Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

We entered 2024 with a renewed sense of conviction in the strength of the U.S. economy, a broadening of equity market leadership, and the investment opportunity presented by U.S. small-cap equities. In December, we added to U.S. small cap from cash and fixed income, taking the asset class to an overweight versus our long-term strategic benchmark, and bringing our overall equity exposure to neutral. Since the start of the year, volatility has increased for U.S. small cap and the late-2023 momentum has fizzled. The equity market has fallen back into its old ways, being led by a handful of the largest companies. However, small-cap equities as an asset class are a very different beast from large cap and often require a specific set of conditions in order to outperform, including solid economic growth, interest rate cuts, and a steepening yield curve. Encouragingly, we expect these conditions to materialize in 2024, and we believe small caps could outperform over our 9- to 12-month tactical investment horizon.

A disappointing track record for small cap

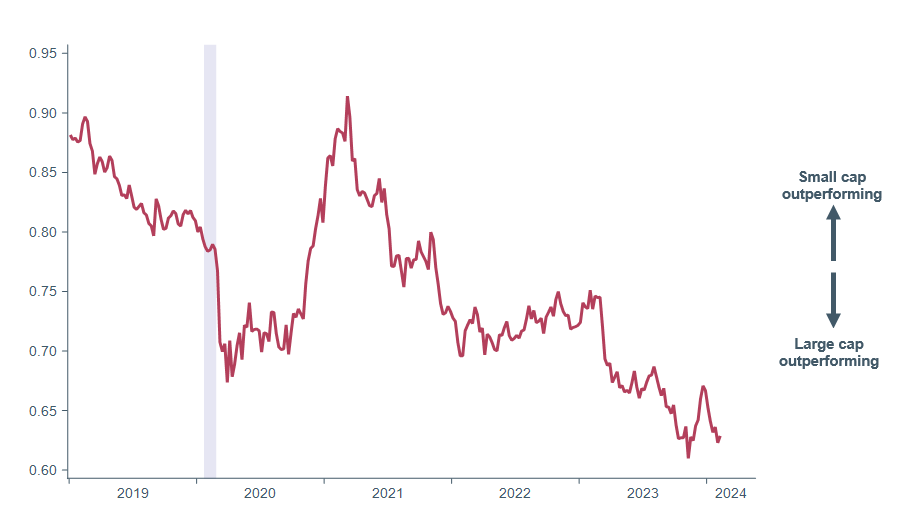

Historical returns going back several decades show a return premium for shares of smaller companies, which tend to realize faster growth rates than larger, more mature companies, though with higher risk. U.S. small-cap equities dramatically outperformed large cap between March 2020 and March 2021, as the economy reawakened from the pandemic. However, since March 2021, U.S. small-cap equities have trailed their larger cap brethren by an astounding 40% cumulative total return (nearly 13% annualized, Figure 1). It would be easy to throw in the towel on U.S. small cap, but we think this is a mistake. Though the asset class is a much smaller share of our strategic asset allocation than large cap (~10% the weight of large cap in a moderate risk profile), the relative risk means a 1% overweight to small cap could cause the portfolio to deviate from the benchmark much more than a 1% overweight to large cap (also known as tracking error). This means trends in small cap are critical to understand.

Figure 1: U.S. small cap has lagged large cap in recent years

Relative performance of S&P 500 index versus Russell 2000 Index

Gray bar represents a recessionary period. Data as of February 15, 2024. Sources: Bloomberg, WTIA.

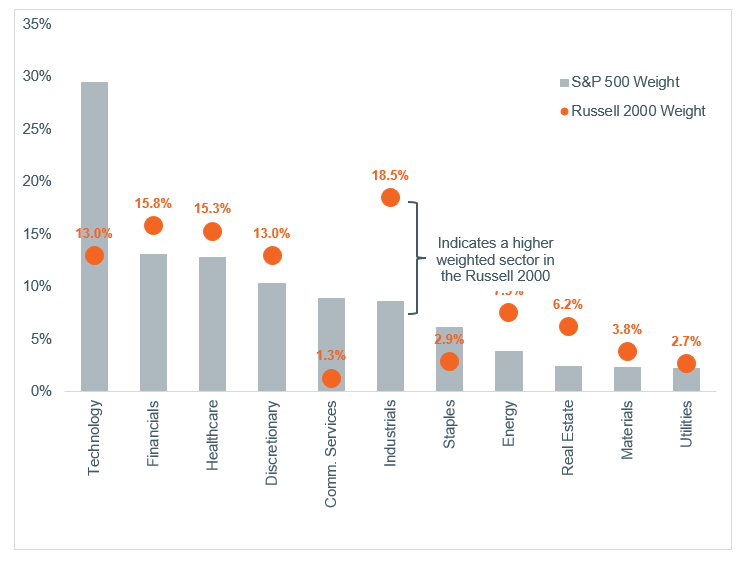

The economic and market conditions of the last three years have not favored small cap. The U.S. economy has remained more resilient than expected, which, all else being equal, would favor the more cyclical nature of the U.S. small-cap index. However, the Russell 2000 small-cap index has almost double the exposure to industrials, energy, and materials as compared to the S&P 500. These sectors have been challenged by sluggish global growth and a manufacturing recession. Most notably, the Fed’s assault on inflation was a “double whammy” for smaller companies. The Russell 2000 Index for U.S. small cap carries a debt ratio[1] more than three times that of the S&P 500 and is generally lower quality (41% of companies in the Russell 2000 are unprofitable, compared to only 6% for the S&P 500), so the rapid increase in interest rates proved a more substantial headwind to small cap. In addition, the deeply inverted yield curve wreaked havoc on small-cap banks, stress that came to a dramatic head in March 2023 with the failure of Silicon Valley Bank and ensuing challenges for regional banks. The Russell 2000 holds a 3% overweight to financials compared to the S&P 500 and obviously has much more exposure to the smaller banks most at risk for deposit flight (Figure 2).

Figure 2: U.S. small cap leans toward more cyclical sectors

Data as of January 31, 2024. Sources: Bloomberg, FTSE Russell.

Small-cap equities started to show some life in the fourth quarter of 2023, but since the start of the year the asset class has been treading water. The market’s expectations for rate cuts in 2024[2] have been dialed back from as many as seven to just four following Tuesday’s disappointing inflation reading. The 10-year Treasury yield topped 4.3%, interrupting the re-steepening of the yield curve. Investors also remain on edge about the health of commercial real estate and the impact to small- and mid-sized banks, most recently shown in the sharp selloff of New York Community Bank. (New York Community Bank, NYCB, is actually a member of the S&P 500, but concerns around real estate exposure of smaller banks has contributed to an 8% performance lag of small versus large financials since the turn of the year.) Meanwhile, U.S. large-cap equities have risen to new highs, driven once again by massive outperformance of a handful of tech-related stocks. The Russell 2000 has less than half the weight to the tech sector as the S&P 500 and has generally not benefited as much from the early-stage enthusiasm around AI-related chip and software companies.

Core narrative

Going forward, conditions should prove more supportive of U.S. small cap. However, leadership must broaden for small cap to work. The small-cap index is much less concentrated than large cap, with the top 10 holdings in the Russell 2000 representing less than 4.5% of the index, compared to 33% for the S&P 500. The market strength needs to be driven more by earnings growth and valuation expansion of cyclical sectors and less by enthusiasm around producers of AI. In fact, smaller companies may stand to benefit the most from the productivity-enhancing benefits of AI.

Despite a disappointing January CPI reading, we are confident the disinflation trend is intact. Fed policy will need to ease this year to avoid a “passive tightening” as inflation comes down and real rates restrict the economy. This easing of policy should benefit the earnings power of more debt-laden small caps. It should also alleviate some of the concerns about commercial real estate maturities, while a steepening of the yield curve should support bank balance sheets.

We do not think this year will require an “either/or” approach to small cap versus large cap. We continue to like the secular growth story of megacap tech, and it is hard to say these stocks are overvalued given the tremendous productivity-generating potential of AI and robust earnings growth (the Magnificent 7 grew earnings by 40% in 2023). We maintain a full allocation to U.S. large cap and would consider adding to the class in the event of a pullback. We are underweight to cash and hold a modest overweight to investment-grade fixed income, which could become a funding source for an increase to equities if rates continue to move higher.

[1] Source: Bloomberg. Refers to net debt divided by EBITDA, as of February 13, 2024.

[2] As measured by the fed funds futures. Source: Bloomberg.

Definitions

Russell 2000 Index measures the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks.

S&P 500 Index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Any positioning information provided does not include all positions that were taken in client accounts and may not be representative of current positioning. It should not be assumed that the positions described are or will be profitable or that positions taken in the future will be profitable or will equal the performance of those described.

Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High-Net- Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income.

Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing.

Allocations: Each strategy group is constructed with target policy weights for each asset class. Wilmington Trust periodically adjusts the policy weights’ target allocations and may shift from the target allocations within certain ranges. Such tactical allocation adjustments are generally considered on a monthly basis in response to market conditions.

The asset classes and their current proxies are: • Large–cap U.S. stocks: Russell 1000® Index • Small–cap U.S. stocks: Russell 2000® Index • Developed international stocks: MSCI EAFE® (Net) Index • Emerging market stocks: MSCI Emerging Markets Index • U.S. inflation-linked bonds: Bloomberg US Treasury Inflation Notes TR Index Value Unhedged* • International inflation-linked bonds: Bloomberg World ex US ILB (Hedged) Index • Commodity-related securities: Bloomberg Commodity Index • U.S. REITs: S&P US REIT Index • International REITs: Dow Jones Global ex US Select RESI Index • Private markets: S&P Listed Private Equity Index • Hedge funds: HFRX Global Hedge Fund Index • U.S. taxable, investment-grade bonds: Bloomberg U.S. Aggregate Index • U.S. high-yield corporate bonds: Bloomberg U.S. Corporate High Yield Index • U.S. municipal, investment-grade bonds: S&P Municipal Bond Index • U.S. municipal high-yield bonds: 60% Bloomberg High Yield Municipal Bond Index / 40% Municipal Bond Index • International taxable, investment-grade bonds: Bloomberg Global Aggregate ex US • Emerging bond markets: Bloomberg EM USD Aggregate • Cash equivalent: 30-day U.S. Treasury bill rate.

Index Descriptions

The Bloomberg U.S. Aggregate Index measures the performance of the entire U.S. market of taxable, fixed-rate, investment-grade bonds. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $250 million.

The Bloomberg U.S. High Yield Corporate Index, formerly known as Lehman Brothers U.S. High Yield Corporate Index, measures the performance of taxable, fixed-rate bonds issued by industrial, utility, and financial companies and rated below investment grade. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $150 million.

The Bloomberg World Government Inflation-Linked Bond (WGILB) Index measures the performance of investment grade, government inflation-linked debt from 12 different developed market countries.

Bloomberg Commodity Index measures the performance of 19 futures contracts on physical commodities. As of the annual reweighting of the components, no related group of commodities (for example, energy, precious metals, livestock, and grains) may constitute more than 33% of the index and no single commodity may constitute less than 2% or more than 15% of the index.

The Dow Jones Global ex-U.S. Index is an equal-weighted stock index composed of the stocks of 150 top companies from around the world (excluding the U.S.) as selected by Dow Jones editors and based on the companies' long history of success and popularity among investors. The Global Dow is designed to reflect the global stock market and gives preferences to companies with global reach.

The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is composed of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

The MSCI All-Country World Index ex USA measures the performance of large- and mid-capitalization stocks in approximately 50 developed and emerging equity markets, excluding the United States.

The MSCI EAFE® (net) Index measures the performance of approximately 20 developed equity markets, excluding those of the United States and Canada. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to nonresident investors.

The MSCI Emerging Markets Index captures large- and mid-cap representation across 26 emerging markets countries. With 1,198 constituents, the index covers approximately 85% of the free-float-adjusted market capitalization in each country.

Russell 1000® Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $309 billion.

The S&P 500 Index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

The S&P Composite Stock Price Index (noted on slide 8) refers to the data series made popular in recent years by Yale Professor Robert Shiller, not to be confused with the S&P Composite 1500, an index that combines the S&P 500, the S&P Mid Cap 400, and the S&P Small Cap 600. Investing involves risks and you may incur a profit or a loss.

The S&P Developed Property defines and measures the investable universe of publicly traded property companies domiciled in developed markets.

The S&P Municipal Bond High-Yield Index consists of bonds in the S&P Municipal Bond Index that are not rated or are rated below investment grade.

The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market.

The S&P United States REIT Index measures the investable U.S. real estate investment trust market and maintains a constituency that reflects the market’s overall composition.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today