Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

March 10, 2021—The overall stock market has been treading water for a few weeks, with the S&P 500 suffering modest setbacks of 3%–5% since the start of the year (and no pullback of 10% or more since the March 2020 crash). Overall market volatility has picked up with fits and starts but has averaged much less than in 2020. However, like a water polo player furiously kicking underneath the surface of the water, the equity market has experienced a severe amount of underlying turmoil and volatility as investors have fled mega-cap growth stocks in favor of value and cyclically oriented companies. Will this be another short-lived value whiplash or a more durable leadership rotation? The answer is not so clear cut, and we are managing portfolios with key investment tenets in mind: diversification and risk mitigation.

Violent value rotation

Since the November 2020 presidential election, the market darlings of 2020, mainly tech-related, growth-oriented companies, have lagged their less-expensive, more cyclical counterparts. The outperformance of value and cyclicals has accelerated in recent weeks for three related reasons:

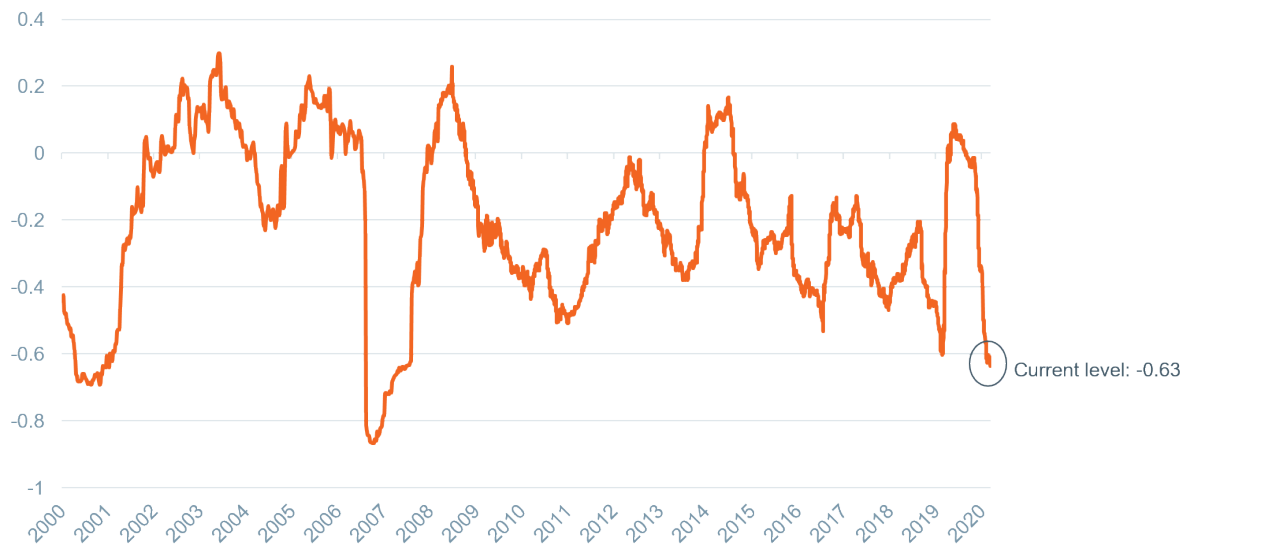

The market rotation out of growth into value has been dramatic by historical standards. The outperformance of pure value versus growth (as measured by the Bloomberg US Pure factor indices) is more than 9% since the start of 2021. During the week of March 1, 2021, the performance delta alone was nearly 3.5%; this represents a three-standard-deviation event (statistically speaking, you would expect a divergence greater less than 0.5% of the time). The correlation between value and growth stands at -0.64, which is the most inversely correlated these two factors have been since the Global Financial Crisis (Figure 1).

Figure 1: Value and growth factors have a strong inverse correlation today

BBG US Value/US Growth Correlation

Sources: Bloomberg, WTIA. Reflects the correlation between the Bloomberg US Pure Value Total Return Index and the Bloomberg US Pure Growth Total Return Index.

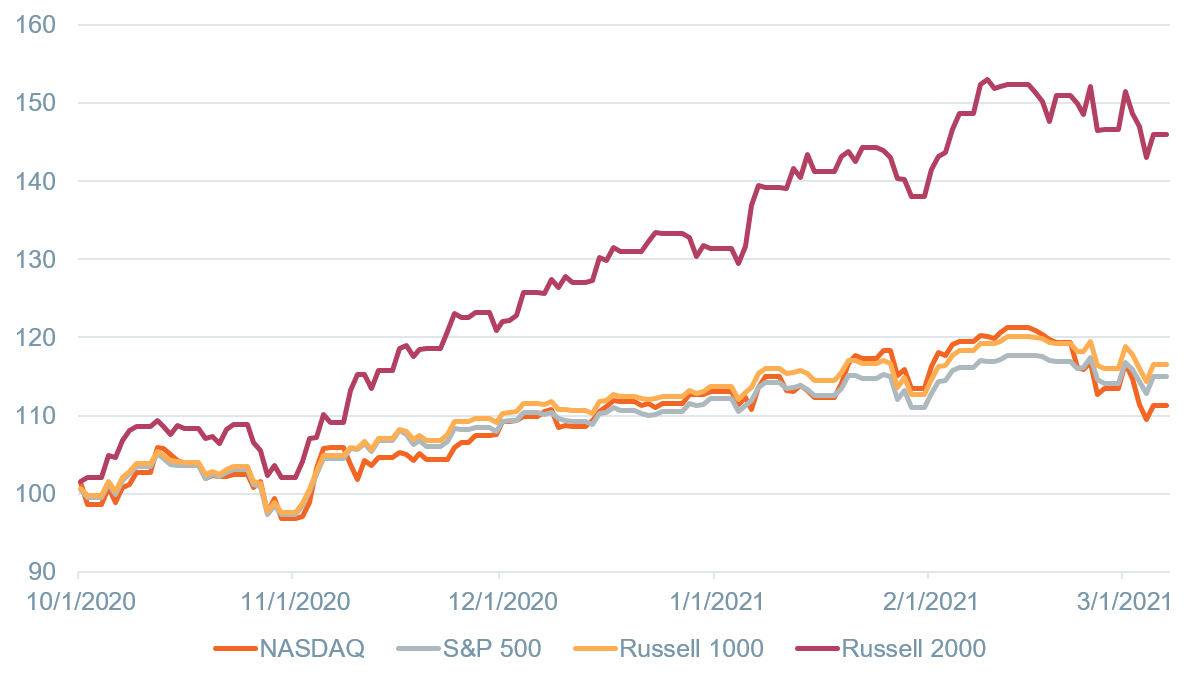

There is certainly more to the story than just growth and value. Other factors, or building block characteristics of a portfolio, have also suffered. Stocks that exhibit lower volatility and higher quality, typically desirable factor traits for a portfolio, have suffered even more than pure growth in recent weeks. The market also, for the most part, has continued to reward smaller stocks (Figure 2).

Figure 2: Factor returns for U.S. equities, indexed at 100 on October 1, 2020

Sources: Bloomberg, WTIA.

Past performance cannot guarantee future results. Indexes are not available for direct investment.

Prudent portfolio construction

How do we approach portfolio construction in an environment of high factor volatility and reduced correlations? The answer is to focus on diversification and risk mitigation. In recent months we have added to value and reduced sizes in domestic and international equities, which has brought our factor exposure in line with our benchmark. We have made modest reductions to some of our growth managers and avoided placing big bets on any one factor.

As it relates to growth, we believe the rate-driven reflex is overdone. Rates are still low, and we continue to expect a multi-year proliferation of technology in business and consumer activity, something we have referred to as “horizontal digitization.” These technologies and platforms can also continue to grow earnings once we all re-emerge from behind our computer screens and revert to normal life. In fact, our expectations for new business creation, capital expenditures, and productivity are all very constructive for many mega-cap, tech-related growth stocks. Caution is always warranted, however, around the most expensive stocks, and a bias toward reasonable valuations and higher quality remains integral to our process.

We also value active management in today’s market. Active managers may be able to take advantage of bouts of volatility or temporary mispricings to generate alpha in the future. They also have the flexibility to raise cash, which could then potentially be deployed at more attractive levels. A year like 2020, where gains in the equity market (at least in the U.S.) were driven by only a handful of stocks, can be a difficult one for many active managers with portfolios comprised of a larger number of stocks. Higher dispersion levels, reduced correlation, and broader participation in equities give active managers a better chance to outperform passive vehicles.

Core narrative

We expect the global economy to hit an inflection point in the near future, which should drive overall economic growth far above rates of recent years and usher in a rotation from consumer spending on goods to services like leisure, travel, hospitality, and entertainment. In this environment, value, cyclical, and smaller stocks should continue to do well. However, do not lose sight of the bigger picture. Our lives will be increasingly technology intensive, even long after the pandemic is behind us, and we are retaining exposure to tech-related growth equities across our portfolios.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss. Indexes are not available for direct investment.

Investments: Are NOT FDIC Insured | Have NO Bank Guarantee | May Lose Value

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Definitions

Alpha, used in finance as a measure of performance, is the excess return of an investment relative to the return of a benchmark index

Bloomberg US Value Portfolio represents the return of the value factor from the Bloomberg US equity model. The value factor aims to differentiate “rich” and “cheap” stocks.

Bloomberg US Growth Portfolio represents the return of the growth factor from the Bloomberg US equity model. The growth factor aims to aims to capture the difference between high and low growers by using historical fundamental and forward-looking analyst data.

Bloomberg US Size Portfolio represents the return of the size factor from the Bloomberg US equity model. The size factor is a composite metric distinguishing between large and small stocks.

Bloomberg US Quality Portfolio is a combination of three BBG Factor indices (Profitability, Leverage and Earnings Variability)

Bloomberg US Low Volatility Portfolio represents the return of the volatility factor from the Bloomberg US equity model. The volatility factor differentiates more volatile and less volatile stocks.

The Nasdaq Composite is a stock market index that includes almost all stocks listed on the Nasdaq stock market. Along with the Dow Jones Industrial Average and S&P 500 Index, it is one of the three most-followed stock market indices in the United States. The composition of the NASDAQ Composite is heavily weighted towards companies in the information technology sector. The Nasdaq-100, which includes 100 of the largest non-financial companies in the Nasdaq Composite, accounts for over 90% of the Nasdaq Composite’s movement. The Nasdaq Composite is a capitalization-weighted index; its price is calculated by taking the sum of the products of closing price and index share of all the securities in the index. The sum is then divided by a divisor which reduces the order of magnitude of the result.

S&P 500 Index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $1.3 billion to $309 billion.

Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $128 million to $1.3 billion.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today