Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

In our 2025 Capital Markets Forecast we highlighted deregulation as a strategic “ladder” for driving capital markets activity and broader economic growth. Deregulation can be beneficial for growth given that its implementation is quick, in essence cost-free, and can act as a ‘rising tide’ benefiting industries broadly rather than picking winners and losers.

While deregulation supports economic activity, its impact can vary significantly across sectors. The energy sector, for example, was the worst-performing S&P 500 group during President Trump’s first term, despite major deregulatory efforts. In contrast, banks are positioned to benefit directly from a lighter regulatory environment. The focus of this note is on the capacity for reduced capital requirements and fewer compliance constraints to enhance banks’ ability to lend, generate returns, and support broader financial market activity. We are overweight banks in client portfolios, as we see this backdrop continuing to support returns for the industry.

Cutting the red tape

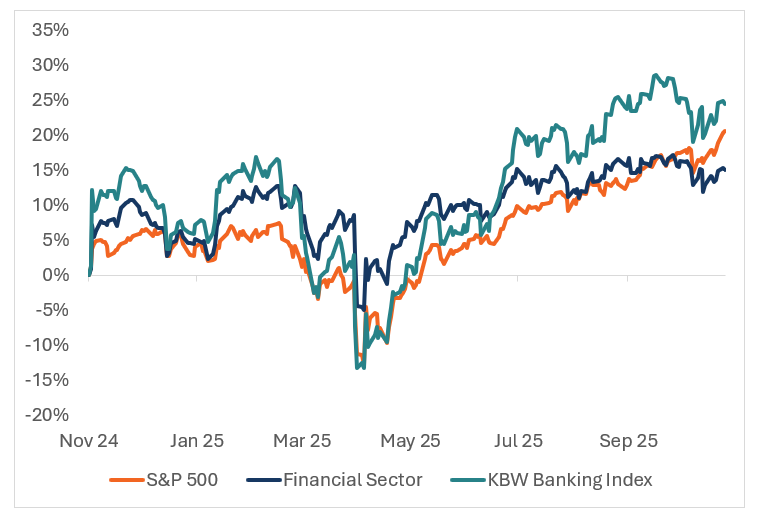

Overall, banks have seen solid price appreciation since Election Day (Figure 1) as investors have digested financial strength, particularly for those banks generating trading revenue, and anticipated less stringent capital requirements could free up capital for lending.

Figure 1: Banks have outperformed the broader market since Election Day

Data as of October 27, 2025. Sources: Bloomberg, WTIA.

Past performance cannot guarantee future results. Indices are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

This favorable setup for banks is now being reinforced by targeted regulatory reforms. One of the main topics of discussion among administration officials, regulators, and C-suite executives across banking is the Supplementary Leverage Ratio (or SLR), which is currently in its proposal stage[1], but is expected to be the first in a series of capital standard changes targeting the banking industry.

The SLR was introduced under the Basel III framework in response to the global financial crisis. At a high level, the objective of the SLR is to serve as a backstop to limit excessive balance sheet expansion by requiring large banks (those above $250 billion in assets) to hold a minimum amount of capital relative to their on- and off-balance sheet leverage exposure.[2]

Stricter regulations apply to the U.S.’s largest and most interconnected financial institutions – known as GSIBs (or Global Systemically Important Banks[3]). These institutions are required to adhere to the enhanced SLR (or eSLR), which imposes an additional leverage buffer of 2% on top of the 3% already required for large financial institutions. Capital requirements are even more rigorous for GSIB subsidiaries, which must maintain an SLR of at least 6% to be “well capitalized” under current regulatory standards.[4] The current proposal aims to recalibrate the eSLR standard for GSIBs by replacing the existing 2% blanket buffer with a more tailored approach based on each bank’s systemic risk score. For most GSIBs, this would reduce the total SLR requirement to a range of approximately 3.5–4.25%.

Proponents of SLR reform include current Federal Reserve Chair Jay Powell, board member Michelle Bowman (a Trump appointee), and Secretary of the Treasury Scott Bessent who argue that the regulatory environment for banks is unduly onerous.[5] Others, such as J.P. Morgan CEO Jamie Dimon have described the system as overly complex, inefficient, and costly. Many in the industry contend that a restrictive SLR discourages banks from acting as market makers, as it penalizes the balance sheet usage required to hold inventory[6] and facilitate trades, thereby reducing market liquidity. They also note that leverage-based capital requirements undermine the efficiency of risk-based capital rules, as banks are forced to avoid low-risk activities like holding treasuries and engaging in repurchase agreements.

Opponents of regulatory change, however, emphasize that the SLR is intentionally risk-intensive and serves as a critical backstop to the global banking system. They point to the failure of Silicon Valley Bank in 2023 as a stark reminder of the dangers of balance sheet mismanagement and the importance of maintaining robust capital safeguards.

If implemented, the proposal would only free up an estimated $13 billion[7] for U.S. GSIBs (roughly 1.4% reduction in Tier 1 capital), which could be used to lend, engage in low-risk activity, or return capital to shareholders. At the bank subsidiary level, however, Tier 1 capital requirements would decline by about 27% (or over $200 billion). Due to consolidated capital requirements at the holding level, the $200 billion cannot be removed from the system all-together but it can be shifted from the bank subsidiary to the parent company, giving GSIBs greater flexibility to allocate capital across their organization.

More importantly, the potential approval of updated SLR standards could signal the beginning of a broader wave of regulatory changes across the banking sector. These may include reforms to supervision and stress testing, as well as recalibrations for Basel III Endgame and capital requirements under the Dodd-Frank Act—another post-crisis regulation Treasury Secretary Scott Bessent has been openly critical of, arguing it created “too small to succeed[8]” and harmed community banks.

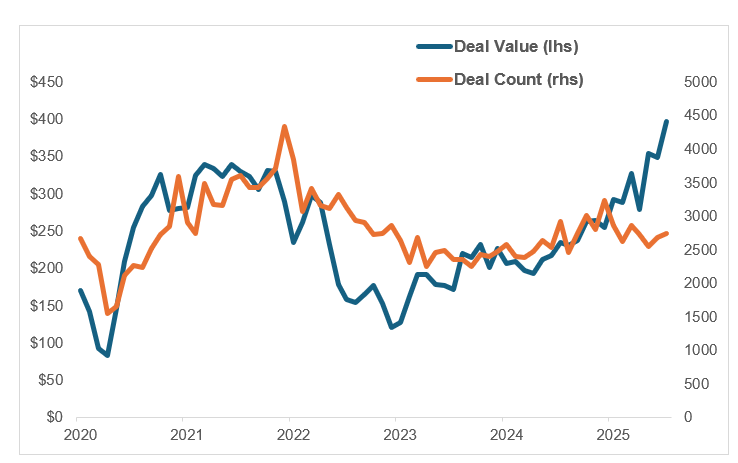

Early signs of deregulation, improved clarity around the effective tariff rate, and a backlog of strategic deal demand have reignited investor confidence in capital markets. This renewed momentum in addition to the expectation for continued rate cuts from the Federal Reserve (the Fed) is reflected in the recent uptick in mergers and acquisitions (M&A) and IPO activity, signaling a robust deal-making appetite that could serve as a tailwind for banks in the coming quarters (Figure 2). In early October, Fifth Third Bancorp announced a $10.9 billion all-stock acquisition of Comerica, the largest U.S. bank deal of the year. Other sectors, including technology and industrials, have also seen heightened M&A activity with several blockbuster deals in recent months.

Figure 2: Deal value (in $B) soars driven by mega deals while deal count remains low

Data as of October 15, 2025. Sources: Bloomberg and WTIA. Deal count includes all proposed M&A deals.

Core narrative:

The stock market has steadily moved higher throughout the summer and into the fall—buoyed by a resurgence of tech, improved sentiment around trade policy, and expectations of a more accommodative interest rate environment. We expect that lighter and more business-friendly regulation will serve as a beneficial “ladder” for capital markets, corporate strategy, and economic growth. The recalibration of the SLR may be incremental on its own, but we believe it signals a broader deregulatory trend that could reshape operating environments for banks and free up significant capital for lending, investment, and other capital markets activities. Given continued strength of the financial sector, paired with the shifting regulatory backdrop and our expectation for a steeper yield curve, we favor financials in client portfolios – focusing on banks over insurance companies due more promising earnings potential. We anticipate that the deregulatory pipeline could act as a catalyst for other sectors, such as energy and technology, providing additional tailwinds heading into 2026.

[1] As of October 15, 2025.

[2] In the current calculation, “leverage” accounts for both on-balance sheet assets and off-balance sheet exposures. The SLR takes a risk-agnostic approach, meaning traditionally safe-haven assets like Treasuries and deposits at the Federal Reserve are treated the same as riskier assets such as corporate bonds.

[3] U.S. GSIBs include JP Morgan, Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, and Wells Fargo, BNY Mellon, and State Street. Data as of November 2024, a new GSIB list will be created in November 2025. Source: Financial Stability Board.

[4] Department of the Treasury: Proposed rule modifications to the Enhanced Supplementary Leverage Ratio for U.S. Globally Systemically Important Bank holding companies and their subsidiary depository institutions. July 10, 2025.

[5] Michelle W. Bowman, “Thoughts on the Economy and Community Bank Capital” (speech, Kansas Bankers Association 2025 CEO & Senior Management Summit, Colorado Springs, CO, August 2025).

[6] Inventory can include government securities (such as Treasuries), corporate bonds, derivatives, foreign exchange instruments, equities, etc.

[7] Source: Federal Reserve Board Meeting Minutes (June 17, 2025), BCA Research.

[8] Source: Remarks by Secretary of the Treasury Scott Bessent before the Fed Community Bank Conference. October 9, 2025.

Descriptions

The KBW Banking Index (often referred to by its ticker symbol BKX) is a benchmark stock market index that tracks the performance of 24 leading publicly traded U.S. banking stocks.

The S&P 500 index is a stock market index that tracks the performance of the 500 largest U.S. companies listed on stock exchanges.

The S&P 500 Financial Sector is one of the eleven sectors that make up the S&P 500 Index, as classified by the Global Industry Classification Standard (GICS). This sector includes all companies involved in finance, investing, and the movement or storage of money.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investment and are subject to change at any time. Reference to the company names mentioned in this material are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Investments that focus on alternative assets are subject to increased risk and loss of principal and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today