Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

California’s public finance priorities are shifting toward pragmatic execution in three areas: housing, education, and resilience. Uneven demographic trends and concentrated wealth shape each of these differently. Growth has slowed overall, but demand remains acute in areas where people and capital cluster, particularly in regions that invest in long-term community assets.

Economic and Demographic Context:

|

Housing continues to play a major part in issuance activity. The evolving tax-credit landscape and layered capital stacks require disciplined administration, especially as new thresholds expand eligibility and diversify deal sizes.

Education remains steady, with charter school expansion fueling complex waterfalls and recurring disclosure obligations that reward organized trusteeship.

Resilience, from water and wastewater systems to wildfire readiness, depends on clear revenue pledges and tested compliance routines across special districts and joint powers authorities.

Each area calls for early collaboration among underwriters, counsel, and trustees who can design transactions that operate smoothly over time.

Achieving California’s public priorities depends on disciplined operations. Every housing, education, and infrastructure project runs on the precision of its funding mechanisms. Trustees and paying agents help keep those systems aligned by handling the operational workflows of the financing. They manage fund movements, verify covenant compliance, and play a central role in maintaining the confidence of investors who rely on uninterrupted performance.

In practice, this activity also entails a thorough review of the governing documents to help ensure that the operating mechanics are sound before signing, confirming that waterfalls and bank instructions are clear, and maintaining consistent reporting, compliance, and disclosure cycles. These measures support transparency and orderly operations.

Across housing, education, and resilience, experienced trustees translate policy intent into operational precision. They play an integral role in converting bond proceeds into working capital for projects that require daily operations for years after the issue closes.

According to the 2025 California Housing Partnership Needs Report, the state is funding only 15% of the affordable housing units needed to meet the demands of low-income households. However, California spends twice as much supporting homeowners than renters and only 25% of renter resources are permanent compared to 98% of the support for homeowners. Affordable and workforce housing remains the most active area in California public finance. Projects commonly combine 4% or 9% Low-Income Housing Tax Credits (LIHTCs) with tax-exempt bonds, subordinate loans, and local grants.

The 2024 federal change, which lowered the bond-financing threshold from 50% to 25%, opened the door to more projects and smaller issuers. That shift brought a new mix of funding sources—tax credits, soft loans, and local grants—that need to work together from the start.

In these structures, potential missteps can slow a project’s completion. As of the end of 2024, 44,723 affordable homes remained stalled in the pipeline due to a range of issues. On the servicing side, payment instructions can get muddled when several lenders and agencies share accounts. Draw requests often arrive without clear backup, and reserve funds can sit idle because release conditions aren’t well defined.

Trustees, paying agents, custodians, and disclosure teams play a crucial role by establishing clear account controls, ensuring that proceeds are invested appropriately in permitted investments, and outlining specific operational mechanics and responsibilities. Early coordination keeps projects organized and helps construction money reach the right place on time.

Housing Stack |

Typical Accounts and Controls |

Bond proceeds |

Project fund – requisition and investment rules |

Tax-credit equity |

Equity escrow – draw approvals, cost certification |

Subordinate debt / soft funds |

Subordinated debt service fund / surplus fund - released by milestone |

Reserves (debt-service, replacement) |

Trustee-controlled - released upon ratio, tests, or trigger events |

Operating revenues |

Revenue fund – waterfall to debt service, reserve, repair and replacement, and rebate funds, as applicable |

Charter schools remain an active segment in California, serving approximately 12% of the state’s public-school students (based on 2022-2023 school year data), and enrollment growth continues to drive facility development and modernization.

For new or expanding schools, the state provides a Charter School Special Advance, which delivers portions of estimated state aid before full apportionment. The first advance, covering July through November, accounts for roughly 37% of a school’s entitlement, with subsequent payments made later in the fiscal year. This mechanism smooths cash flow for young or growing schools and helps underpin repayment capacity in early months.

Financings often use lease-revenue or conduit structures backed by state payments. Trustees and paying agents coordinate schedules so that debt service aligns with advance timing, and they maintain reporting calendars that reflect each school’s funding cycle.

When cash flow, calendar, and coverage definitions are in place, the result is predictable performance and stronger administrative control. That consistency allows schools to focus on education while their financings remain stable over time.

California’s resilient infrastructure agenda now centers on water and wastewater modernization, wildfire readiness, and the growing role of special districts funded by fees or assessments. In FY 2024–25, the State Water Resources Control Board committed $2 billion to over 390 community systems.

Meanwhile, wildfire prevention grants in 2024 included $90.8 million across 94 local projects, with over $450 million awarded statewide in the last five years.

Projects often have long spend-down phases, during which rate-setting and investment policies must preserve liquidity while respecting covenants. Some financings layer additional bonds tests (ABTs) atop rate covenants, creating multiple thresholds that must calibrate to evolving system demands.

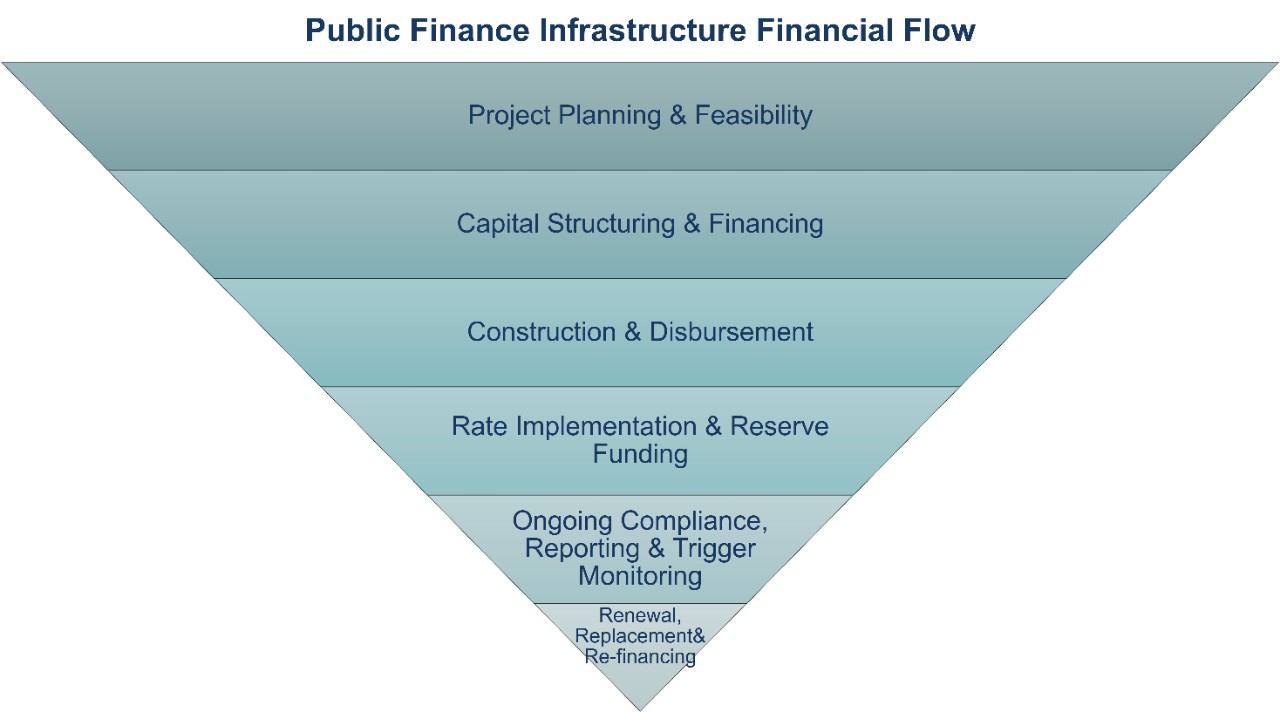

Funds flowing through escrow or trustee accounts must feed infrastructure draws, debt service, and reserve obligations in a tight sequence. Reporting triggers, reserve releases, and change-of-rate calculations must sync with system contracts, capital plans, and revenue forecasts.

California continues to see an influx of first-time or infrequent issuers entering the public finance market. Many of these organizations, particularly special districts, charter schools, and local agencies, bring strong projects but may have limited experience with the ongoing requirements that follow a bond closing. Five alignments at the term-sheet stage can prevent costly adjustments later.

Establishing these basics early gives new issuers a stable foundation for operating their financings confidently over time.

Our public finance professionals understand what it takes to make a transaction successful. They are here to support you and provide answers to any questions you may have.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today