Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

March 17, 2023

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually, and then suddenly.”

- The Sun Also Rises, Ernest Hemingway

We suspect that quote has been widely used this week, so we’re being unoriginal, but it’s too perfect to pass up. It captures the speed at which Silicon Valley Bank (SIVB) failed last Friday, March 10, followed two days later by Signature Bank of New York (SBNY) on Sunday, March 19. Those failures led to a broader crisis in U.S. domestic regional banks, broader financial market volatility, and a sharp repricing of expected Federal Reserve (Fed) policy. By week’s end, the market is now pricing in just one more Fed hike of 25 basis points,* or bps (0.25%), and then sharp cuts in the second half of 2023.

If the Fed were to follow that path, it would likely be a boon for risk assets. But, in our view, it is far too soon to draw that conclusion. Quick action by the Federal Deposit Insurance Corporation (FDIC), Treasury, and Federal Reserve to quell the panic has helped. The episode has not concluded, and could worsen, but our expectation is improvement going forward. If that transpires, the Fed is still facing a slowing economy, but one with strong labor force growth and still-too-hot-inflation. In that case, we would expect them to return to an expected path of multiple rate hikes, risk of recession, and a challenging environment for risk assets.

Bank failures and challenges

The failures of SIVB and SBNY were simple, classic bank runs, far easier to understand than the convoluted financial crisis of 2008 that was caused by complicated, intertwined financial derivatives products tied to the housing market. SIVB received massive influxes of deposits over the past several years, as its Silicon Valley customers received funding from venture capital investors among other sources. Deposits doubled in 3Q 2021 in year-over-year terms. But with little ability to make loans with all of those funds and a desire to earn returns, SIVB management purchased a large amount of long-dated fixed income securities, taking on significant interest rate risk.

In 2022, the bank was hit by a double whammy of rising interest rates that drove down the value of those investments, and withdrawals by its customers who needed that cash for operations. To meet those deposit demands, SIVB decided to sell $20 billion of securities, taking a $1.8 billion loss. It hoped to raise equity to fill the hole, but did so after publicly reporting the loss, causing jitters in the market, and the attempt to raise funds failed. This prompted a bank run. SBNY’s details were different, as it was impaired by a decision to get into financing cryptocurrency firms over the past years, but similarly faced a run.

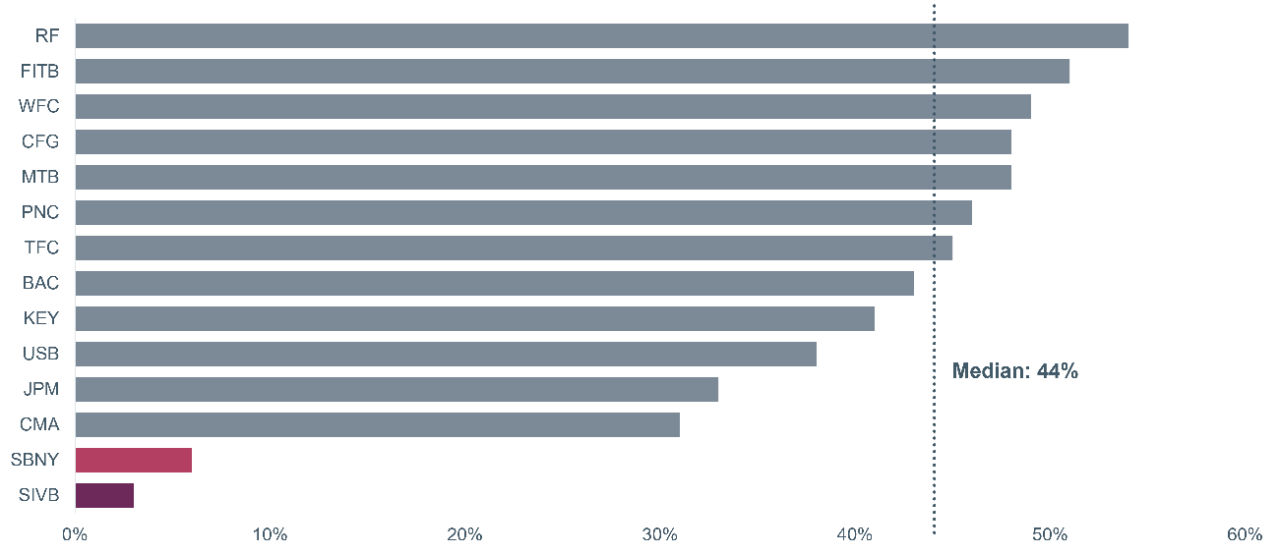

Critically, SIVB and SBNY were susceptible to a run because a large share of their customers held balances that were not insured by the FDIC (Figure 1). Individuals with very high balances and companies that kept high balances for operational purposes stood to lose most balances over the $250,000 threshold.[1] Many of them moved quickly to withdraw balances for fear of losing them.

Figure 1: Deposit accounts <$250k (% of total deposits)

Data as of December 31, 2022. Sources: Bloomberg, Citi Insights. Banks are identified by their tickers. The banks that are represented consist of the 11 stocks in the S&P Regional Bank Index and the five stocks in the S&P Diversified Bank Index.

As the week has plodded (slowly) on, the stock prices of other U.S. regional banks have whipsawed with each incremental piece of news and, as investors parse through the very different balance sheets of each, looking to distinguish those most at risk and those that are better-positioned.

Investors shifted concern across the Atlantic on Wednesday, March 15, with concerns about Credit Suisse permeating the sector. The Swiss lender has been troubled for years due to scandals and financial losses, prompting multiple changes in management. Shares fell from $18 at the start of 2018 to just $3 at the start of 2023. On Wednesday, shares fell 24% and credit default swaps on their bonds surged, and inverted, indicating serious investor concerns or expectations of a default. The decline was deepest midday before the Swiss National Bank said it would provide liquidity to the bank if necessary.

Government response

The U.S. government responded swiftly hoping to prevent a pervasive bank run across the country. It consisted of two main actions. First, the Fed, U.S. Treasury, and FDIC jointly announced on Sunday evening that the FDIC would protect all deposits for customers of the failed SIVB and SBNY banks, not just those below the $250,000 threshold. Second, the Fed announced a newly created liquidity facility available to all banks.

The Bank Term Lending Program (BTLP) allows any bank that has access to the regular “discount window”—the standard facility that is typically used for overnight funds to borrow from the Fed but with two critical, distinct features. First, loans can be taken for up to a year. Second, banks can borrow using their typical securities as collateral (Treasuries, mortgage-backed securities, agency securities, etc.) but at the par, or “face,” value of the security. So, even as banks have seen the value of their securities portfolio decline in the rising rate environment, they are now able to borrow above the market value of those securities. This is intended to enable banks to endure deposit outflows without needing to sell securities, as in the case of SIVB.

Financial conditions tighten

The path forward for the economy and the Fed depend significantly on the evolution of broader “financial conditions” and how they affect the economy. With so much focus on the Fed’s main policy rate, the federal funds rate, it is easy to forget that is only an overnight interest rate used by banks to lend to one another.

What really matters is not so much that policy rate but rather how the Fed’s actions are transmitted into more widely used interest rates faced by consumers, homebuyers, and businesses. The term “financial conditions” is meant to encapsulate the overall degree of conditions of financial markets, including interest rates across the yield curve, credit spreads, equity valuations, and currencies. It refers to financial conditions that essentially do the work of the Fed in either tightening or loosening access to liquidity.

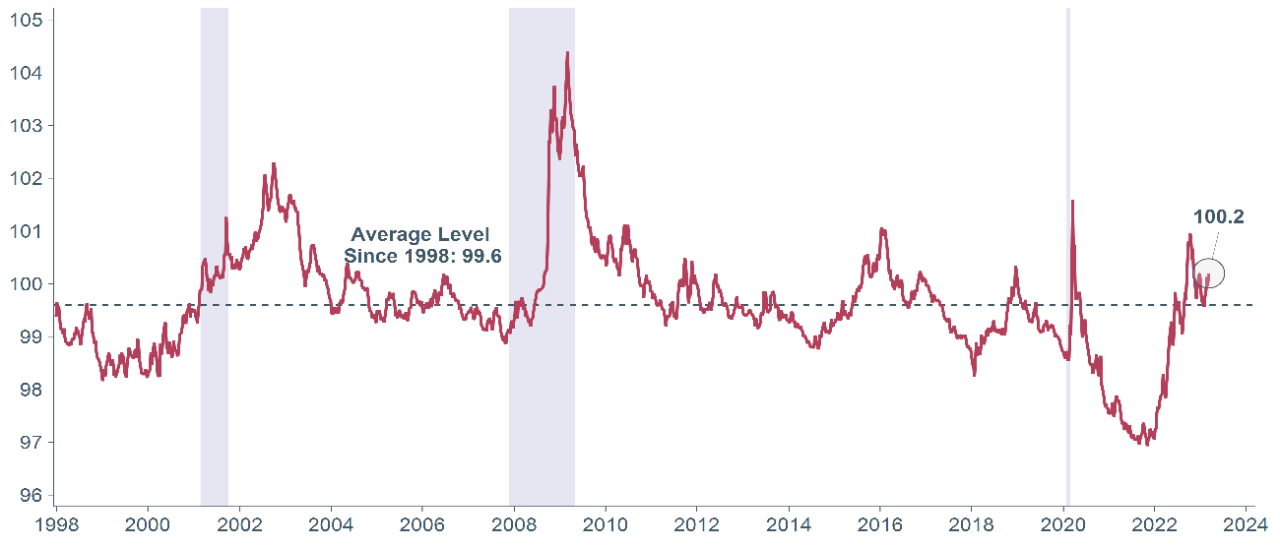

Despite a near-record pace of tightening from the Fed in 2022, financial conditions are still only back to long-term historical averages (Figure 2). They have tightened significantly since the start of the Fed’s rate hike campaign in 2022, but only marginally in the wake of the bank crises, and will be important to watch going forward. In particular, should banks recoil from lending or tighten standards—a trend that was already in place before the failure of SVB—financial conditions could tighten even without the Fed doing much more to raise the fed funds rate. If bank lending standards tighten too much, it could cut off access to credit to institutions looking to invest and borrow, increasing recession risks.

Also of note is recent stress in the most liquid parts of the market, including U.S. Treasury bonds and German bunds. Due to a flight to safety on the part of investors, trading volumes have surged and bid/ask spreads have widened. This is a clear sign of stress that, if continued, could put pressure on pricing of related securities, including derivatives and lending products.

Figure 2: Financial conditions tighten, but in line with historic average

Goldman Sachs U.S. financial conditions index (1998–present)

Data as of March 14, 2023. Sources: Goldman Sachs, Bloomberg. The index is defined as the weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP.

Fed rate hike expectations have collapsed but more hikes likely ahead

Going into the crisis, we expected inflation to keep decelerating but be stubbornly high and fail to fall sustainably to the Fed’s 2% threshold. As described in our 2023 Capital Markets Forecast, multiple forces could keep inflation higher than desired for a multiyear period. We expected the Fed to raise the federal funds rate multiple times in 2023, and a mild recession in the U.S. later this year.

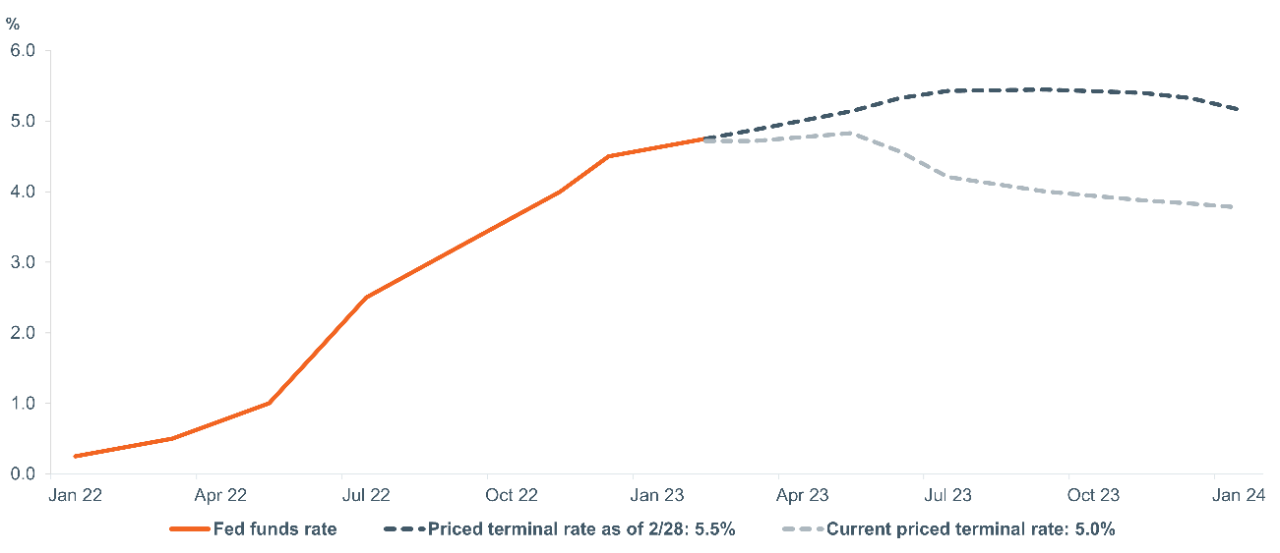

The bank crisis has shifted the market’s predictions for the Fed quickly and dramatically. Before the failure of SIVB, traders were pricing in a peak rate of 5.5%, and perhaps a single rate cut of 25 bps later in 2023. Since then, expectations have been pushed down to perhaps one more rate hike this spring, followed by roughly 100 bps of cuts over the second half of the year (Figure 3). We think it is too soon to adopt such a stance.

Yes, if financial conditions tighten more, or if banks are simply less willing to make loans, the crisis will be helping the Fed toward its goal of slowing the economy and bringing down inflation. But if the crisis passes, the Fed will find itself right back where it was on the eve of recent events, with high inflation that must be addressed. We think it more likely than not that the Fed will need to still hike multiple times this year to bring down inflation, and that could pose challenges to risk assets.

Figure 3: Rate hike expectation sharply lower following 2023 bank crises

Market pricing of federal funds rate (current vs. Feb. 28, 2023)

Data as of March 14, 2023. Sources: Goldman Sachs, Bloomberg. The index is defined as the weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP.

Core narrative

The crisis in U.S. regional banks is ongoing, but measures taken by the government are helping with liquidity. Conditions could certainly worsen and there could be more bank failures, but we expect improvement from here. Financial conditions have tightened as a result of the crisis, and are likely to help slow the economy and bring down inflation, but only on the margin. We expect the Fed will need to hike a few more times this year and hold rates at that peak for most of 2023. Before the crisis, we placed a 55% probability on a mild recession in 2023 and a 40% chance of a soft landing, with the balance allotted to a small chance of a severe recession. The chance of a recession may be slightly more elevated now, but hinges significantly on the path of the crisis, which is ongoing.

We have recently further reduced our underweight to equities, taking down U.S. small-cap equities marginally in favor of hedge funds—or liquid alternatives, depending on the client. Higher interest rates pose a greater burden to smaller companies than large ones, given their higher debt ratios. We also maintain an underweight to international developed economies, where sluggish growth, the war in Ukraine, and a strong dollar continue to present headwinds for Europe, in our view. Within equities, and especially in our remaining small-cap allocation, we are focusing on investing in high-quality companies, a strategy that we expect to excel in an environment of high interest rates and contracting earnings. We are playing defense with an overweight to cash and fixed income, as well as shoring up our allocation to hedge funds (now neutral versus our long-term strategic benchmark). How long we remain on defense depends on how the economy and markets unfold in coming months.

For more on this important topic, we invite you to listen to the replay of our March 16 webinar, Economic, Market & Monetary Consequences of Bank Failures, hosted by Chief Investment Officer Tony Roth.

[1] Since 1933, the Federal Deposit Insurance Corporation (FDIC) has provided certain protections for depositors at FDIC-insured institutions. Specifically, the FDIC insures deposits at these institutions, including cash deposits and certificates of deposit, up to at least $250,000 per depositor, per institution. For individuals holding accounts in other ownership categories, coverage in excess of $250,000 may be possible depending on how each account is titled. Individual retirement accounts (IRAs) continue to be insured separately up to $250,000 per individual per FDIC-insured institution. As always, the FDIC does not insure investments, nor does it cover losses in principal value of assets held in stocks, bonds, mutual funds, life insurance policies, annuities, municipal bonds, or other investments.

*Basis points refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today