Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

At the outset of 2025, many market participants expected a broad-based surge in activity across syndicated loans, private credit, and CLOs. The year began with strong pipelines, abundant dry powder, and optimism that deal origination volume would swell. As a provider of corporate trust and agency services the conversations we had at many of the conferences we attend reflect this sentiment.

But by midyear, the reality has become more nuanced. While momentum and pipelines continue to build overall, net new origination activity has unfolded more slowly and unevenly, influenced by macroeconomic conditions, geopolitical volatility, and structural changes in both bank and non-bank lending channels.

Syndicated loan markets entered the year with heightened expectations. M&A activity began to recover, and deal flow pipelines looked promising. However, much of that early optimism met delays in execution. Our experience throughout Q1 and Q2 2025 saw deals continue to be deferred. This cadence created a softer than expected start.

Even so, the underlying trend remains positive. Leveraged loan issuance is forecast to reach $550–$600 billion in 2025, representing a 77% increase year-over-year. Institutional loan volume reached $144.5 billion in the first quarter, a 47% increase over the previous quarter. New buyouts and M&A transactions are contributing to supply, especially as private equity sponsors look to reposition assets that have remained in portfolios longer than planned.

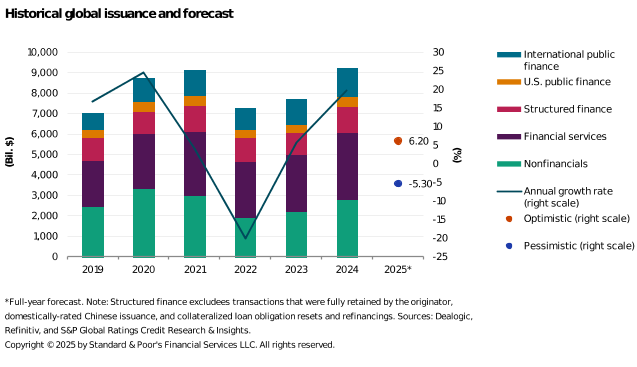

Despite these conditions, the current economic outlook still has the potential to stall activity. Any combination of concerns about tariffs, Middle East, Ukraine, U.S. Congress gridlock, or credit downgrade risks could derail the potential for seeing historic growth in this asset class. Per S&P Global, the range for issuance growth in 2025 could be as high as 6.2% or as a decrease of 5.3% due to perceived uncertainties (see chart).

At the same time, banks are becoming more selective in participation, influenced partly by the final implementation details of Basel III capital requirements. Often referred to as Basel IV in the industry, these reforms introduce stricter rules on credit risk, operational risk, and the use of internal models, including the imposition of an output floor that limits how much capital relief banks can achieve. The new rules, expected to take effect in 2025 or early 2026, are already prompting some global banks to retrench from secured debt and syndicate more broadly to manage balance sheet constraints. For banks, the combined effect is not only a reduction in balance sheet capacity but also a need to revisit capital allocation strategies, adjust pricing, and reconsider their role in credit distribution. This environment challenges banks’ ability to warehouse and hold risk, but also creates an opening for capital-efficient distribution models and partnerships with non-bank lenders.

In contrast to the caution seen in syndicated bank lending, private credit continues to accelerate. Managers entered 2025 with ample capital to deploy and are taking advantage of the pullback by banks to win deals, particularly in the middle market. Private credit is on a long-term surge, with global private credit assets under management (AUM) anticipated to reach $3 trillion by 2028. This positioning, combined with private lenders' structural flexibility and creative financing approaches, has kept deal activity strong.

We also see private credit funds increasingly active in warehouse and forward flow arrangements, especially in the consumer ABS space. Many are warehousing assets with the intent to securitize once market conditions improve, while others are taking advantage of favorable pricing to initiate forward purchase agreements.

While some risk remains embedded in looser credit agreement covenants, these vulnerabilities have yet to materialize as widespread problems. Despite earlier concerns about a wave of restructurings, defaults have remained modest. Most troubled companies have found support through maturity extensions or covenant adjustments rather than full-scale workouts.

The CLO market has been exceptionally active in the first half of 2025. Reset and refinancing activity has surged, partly driven by tighter spreads at the top of the capital stack. We've seen some triple-A tranches in the market repricing into the 115 bps range, which may prompt a flurry of restructured and newly originated vehicles.

Forecasts also suggest CLO issuance will again surpass record levels, with 2025 volume projected to approach $50 billion. The market's appetite remains strong, supported by relative value and the continued demand for structured credit exposure in a rate environment that is easing but still elevated.

The surge in CLO activity from the volume of resets, refinancings, and new issuances sets a high bar for operational infrastructure across the ecosystem. In particular, the first half of the year has seen heightened activity in underlying facility restructurings and risk transfers as managers seek to optimize portfolios and extend the life of capital. Trustee services, collateral administrators, and settlement platforms must carefully and thoughtfully use their existing and future capacities.

In addition, providers must navigate complex timelines, overlapping transactions, and increased customization in documentation and reporting. Notably, assets are being moved between funds or repositioned into new CLO vehicles, even within the broadly syndicated loan (BSL) space, where such behavior was less common in prior cycles. This combination of volume, velocity, and complexity demands sharper coordination and deeper institutional capacity. These requirements give an edge to providers with long-standing experience, integrated teams, and the ability to scale with precision.

As deal activity rises across syndicated loans, private credit, and CLOs, the demands on operational infrastructure are increasing. For loans, execution timelines are shorter, transaction structures more customized, and expectations around service delivery have grown. For CLOs, complexity is increasing due to end-of-life vehicles and asset reshuffling. In this environment, operational strength is emerging as a key differentiator.

Trustee and agency roles are at the center of this shift. These functions must manage complex transactions, navigate tight turnarounds, and support more tailored reporting requirements. Meeting these expectations depends on having experienced teams, reliable systems, and the ability to scale without compromising performance.

Training new staff remains a significant challenge. Many roles require nine to twelve months before professionals are fully ramped. To maintain responsiveness during periods of high volume, successful firms pair new hires with seasoned colleagues and invest in systems that support continuity and institutional knowledge.

Firms that view operational capacity as a strategic asset rather than a constraint are best positioned for long-term success. Their ability to adapt to shifting market demands while maintaining execution quality gives them a distinct edge. For professionals in the trustee and agent space, this environment offers not just pressure but also an opportunity to develop deep expertise and play a central role in an increasingly sophisticated market.

The first half of 2025 has affirmed the resilience of private markets and the staying power of structured products despite macroeconomic headwinds. The pace of deal activity is rising. At the same time, execution, oversight, and service delivery are expected to keep up with rapid change. As regulatory shifts reshape the role of banks in lending and private credit continues to scale, the second half of the year will test how well firms can sustain growth while upholding the operational and fiduciary standards the market demands.

Whether through navigating Basel-driven retrenchment, supporting high-volume CLO issuance, or enabling warehouse-to-securitization pipelines, the institutions that bring both agility and insight to the table will continue to find opportunity, even in a market of fast change and moving targets.

Connect with Wilmington Trust’s Loan Market Solutions team to explore how our insights and our corporate trust and agency services can help you stay ahead. Contact us today to start the conversation.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today