Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

The strength of the U.S. capital markets have contributed significantly to the country’s economic exceptionalism (discussed in depth in our 2024 Capital Markets Forecast), acting as a catalyst for growth, job creation, and innovation. Today, America has the deepest, most liquid, and efficient markets in the world, making it an attractive destination for entrepreneurs that want to scale and grow a business. Startups and early-stage companies benefit from ample funding in the private markets—accessible through a vast network of professional venture capitalists and private equity (PE) firms—that raise capital from institutional investors and wealthy individuals to create investment funds. Today, the U.S. remains the global leader in advanced technologies and scientific breakthroughs, in part due to superior research and development (R&D) and low barriers to new business creation, but also because of the scaling made possible by America’s deep private markets ecosystem. Few countries have been able to establish a similar environment for growth and innovation, which has played a large part in the outperformance of the U.S equity markets over the past decade.

Private capital fundraising, which attracts the likes of PE firms, family offices, and sovereign wealth funds, is usually accomplished through long-term, pooled investment strategies that manage portfolios of privately held companies—or other assets, such as credit, real estate, and infrastructure. Investing in the private markets generally refers to providing equity and debt capital to companies that are not listed on public exchanges. This type of investment has typically been limited to institutions and wealthy individuals deemed accredited investors by the SEC. In recent years, the prospect of rising future liabilities and diminished expected returns for most asset classes has driven more investors to increase their exposure to private markets in search of growth, yield, and diversification.

Figure 1: Top 10 countries by PE fundraising

Five-year period ending 3/31/2023

Source: PEI300. Data as of 3/31/2023.

As the largest asset class within the private markets, PE offers the potential for enhanced returns and an expanded opportunity set beyond traditional public equity markets, including exposure to companies and technologies in the earliest stages of growth and development. PE firms raise capital from qualified investors known as limited partners (LPs) in order to invest in privately owned companies. Their objective is to significantly increase the value of their portfolio companies and then sell them—or their equity stake—for a profit. Investments typically fall into three main categories broken out by stage. These include buyouts, where a controlling interest in an established company is purchased, usually with a combination of debt and equity, or growth equity, in which capital is provided to help a company grow in exchange for a minority interest. Venture capital (VC) targets early-stage startups, often with disruptive technologies and new business models, that have the potential for exponential growth. VC tends to come with greater risk due to its focus on young companies with uncertain prospects.

Today, the U.S. dominates the PE industry globally, managing more than $3 trillion in buyout and growth equity assets1 , and nearly $1 trillion in VC.2 The country is also home to eight of the 10 largest PE firms in the world and leads in capital fundraising (Figure 1). In 2023, 70% of PE capital was raised in North America, primarily by U.S firms.3 North America is the favored region globally for invested capital, with more than 50% of PE funds worldwide focused on the area.4 Very few countries have been able to match America’s ability to build successful companies—from startups to multi-billion-dollar firms—making it an attractive destination for investors and entrepreneurs from all around the world. As the industry has grown, its contribution to the economy has become more significant. In 2022, it supported 6.5% of the country’s gross domestic product (GDP) and had a total economic impact of around $1.7 trillion, employing over 12 million Americans, earning $1 trillion in wages.5

Figure 2: U.S. PE funds have a strong record of outperformance*

U.S. PE returns vs. Russell 3000 Index over multiple time horizons

Source: Cambridge Associates U.S. Private Equity benchmark data as of September 30, 2023.

*Cambridge Associates uses the pooled horizon IRR calculation to calculate the official quarterly, annual, and multi-year index figures. It’s based on data compiled from 1,538 U.S. private equity funds, including fully liquidated partnerships, formed between 1986 and 2023. The Russell 3000 PME calculation is a private-to-public comparison that seeks to replicate private investment performance under public market conditions.

The PE industry has seen strong growth over the past two decades as its superior returns and perceived lower volatility continue to attract new capital from investors. PE’s performance advantage stems in part from a larger investable universe. While there are hundreds of thousands of private U.S. companies, the number of publicly listed entities has fallen from 8,000 in 1996 to fewer than 4,000 in 2023.6 The growing availability of capital means more companies are opting to stay or go private, avoiding the enhanced regulation, disclosure requirements, and shareholder pressures that come with being a publicly traded company. In 2022, for instance, U.S. buyout firms spent a record $195 billion to acquire 47 publicly traded companies, with “take-privates” accounting for about 19% of all U.S. deals by value.7

With a larger and more dynamic opportunity set, PE firms have become skilled in value creation and delivering attractive risk-adjusted returns for their investors. For example, buyout/growth equity funds, the largest and most developed segment of the market, have maintained a consistent record of outperforming the broad U.S. public equity market, particularly over medium and longer time periods (Figure 2). Fund managers often will look for fundamentally sound companies that can be improved through operational efficiencies and management changes and then sold for a higher multiple on invested capital at exit. While average PE returns often compare favorably to U.S. public equities, individual PE fund performance may deviate meaningfully, thus manager selection is imperative.

There are other risks and limitations to consider. PE investments are generally long-term commitments, which can result in limited liquidity. It can take years before an investor realizes a return. PE firms often charge higher management fees due to the expertise and resources required when managing a portfolio of privately held companies. There is also a risk of losing invested capital as not all PE investments will be successful. It is important for investors to carefully consider their risk tolerance, liquidity objectives, and time horizon before investing in PE.

In recent years, we have also seen a flood of new capital enter the VC market, driven in part by record-low rates, pandemic-induced disruption, the rapid pace of innovation, an increase in high-growth U.S. companies, and a big appetite for tech initial public offerings (IPOs). At the height of the VC market in 2021 U.S. firms raised a record $128.3 billion, representing a 47.5% year-over-year increase from 2020.8 VC firms seek to earn higher overall returns by providing foundational capital to startups with growth potential, often in emerging, high risk industries, such as generative AI and quantum computing. This type of strategy has the greatest dispersion of returns with a high rate of failure being offset by a small number of home runs. Incredibly successful bets, such as Meta, Alphabet, Airbnb, and Uber have generated hundreds of millions of dollars for early investors. The prospect of big gains has attracted some of America’s most sophisticated investors, including large university endowments, which on average held 14.5% of their assets in VC in 2022, up from 7% in 2017.9

At a macro level, VC has historically been an important engine of U.S. economic growth and progress, providing capital for companies to invest in new technologies and transformative business models. Through their funding, mentorship, and industry expertise, VC firms encourage entrepreneurship and risk taking, which in turn can lead to technological advancements and scientific breakthroughs. Major research universities, such as Stanford, MIT, and Harvard, have traditionally worked with VC firms in R&D across the fields of science and technology, with the goal of commercializing new advancements. This innovation ecosystem has enabled the U.S. to lead the world in the development of critical technologies, notably the computer, semiconductors, the internet, and GPS. In recent years, VC has contributed to the dynamism of the U.S. economy by backing high-growth startups that eventually became established companies with competitive advantages in their respective fields, such as Instagram, LinkedIn, Meta, Alphabet, Uber, Lyft, Coinbase, PayPal, and Zoom Technologies, to name a few.10

Today, North America attracts nearly 50% of global capital fundraising, led by California’s Silicon Valley (SV), New York City, Los Angeles, Boston, and Seattle.11 SV has access to a large number of prospective investors, including tech-savvy billionaires with an appetite for risk—making it one of the most developed VC ecosystems globally with over $350 billion invested in companies between 2017 and 2Q 2023.12 The U.S. also continues to be at the forefront of next-gen technologies, most recently in areas like generative AI and climate tech, supported by private capital. America, for instance, raised $47.4 billion in private capital for AI in 2022, 50% of the global total. America also has the largest number of newly funded AI startups. OpenAI, funded by Microsoft and other private investors, is one of the world’s biggest AI success stories to date.13

Investors once gained exposure to the growth potential of groundbreaking startups and technologies through the stock market after these companies went public. From the end of World War II through the early 1970s, fast-growing companies in need of capital typically raised it in the public markets via an IPO. As more investors enter the private markets, companies are remaining private longer, often utilizing growth equity capital to expand under the radar, free from public scrutiny. Since the 1990s, the average age of companies going public via IPO has increased from eight to 11 years.14 Uber and Airbnb, for example, two of the largest tech IPOs ever, waited 10 and 12 years, respectively. Further, around 30% of companies that went public in 2020 raised over $100 million before their IPOs. In 2015, this percentage was just 7%.15 Consequently, companies are experiencing more of their growth in the pre-IPO stage, making private markets essential when trying to access such opportunities. Private offerings now account for approximately 70% of new capital raised in the U.S. markets.16

Today, advancements in digital technologies including the cloud, Internet of Things (IoT), and AI, are helping companies to build and scale disruptive businesses and technologies at a rapid pace. As more investors seek exposure to technological change, startups are raising record amounts of capital and growing in size and value. This can be seen in the rise of unicorns—tech startups with valuations of $1 billion or more. Between 2017 and 2021, growth equity’s share of private tech investment increased from 19% to 27% as PE firms deployed large amounts of capital to help relatively mature startups pursue breakthrough innovation and scale in such areas as commercial space travel, nuclear fusion, and biotech.17 As of 2024, there are currently more than 1,300 unicorns worth in excess of $6 trillion around the world, with over 50% located in the U.S. (total estimated value of $3.2 trillion). SpaceX, for example, an American spacecraft manufacturer founded by Elon Musk, has a valuation of over $100 billion.18 Notably, AI startups comprised 44.4% of new U.S. unicorns in 2023.19

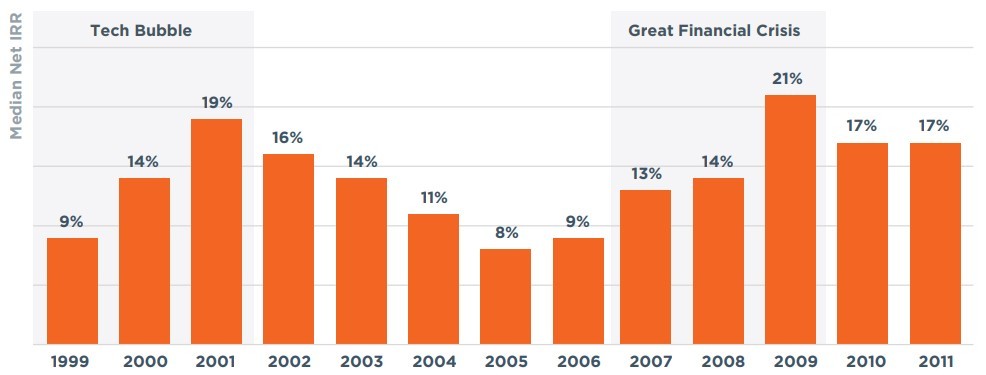

Figure 3: Post-recession PE vintages tend to outperform

Median U.S. PE fund Net IRR by vintage year

Source: Cambridge Associates U.S. Private Equity Index.

Data as of June 30, 2022.

PE firms have historically played a vital role in supporting the U.S. economy, providing capital for companies, and in turn, potentially generating returns for investors. In times of macro uncertainty or global crisis, they often become even more important. During the 2020 pandemic, for example, PE firms invested billions of dollars to help struggling companies in hard-hit industries like retail, entertainment, and travel as the U.S. economy shut down. This included providing capital for existing portfolio companies to retain employees and meet critical expenses, as well as acquiring companies experiencing financial distress or in bankruptcy. In 2020, PE raised $450 billion with $14 billion invested in companies in bankruptcy or financial trouble. Examples include rental car company Hertz and retailer Brooks Brothers.20

What is good for private companies can also be good for investors. History has shown that some of the best performing fund vintages—years in which funds are formed—have been deployed in economic downturns and periods of market stress. This is evident looking at the vintage years that occurred during the tech bubble and great financial crisis (Figure 3). During these periods, PE firms had opportunities to invest in companies at more attractive valuations, improve their operational performance and profitability, and then potentially realize large gains at exit. Unlike other investment vehicles such as mutual funds, exchange-traded funds (ETFs), and hedge funds, PE firms have more flexibility to hold dry powder (cash committed by LPs) and wait for the right moment to make an investment. They also have more control around the duration of investments, allowing them to exit companies at better valuations. While the industry has struggled over the past two years amid rising interest rates, falling valuations, and a weak IPO market, history suggests this might be another opportune time for PE firms to optimize future returns.21 Manager selectivity is still key, however.

Despite the opportunities that may come with heightened market volatility and lower valuations, not all investments will be long-term winners. Economic downturns or changes in industry dynamics may negatively impact the performance, or return potential, of individual companies in a PE fund. Raising capital from investors can also be more challenging during times of economic stress.

The pandemic also demonstrated the importance of VC in driving innovation and scientific breakthroughs when they're needed the most. History has shown that technological advancements accelerate during times of uncertainty and global challenges. The depth of America’s private markets means companies have the tools and resources they need to continually innovate and adapt. VC firms have become skilled at adjusting portfolio strategies as market conditions change—investing in companies, technologies, or industries that are more resilient or in higher demand.

In 2020 and 2021, for instance, capital poured into startups that might help the U.S. manage, or end, the pandemic. In 2021, VC firms invested approximately $329.9 billion across industries like pharmaceuticals and biotech, e-commerce, food delivery, fitness, and work-from-home technologies. While some of these investments were reflective of “irrational exuberance” in a low interest rate/risk-on environment, venture-backed firms like Zoom Technologies and bio-tech company Moderna were critical to enabling remote work and finding a vaccine.22 Today, we are seeing investment in technologies that promote business efficiency, national security, and long-term resilience, such as generative AI, automation and robotics, cybersecurity, defense tech, and clean energy. Additionally, VC deal count has fallen less than deal value, indicating that valuations are becoming more reasonable, making the asset class a more attractive proposition for investors.23

The evolving investment landscape has demonstrated the valuable role private capital has played in U.S. economic exceptionalism and the outperformance of the U.S. stock market over the past decade. By infusing businesses with capital and industry expertise, PE firms have helped to spur growth, productivity, and job creation. Today, the depth of America’s investment ecosystem provides a level of innovation and scale that remains largely unmatched by other nations. For qualified investors willing to take on greater risk, PE has become an important contributor to long-term growth and diversification. It can also provide access to unique investment opportunities not available in public equity markets.

At Wilmington Trust, we believe investing in the private markets is a long-term endeavor that requires discipline and a strong manager selection process to identify compelling, high-quality opportunities. As more investors enter the private markets and companies opt to stay private, we expect private capital to play an increasingly important role in the U.S. economy as a force for growth and wealth creation.

Please complete the form below and one of our advisors will reach out to you.

1 Tim Clarke, et al., “2024 US Private Equity Outlook,” PitchBook, December 19, 2023.

2 “Quantitative Perspectives: US Market Insights,” Pitchbook, Q1 2024.

3 Torsten Slok, Jyoti Agarwal, and Rajvi Shah, “Outlook for Private Markets,” Apollo Global Management, September 2023.

4 "Target region of global private equity funds 2021,” Statista Research Department, August 30, 2022.

5 Economic contribution of the US private equity sector in 2022,” (investmentcouncil.org) EY, April 2023.

6 Nicole Goodkind, “America has lost half its public companies since the 1990s. Here’s why | CNN Business,” CNN Business, June 9, 2023.

7 Madeline Shi, “Why PE’s take-private joyride is downshifting,” PitchBook, January 23, 2023.

8 Priyamvada Mathur, “Six charts that show 2021’s record year for US venture capital,” Pitchbook, January 18, 2022.

9 Juliet Chung and Eliot Brown “Big University Endowments Hampered by Startup Write-Downs, MSN, October 23, 2023.

10 “Can Silicon Valley still dominate global innovation?” The Economist, April 16, 2022.

11 “Global Startup Ecosystem 2023,” StartupBlink, 2023.

12 Nalin Patel and Charlie Farber, “Global VC Ecosystem Rankings,” PitchBook, October 10, 2023.

13 “Artificial Intelligence Index Report 2023,” Stanford University Human-Centered Artificial Intelligence.

14 “Private markets have grown exponentially,” The Economist, February 23, 2022.

15 Christian Buecker, Greg Fiore, Dunigan O’Keeffe, and Sean Tanaka, “The age of unicorns is not over. Here’s why you shouldn’t count out tech’s growth equity investors,” Fortune, December 1 , 2022.

16 Commissioner Allison Herren Lee, “Investing in the Public Option: Promoting Growth in Our Public Markets: Remarks at The SEC Speaks in 2020,” SEC.gov, October 8, 2020.

17 Buecker, Fiore, O’Keeffe, and Tanaka, “The age of unicorns is not over. Here’s why you shouldn’t count out tech’s growth equity investors.”

18 Jordan Rubio, “Unicorn Companies Tracker,” PitchBook, March 1, 2024.

19 Jacob Robbins, “4 charts: 2023’s VC investor pullback,” PitchBook, January 18, 2024.

20 “Private Equity Is Helping Drive the Economic Recovery During COVID-19 - American Investment Council,” American Investment Council, December 4, 2020.

21 “Quantitative Perspectives: US Market Insights.”

22 “Q4 2021 PitchBook-NVCA Venture Monitor,” Pitchbook, January 13, 2022.

23 “Quantitative Perspectives: US Market Insights.”

DEFINITIONS

The Bloomberg U.S. Corporate High Yield Index, formerly Lehman Brothers U.S. High Yield Corporate Index, measures the performance of taxable, fixed-rate bonds issued by industrial, utility, and financial companies and rated below investment grade. Each issue in the index has at least one year left until maturity and an outstanding par value of at least $150 million.

MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 developed markets countries around the world, excluding the U.S. and Canada. With 902 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets Index captures large- and mid-cap representation across 26 emerging markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, representing approximately 92% of the total market capitalization of the Russell 3000 Index.

Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which representsapproximately 8% of the total market capitalization of the Russell 3000 Index.

Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market.

S&P 500 index measures the stock performance of 500 large companies listed on stock exchanges in the U.S. and is one of the most commonly followed equity indices.

DISCLOSURES

This article is for educational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or as a determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on their objectives, financial situations, and particular needs. This article is not designed or intended to provide financial, tax, legal, accounting, or other professional advice since such advice always requires consideration of individual circumstances. If professional advice is needed, the services of a professional advisor should be sought.

References to company names in this article are merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies.

References to specific securities are not intended and should not be relied upon as the basis for anyone to buy, sell, or hold any security. Holdings and sector allocations may not be representative of the portfolio manager’s current or future investments and are subject to change at any time.

The information in this article has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. The investments or investment strategies discussed herein may not be suitable for every investor. There is no assurance that any investment strategy will be successful.

Third-party trademarks and brands are the property of their respective owners. Third parties referenced herein are independent companies and are not affiliated with M&T Bank or Wilmington Trust. Listing them does not suggest a recommendation or endorsement by Wilmington Trust.

Investing involves risks, and you may incur a profit or a loss. Past performance cannot guarantee future results.

Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Stock risks:

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this document will be profitable or equal any corresponding indicated historical performance level(s).

Securities markets are volatile and the market prices of securities may decline. Securities fluctuate in price based on changes in a company’s financial condition and overall market and economic conditions.

CFA® Institute marks are trademarks owned by the Chartered Financial Analyst® Institute.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

What can we help you with today