Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

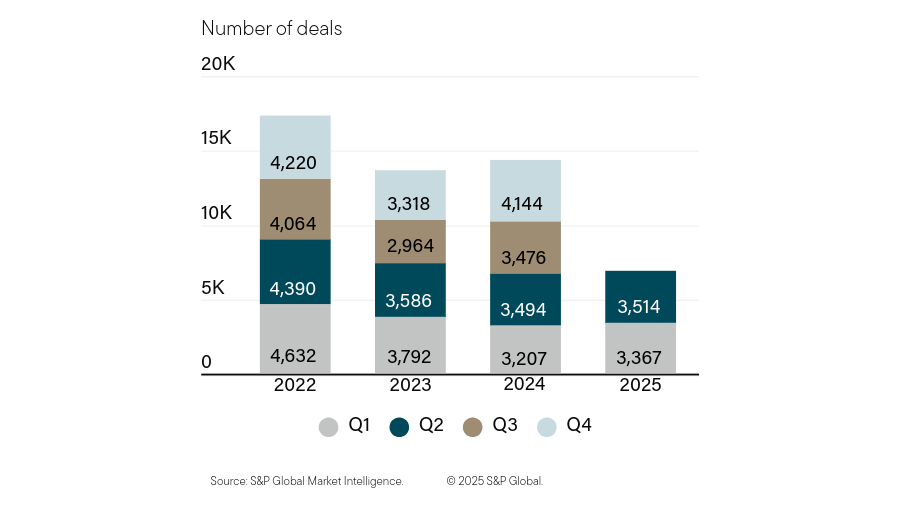

Mid-market Mergers & Acquisitions (M&A) deal activity in continental Europe and the U.K. has stabilised and found slight quarter-over-quarter growth in 2025 (see below chart). While monetary tightening, rising interest rates, geopolitical uncertainties, and inflation concerns began shrinking dealmaking in 2022, signs of recovery appeared in the second half of 2024. Our conversations with clients suggest continued optimism for 2025 and the remainder of the decade, although risks from trade dynamics, climate, and global instability temper their sentiment.

Several factors lie behind this emerging trend:

This European M&A renaissance creates both opportunities and operational challenges. Higher deal volumes mean compressed due diligence timelines and increased pressure to execute flawlessly.

Fast, compliant execution is essential to avoid risks that can delay M&A deals and derail value. Escrow and paying agent services play a critical role in helping to secure funds, managing release conditions, and helping to ensure payments flow smoothly—particularly in cross-border transactions where currency flows, Know Your Customer (KYC), and documentation add complexity.

Yet many deals still face predictable challenges that can strain relationships, affect timing, and compromise transaction success:

Providers with pre-approved templates, streamlined onboarding, and operational flexibility help counterparties manage these late-stage hurdles and preserve deal momentum.

Addressing these operational hurdles requires providers who combine flexible execution with standardised tools and templates. This operational experience sets the stage for escrow and paying agent best practices that bring consistency, speed, and assurance to complex transactions.

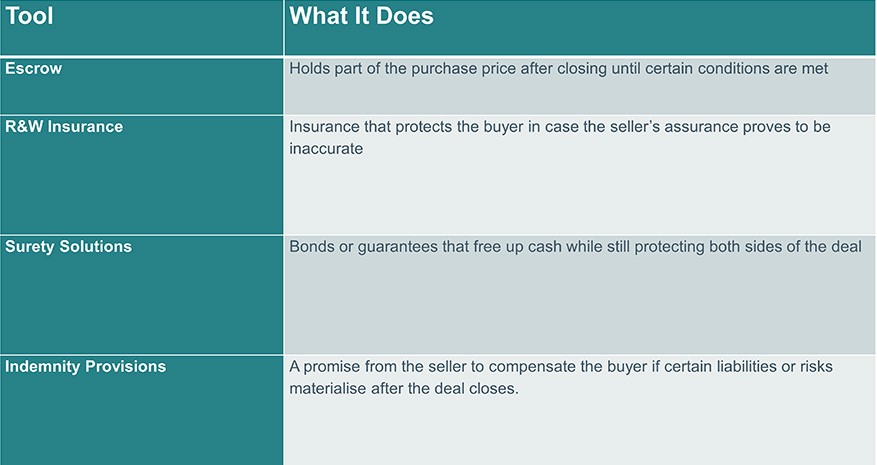

In M&A transactions, escrow arrangements can hold a portion of the purchase price after closing to cover potential claims under the purchase agreement. They help post-closing risk by including clear, contractually defined terms for both parties. Potential conditions can consist of purchase price adjustments, performance milestones, indemnity claims, or the survival of warranties. The use of escrow tends to be more common in the U.S. or in European deals with U.S. buyers.

The duration of these escrows typically synchronises with the survival period of key representations and warranties, which tend to fall between twelve and eighteen months. The size of the escrow is usually negotiated based on the risk profile of the deal and whether other protections, such as representations and warranties (R&W) insurance, are in place.

Among these, escrow arrangements remain a core tool for securing transactions. Insurers may not underwrite fast-moving deals, higher-risk industries, distressed sales, or transactions late in a fiscal year. In addition, many transactions use both R&W insurance and escrow accounts to cover policy exclusions or retention amounts. This combination allows buyers to transfer most of the risk to the insurer while maintaining a limited pool of funds for fast, straightforward resolution of claims.

In summary, when certainty of execution, ready access to cash, and mutual trust are essential, escrow delivers a straightforward and dependable solution. It provides tangible control by setting aside funds under clear payment instructions, ensuring that claims can be addressed promptly within the escrow framework rather than through broader litigation.

Paying agents aim to keep funds flowing smoothly after a transaction closes. In Europe, law firms have often supported this role, but deal sizes, the increasing number of sellers, growing liability, compliance pressure, and professional conduct restrictions make them increasingly unwilling or unable to hold client funds directly.

Paying agent activities typically begin before the closing and continue through post-closing obligations. Paying agents act as neutral facilitators that will follow payment instructions precisely, adding a layer of confidence and professionalism to the deal. They disburse payments in line with transaction agreements, including the purchase price, deferred or milestone-based considerations, earn-outs, and post-closing adjustments such as working capital settlements or indemnity payouts. Increasingly, transaction and servicing costs flow through the paying agent as well.

Paying agents also helps keep payment flows smooth across currencies and jurisdictions. Their ability to execute efficiently in cross-border or multi-party transactions, supported by efficient FX conversion and settlement, helps ensure that funds reach the right counterparties without added friction.

European M&A is entering a new phase where operational trust and execution efficiency are competitive differentiators in deal success. Selecting strong and nimble providers can help you reduce transaction friction during high-stakes deal activity. As transaction volumes grow and complexity increases through 2030, the choice of escrow and paying agent providers should receive the same strategic consideration as legal counsel and tax advisors.

With experience across complex M&A transactions, our team at Wilmington Trust can help simplify escrow and payment execution when timing and trust matter most.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today