Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

The conflict in the Middle East is the latest impetus behind a surge in global arms demand that is bolstering sales for America’s leading defense contractors. Geopolitical tensions, particularly Russia’s invasion of Ukraine, is driving the strongest defense market in over a decade. This trend is part of a broader response by the U.S. and its allies to growing strategic challenges from China and Russia. In 2022, global defense spending increased for the eighth consecutive year to reach a record $2.2 trillion, with America comprising 39% of this total, or $877 billion. While the number may seem high, it represents just 3% of U.S. GDP.[1] The administration has shown no desire to reduce support for the military, and this sentiment is spreading globally, setting up another potential tailwind for U.S. defense contractors.

At the same time, advancements in compute, storage capacity, and global connectivity have ushered in a “digital age” in which data are fundamental inputs and sources of value for companies and the broader economy, sparking disruption across all industries—defense and intelligence included. The digital transformation has motivated the U.S. military to adopt smarter technologies and equipment to remain competitive, including advanced missiles, space defense, and modern jets, further supporting the defense industry. Similar to the wave of research and development(R&D) we saw during the Cold War, the Department of Defense (DoD) has acknowledged the need to collaborate with the private sector as nontraditional defense companies gain traction with emerging technologies and innovations.

While taking an unbiased view on the current debate in Congress over the defense budget, the investment team believes that these secular growth trends will continue to drive new opportunities for investors. We expect U.S. defense contractors, and their tech partners—including developers of artificial intelligence (AI), internet of things(IoT), robotics, and other digital technologies—to be key beneficiaries as the Pentagon embarks on a path of modernization to maintain America’s military advantage.

Resilient demand amid rising geopolitical risks

An increasingly unstable geopolitical backdrop likely means more funds for national defense and its suppliers. As the conflict in Ukraine persists, both the U.S. and European Union (EU) are contemplating how best to increase their industrial capacity, replenish weapons stockpiles, and prepare for future conflicts. China, which has significantly increased its military spending over the past five years, from aircraft to hypersonic missiles, has provided further incentive for the U.S. and EU to build up their defenses. In June, the Administration’s Fiscal Responsibility Act of 2023 adopted a proposed defense budget of $886 billion for fiscal year 2024, a 3.2% increase from 2023. The administration has also requested $105 billion for Ukraine and Israel in a separate aid package.[2]

Although funding for the military has long had bipartisan support, an increasingly divided Congress and fiscal austerity rhetoric in Washington could impact future spending levels. The DoD, for instance, faces an automatic 1% budget cut off FY23 levels should Congress fail to pass all 12 spending bills by the end of the calendar year.[3] Defense provisions have been a key source of debate, but House and Senate leaders have vowed to reach a consensus on a defense bill before January.[4] The upcoming presidential election has also raised uncertainty around whether the next administration will be as committed to funding military aid for Ukraine, Israel, and other foreign conflicts.

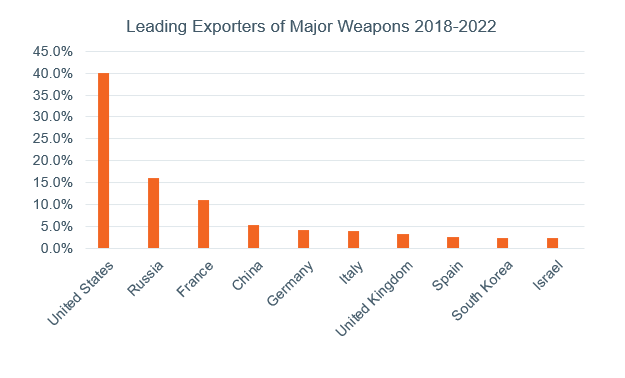

The U.S. is home to the largest defense contractors in the world, including Lockheed Martin, Boeing, General Dynamics, and RTX Corp.,[5] and dominates the global weapons trade, accounting for 40% of total exports from 2018–2022 (Figure 1). Amid heightened global hostilities, these companies are best positioned to profit from growing backlogs and orders for American weapons. In the EU, Poland, Finland, and Germany have pledged to spend at least 2% of GDP on defense—a NATO target they have failed to meet for many years—in support of Ukraine.[6] There is an acute need for basic weapons and shells, which is benefiting U.S. manufactures, as well as BAE Systems, the giant British military contractor.[7]

Figure 1

Leading exporters of global arms

U.S. market share versus national competitors (average exports as % global total)

Source: Stockholm International Peace Research Institute, as of 2022.

Countries in Southeast Asia have also generated billions of dollars in new orders for the U.S., primarily in response to China’s expanding military power, with $19 billion alone earmarked for Taiwan.[8] Lockheed, an American defense contractor with over $60 billion in annual revenue, has received $950 million in missile orders from the Pentagon in 2022, in part to restock supplies used in Ukraine.[9] Internationally, the company is considered a critical partner in the procurement of advanced aviation and defense solutions, and has secured $50 billion in contacts to build F-35 fighter jets for U.S. allies in Asia and Europe.[10]

The digital age of defense

Over the past decade, the Pentagon has been focused on a strategy of digital transformation, investing in high priority systems like AI, small satellites, hypersonics, 5G networks, and unmanned drones to enhance its capabilities. Smart weapons, for instance, which use computers, AI, and automation to apply force more precisely and effectively, are now being used in combat.[11] The DoD’s commitment to modernization can be seen in its proposed 2024 defense budget, which seeks $145 billion for R&D, with $17.8 billion earmarked for science and technology initiatives and $1.8 billion for AI. [12] The Defense Innovation Unit, a Pentagon-funded entity tasked with identifying commercial technologies with military potential, estimates that predictive analytics, a technology that uses AI to forecast possible maintenance issues, could save the Air Force $15 billion a year. [13]

As the world becomes more interconnected and complex, conventional weapons and tactics are also being replaced by cyber warfare—targeting enemy information systems with the intent to cause damage or disruption, as well as electronic warfare—taking control of a country’s electromagnetic spectrum to disable communication, radar, and other electronic systems. This has bolstered demand for AI and machine learning, which can identify and respond to attacks faster, often in real time. The U.S. Army, for instance, has developed a new AI-enabled tool called the Advanced Dynamic Spectrum Reconnaissance (ADSR), which uses wireless communications networks to avoid enemy jamming (the interference of radar signals). [14]

The U.S. defense industry is fairly concentrated, with a select group of companies providing the majority of the technologically advanced equipment used by the military today. As the conflict endures in Ukraine, companies like Lockheed and BAE Systems are under increasing pressure to produce weapons and ammunitions faster and more cost efficiently for the Pentagon, while also maintaining their superiority in defense and intelligence innovation. AeroVironment, for example, a growing direct competitor to more established U.S. players, has seen 40% y/y revenue growth as demand rises for its AI-powered robotic devices, as well as unmanned aircraft and ground vehicles. [15] To reinforce its market share, Lockheed has made significant investments in AI, robotics, cyber, and satellite capabilities, among others, to hasten the development of modern air and missile defense systems, including rocket fuel missiles and supersonic reconnaissance drones. [16] The U.S. Army, for example, is paying Lockheed $72.8 million to design the first integrated cyber, electronic warfare, and intelligence-gathering platform. [17]

A new growth driver for the tech sector

The private sector has become a core component of the broader U.S. defense strategy. While the DoD played a prominent role in funding major technological advancements during the Cold War—such as the computer, internet, and semiconductors—over time, the private sector has evolved to become the biggest driver of R&D and innovation. Going forward, leveraging the expertise of nontraditional defense companies with new ideas and technologies will be critical to modernizing the military and ensuring national security, in particular helping to protect the massive amount of classified data now generated by the government.

In recent years, America’s tech giants have secured thousands of contracts to provide the digital tools needed to create next-gen defense and intelligence systems, including AI, the cloud, IoT software, and real-time data analytics. Microsoft, for instance, won a $22 billion agreement to supply the U.S. Army with augmented reality goggles, [18] while Amazon, Alphabet, Microsoft, and Oracle are currently sharing a $9 billion cloud-computing agreement with the Pentagon. [19] Lockheed, meanwhile, is utilizing Microsoft’s cloud-based AI, modeling, and simulation program to assess potential defense technologies virtually and create cyber solutions for the military. [20] These are just a few examples of how big-tech and AI is disrupting yet another sector.

The defense sector’s focus on software development also creates opportunities for providers of sensors, advanced components, AI chips, and other processing and networking solutions. In 2023, Nvidia launched DGX Quantum, an AI supercomputer that Lockheed is using to develop and train models for predictive maintenance. [21] Intel, a U.S. semiconductor manufacturer, is expected to receive billions of dollars from the CHIPS Act to produce chips exclusively for the Pentagon. The government has also been building out its 5G network capabilities to accelerate its digital transformation via stronger and faster connectivity. Arista Networks, which produces cloud networking solutions for “hyperscale” data centers, was granted a $100 million contract to upgrade the military’s networking equipment. [22] Qualcomm Technologies, a wireless tech company, is also working with the U.S. Navy to assess the potential benefits of 5G, AI, and cloud computing. [23]

Core narrative

At Wilmington Trust, the investment team believes that emerging secular growth trends will continue to provide new opportunities for investors across the industrials sector, aerospace and defense included. Rising geopolitical tensions, combined with the Pentagon’s long-term modernization strategy, is expected to boost demand for innovative defense and intelligence solutions. As disruptive forces reshape the industry, defense contractors will need to collaborate with partners across the tech ecosystem, including developers of AI and other software, to improve autonomous weapons, intelligence gathering, surveillance systems, and robotic vehicles. As the global race to modernize gains momentum, an increasing number of U.S. tech companies have set their sights on the defense sector, seeking to leverage their leadership in R&D and AI to win long-term contracts and help meet future military needs. We currently have exposure to the defense theme across our equity strategies, with an emphasis on the emerging defense players in our growth-tilted portfolios.

[1] “https://www.sipri.org/media/press-release/2023/world-military-expenditure-reaches-new-record-high-european-spending-surges.” Stockholm International Peace Research Institute, April 2023.

[2] “https://www.sipri.org/media/press-release/2023/world-military-expenditure-reaches-new-record-high-european-spending-surges.” Stockholm International Peace Research Institute, April 2023.

[3] “How to Enforce a Debt Deal: Through ‘Meat-Ax’ Cuts Nobody Wants - The New York Times (nytimes.com),” NY Times, June 2023.

[4] “With rare pledge of compromise, House and Senate leaders promise to pass bipartisan defense policy bill (msn.com),” Washington Examiner, December 2023.

[5] “https://www.visualcapitalist.com/the-top-25-defense-companies-by-revenue/,” Visual Capitalist, October 2023.

[6] “Seven European nations have increased defense budgets in one month. Who will be next? - Breaking Defense,” Breaking Defense, March 2022.

[7] “https://www.nytimes.com/2023/11/18/world/europe/europe-military-aid-ukraine.html, “ NY Times, November 2023.

[8] “https://www.msn.com/en-us/news/world/taiwans-long-wait-for-nearly-dollar20-billion-in-american-weapons/ar-AA1jEqeq,” MSN, November 2023.

[9] “Military Spending Surges, Creating New Boom for Arms Makers - The New York Times (nytimes.com), NY Times, December 2022.

[10] https://about.bgov.com/news/lockheeds-f-35-mega-deal-largely-cushioned-from-budget-impasse/, Bloomberg Government, August 2022.

[11] “U.S. Statement on LAWS: Potential Military Applications of Advanced Technology - U.S. Mission to International Organizations in Geneva (usmission.gov),” U.S. MISSION GENEVA, March 2019.

[12] “Department of Defense Releases the President's Fiscal Year 2024 Defense Budget > U.S. Department of Defense > Release, U.S. Department of Defense, March 2023.

[13] “Could artificial intelligence save the Pentagon $15 billion a year? (c4isrnet.com),” C4ISRNET, 2019.

[14] “US Army Deploys Advanced AI-Enabled Electronic Warfare Tool - Defence Street,” Defense Street, November 2023.

[15] “AeroVironment Deals With NASA, JPL; AI-Powered Robotics Ignite AVAV stock (investors.com),” Investor’s Business Day, October 2023.

[16] “https://www.lockheedmartin.com/en-us/news/features/2022/accelerating-artificial-intelligence-ai-at-scale.html,” Lockheed Martin Corporate Site, May 2022.

[17] “Army issues first award to integrate cyber, EW and intelligence system on armored platform |,” Defense Scoop, April 2023.

[18]“ https://www.forbes.com/sites/ginaheeb/2021/03/31/microsoft-wins-22-billion-army-contract-for-augmented-reality-headsets/?sh=236158ce65d4,” Forbes. March 2021

[19] “Pentagon splits $9 billion cloud contract among Google, Amazon, Oracle and Microsoft | Reuters”, Reuters, December 2022.

[20] “Lockheed Martin, Microsoft announce landmark agreement on classified cloud, advanced technologies for Department of Defense - Stories,” Microsoft Website, November 2022.

[21] “https://www.investors.com/news/technology/arista-pentagon-contract-cloud-computing-cisco-protest/#:~:text=Arista%20Networks%20%28ANET%29%20has%20won%20a%20large%20Pentagon,of%20archrival%20Cisco%20Systems%20%28CSCO%29%2C%20says%20an%20analyst,” NVIDIA Success Story | Lockheed Martin,” Nvidia Corporate Site, 2021.

[22]“ Arista Grabs Pentagon Contract As Cisco Protests | Investor's Business Daily (investors.com),” Investor’s Business Daily, October 2018.

[23]“ https://www.c4isrnet.com/industry/2023/02/13/us-navy-teams-with-qualcomm-to-research-5g-artificial-intelligence/,c4isrnet,” C4ISRNET, February 2023.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

The gold industry can be significantly affected by international monetary and political developments as well as supply and demand for gold and operational costs associated with mining.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today