Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

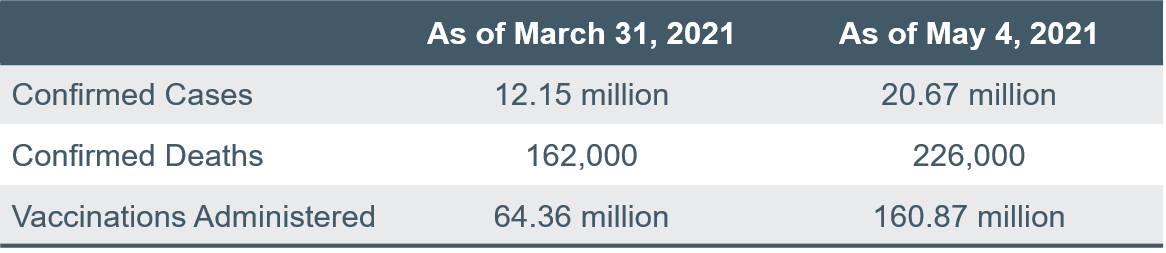

May 10, 2021—We have all seen the horrifying images coming out of India. The recent wave of COVID-19 illnesses, deaths, and lockdowns are having a severe negative impact on the operations of Indian business, including those listed on the Mumbai Stock Exchange. The human toll of the India outbreak has been devastating and heartbreaking. Moreover, the situation may worsen before it stabilizes, especially if vaccinations do not further accelerate. We provide data on the surge in confirmed cases, confirmed deaths, and vaccines administered, and as of May 4, 2021 (Table 1).

Table 1: India COVID-19 2Q 2021 cases, deaths, and vaccines administered

To date through May 4, 2021

Source: Bloomberg

As investment professionals, we need to dimension the financial impact on emerging markets equity returns, particularly given our overweight to equities, including those of emerging markets (EM).

For second quarter 2021, to date through May 4, EM equities (MSCI EM) have returned 1.51%. This compares to 4.79% for U.S. equities (Russell 1000 Index) and 2.63% for international developed equities (MSCI EAFE). While markets have held EM in slight disfavor during 2Q 2021, there has not been a particularly wide performance dispersion among these equity asset classes.

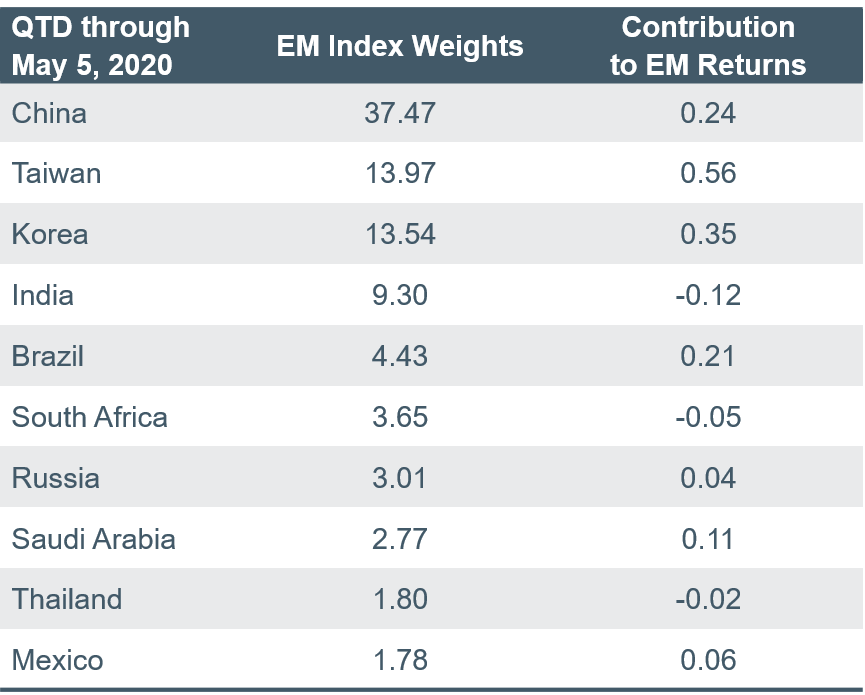

Index weights and return contributions of the 10 largest markets in the EM index are illustrated in Table 2. Indian equities have detracted 12 basis points (bps) from emerging market equities performance. While India has been the largest detractor among the top 10 markets, the negative contribution has not been particularly large. This is because India comprises only 9.3% of the EM index.

One issue for Indian equities is that firms are largely focused on the domestic market, rather than on export markets. So, the impact of the local COVID-19 situation is greater than might be seen in Taiwan or Korea.

India’s 12bps drag on EM equities returns was offset by China’s 24bps positive contribution. Given that China comprises 37% of the EM index, its contribution could have been greater were it not for the negative effects of the authorities’ efforts to impose antitrust regulation on the country’s mega-cap internet platforms: Alibaba, Tencent, and JD.com, among others. We detailed this situation in a recent Wilmington Wire. As 2021 progresses, we believe the existing platforms, and newer competitors, will emerge stronger than before.

We are encouraged by equity analysts’ expectations of sustainable high rates of earnings growth for these firms, as well as the relatively small size of the antitrust fines imposed on the platforms, which the firms have been able to easily pay out of their cash piles.

Table 2: Emerging markets weights and contributions for second quarter through May 5, 2021

Source: Bloomberg

Core narrative

While India’s COVID-19 situation is horrifying, the impact EM equity returns has so far not been particularly large. We do not believe the situation merits reducing our tactical overweight to EM equities, which is part of our overall equity weight to equities. Of course, we are continuing to closely monitor the situation for a potential worsening impact on global equities. Of some concern is the possibility that new vaccine-resistant variants might emerge from India. However, the UK, South African, and other variants seen thus far have not been able to elude the immunity arising from vaccination.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

MSCI EAFE® (net) Index measures the performance of approximately 20 developed equity markets, excluding those of the United States and Canada. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to non-resident investors.

MSCI Emerging Markets (net) Index measures the performance of approximately 25 developing equity markets. The total returns of the index are net of the maximum tax withholding rates that apply in many countries to dividends paid to non-resident investors.

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. As of its latest reconstitution, the index had a total market capitalization range of approximately $1.3 billion to $309 billion.

Third party trademarks and brands are the property of their respective owners. Any reference to company names mentioned in the podcast should not be constructed as investment advice or investment recommendations of those companies.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today