Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

After a post-COVID reopening boost, the Chinese economy is losing momentum. Domestic spending has been weighed down by a faltering property sector and sagging consumer confidence. A global slowdown continues to hurt China’s manufacturing sector with a double-digit contraction in exports. Unlike other major central banks, the Peoples’ Bank of China (PBoC) is not engaged in a war on inflation so has not been hiking rates, giving it more policy options to fight the slowdown. And it has fiscal options too. However, the Chinese government’s efforts have so far been targeted and limited in scale due to various economic and political factors. The government continues to target a growth rate of 5 percent this year which is unlikely without a major package of fiscal and monetary stimulus.

Given that China is the second largest global economy and a key trading partner for many countries, the slowdown is likely to have global spillovers via the trade channel. Another source of possible spillover is the risk-sentiment channel where a sharp depreciation of the Yuan or a drop in Chinese equities could lead to increased global risk aversion and ripple through global markets.

The slowdown

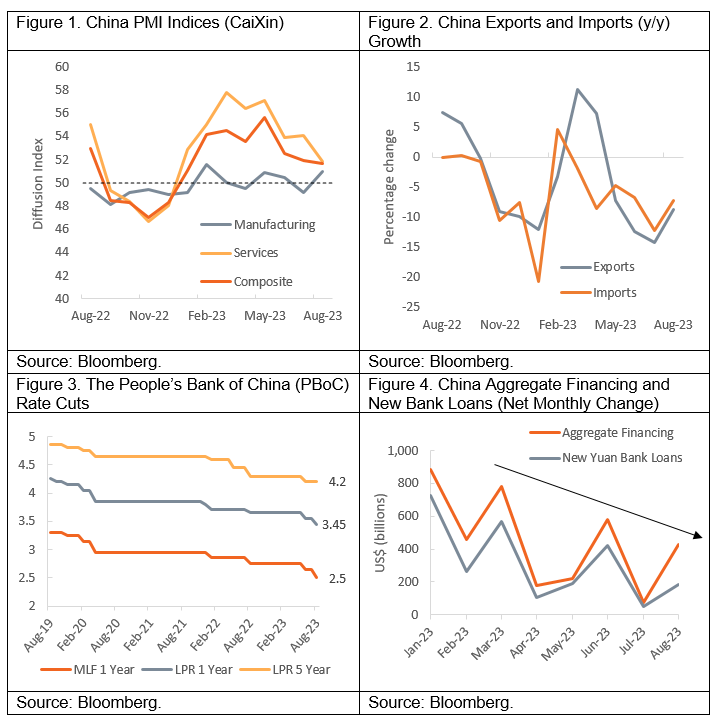

China’s economy has lost momentum with quarterly GDP growth (q/q) slowing to an annualized rate of 3.2% in 2Q2023. Trade is one key reason, with both exports and imports declining year-over-year (Figure 2). The softening has eased price pressure and CPI inflation came in at -0.3% yoy in July 2023. Negative inflation coupled with weak credit demand raises the risk of China’s economy entering a liquidity trap, when households and private businesses deleverage, and interest rate policy becomes ineffective.

Labor markets are also softening. Youth unemployment soared to an unprecedented 21% leading the government to pause reporting of that data. Lastly, the property sector has been a drag on economic growth both through slowing construction and a negative wealth effect from falling prices. If there is any bright side to be seen, the CaiXin Purchasing Managers Indices (PMI) are pointing to an expansion – any number above 50 points to a possible expansion in manufacturing (Figure 1).

The government has tools available to provide a boost to growth but has taken only marginal steps including interest rate cuts, tweaks to lending regulations, and support to the sagging equity markets. They help but are in no way sufficient to bring growth up to their target, in our view. To boost aggregate demand, the PBoC has cut several of its many policy rates (e.g., the Medium-term Lending Facilities – 1 year rate has been cut from 2.95% to 2.5% since January 2022, see Figure 3.) with limited success in stimulating credit demand. The PBoC also encouraged state-owned banks to increase lending, but the appetite for borrowing is weak and loan growth remains on a downward trend (Figure 4)

The property sector

Authorities have been concerned for years about the property sector. It was a source of strong growth, but strong demand and speculation drove prices ever higher leading to affordability problems. They also fret about the risks that high leverage and a real estate bubble pose to financial stability. As a result, they tightened lending standards for property builders starting in late 2020 which culminated in defaults by large builders such as Evergrande and Country Garden, as well as some smaller builders. Officials were initially reluctant to provide significant support to those in failure as it could further inflate the real estate bubble. However, as the crisis worsened this year, authorities have taken incremental steps such as lowering the minimum down payments and reducing the interest rate on existing mortgages by State-owned banks. Lastly, the government lifted a long-standing curb on home-purchases in the non-core districts for major cities, providing a temporary boost to property prices and sales.

Equity markets

Equity markets initially boomed when China reopened this year in January 2023, but that gradually faded away as the economy faltered. The CSI300 Index declined 12.6% from its January peak and hit a new low for the year on September 21. The government’s effort to support the equity markets through measures such as halving the securities trading stamp tax; encouraging companies to buyback more shares; and intensifying punishments for illicit trades have largely failed to provide much of a boost. Foreign investors also continue to flee the Chinese equity market at a record pace as they remain uncertain and look for signs of economic stabilization and a market bottom. As of September 20, net foreign outflows amounted to 23 billion Yuan, following a record 90 billion Yuan selloff in August.

Balancing political and economic goals

The marginal policy response raises the question why the Chinese authorities have not opted for large-scale policy options to stimulate the economy. We see two main reasons. First, the current government appears to put a greater emphasis on political/national security considerations rather than economic issues. Over the last two years the government has taken steps to rein in private firms including a crackdown on after-school education; regulatory campaign against high-tech firms such as Alibaba; and, most recently, an anti-bribery drive against the hospital and health care industry. Meanwhile, Xi’s idea of common prosperity continues to cause unease among private business owners. Starting this year, to revive the economy, the Chinese government has taken steps to reassure the private sector of a supportive environment and promise equal treatment with state-owned enterprises. These efforts may be bearing some fruit as August data show some signs of stabilization in manufacturing and retail sales as private business activities have picked up.

The second reason for the lack of an old-school infrastructure-based stimulus may be the government’s desire to shift the economy away from construction and low-end manufacturing to the “new economy,” focusing on Electric Vehicles (EVs), renewable energy, and chips. Since 2016, the Chinese EV industry has received massive government support, including tax breaks, production subsidies, cheap land, loans or grants, R&D assistance, and government bulk purchases. The stimulus continues in 2023, with a recent extension of the EV tax cut until 2027. The significant support has boosted Chinese EV production and global competitiveness. The auto industry’s y/y production has far exceeded the overall y/y industrial production this year. The progress in the “new economy” sector has been a bright spot in the Chinese economic outlook, however it remains to be seen if it will be sufficient to pull the Chinese economy out of its current slump.

The uncertain outlook

The economic outlook for China remains uncertain and could surprise on the upside as well as the downside. As most central banks are reaching their peak interest rate, a soft landing in the U.S. along with resilient demand from Europe and Japan could stimulate external demand in China. Low inflation in China could result in lower international prices meaning that global central banks may not have to hold their rates high for long – providing a further boost to external demand. The government in China has significant fiscal policy room – at least at the central government level – so if the economy continues to falter, the authorities could provide further stimulus restoring domestic and international confidence.

On the downside, the geopolitical considerations could take precedence and the government may be willing to withstand more economic pain to stamp its control. Further decoupling from China could lead to lower external demand pushing the economy into a recession. The progress in the “new economy” could be hampered by regulatory actions such as the EU’s probe into China’s EV subsidies.

Core narrative

During the current economic slowdown, the Chinese government has chosen to implement limited and targeted stimulus measures, rather than the large-scale stimulus typically seen during previous economic downturns. This approach is due to a variety of economic and political factors. The impact of these stimulus measures has been mixed. While there have been recent signs of stabilization and bright spots such as the EV industry, significant longer-term challenges remain. Therefore, we maintain a cautious stance on China. Overall, we are cautious on equity, carrying a slight underweight relative to our benchmark, but remain neutral on EM due to the stronger performances of other Emerging Market countries.

Descriptions

The CSI 300 is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

The gold industry can be significantly affected by international monetary and political developments as well as supply and demand for gold and operational costs associated with mining.

What can we help you with today