making it difficult to enact change. The implications of immigration policy for inflation and economic growth make it a key issue to watch in the 2024 election.

Catalyst for economic growth

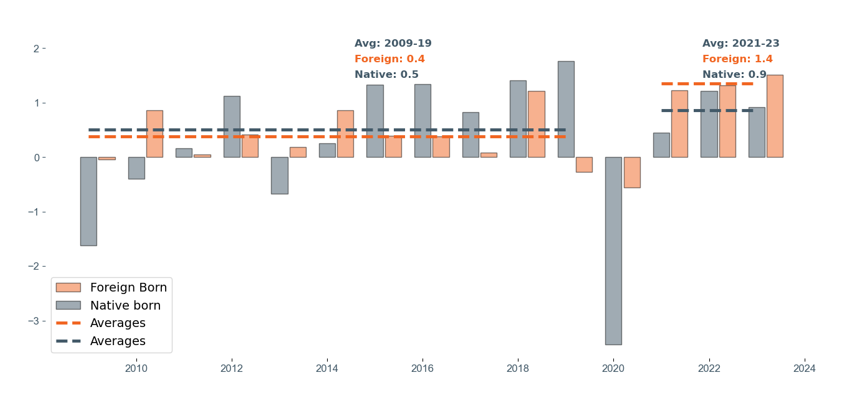

Labor force growth is a key input for the expansion of any economy and is determined by population growth and the share of that population that decides to work. All else equal, the greater the growth of the labor force, the more goods and services that can be produced. Labor force participation varies over time with structural changes, and people can adjust their behavior with the ups and downs of the economy. In the absence of strong natural population growth, higher net immigration (inflows minus outflows) has become critical to U.S. gross domestic product (GDP) expansion. In the years following the pandemic, migrants were instrumental in boosting the labor force supply and helping companies meet demand for goods and services as the economy reopened (Figure 1).

Figure 1

Immigration: A critical factor in labor supply growth

Annual labor force growth by place of birth (millions)

Data as of June 30, 2024. Sources: Bureau of Labor Statistics, WTIA.

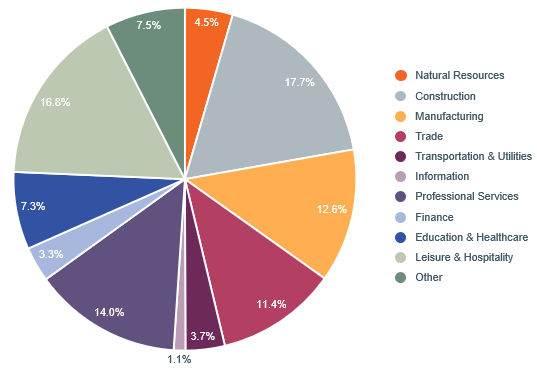

Higher net immigration was also a key ingredient to taming inflation over the past three years without a sharp slowdown in growth. In particular, robust immigration has provided an abundance of low-skilled workers to ease labor shortages in certain industries, such as construction and leisure, and hospitality (Figure 2).[1] This allowed U.S. companies to hire more workers without having to raise wages significantly to compete for labor.[2] An analysis by Goldman Sachs concluded that the increase in foreign-born workers in 2022 helped to reduce wage growth by 0.3% overall, and at least double that in the leisure and hospitality sectors. Fed Chair Jerome Powell recently cited both immigration and a greater labor participation rate as key drivers of higher economic output in 2023.[3]

Figure 2

Immigrant workers have played a large role in alleviating labor supply shortages

Percentage share of unauthorized immigrant population by industry

Source: Moody’s Analytics, as of August 2024.

Higher immigration helps to explain other aspects of the recovery. More workers means there are more people to buy goods and services. Research has shown that retail sales growth has accelerated more in states with a higher rate of net immigration.[4] Long term, foreign-born workers have historically been significant contributors to innovation and new business creation. According to an MIT study, they are 80% more likely to start a business than natural born citizens and are responsible for 42% more new jobs.[5] Further, 55% of billion-dollar U.S. startups, also referred to as “unicorns,” were founded by immigrants.[6]

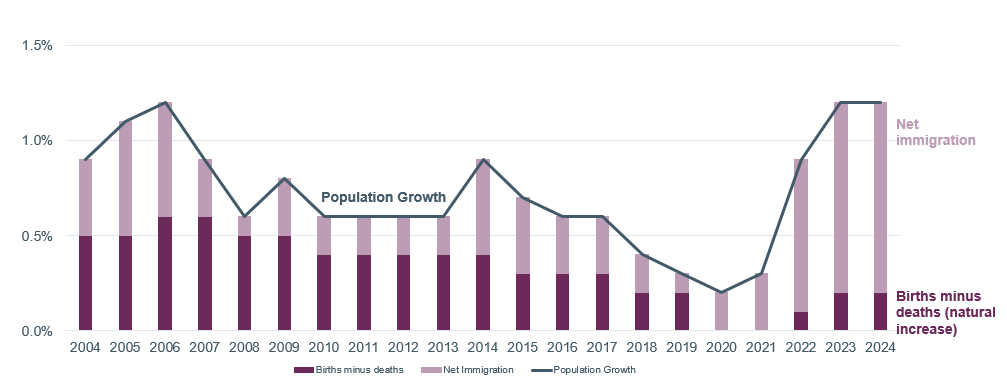

Long-term U.S population trends

Over the past decade, immigration has become a significant contributor to U.S. population growth (Figure 3). By 2040, it is expected to account for all growth in the population.[7] Amid rapidly aging demographics, foreign-born workers will become increasingly critical to maintain labor force growth and America’s competitive edge. A falling U.S birth rate and retiring baby boomers have caused a sharp rise in the dependency ratio—the total number of people too young or old to work, divided by the working-age population (15–64 years old). For context, while the U.S. working-age population grew by 11.3 million from 2000 to 2005, it rose just four million between 2011 and 2020.[8] This is a global phenomenon, with countries like Japan and Europe experiencing a similar trend. Today, more than 17% of Americans are ages 65 or older, an increase from about 10% in 1970. By 2060, nearly 25% of the U.S. will be at least aged 65.[9] Fewer workers makes it harder to fund Social Security and Medicare, which will put additional strain on the health care system, tax revenues, and the federal budget.[10] While recognizing the importance of immigration to GDP growth, higher-than-usual migrant inflows in 2022 and 2023 have strained U.S. city budgets and augmented housing shortages. This has highlighted the need for a balanced approach to immigration policy to ensure that the economic costs don’t outweigh the benefits.[11]

Figure 3

Immigration has become a significant contributor to U.S. population growth

Demogrphic factors that contributed to population growth (2004-2024)

Data as of June 30, 2024. Sources: Congressional Budget Office (CBO) and Brookings Institute.

The Congressional Budget Office (CBO), a nonpartisan public agency, has brought new attention to the recent surge in immigration and its impact on U.S. population growth and labor force. New data from the agency show that net immigration totaled 3.3 million in 2023. This was more than triple the CBO’s original projection of 1.2 million, which was made in 2019.[12] This revision was driven mainly by migrants without legal worker status, also known as “other foreign nationals.” Additionally, the U.S. saw an increase in asylum seekers and refugees who were given temporary work permits while awaiting court hearings. Due to higher-than-expected net immigration, the CBO raised its estimates for population growth from 0.5% to 1.1% in 2023 and from 0.5% to 1.2% in 2024.[13] It also predicts that the U.S. labor force will grow by 5.2 million more than forecasted through 2033.[14]

Core narrative

The recent influx of immigrants has been critical to the rapid disinflation that has sustained the post-pandemic recovery. Faster population and labor force growth, largely from unauthorized workers, has meant that employment could grow more quickly than previously believed without driving inflation higher. It has also boosted consumer spending and employment. While the surge in migrants at the southern border has put pressure on government resources, recent data show that inflows have slowed to 2021 levels.[15] Looking forward, while technological advances and incentives for investment will contribute to productivity over the long term, foreign-born workers will become increasingly necessary to maintain labor supply growth as America’s population ages and birth rates decline. The U.S. will need to address structural challenges in the system to ensure that the economy continues to benefit from immigration. We expect the outcome of the presidential and congressional elections to have significant implications for U.S. policy as both parties look to create a better system.

[1] Mark Zandi, et al., “Assessing the Macroeconomic Consequences of Harris vs. Trump,” Moody’s, August, 2024.

[2] Mohamad Moslimani and Jeffrey S. Passel, “Key findings about U.S. immigrants,” Pew Research Center, September 27, 2024.

[3] Sarah Hansen, “Why Immigration Has Boosted Job Gains and the Economy,” Morningstar, May 16, 2024.

[4] Wendy Edelberg and Tara Watson, “20240307_ImmigrationEmployment_Paper,” Brookings Institute, March 2024.

[5] Peter Dizikes, “Study: Immigrants in the U.S. are more likely to start firms, create jobs,” Massachusetts Institute of Technology (MIT), May 9, 2022.

[6] Stuart Anderson, “2022-BILLION-DOLLAR-STARTUPS.NFAP-Policy-Brief.2022,” National Foundation for American Policy, July 2022.

[7] “The Demographic Outlook: 2024 to 2054,” CBO, January 18, 2024.

[8] “Global Economic Briefing: Immigration: Global Perspective on a Growing Macro Driver,” Morgan Stanley, August 7, 2024.

[9] Aaron Zitner, et. al., “Exclusive | Americans Are More Reliant Than Ever on Government Aid,” WSJ, September 30, 2024.

[10] “Five Charts about the Future of Social Security and Medicare,” Peter G. Peterson Foundation, June 2, 2022.

[11] Elisabeth Buchwald, “Here’s how an immigration surge hurts—and helps— the US economy,” CNN, March 20, 2024.

[12] Evgeniya Duzhak, “Recent Spike in Immigration and Easing Labor Markets,” Federal Reserve Bank of San Francisco, July 15, 2024.

[13] “Friday Finish – US Economics: Immigration and (Dis)Inflation,” Morgan Stanley, March 1, 2024.

[14] “Unprecedented U.S. immigration surge boosts job growth, output,” Federal Reserve Bank of Dallas, July 2, 2024.

[15] “GIS-View-October-2024-PB-EU.pdf,” JP Morgan, October 2024. Original source no longer available.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today