Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Having significant assets creates opportunities, but some types of assets also present a challenge: how to access liquidity for major goals without disrupting your carefully constructed wealth management strategy or disrupting your business. Custom credit solutions may expand what you can achieve with your wealth through the strategic use of leverage. By using existing assets as collateral, it can provide access to capital while seeking to preserve your long-term financial plan.

However, custom credit is more than a banking product such as a loan. It is a process that combines your personal, business, and financial objectives into a tailored liquidity solution. Rather than providing standardized lending terms, this process involves understanding your unique goals, assessing your complete financial picture, and designing a credit structure that works specifically for your situation.

The word “leverage” may seem uncommon in this context, but it can play a role in your wealth strategy in surprising ways. Leverage allows you to borrow against your assets rather than liquidating them. Rather than selling investments or business interests, you can fund major purchases or work toward achieving your goals while seeking to maintain your long-term wealth-building strategy.

Consider a common situation: you have substantial business interests that require you to travel for in-person meetings with international clients, employees, suppliers, and stakeholders. To optimize your time, you are considering high-ticket purchases, but you prefer not to liquidate business assets or disrupt operations.

Custom credit solutions can help you use your assets for strategic leverage to access liquidity while working to preserve your business capital and investment strategy.

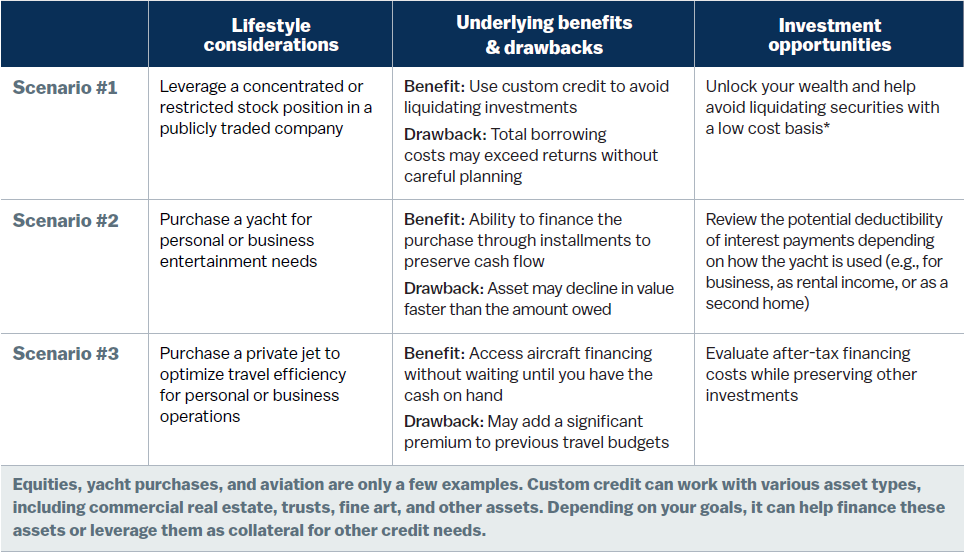

These scenarios illustrate how custom credit represents a strategic approach to wealth management. The idea of “strategic leverage” reframes the relationship between your assets and your goals. Rather than seeing illiquid wealth as limiting, this perspective views your asset base as a foundation for expanded opportunities.

Figure 2: Strategic leverage summary

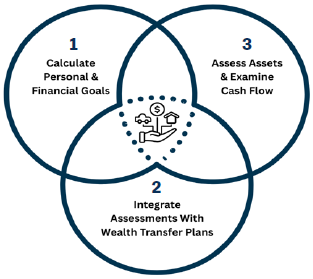

The right approach requires careful evaluation of your specific assets, objectives, and risk tolerance. This assessment typically follows a three-part process.

Your advisor reviews how custom credit can support short-term needs and long-term wealth objectives. During this assessment, you should consider how leverage can enhance estate planning, family inheritance strategies, and, if applicable, business exit planning without disrupting your core wealth strategy.

Your advisor then develops a custom credit implementation timeline based on your documented goals and objectives. Risk assessments analyze the cost of fixed or floating interest rates and the appropriate covenants for custom credit options. They should also include market volatility scenarios to gauge your risk tolerance and repayment flexibility, helping to ensure the strategy remains sustainable.

An analysis of your existing cash flow, balance sheet and wealth structure determines your capacity for strategic leverage through custom credit solutions. A custom credit advisor works with you and your wealth advisor to evaluate and tailor various borrowing structures.

Despite the many benefits, borrowing may not make sense in every situation. Successful implementation requires attention to risk, tax, and appropriateness to build a bespoke approach.

First, risk management can help you mitigate the impact of interest rate fluctuations that affect your borrowing costs over time. Your advisor can help manage this exposure by balancing fixed rates, floating rates, and derivative instruments. Your advisor can also stress-test various scenarios to make sure your solution is still viable as economic and market conditions change.

In addition, tax implications play a significant role in deciding between strategic borrowing and asset sales. Interest may be deductible, but eligibility depends on how borrowed funds are used rather than the type of loan or borrower. In other words, these “interest tracing” rules mean personal loans can qualify for deductions when the funds serve certain deductible purposes. While this article cannot provide tax advice, your tax advisor can help you compare implications of strategic borrowing and liquidating appreciated assets.

Finally, customization to your needs is fundamental. Rather than one-size-fits-all lending, the most effective solutions are generally bespoke to your financial capacity, objectives, and timeline, helping ensure they enhance your overall wealth strategy rather than creating unintended longer-term challenges.

As the framework and considerations suggest, custom credit decisions are most effective when they integrate all aspects of your wealth strategy. Rather than treating financing as a standalone decision, the best outcomes may emerge from coordinating with your wealth advisor, tax advisor, and estate attorney from the outset.

These key questions can help guide productive discussions with your advisory team:

To explore how custom credit might fit into your wealth management strategy, connect with Wilmington Trust to discuss your specific situation and goals.

Please see important disclosures at the end of the article.

Please complete the form below and one of our advisors will reach out to you.

* Indicates a required field.

*Basis is the value used to determine gain or loss on the sale or transfer of an asset, typically equal to its purchase price plus associated costs.

This article is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service. This article is not designed or intended to provide financial, tax, legal, investment, accounting, or other professional advice since such advice always requires consideration of individual circumstances. If professional advice is needed, the services of a professional advisor should be sought.

There is no assurance that any investment, financial, or estate planning strategy will be successful.

Investing involves risks and you may incur a profit or a loss. Asset allocation/ diversification cannot guarantee a profit or protect against a loss.

Wilmington Trust is not authorized to and does not provide legal or tax advice. Our advice and recommendations provided to you is illustrative only and subject to the opinions and advice of your own attorney, tax advisor or other professional advisor.

Credit is being offered by M&T Bank. Member FDIC. The credit offering requires an investment account at M&T Bank, Wilmington Trust Company, and Wilmington Trust N.A. and sufficient eligible collateral to support a credit facility of the applicable loan amount. M&T Bank, Wilmington Trust Company, and Wilmington Trust, N.A. are affiliated, but are separate entities. Neither M&T Bank, Wilmington Trust Company, nor Wilmington Trust, N.A. is responsible for the products and services of each other.

Borrowing with securities as collateral involves certain risks and is not suitable for everyone. A complete assessment of your individual circumstances is needed when considering a securities-based loan. You should review both the Securities-Based Lending Program Credit, Security and Guaranty Agreement, and the Disclosure, Waiver of Conflict of Interest, Acknowledgment and Release carefully with your legal and tax advisors. Also consider the following:

• Credit secured by marketable securities can increase your level of market risk

• The downside is not limited to the collateral value in your pledged account

• Assets held in your accounts may lose market value or may be afforded less collateral value by the lender at any time, resulting in a collateral call

• The collateral maintenance requirements can be increased at any time, which may result in a collateral call, and the lender is not required to provide you with advance written notice

• You are not entitled to an extension of time on a collateral call

• An increase to the variable interest rate will result in a higher periodic payment required and, if you are unable to make the higher periodic payment, could result in a collateral call; the sale of any securities in your account may be initiated, without contacting you, to meet a collateral call

• Your ability to withdraw assets will be subject to the consent of the lender

• The sale of your pledged securities may cause you to suffer adverse tax consequences; you should discuss the tax implications of pledging securities as collateral with your tax advisor. Neither M&T Bank Corporation, nor any of its subsidiaries, affiliates, or advisors, provide legal, tax or accounting advice; you should consult a legal and/or tax advisor before making any financial decisions.

All securities and accounts are subject to eligibility requirements. Certain restrictions and terms and conditions apply. Tax-deferred assets are not eligible. Financing real estate with a securities-based loan or line of credit carries risk and may not be appropriate for your needs. Securities held in a retirement account cannot be used as collateral to obtain a loan.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today