Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

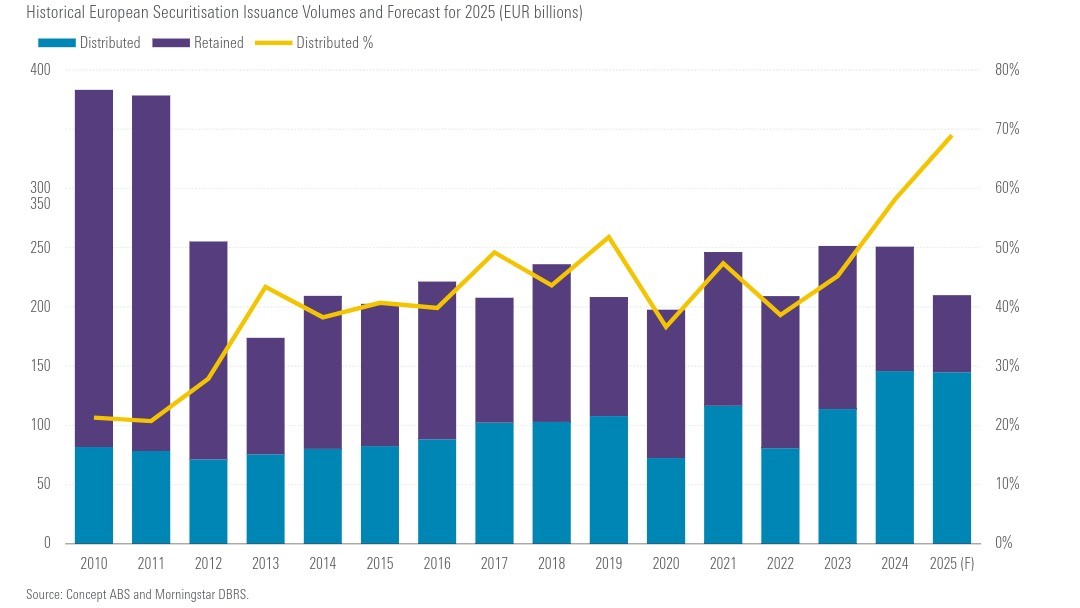

Europe's securitisation market continues to build momentum. In 2024, total issuance reached €250.9 billion (see below chart from Morningstar DBRS, "Historical European Securitisation Issuance Volumes and Forecast for 2025") , the highest annual figure since the global financial crisis. Investor-placed deals alone accounted for nearly €146 billion, demonstrating renewed confidence in structured finance across the continent.

Yet every successful transaction depends on robust legal structures, comprehensive regulatory compliance, and precise operational execution. Two entities play central administrative roles in this process: the Special Purpose Vehicle (SPV), which holds the securitised assets and issues securities to investors, and the Corporate Service Provider (CSP) that establishes and manages the SPV throughout the transaction's lifecycle.

What exactly is a Corporate Service Provider? A CSP is a specialised firm that provides the operational infrastructure and governance framework necessary for SPVs to function effectively. CSPs offer everything from legal entity formation to ongoing administration, compliance management, and director services. |

In addition to providing administrative excellence, CSPs also provide an operational foundation for the SPV to operate independently, maintain compliance across multiple jurisdictions, and fulfil its obligations throughout the entire deal lifecycle.

Like the foundation of a building, people typically do not focus on it once construction is complete. However, it is critical to making sure a securitization transaction is built to last. Without this foundation, even well-structured transactions can face serious challenges, especially for transactions that have a lifecycle of several years or more.

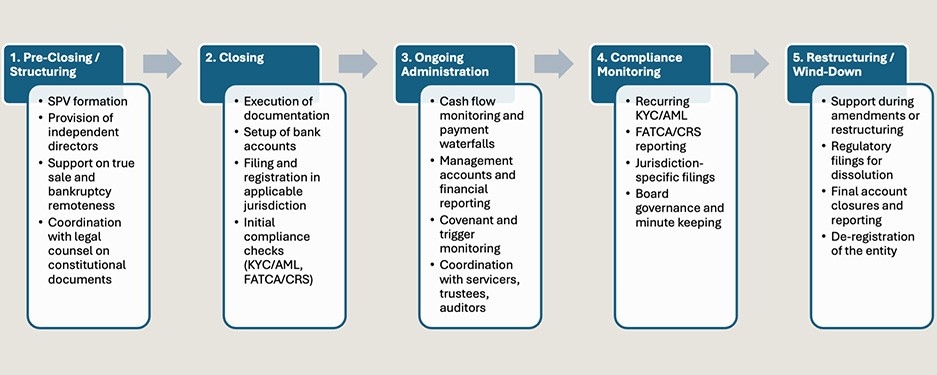

From day one, CSPs should bring experience honed over decades of structured finance evolution. They advise on documentation requirements and provide qualified directors who understand both the legal obligations and fiduciary responsibilities of SPV governance. Importantly, they support achieving ‘true sale’ treatment and establish "bankruptcy remoteness," the legal isolation that separates the SPV from the originator's balance sheet.

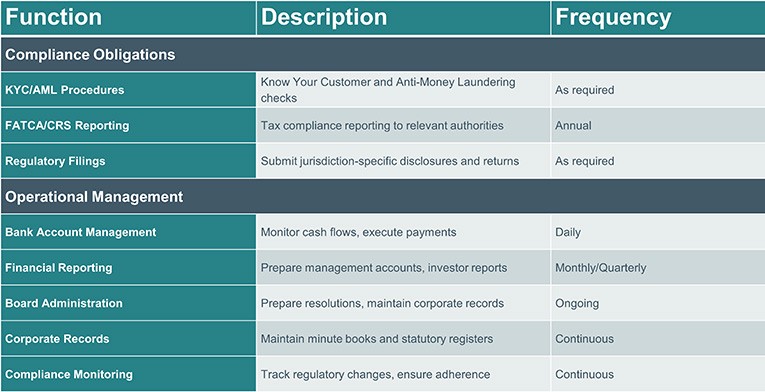

Once the SPV is established, CSPs carry out the core tasks for an SPV behind a securitisation by handling the full spectrum of compliance and operational requirements throughout the transaction lifecycle, while maintaining the SPV's independence and integrity.

A common misconception treats CSPs as interchangeable service providers that are relevant only at transaction launch. This view overlooks a crucial reality: most securitisations span years, sometimes decades. CSPs must provide continuity and experience through credit cycles, personnel changes, and evolving regulatory landscapes.

Consider the practical implications:

In this environment, the CSP's value lies not only in current capabilities but in institutional resilience, which separates long-term service providers with strategic capabilities from simple service providers.

Current market dynamics position securitisation for continued growth. The recent package of reforms published by the European Commission on 17 June 2025, include streamlined investor obligations, relaxed Simple, Transparent, and Standardised (STS) criteria, simplified reporting templates, and more risk-sensitive capital rules. The reforms seek to reduce operational burdens, boost capital relief, and increase participation without compromising financial stability. They signal policymakers' commitment to simplifying requirements and reducing barriers for issuers and investors alike by enabling institutions to engage in more securitisation activity and use the resultant capital relief for additional lending.

CSPs have evolved alongside these developments, transforming from simple company administrators into support evolving market practices within regulatory bounds. As synthetic risk transfer (SRTs), warehouse financings, and private securitisations gain prominence, CSPs will likely serve as an increasingly vital link between complex structures and the regulatory frameworks governing them.

For issuers and their advisors, engaging a CSP represents a strategic decision that determines how smoothly and securely the SPV, and by extension, the entire transaction, will function over time. Importantly, it helps establish a legal and operational infrastructure designed to perform not only on day one, but in year five, ten, or twenty.

As European securitisation continues to evolve, CSPs will remain critical enablers of both growth and stability. In a market where credibility, operational control, and structural continuity determine success, their role transcends simple administration.

For issuers navigating this complex landscape, while a CSP is required, the more meaningful question is which provider aligns most closely with long-term objectives. In a market built on trust and performance, that foundation must indeed be built to last.

At Wilmington Trust, we don’t just support your transactions, we build lasting relationships.

Get in touch to explore how our CSP services can help you achieve long-term success.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today