Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Policy-driven volatility in China’s economy and domestic equities may increase in the medium term, especially after the conclusion of the twice-a-decade National Congress of the Chinese Communist Party (CCP). In this article, we will take a look at what the confirmation of Xi Jinping as the general secretary of the CPP for a third, five-year term could mean for the economy and domestic equities. Specifically, we address the implications of Xi’s concentration of power on the five key themes in his speech:

1. Strong defense of China’s zero-COVID policy

2. Emphasis on security over growth

3. Economic self-reliance

4. Reunification with Taiwan, and not ruling out military force to do so

5. Strict, ideological adherence

Xi’s concentration of power

Breaking precedent of retiring after a decade, Xi Jinping’s third, five-year term will make him the longest-serving CCP leader since its founder, Mao Zedong. Similar to Mao, Xi positioned himself as the party, and the party as the country. Therefore, any pushback against him is de-facto a pushback against the country.[1] There is also no clear successor currently, suggesting Xi intends to rule for life. This idea is reinforced by the new Politburo Standing Committee (PSC), which has been recently packed with Xi allies. Li Keqiang, who served as premier and openly criticized the lockdown measures (and therefore functioned as a power check), is now being replaced by Li Qiang, a Xi loyalist.

The critical takeaway as it relates to Xi’s concentration of power is the mode of political and economic governance he will continue to impose. It marks a significant departure from the modus operandi of his predecessors and a general trend of stellar economic and political growth for decades—and therein lies the risk. Relative to Deng Xiaoping, who advocated for decentralization, market-based reforms, and distributed political power within the party, Xi’s new direction runs opposite. A lack of checks and balances is also at the nerve center of concerns among investors.

The speech

President Xi’s opening speech carried few surprises, giving investors both reassurance in the certainty of continuity, and disappointment simultaneously. The market reaction after the congress suggests it was more so the latter. For instance, Chinese stocks had their worst, single-day performance since 2008 the day after these announcements were made: The yuan hit a 14-year low against the U.S. dollar, and the CSI 300 Index fell almost 3%.[2]

But why did equity markets panic? In addition to trumpeting the achievements China attained under his leadership, there were also themes that may have elevated investor angst. These include: a strong defense of China’s zero-COVID policy, emphasis on security over growth, economic self-reliance, reunification with Taiwan, and strict ideological adherence. These themes create a constellation of problems, which could undermine Chinese economic growth and dent future returns on domestic equities.

Zero-COVID policy

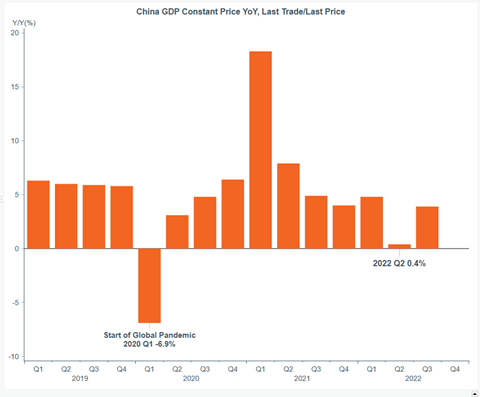

China’s economy took a hit in 2021, in large part due to Xi’s strict lockdown measures to stymy the spread of COVID-19. In his speech, the Chinese leader defended the country’s zero-COVID policy (ZCP), claiming it protected “the people’s health and safety to the greatest extent possible.”[3] However, the economy paid a hefty price. On an annualized basis, gross domestic policy (GDP) grew 0.4% in 2Q 2022 on a year-over-year (yoy) basis (versus expectations for 1.2%), the weakest reading in two years.[4] GDP for 3Q did show an improved growth rate of 3.9%, beating the 3.3% forecast on a yoy basis.[5] However, with Xi’s resolve on ZCP solidified, and no opposition in the PSC, it is difficult to see how the country will be able to meet its targeted growth rate of 5.5% this year if lockdowns continue.[6]

Figure 1: Chinese GDP

Data as of October 25, 2022. Source: Bloomberg.

Amplifying the economic uncertainty is China’s chronic pain of the financial turmoil stemming from Evergrande, the country’s second-largest property developer. The gravitational pull of its ongoing debt problem continues to drag other parts of the economy into its orbit. With housing accounting for approximately one-third of China’s GDP, precarious fundamentals in that sector have had a ripple effect.[7] Companies along the production chain, such as steel and construction services firms, are taking losses from Evergrande’s inability to pay.[8] ZCP could exacerbate the problem if it undermines consumer confidence, generates higher levels of unemployment, and inhibits the ability of Chinese citizens to purchase homes. If real estate sales continue to plummet, it could worsen current economic woes and elevate domestic volatility in equities.

Security over growth

In his speech, Xi Jinping mentioned the word “security” 91 times and spoke of China cultivating “indigenous innovation” as part of the broader goal of national self-reliance—especially in technology.[9] Beijing’s newest targeted industrial policy is unprecedented and involves heavy investment in frontier tech. This is in large part being fueled by Beijing’s rivalry with the U.S., particularly in the areas of strategic technologies. These include artificial intelligence (AI) and semiconductor chips used to power AI with various military and non-military applications.

On October 7, President Joe Biden issued sweeping restrictions on China’s access to semiconductors and the equipment to manufacture them. Vis-a-vis each other, the U.S. and China are now prioritizing security over mutually beneficial economic agreements; particularly in the areas of strategic technology, a cornerstone of Xi’s agenda to cement China as a global superpower.

Economic self-reliance

In addition to manufacturing strategic technology at home, Xi has also been stressing the importance of domestic self-reliance. From a policy perspective, this involves shifting from an export to a consumer-driven economy. This accomplishes two goals. One, it reduces dependence on the West, and two, it helps insulate China from financial and economic convulsions from the U.S. and Europe. Reading between the lines, what this means for Xi is that he is able to pursue regional political ambitions and reduces the cost of Western response (e.g., sanctions—as in the case of Russia invading Ukraine).

Reunification with Taiwan

A key part of Xi’s political ambitions is the reunification of Taiwan with the mainland, an outcome he sees as inevitable. The prospect of a direct war between China and the U.S. weighs heavily on policymakers, though it is unclear when it will happen—if even at all. Chinese officials have already met with banks to understand how their overseas assets could be protected in the case of U.S. sanctions.[10] With Xi at the center of policymaking and the PSC resolutely behind him, a military operation in Taiwan would likely be a Xi-driven strategy—and a violent one. The economic and financial disruption from such a conflict would be enormous and could exacerbate supply-chain bottlenecks and amplify shortages in key products like semiconductors.

Ideological purity

Lastly, Xi’s speech placed a strong emphasis on “Xi Jinping Thought” as the ideological foundation of the CCP, and therefore, the country. Complementing his Marxist-based theory is the idea Xi put forth of “common prosperity” and alluded to notions of wealth distribution. From the perspective of entrepreneurs and investors, this is antithetical to the mode of capitalist governance that made China an attractive investment vehicle. With wealth distribution being a centralized, top-down process, it may create more regulatory scrutiny for domestic businesses and foreign investors. Businesses may therefore be hesitant to expand their commercial enterprises, and foreign investors may reduce their investments in China out of concern of sudden policy moves. This is not unlike what happened in Hong Kong, shortly after the passage of the National Security Law. Beijing’s crackdown on the tech sector for ideological reasons is a tangible example of this, and China’s markets are feeling it. The Wall Street Journal (quoting the Rhodium-Atlantic council) found that “foreign direct investment as a share of China’s GDP has declined steadily, to 21% last year from nearly 30% a decade earlier.”[11] If centralization of power and ideology continue to walk hand-in-hand, the economy and domestic markets may pay the price for it.

Core narrative

Xi’s speech and the conviction behind his principles and policies illustrate the many challenges investors face in what appears to be a new age of centralized governance. The prioritization of political policies over economic integration is part of the larger trend of deglobalization. In this environment, emerging markets may exhibit more policy-related volatility than has been the case historically.

This does not mean U.S.-based investors should reject emerging markets equities or, more specifically, Chinese equities. Valuations for Chinese equities are very compelling, and our allocation to emerging markets equities typically incorporate active managers with “boots on the ground” and long track records of investing in China. Additionally, a very strong dollar has weighed on emerging markets equities in 2022. As we approach the Federal Reserve’s peak fed funds rate for the cycle, we expect the U.S. dollar to lose some steam. That would provide relief for emerging markets economies with significant debt denominated in U.S. dollars. Historically, a weakening dollar has been correlated with better relative returns of emerging markets equities versus those of the U.S.

China-related risk adds to an already long list of macro concerns. However, the Investment Committee sees considerable risk as already being priced into markets and thinks the time to reduce risk has passed. Our portfolios hold an overall neutral allocation to equities but with a preference for U.S. large caps over international equities versus the long-term strategic asset allocation benchmark. Our portfolios also hold a neutral allocation to fixed income, an overweight to cash, and underweights to real assets and alternatives. We continue to monitor the economy and markets and will adjust portfolios accordingly.

Dimitri Zabelin

Thematic Research Strategist

Definitions:

CSI 300 Index is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange. It has two sub-indexes: the CSI 100 Index and the CSI 200 Index.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Wilmington Trust is a registered service mark used in connection with various fiduciary and non-fiduciary services offered by certain subsidiaries of M&T Bank Corporation including, but not limited to, Manufacturers & Traders Trust Company (M&T Bank), Wilmington Trust Company (WTC) operating in Delaware only, Wilmington Trust, N.A. (WTNA), Wilmington Trust Investment Advisors, Inc. (WTIA), Wilmington Funds Management Corporation (WFMC), and Wilmington Trust Investment Management, LLC (WTIM). Such services include trustee, custodial, agency, investment management, and other services. International corporate and institutional services are offered through M&T Bank Corporation’s international subsidiaries. Loans, credit cards, retail and business deposits, and other business and personal banking services and products are offered by M&T Bank. Member FDIC.

©2022 M&T Bank and its affiliates and subsidiaries. All rights reserved.

[1] Tony Sachs, From Rebel to Ruler, July 6, 2021.

[2] Xi’s Power Grab Spurs Historic Market Rout as Foreigners Flee, Bloomberg.

[3] Key Takeaways From Xi Jinping’s Two-Hour Speech.

[4] Bloomberg data.

[5] Bloomberg data.

[6] Shanghai lockdown: Economy shaken by zero-Covid measures, BBC News.

[7] China’s property market debt could weigh on the country for years, economist George Magnus warns.

[8] China Evergrande’s Debt-Crisis Fallout: Losses, Layoffs and More Defaults.

[9] Xi Jinping provokes a spectacular sell-off in China’s markets.

[10] China Working to Protect Overseas Assets in Amid Fear of US Sanctions, businessinsider.com.

[11] Xi Jinping’s Ideological Ambition Challenges China’s Economic Prospects, The Wall Street Journal.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today