Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Introduction

In late September, Beijing revealed a series of monetary and fiscal stimulus measures aimed at stabilizing the economy and boosting investor confidence. The announcement of the stimulus package, potentially the third-largest in China’s history as a percentage of gross domestic product (GDP),[1] sparked a sharp rally in the equity market after more than three years of a bear market. The timing and magnitude of the stimulus signals that Beijing understands the urgency of addressing the challenges facing the economy, which include a property market slump, weak consumer spending, and high government debt. While the government’s actions have provided some short relief to the economy, structural risks remain. For further equity upside, investors will likely need to see additional policy measures and improvement in economic indicators. Nonetheless, it’s encouraging that the government seems more committed to turning things around. As investors face an increasingly complex landscape, we think it’s important to stay nimble and leverage active management to help identify companies with strong growth opportunities, and navigate macro and policy-related risks. Looking to the broader emerging markets (EMs), we believe the asset class continues to offer a balanced risk-reward proposition, and we maintain a neutral positioning in portfolios.

The current state of the economy

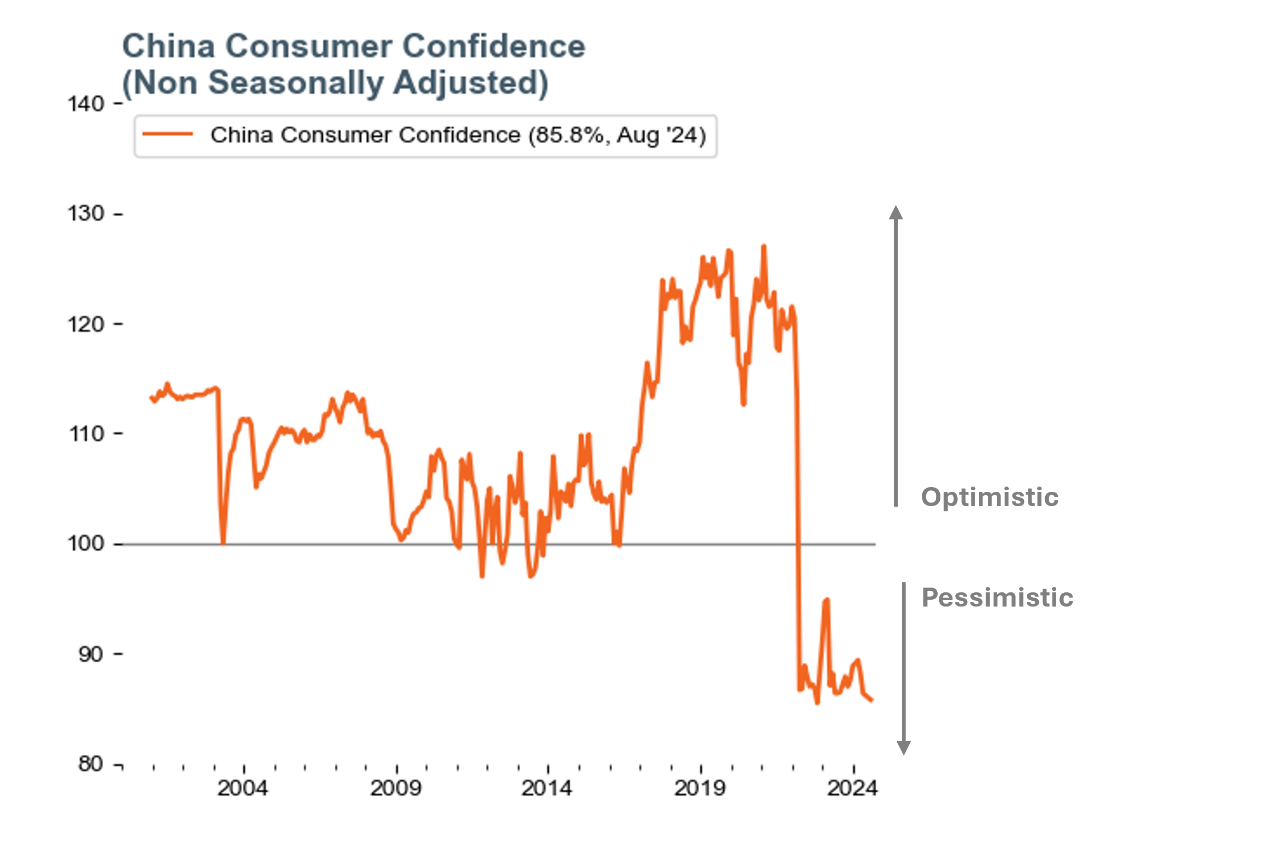

China’s GDP continued to grow at a lackluster pace of 4.6% year over year (y/y) in the third quarter, highlighting the need for stimulus to reinvigorate the economy. The Purchasing Managers’ Index (PMI), a key survey of businesses, remained below 50 in September, signaling contraction. The property market remains a key risk despite efforts to ease the financial burden on homeowners and to boost demand. Real estate prices and sales continue to decline in 2024. Consumer confidence also remains historically low (Figure 1), exacerbated by deflationary pressures. The Producer Price Index (PPI), which measures the prices domestic producers receive for their output, showed a y/y drop of 2.5% in September. This marks the 24th consecutive month of negative growth and suggests weaker demand for goods and services. Government debt has also reached record levels, with many regions struggling to meet their financial obligations.[2] Trade relations with the U.S. and European Union (EU) have added additional complexity as ongoing tensions weigh on trade. In September, Chinese exports rose just 2.4% y/y, much lower than expected. Disappointing economic data have weighed on investor sentiment, with the equity market losing nearly half its value from its peak in 2021 through mid-September 2024.

Figure 1

Consumer confidence remains historically low

Source: Bloomberg.

Despite its economic issues, China continues to grow its global lead in the development of emerging technologies and strengthen its manufacturing capabilities. The government has been focused on integrating science and technology more closely with the economy to boost productivity growth and drive innovation. This is part of China’s larger plan to shift its economy from low-cost manufacturing to services and higher value-add industries. Robust research and development spending has enabled the country to dominate a number of strategic industries, including electric vehicles (EVs) and batteries, 5G networks, machine learning, and semiconductors. China currently controls 77% of battery production[3] and 54%[4] of all EV manufacturing. Chinese firms are also gaining market share in construction machinery and outdoor power equipment due to the global shift toward electrification.[5]

China’s stimulus package: What’s changing on the policy front

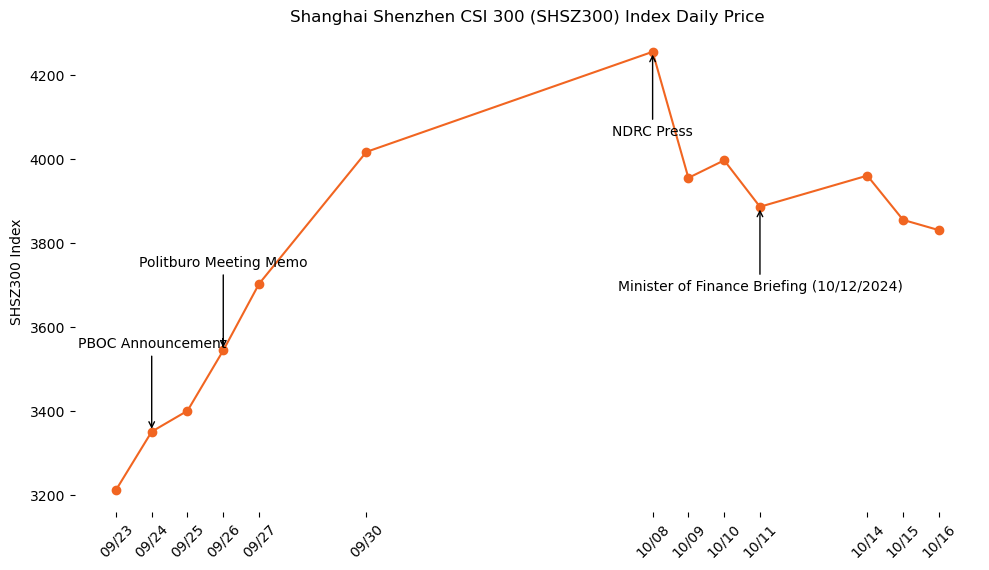

In late September, the Chinese government unexpectedly released a series of monetary and fiscal stimulus measures. This comprehensive package aims to revitalize GDP growth by increasing liquidity, lowering borrowing costs, stabilizing the equity and housing markets, and bolstering consumer sentiment. Significantly larger and broader than previous efforts, Beijing’s policy announcement sparked a rebound in Chinese equities, with the CSI300 index surging 32% from its low on September 23 to a local peak on October 8. Since then, the markets have become increasingly volatile as investors digest new policy updates and actions.

Key policy announcements:

Overall, recent policy announcements have significantly impacted the equity market, driving volatile fluctuations in investor sentiment. The CSI300 index’s daily price movements clearly reflect these shifts with each new policy update (Figure 2).

Figure 2

Fiscal stimulus announcements drive investor sentiment

Source: Bloomberg.

What does the policy shift mean for the economy and markets?

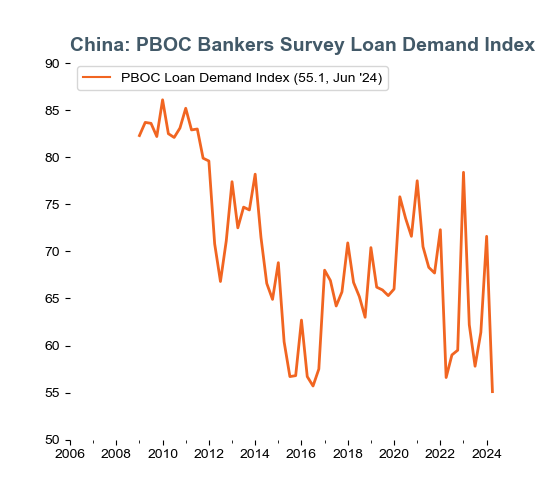

Despite significant monetary and fiscal measures, Beijing’s ability to stabilize the economy remains uncertain. Without specific details on the size and breadth of China’s stimulus package, we cannot accurately gauge its potential impact. The effectiveness of monetary policy will hinge on whether it can generate higher loan demand, which remains at historic lows despite multiple interest rate cuts (Figure 3). While liquidity injections and lower rates have reduced some pressure on heavily indebted property firms and households, they do not resolve the deeper issues plaguing the economy. The coming months will determine whether Beijing can deliver a real turnaround. We may see weak economic and corporate earnings data for several months before any improvement. Inflationary pressures from increased liquidity and spending could also complicate the outlook. Long-term, structural challenges, including an aging population, high youth unemployment, overcapacity in the property sector, and elevated debt levels, pose risks to China’s growth trajectory that are difficult to reverse with policy alone.

Figure 3

Loan demand remains at historic lows

Source: Bloomberg.

China’s structural challenges make it unclear whether a longer-term rebound in the Chinese equity market is feasible. Any further upside will likely require more fiscal stimulus and policies that go beyond a short-term tactical boost and include structural reforms. As of now, there is insufficient evidence suggesting a sustainable recovery in investor sentiment. Previous market rallies have been short-lived when stimulus measures fell short of investor expectations. We expect market volatility to persist for the foreseeable future as investors digest a rapidly evolving policy landscape and its implications for economic growth. Market sensitivity to policy signals underscores the need to closely monitor government statements and actions.

Global conflicts, trade tensions with the U.S. and Europe, and the upcoming U.S. election present additional risks to the economy and markets. Trade sanctions and higher tariffs on Chinese goods could further impede export growth, while heightened geopolitical tensions may affect foreign investment and support for domestic innovators. The Biden administration recently raised tariffs on Chinese EVs, batteries, solar cells, and steel and aluminum products.[6] The U.S. has also looked to restrict China’s access to high-end AI chips and U.S.-built semiconductor manufacturing equipment.[7] These policies could slow the growth of China’s tech- and science-focused industries, especially those highly dependent on U.S. demand or U.S. technology/components.

Core narrative: Do these policies change our investment view and EM positioning?

Beijing’s recent policy actions have provided some relief to China’s economy and sparked a strong rally in the equity market. We are more optimistic about the country’s short-term growth prospects as we believe the risks are now more balanced. However, for a sustained recovery in investor confidence, we’ll need to see more policy measures and evidence of improving macro conditions. It’s also important to note that China accounts for just 30% of EM indices, thus we evaluate the asset class as a whole when making investment decisions. Overall, we continue to believe that EM equities offer balanced risk-rewards, and we maintain a neutral positioning in portfolios. Active management is our preferred strategy when investing in this space. Since the Chinese equity market is very policy oriented, an on-the-ground understanding of how government actions might impact future returns is crucial. Capitalizing on long-term secular growth opportunities also requires robust fundamental research and bottom-up stock selection. In this context, we leverage the expertise of active managers across our portfolios to help identify companies with strong fundamentals, capitalize on inefficiencies in the market, and generate attractive risk-adjusted returns for investors.

[1] Deutsch Bank Research, October 23, 2024.

[2] “China’s LGFV Insiders Say $9 Trillion Debt Problem is Worsening,” Bloomberg News, 08/23/2023.

[3] Govind Bhutada, “Visualizing China's Dominance in Battery Manufacturing (2022-2027) (visualcapitalist.com),” Visual Capitalist, January 2023.

[4] Alicia García-Herrero. “Following a boom, China's electric vehicle industry now faces weak domestic demand and heightened geopolitical risk (bruegel.org),” Bruegel, August 2023.

[5] Wenli Zheng, “China: Time To Revisit An Unloved Asset Class | T. Rowe Price (troweprice.com),” T. Rowe Price, December 2023.

[6] Katie Lobosco, “Biden finalizes increases to some of Trump’s China tariffs | CNN Politics, CNN, September 13, 2024.

[7] Gregory C. Allen “Choking off China’s Access to the Future of AI (csis.org),” CSIS, October 11, 2022.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today