Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

The end of the third quarter brings to a close what has been a challenging few months for stocks and bonds alike. Make no mistake: Year-to-date returns are still above average for equities and respectable for a diversified portfolio.1 But the market has pulled back from gains that, in our view, had run well ahead of economic fundamentals, which are now on a weakening trajectory. Indeed, the strong economic growth of the third quarter is unlikely to continue at current levels as headwinds build for the U.S. consumer. But encouragingly, these challenges are not likely to result in a U.S. recession over the next year. Putting this all together, there are reasons to be both cautious and optimistic. The defensive stance we have maintained in portfolios all year is now paying off. At the same time, we are seeing opportunities emerging over a 12-month horizon for patient investors and believe our next move is likely to lean into stocks when the right moment presents itself.

On the optimistic side, the consumer has defied gravity this year and powered the economy to very solid growth through the third quarter. The overwhelming consensus from economists to start the year was that the U.S. economy would have entered recession by now, and strong consumer spending has forced most of Wall Street to either reverse or push out the timing of those expectations. Prime-age labor force participation has increased, and the number of people quitting jobs to take another for higher pay has come down markedly, easing wage inflation. Overall, the labor market is cooling but remains strong. And the single best thing for the economy is a strong job market that keeps paychecks rolling into consumer bank accounts. The manufacturing economy has been in recession, but leading indicators suggest activity may be bottoming. Outside of the U.S., economic growth in China and Europe has been very disappointing, but a series of measures to stimulate the Chinese economy may help global growth going forward.

Figure 1: Real interest rates continue to push higher

Real 10-year Treasury yield

Inflation is falling nicely. Headline Personal Consumption Expenditures (PCE) is still 4.2% y/y, but the 3-month annualized rate of inflation for Core PCE is now 2.2%, within reach of the Fed’s target. The market is placing a 20%–25% chance of one more rate hike from the Fed. It is quite possible that by the time the November and December policy meetings roll around, the Fed sees ample evidence that a shift to a “hold and monitor” stance is justified. At that time, the focus will turn to how long the Fed maintains policy rates at these elevated levels. If inflation continues to decelerate, the Fed’s policy will become increasingly restrictive, as measured by real interest rates (Figure 1), and the lagged effects of tight monetary policy will continue to build. The most notable takeaway from the September Federal Open Market Committee (FOMC) meeting (when the Fed’s committee held rates steady at 5.5%), was its reassessment of how many rate cuts are expected in 2024. The median FOMC member went from projecting 100 basis points, or bps (1.00%) of rate cuts in 2024 to now just 50bps. A strong economy, resilient consumer, and Teflon job market may mean the Fed keeps rates higher for longer, which may have less rosy implications for markets.

Figure 2: Aggregate excess savings approach prepandemic trend

Total household deposits

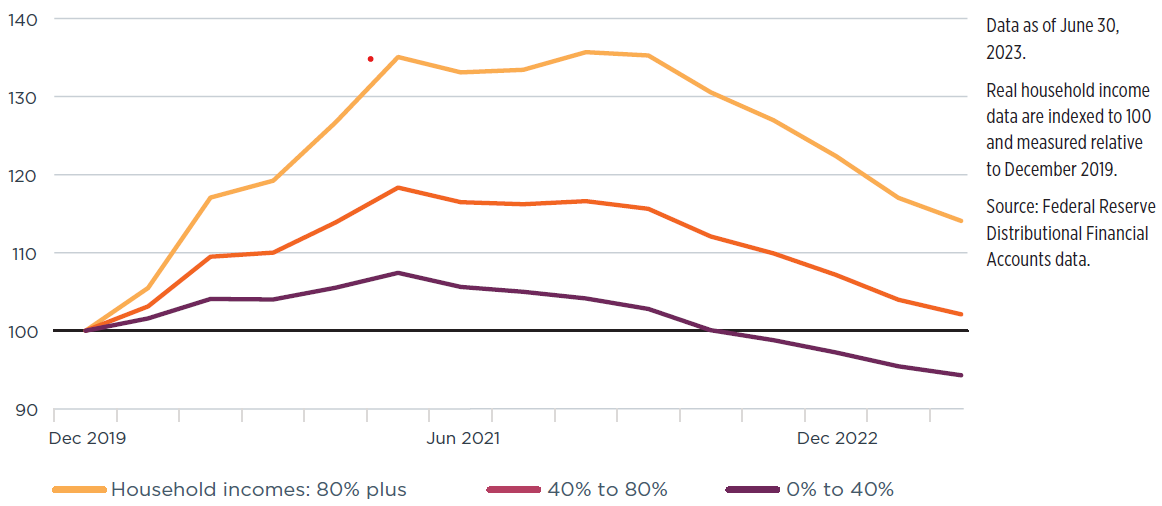

As we move into the fourth quarter, tailwinds for the consumer will fade and headwinds could begin to build. Consumer savings accounts are still padded from extraordinary Covid-related stimulus, but excess savings is being depleted at a rapid pace (Figure 2). Admittedly, different data sources paint slightly different pictures of how much savings the consumer has left and where it is going. For example, not all excess savings is being spent. Some consumers are using savings to pay down debt, which strengthens balance sheets, while others are moving cash into higher-yielding fixed income securities. The consistent takeaway is that there is much less excess savings to power goods and services purchases than there was earlier this year. For the lower income demographic, savings are now below prepandemic levels (Figure 3).

Figure 3: Lower income consumers see savings below prepandemic levels

Real household savings

We are on the watch for further deterioration in the spending power of this lower income demographic—and we expect further pain from rising gasoline prices and resumption of student loan payments. Credit card delinquencies at the aggregate level are not alarming, but they are rising rapidly for lower-income borrowers as borrowing rates hit their highest level on record at 20.7% in May.*

Other “known unknowns” include the duration and impact of union strikes, as well as the chance of a prolonged government shutdown. (At the time of writing, UAW strikes were still ongoing, and Congress had reached a deal to fund the government but only for an additional 45 days.) These policy risks tend to get lots of headlines but have historically had a temporary and modest impact on economic activity. Still, that does not mean they cannot provide another catalyst for profit-taking in the equity market.

When we lay it all out, the balance of risks favors a soft landing for the U.S. economy. We place the highest probability—slightly greater than even odds—on slower but sustained economic growth as we move into 2024. We give a roughly 25%–30% probability to a mild recession scenario, which could see a modest pullback in consumer spending and capex and a roughly 2% increase in the unemployment rate. The probability of a “no landing” scenario has increased in recent weeks. We define a no-landing scenario as economic activity continuing at an above-trend pace and necessitating “higher for longer” interest rates. Ironically, this no-landing scenario may be the worst for equities, since it could result in the Fed overtightening policy and sending the economy into a deeper recession further down the line.

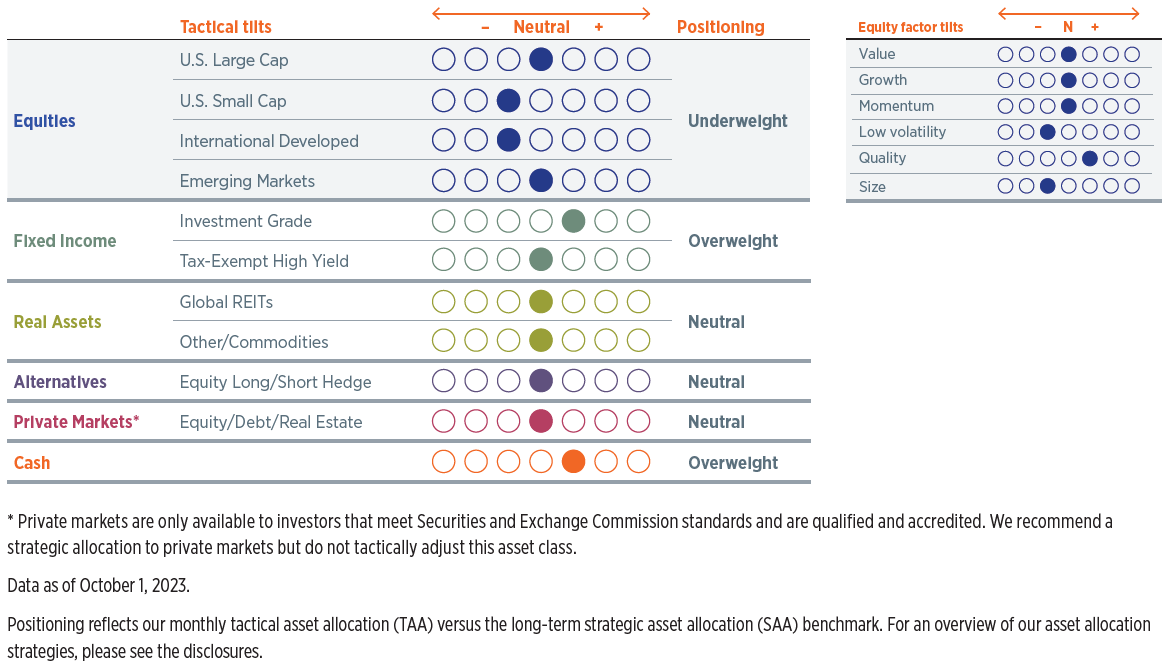

A constructive economic outlook may seem at odds with our slightly defensive positioning in portfolios. We currently hold a slight underweight to U.S. small-cap and international developed equities versus our long-term strategic benchmark. When we compare the value proposition of equities to safer assets—including cash and investment-grade fixed income—we are hard-pressed to find a compelling argument for taking on added risk at this time. The 10-year Treasury yield climbed to 16-year highs in the third quarter. It is our view that rates will come down over the next 12 months, as growth slows and the Fed begins to cut rates. This argues for an overweight position in investment-grade fixed income.

While we still hold slightly elevated levels of cash as dry powder, cash holds significant reinvestment risk—meaning that if short interest rates come down, return prospects will be much less attractive than if an investor had been holding longer-duration assets. The risk versus return profile for investment-grade fixed income is favorable, as the current yield means that even a moderate 50bps increase in rates from here could still result in positive total returns for bonds. Meanwhile, if rates fall by 50bps or more, total returns could approach double digits. For the municipal bond market in particular, municipalities have solid balance sheets with ample cash, and inefficiencies of that market offer potential for those focusing on sound credit research.

Figure 4: Current positioning

High-net-worth portfolios with private markets*

We recognize short-term risks for the U.S. economy, but the prospects over the next 12 months are brightening, especially relative to most other parts of the world. A preference for the U.S. over international equities is a feature of our long-term strategic asset allocation, and it could factor more prominently in our tactical positioning in coming months should the pullback in U.S. equities continue. Valuations for the U.S. equity market overall are a bit elevated, but this is not the case outside of the largest stocks. In addition, those highly valued stocks generally hold unique, dominant positions in one of the most exciting structural investment themes: artificial intelligence (addressed comprehensively in our research paper, The Future of AI Is Here: Investment Risks & Opportunities). A broadening of equity leadership and higher dispersion in the market (i.e., a market less reliant on just a handful of stocks for powering the gains) should benefit active managers focused on value and quality. Within our portfolios, we maintain balanced exposure between the growth and value factors and hold a preference for higher quality (lower leverage, higher profitability, and management quality). We expect this positioning to reap benefits for our clients in the months ahead.

Please see important disclosures at the end of the article.

* Sources: The Federal Reserve Bank of St. Louis; Bloomberg.

1 Data as of September 30, 2023. Sources: Bloomberg, WTIA. 60/40 benchmark represents a 60% weight to the MSCI ACWI and 40% to the S&P Municipal Bond Index rebalanced monthly.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today