Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Germany’s commercial real estate (CRE) sector has faced severe stress due to rising interest rates, inflation in construction costs, and a sluggish post-COVID economy. Those pressures sharply reduced investment volumes. By 2023, Germany’s CRE investment market fell to €21.5bn, a 60% decline compared to 2022 and the lowest point since 2010.1

While we have seen only minor financing activity through the end of Q3 2024, mainly via short-term bridge loans, could 2024 mark the beginning of stabilisation and recovery? In June 2024, the European Central Bank cut rates, with additional reductions in September and October. Recent reporting showed that economists expect continued ECB rate cuts through March 2025.2

The current picture

Rising interest rates and inflation in development costs have created a notable mismatch in the German real estate market.

This CRE market stress has deterred investors, fuelling a cycle of inactivity that further strains developers and financers/investors.

A mixed picture of recovery signals

The ripple effects of interest rate hikes took several quarters to affect Germany’s CRE market. Similarly, we expect the impact of interest rate cuts on German CRE to materialise gradually over the coming quarters. We hear concerns that span the CRE sector, from developers to sellers and buyers to financers, lenders, and investors.

In summary, developers are still struggling with rising costs and uncertain returns, while buyers and sellers remain at a standstill over valuations. Interest rates have reversed, but other factors remain, including real estate demand, property valuations, and large-scale socio-economic factors.

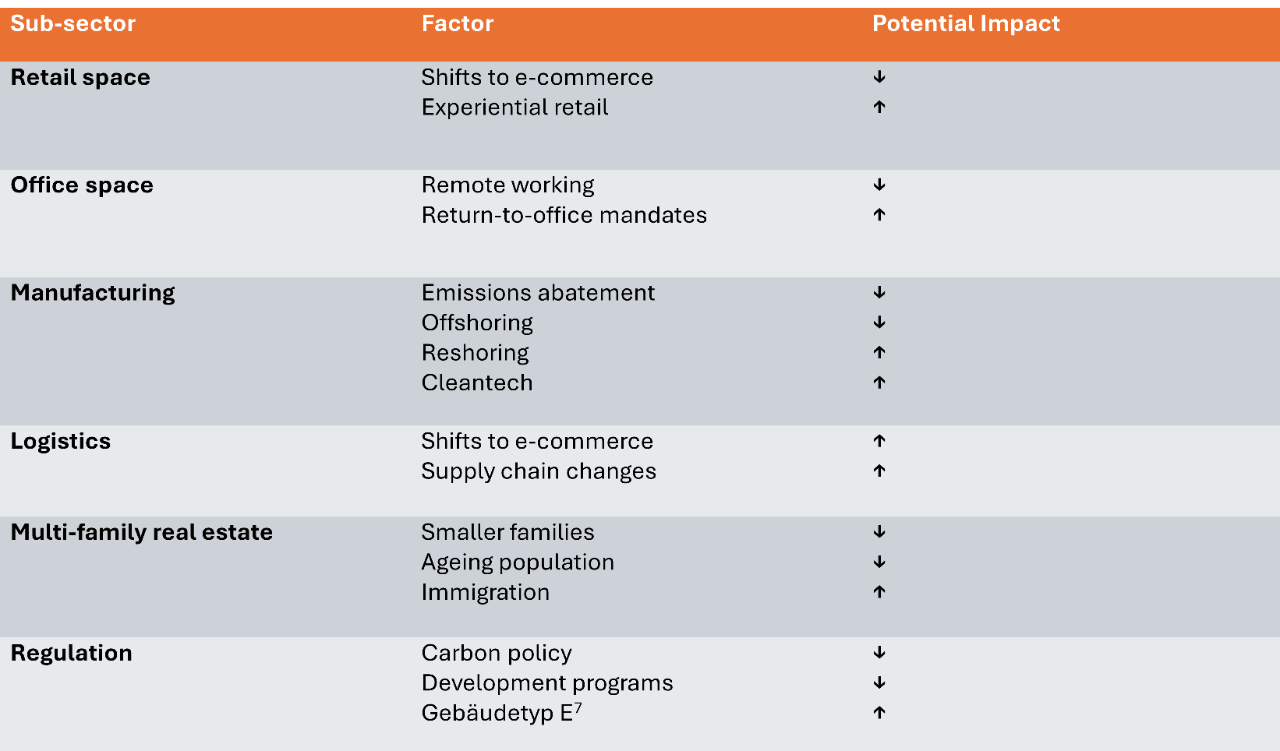

These factors create a mixed picture but also suggest potential “hotspots” in some German real estate sectors. Some urban regions in Germany are also quite active, notably Berlin, Munich, Frankfurt, Hamburg, and Düsseldorf and their surrounding metro areas.

Stabilising effects under the surface

Lender willingness to “amend and extend” loans has played a large part in maintaining CRE debt stability even while distress has emerged and transactions have slowed.

From Wilmington Trust’s perspective as a trustee services provider, we have seen notable efforts by lenders to prevent defaults by extending financing under strained conditions.

Despite efforts to stabilise the market, sometimes conflicting interests can arise among senior and junior lenders, who are bound by different priorities. Such conflicts risk leading to delays when acting quickly is necessary, particularly in large-scale developments. It is crucial to resolve them quickly to lower the potential for defaults.

Adherence and neutrality are key

Loan servicers—such as agents and trustees—must possess three core strengths to help advocate for fair outcomes for all parties:

These strengths rely on a deep understanding of underlying documentation and experienced oversight.

Documentation agreed upon at the outset of financing must serve as the foundation for enforcement, leaving no room for favour. This clarity safeguards stakeholders and prevents delays that could deepen financial instability.

Strong oversight can also mitigate tensions between various lenders and investors. Impartiality ensures a neutral approach, preserving trust and enabling timely decisions.

Adopting these best practices is crucial for developers and lenders to stabilise distressed markets and pave the way for CRE recovery in Germany. By focusing on diligence and fidelity to established loan documentation, stakeholders can address current market challenges professionally and fairly. This strategy not only stabilises individual projects but also restores broader market confidence—a vital step towards breaking Germany’s cycle of CRE inactivity.

For the experience you need to support transactions in the bank loan and securitization markets, contact a Wilmington Trust Loan Market Specialist today.

[2] https://www.nytimes.com/2024/12/12/business/european-central-bank-interest-rates.html

[4] https://www.elibrary.imf.org/view/journals/018/2024/035/article-A001-en.xml

[5] https://www.jll.de/en/trends-and-insights/research/investment-market-overview

[7] Property Type E, also known as Gebäudetyp E, is a new classification for residential buildings that aims to simplify construction by focusing on structural integrity and relaxing comfort standards that tend to increase costs.

Wilmington Trust’s domestic and international affiliates provide trust and agency services associated with restructurings and supporting companies through distressed situations.

Not all services are available through every domestic and international affiliate or in all jurisdictions. Services are available only to corporate and institutional clients, (i.e. Eligible Counterparties or Professional Clients as defined by applicable regulations) and not to Retail clients).

This article is intended to provide general information only and is not intended to provide specific investment, legal, tax, or accounting advice for any individual. Before acting on any information included in this article you should consult with your professional adviser or attorney. Facts and views presented in this report have not been reviewed by, and may not reflect information known to, or the opinions of professionals in other business areas of Wilmington Trust or M&T Bank. M&T Bank and Wilmington Trust have established information barriers between their various business groups.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today