Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Despite a number of macro headwinds and a decline in U.S. corporate profits this year, capital expenditures (capex) by S&P 500 companies have been surprisingly resilient and is now on track to increase 6% in 2023, outpacing revenue and earnings growth expectations.[1] Demand for capital goods orders were stronger than expected in June, led by investments in machinery, computers, and electronic products as well as electrical equipment, appliances, and components.[2]Structural changes in the economy—including the digital transformation, the growth of automation, and the energy transition—have required companies to invest through the entirety of the business cycle to remain competitive in an environment of rapid change. Coordinated fiscal stimulus has also acted as a tailwind as the U.S. seeks to increase the production of semiconductors and electric vehicle (EV) components at home and meet ambitious decarbonization goals.

Over the past decade, we have seen more investment in “asset-light” technology (less ownership of fixed assets on the balance sheet) than in any previous cycle, accelerated in part by the onset of the COVID-19 pandemic in the U.S. in 2020. As the nation implemented stay-at-home mandates and people practiced social distancing, companies were forced to adapt and increased their spending on digital solutions to allow for efficient remote working conditions and to meet demand for virtual customer experiences. At the same time, supply-chain disruptions and labor shortages compelled many industries to invest in automation, software, data analytics, and AI-powered insights to boost productivity and reduce the cost of capital and labor. Digital technology, combined with electrification, is also a key enabler of the energy transition, helping to integrate renewables, improve the reliability of power grids, and create new lower carbon fuels and other products. These structural shifts sparked the largest resurgence in capital spending since the 2013–2014 fracking boom, with capex by S&P 500 companies rising at an annual rate of over 15% in 2021 and 19% in 2022.[3]

Today, a focus on supply-chain resilience, escalating trade tensions with China, and decarbonization is driving a shift in U.S. industrial policy, which we believe will support additional capex growth. Recent policy initiatives enacted by Congress, aimed at reducing America’s reliance on foreign suppliers for technologies critical to maintaining national security and reducing emissions (including semiconductors and green energy components) is providing incentives for U.S. companies to bring back production from abroad (onshoring) or add new capacity on domestic shores (reshoring). Expanding the country’s manufacturing sector and capitalizing on new opportunities in clean energy will require extensive capex to build out the necessary infrastructure, supporting investments in more cyclical industries, such as robotics, electrical equipment, semiconductors, chemicals, and transportation. We discuss the sectors and themes best positioned to benefit from the next wave of spending.

De-risking the global supply chain

Globalization was one of the most important structural shifts of the late 20th century, with many developed nations moving the production and manufacturing of goods overseas (offshoring), to take advantage of cheaper labor and material costs and verticalization of supply. Today, 28% of manufactured goods are produced in China while the U.S. has transitioned to a primarily services-based economy.[4]Globalization has brought many economic benefits, including higher productivity and economies of scale, but it has also come at the cost of significant supply-chain vulnerabilities.

The pandemic has highlighted the degree to which global supply chains are susceptible to shocks and disruptions, with many U.S. companies experiencing shortages and delays as foreign suppliers imposed restrictive COVID policies and factories were shutdown. The pandemic also underscored how much the country relies on China for key strategic technologies and medical products. In 2021, for instance, a shortage of semiconductors impacted nearly every industry, detracting ~$250 billion from gross domestic product (GDP). The auto industry was hit especially hard as eleven million fewer vehicles were produced, losing around $200 billion. Semiconductors are essential to most advanced industrial, military, and commercial systems, including smartphones, aircraft, weapons, the internet, and factory automation.[5]

Since then, the Russian invasion of Ukraine and growing hostility with China over trade and technology have prompted the U.S. to enact new policies incentivizing companies to increase the domestic production of goods vital to national security, including semiconductors and green energy components. As part of this shift, U.S. companies are also moving production to “friendly” economic allies in closer locales, such as Latin America, or to countries near China, including India and Vietnam, that offer the benefits of cheaper labor and growing working age populations. U.S. Treasury Secretary Janet Yellen has explicitly stated that their intention is not to decouple from China, which she says would be “disastrous for both countries and destabilizing for the world,” but rather to “de-risk” and diversify their supply chains. In July, Yellen visited Beijing to reinforce America’s commitment to improving relations with China and maintaining a strong trade partnership.[6]

While we believe the costs and complexities involved with reorganizing the global supply chain will likely limit the growth of the reshoring and onshoring trend in the U.S., at least in the near term, we do expect a renewed focus on U.S. industrial policy and manufacturing to yield new investment opportunities. We see two potential beneficiaries of public policy and capital spending today.

Revitalized U.S. industrial policy

In 2021, the U.S. government launched a major initiative to reshore several industrial sectors that are increasingly critical to national security, including semiconductor manufacturing and advanced packaging; large capacity batteries used for EVs; and critical minerals and materials. The Inflation Reduction Act (IRA) and the CHIPS and Science Act of 2022 are expected to accelerate the expansion of manufacturing capacity, distribution networks, and other domestic supply-chain assets in the U.S. Since the passage of the bills, over $200 billion in new manufacturing projects have been announced by both U.S. and foreign-based companies. The largest investment has been in clean energy technology and semiconductors, where new financing is almost double from 2021 levels.[7]

Chipping away at Asia’s market dominance

The CHIPS Act 2022 allocates over $50 billion to strengthen the U.S. semiconductor supply chain, spur investments in manufacturing facilities, and stimulate R&D. Onshore manufacturing has been falling for decades as production moved to countries like Taiwan, which currently controls over 90% of the global supply of high-end chips and 60% of all chips.[8]This factor, combined with the COVID-induced chip shortages and the importance of chips for defense, has motivated U.S. leaders to treat semiconductors as an essential element of national security, especially within the context of China–U.S. relations. Semiconductors are poised to become a $1 trillion industry by the end of the decade, in part due to a number of secular trends, including digitization of the economy, the growth of automation and AI, and the electrification of the auto industry.[9]Companies that are part of the semiconductor supply chain or that directly produce semiconductors could see sustainable revenue growth over the next decade as production moves to domestic shores.

Since the introduction of the CHIPs Act, over $200 billion in private investments have been announced by both U.S. and foreign-based companies—including Intel, Texas Instruments, Micron, Taiwan Semiconductor Company Manufacturing, Samsung, and GlobalFoundries. The projects focus on the construction of new manufacturing facilities (fabs) and the expansion of existing sites. Plans to establish new fabs in the U.S. are also attracting billions of dollars in investment for the chemicals and materials needed for chip fabrication, providing new revenue drivers for the materials sector.[10]

Rewiring the clean energy supply chain

Clean energy will also play a vital role in national security as the U.S. looks to reduce its dependence on China for critical materials and technologies. The IRA offers unprecedented levels of support for companies that make solar panels, wind turbines, batteries, and other key technologies, as well as for companies that mine, process, and recycle “critical minerals” and materials for EV batteries. Renewable energy manufacturers can earn the IRA’s tax credits if they use components produced in the U.S. Since its passage in last August, companies have announced over $150 billion in utility-scale clean energy projects and factories, leading to 18,000 new manufacturing jobs.[11]

The IRA also provides tax credits for consumers who purchase electric and fuel cell vehicles. However, to qualify for the full credit, the vehicle must meet new manufacturing standards requiring batteries and critical minerals to be at least partially sourced from the U.S. Starting in 2025, vehicles will not qualify if the battery’s minerals were extracted, processed, or recycled by a foreign entity of concern,” which includes Russia and China.[12]Today, around 70% of the EV battery supply chain is dependent on China for the mining and refining of critical materials.[13]The IRA includes tax credits for the domestic production of battery cells, battery packs, and 10% of the costs of mining or refining “critical minerals or producing electrode materials. It also provides funding for the construction of new manufacturing facilities. Along with the IRA, the Bipartisan Infrastructure Law (BIL) provides $7 billion to strengthen the battery supply chain.[14]

Since the passage of the bills, more than $70 billion in manufacturing projects for clean energy components have been announced, primarily for EVs and batteries, as well as solar panels. South Korea accounts for one-third of the investments as the country seeks to profit from its expertise in battery manufacturing and surging demand for EVs in the U.S. By 2026, U.S. EV manufacturing facilities are expected to have an annual production capacity of around four million new passenger vehicles. The U.S. will also be able to produce enough batteries to supply over 11 million cars each year.[15] Bloomberg estimates that EVs as a percentage of car sales will rise from 7.6% in 2022 to 28% by 2026, presenting a significant opportunity for companies that are part of the U.S. battery supply chain.[16]

Economic Implications

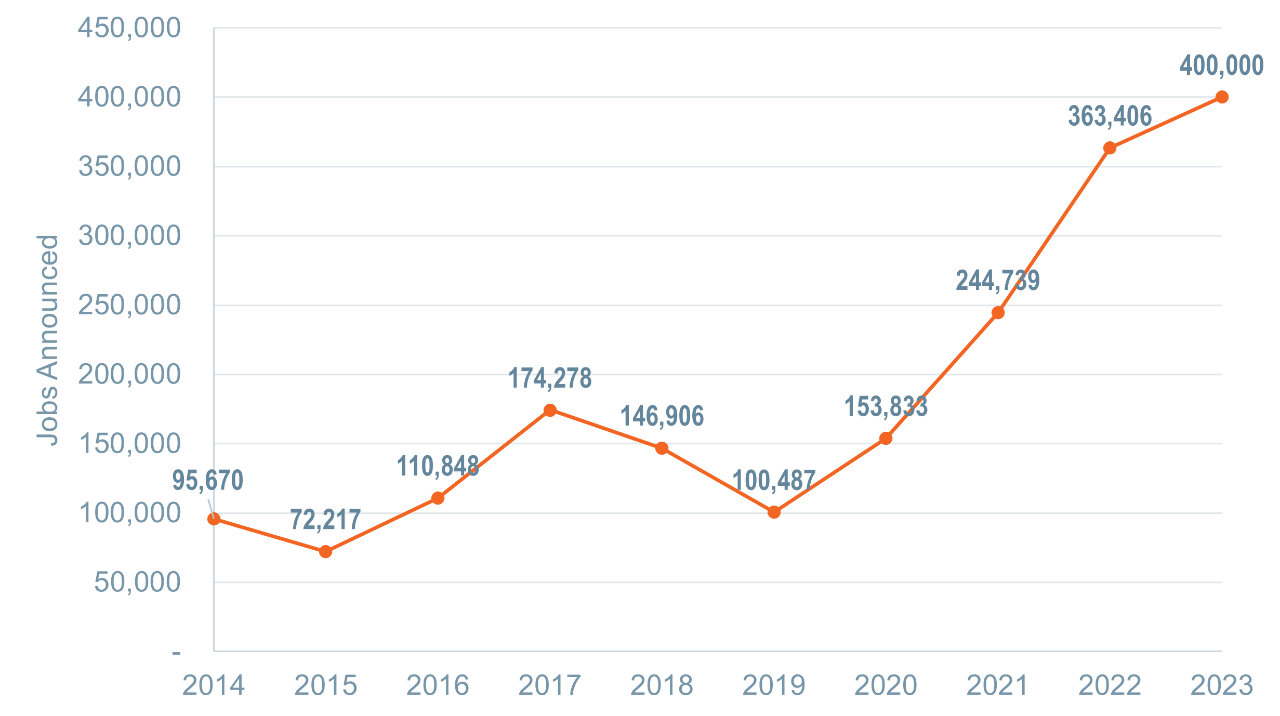

Supported by the IRA and CHIPS act, the U.S. has experienced a rush of construction spending for domestic manufacturing facilities, led by investments in computer, electronics, and electrical manufacturing. As of April 2023, the annual rate reached $190 billion versus $90 billion in June 2022, with manufacturing comprising around 13% of non-government construction.[17] At the same, reshoring and foreign investment job announcements hit a new annual high of 364,000 in 2022, an increase of 53% from 2021 (Figure 1). 101,500 jobs were added in the first quarter of this year, led by electrical equipment for EVs. Based on current trends, reshoring and foreign investments could yield over 400,000 new manufacturing jobs this year.[18]

Figure 1

New manufacturing job announcements hit an all-time high in 2022 Investments in EVs and semiconductors driving growth

Reshoring + Foreign Direct Investment New U.S. Manufacturing Jobs

Source: Reshoring Initiative Library Data. Data as of March 31, 2023.

The government’s efforts to boost the manufacturing sector has the potential to strengthen the U.S. over the long term due to manufacturing’s outsized impact on the economy. While manufacturing encompasses 8% of the workforce and 11% of GDP, it drives 35% of productivity growth, 60% of exports, and 70% of R&D spending.[19] It also spurs demand in industries that provide services and inputs and supports domestic suppliers. We believe increased spending on manufacturing will provide structural demand tailwinds for a number of industries:

Core narrative

The pandemic’s disruption of global supply chains sparked a resurgence in U.S. manufacturing in 2020, with many companies onshoring or reshoring the production of essential products, including medical equipment and pharmaceuticals. More recently, trade disputes with China and the war in Ukraine has further revealed supply-chain vulnerabilities and the need to strengthen industries critical to national security. The U.S. responded with the IRA and Chips Act, fueling a wave of new capital investment on new clean energy and semiconductor manufacturing facilities and supporting infrastructure. We expect these secular tailwinds to provide earnings support for the industrial sector as demand rises for capital goods, robotics, electrical equipment, energy, commercial services, and consumer durables. Supported by reasonable valuations and solid growth prospects, we are currently assessing opportunities in the sector to capitalize on this trend. For clients seeking greater visibility into how these trends and investment ideas are making their way into portfolios, please reach out to your investment advisor.

[1] Kristin Broughton, Companies’ Capital Spending Forecast to Slow in 2023 Amid Recession Fears - WSJ, WSJ, January 2023.

[2] Mike Segar, “ U.S. Core Capital Goods Orders, Shipments Rebound Strongly in October (usnews.com),” Reuters, November 2023.

[3] Kristin Broughton, Companies’ Capital Spending Forecast to Slow in 2023 Amid Recession Fears - WSJ, WSJ, January 2023.

[4] World Population Review, Manufacturing by Country 2023 (worldpopulationreview.com),” 2023.

[5] Dylan Walsh, “How auto companies are adapting to the global chip shortage | MIT Sloan,” MIT, July 2022.

[6] Jennifer Hansler, Nectar Gan and Juliana Liu, “Yellen China visit: The world is big enough for US and China, US treasury secretary says | CNN Business,” CNN, July 2023.

[7]The American Presidency Project, “ICYMI: Fortune: "Biden's massive manufacturing push is working and U.S. companies have already committed $200 billion to new projects" | The American Presidency Project (ucsb.edu),”April 2023.

[8] Compound Semiconductor News, “Why does Taiwan make all the chips? - Compound Semiconductor News (csfusion.org),” August 2022.

[9] Ondrej Burkacky, Julia Dragon, and Nikolaus Lehmann, “The semiconductor decade: A trillion-dollar industry | McKinsey,” McKinsey, April 2022.

[10] Robert Casanova, “The CHIPS Act Has Already Sparked $200 Billion in Private Investments for U.S. Semiconductor Production - Semiconductor Industry Association (semiconductors.org),” SIA, December 2022.

[11]Michelle Lewis, The US has seen 5 years' worth of clean energy investments in just 9 months – here are the highlights (electrek.co), Electrek April 2023.

[12] U.S. Department of Treasury, “Treasury Releases Proposed Guidance on New Clean Vehicle Credit to Lower Costs for Consumers, Build U.S. Industrial Base, Strengthen Supply Chains - WITA,” WITA, March 2023.

[13] Geraint John,“interos.ai/blog-battery-supply-chains-reliance-on-china-threatens-the-electric-revolution/#:~:text=A new report by the International Energy Agency,for anodes – the two key battery components.,” Interos, August 2022.

[14] “Tracking the Post-IRA Boom in the US EV Supply Chain - CleanTechnica,” Clean Technica, February 2023.

[15] “State-Electric-Vehicle-Policy-Landscape.pdf (edf.org),” Environmental Defense Fund, March 2023

[16] Anne Fischer, “EV sales to account for one-third of US passenger car sales by 2026, says BNEF – pv magazine International (pv-magazine.com),” PV Magazine, June 2023.

[17] Eric Van Nostrand, Tara Sinclair, Samarth Gupta, “Unpacking the Boom in U.S. Construction of Manufacturing Facilities | U.S. Department of the Treasury,” U.S. DEPARTMENT OF THE TREASURY, June 2023.![]()

[18] “2023_Q1_data_report.pdf (reshorenow.org),” Reshoring Initiative, Q1 2023.

[19] James Manyika, Katy George, Eric Chewning, Jonathan Woetzel, and Hans-Werner Kaas, “US manufacturing: Building a more competitive sector | McKinsey.” McKinsey, April 2021.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Third-party trademarks and brands are the property of their respective owners. CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The index has 503 components because three of them have two share classes listed.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today