Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

February 5, 2021—Recent headlines have fixated on a ballooning mass of retail investors contributing to turbulent swings in select corners of the equity market. Most recently these have been in shares of Gamestop, AMC and others, which saw euphoric, triple-digit gains over a matter of days before eventually crashing down to earth. Given the attention devoted to this topic of late, we find it instructive to review the key developments that have set the stage for the changing composition of equity market participants as we outline our thinking about the role and impact of retail investors going forward. While we do not view retail trading as a systemic threat to the broader market, recent activity suggests that retail investors could be a more prominent feature of the investment landscape, and in addition to a series of structural shifts outlined in Theme 3 of our 2021 Capital Markets Forecast, may contribute to a more volatile trading environment.

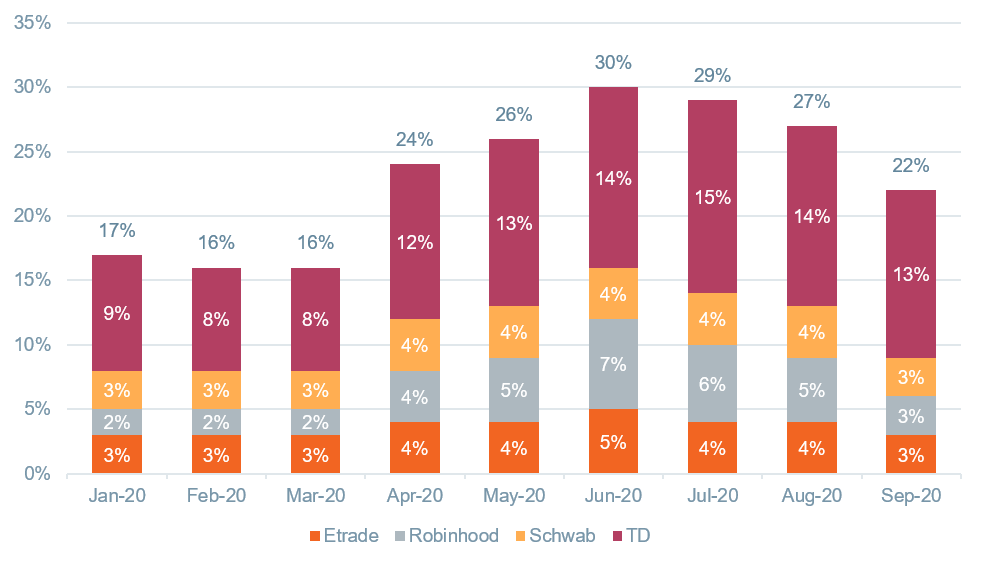

Figure 1: Retail brokerage volume as a % of overall U.S. equity market volume

Sources: J.P. Morgan Research, FINRA.

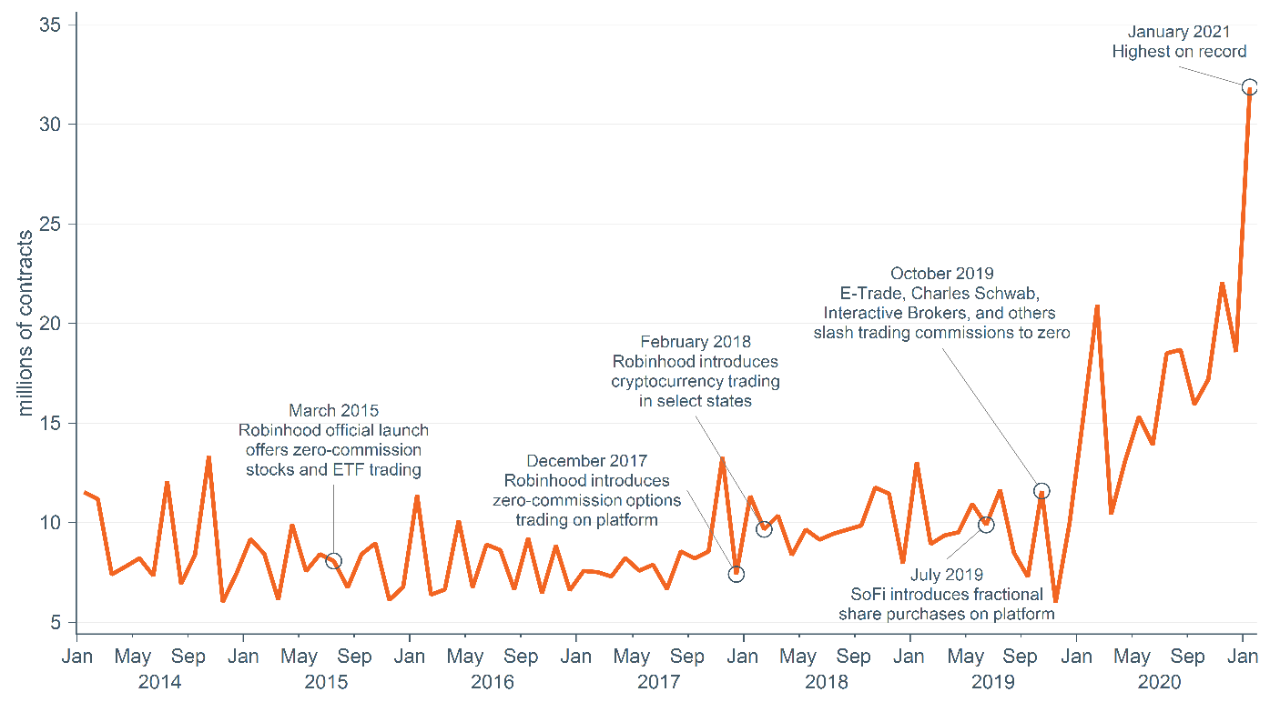

Key factors driving the retail resurgence

The sudden surge in retail trading, or at least the media’s extensive coverage of it, seems to have risen abruptly, although the trend has been gradually building for several years before exploding during the pandemic in 2020. According to Citadel, retail trading moved up to 20%–25% of total equity market trading volume in 2020, compared to around 10% in 2019. Data from FINRA shows that the retail brokerage share of U.S. stock and ETF volume swelled to a record 30% in June 2020 (Figure 1). In our view, the retail narrative is first and foremost, a story of innovative fintech companies, including Robinhood and SoFi, challenging the traditional norms long enforced by legacy online brokers. The resulting transformative shift in the competitive landscape that followed helped remove barriers to investing in the stock market for smaller investors before the unique circumstances of the pandemic effectively pushed a retail trading frenzy into overdrive. We believe that the following four factors have been largely responsible for rising retail participation in equity markets.

Figure 2: U.S. total call option volume (daily average) and timeline of key developments across retail brokers

Sources: Bloomberg, Macrobond.

The recent bout of retail-driven volatility has also shed light on other emerging topics that may draw further scrutiny from regulators. First is the increasing role of social media, which is changing the way investors communicate. Despite spending more time at home, the use of online applications and message boards has seemingly enhanced the flow of information between the newest generation of investors, enabling them to coalesce around favorite trades. Second, is the magnitude of short positions (bets on a stock moving lower) held by hedge funds, which in the case of GameStop amounted to an astounding 140% of shares available for trading. Such extreme asymmetry left short-sellers betting against GameStop particularly vulnerable to a “short-squeeze” in the event of a sustained upward price move putting markets at risk of a potential cascade of forced selling as hedge funds closed out positions en masse. While it remains to be seen whether any regulatory action will be taken, both topics will expectedly be more closely monitored by regulatory bodies moving forward.

Core narrative

As we highlighted in the Market Fragility segment of our recent Capital Markets Forecast, a series of changes in market structure (regulation, rise of ETFs, quantitative trading strategies) over the past decade have contributed to increasingly frequent high volatility events. The retail story has emerged as another structural shift to be watching but does not impact our view as it relates to portfolios. We remain committed to our expectation that the continued rollout of vaccines will help economic activity start to improve later in the year, which combined with further fiscal spending and accommodative monetary policy should provide a highly favorable backdrop for equities and risk assets more broadly in 2021.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Reference to the company names mentioned in this example is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Indexes are not available for direct investment.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today