Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

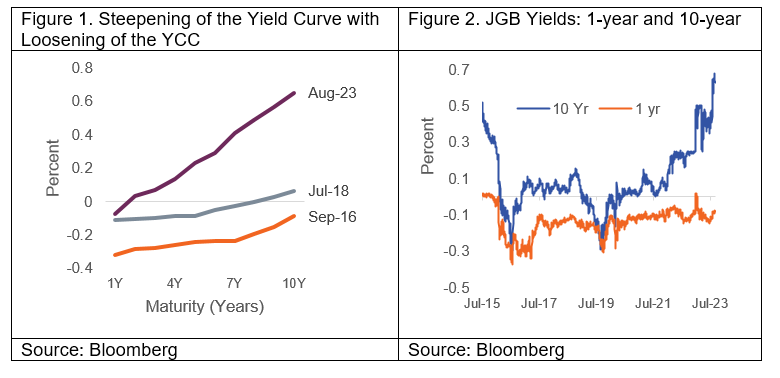

In recent remarks, the Bank of Japan (BoJ)’s Governor Ueda hinted that the BoJ may have enough data by year end to determine whether it can end its long-standing negative interest rates (NIR) policy. While the statement included several caveats such as the need to patiently maintain the ultra-loose policy and a reminder that the BoJ has not yet achieved its target, this is the first time that Governor Ueda has acknowledged the BoJ may be in a position to increase short-term rates from -0.1%, sending both bank stocks and yields higher. This is in line with an earlier policy change in July, where the BoJ surprised markets by loosening its long-held grip on long-term interest rates, letting them drift above 0.5% for the first time in years. A resilient economy and inflation consistently above its 2% target were partly behind the decision to allow more flexibility in its yield curve control (YCC) regime. This amounts to a tightening of monetary policy and a steepening of the yield curve (Figure 1).

This YCC policy shift could have important consequences for global markets because it could draw more financial flows to Japan’s bond market leading to higher global yields. This is particularly the case for U.S. yields where Japanese residents are the largest foreign holders of U.S. Treasurys. At the same time, robust economic growth could provide a boost to Japanese equities. The steepening of the yield curve is also a positive for bank profits as net margins improve. However, significant risks remain, including a return of disinflation, a global economic slowdown, and an unruly exit from the YCC leading to financial turmoil.

Yield curve control

Japan’s economy has struggled with low inflation and stagnant growth for more than three decades and, in response, the BoJ was a pioneer in running unconventional monetary policy. These policies included short-term rates at or near zero along with aggressive quantitative easing (large purchases of government bonds and other riskier assets) with a commitment to flattening the yield curve. The goal was to aggressively stimulate the economy by lowering real interest rates (nominal rates minus inflation) a key economic variable for investment and saving decisions. In January 2016, the BoJ went a step further and introduced an NIR policy, setting the short-term rate at -0.1%, where it has stayed to this day.

A consequence of the NIR policy was that the entire yield curve turned negative, including the 10-year Japanese Government Bond (JGB). A flat and negative yield curve raised concerns around market distortions and profitability of financial institutions. There was a risk that if the yield curve remains flat for too long, compressed interest margins would make it more challenging for banks to play their financial intermediation and maturity transformation roles. To address these concerns, the BoJ introduced YCC to steepen the curve, setting a target for the 10-year JGB around 0%.

Past performance cannot guarantee future results.

The loosening of YCC could drive global yields higher and boost Japanese equity markets.

As inflation and growth have picked up in 2023, however, the BoJ has incrementally made its YCC regime more flexible. Inflation hit a high of 4.3% year over year (y/y) in January 2023—the highest in 33 years. Similarly, GDP growth in 2Q 2023 was 4.8% on the heels of 3.2% in 1Q 2023. The BoJ has loosened the YCC a number of times since its inception with the most recent changes in December 2022 and July 2023. The December 2022 announcement widened the range over which the 10-year JGB yield was allowed to vary around its target of 0% from ± 0.25% to ± 0.5%. More recently (July 2023), the BoJ announced that the ± 0.5% limit will no longer be treated as a “rigid limit” but a reference and, increased the target rate for JGB purchase operations—the rate at which it will purchase any outstanding bonds—from 0.5% to 1.0%. The 10-year JGB yield has risen by around 20 basis points, or bps (0.20%) since the announcement (Figure 2).

The rise in Japanese yields could send global yields higher as demand for foreign assets by Japanese investors wanes. As shown in Figure 3, the Japanese resident holding of long-term foreign bonds rose steadily to a high of nearly $3 trillion in 4Q 2020. As the YCC becomes more flexible and the Japanese long-term yields are allowed to increase, flow of investment is likely to be reversed leading to higher global yields.

U.S. long-term rates are particularly exposed to this risk as both U.S. Treasurys and JGBs are considered safe haven assets and also because Japanese residents are the largest foreign holders of U.S. Treasurys. As of June 2023, $1.1 trillion U.S. Treasury securities were held by Japanese residents representing 14.6% of all foreign holdings. As mentioned in our Chief Investment Officer Tony Roth’s September letter, (“Bond Yields: What goes up, must come down. Or does it?") with U.S. yields already under pressure due to higher supply from the U.S. Treasury and the Federal Reserve unwinding its holdings, waning demand from Japanese residents, on margin, could send the yields even higher. However, the incremental impact of the recent higher Japanese long-term yields on global yields will be dampened by the fact that Japanese appetite for foreign assets had started to wane earlier in 2022 (Figures 3 and 4).

A steepening yield curve in Japan (Figure 1), could also lead to higher bank profits through improvement in net margins, but it could also lead to losses on bond holdings and higher provisioning for losses. A recent International Monetary Fund paper found that that a steeper yield curve improves bank profitability in Japan.[1] Higher bank profits coupled with the repatriation of investments from abroad and a robust economy could provide a boost to Japanese equities.

However, risks remain

Despite the robust growth as well as higher than target (2%) inflation, the BoJ remains concerned about disinflation and cautioned that prematurely tightening policy could harm the economy. A return of disinflation or decelerating growth—possibly driven by a global economic slowdown—could lead the BoJ to flatten the yield curve again, lowering long-term yields and decreasing demand for Japanese assets. There is also a risk that an unruly unwinding of the YCC with a steepening yield curve could lead to stress in the Japanese financial sector, particularly for those holding long-term assets. The incremental approach that the BoJ has taken to unwind the YCC suggests that this is unlikely to be the case.

Core narrative

BoJ has been incrementally making its YCC more flexible leading to an increase in long-term rates in Japan and a steepening of the yield curve. The YCC contributed to lower global yields—including U.S. Treasurys—by keeping Japanese yields artificially low and increasing demand for foreign assets by Japanese residents seeking higher yields. A loosening of the YCC is likely to reverse this trend providing a boost to Japanese equities. However, the waning demand for foreign assets from Japanese investors can weigh on equities and lead to higher yields outside of Japan. The risk of a global slowdown remains high and brings downside risk to the performance of international developed equities. We hold an underweight to equities, both in U.S. small-cap and international developed asset classes, and an overweight to cash and investment-grade fixed income.

[1] Fendoglu, Salih. 2023. “JGB Yield Curve and Macro-Financial Stability: How Would a Steeper JGB Yield Curve Affect Bank Profitability?” IMF Selected Issues Paper (SIP/2023/032). Washington, D.C.: International Monetary Fund.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

The gold industry can be significantly affected by international monetary and political developments as well as supply and demand for gold and operational costs associated with mining.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today