Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

February 23, 2022—The rapidly escalating Russia–Ukraine conflict has dominated the news flow and financial market action over the past few weeks. The S&P 500 on Tuesday hit a new low for the year, correcting -10.25% since January 3. Wilmington Trust’s Investment Committee has been in constant communication and meeting with increased frequency. As of Tuesday, February 22, we are maintaining our current portfolio positioning and continuing to closely monitor the evolving situation.

An investment lens

Russian troops stationed on the border of Ukraine or in Belarus have nearly doubled since January 30. Russian President Putin gave a speech on Monday directly challenging Ukraine’s sovereignty, which was immediately followed by recognizing Ukraine’s separatist regions of Donetsk and Luhansk. It is unclear whether this is the end of just the beginning of Putin’s attempt to reclaim what he sees as rightfully his. Some sanctions have been announced by the UK, Europe, and the U.S., while Russian’s Nord Stream 2 pipeline will remain on hold indefinitely.

The events transpiring in eastern Europe are of historic importance, but the investor’s lens must be focused on potential transmission to the economy and financial markets. As long-term investors, we are charged with determining what—if anything—will change in terms of our global economic outlook as a result of military actions in Ukraine.

There are a variety of possible outcomes and, given the consolidation of power in a single person in Russia, it is difficult for even the most seasoned political analyst to handicap the results. From our vantage point, our base case is the global economic outlook will not be altered to a degree that would warrant a change in our portfolio positioning. We retain a modest overweight to equities, including to U.S., international developed, and emerging markets. Risks are certainly elevated, and we are monitoring the situation closely to determine if political risk could spill into economic risks, most notably through a spike in oil prices that could damage the global consumer.

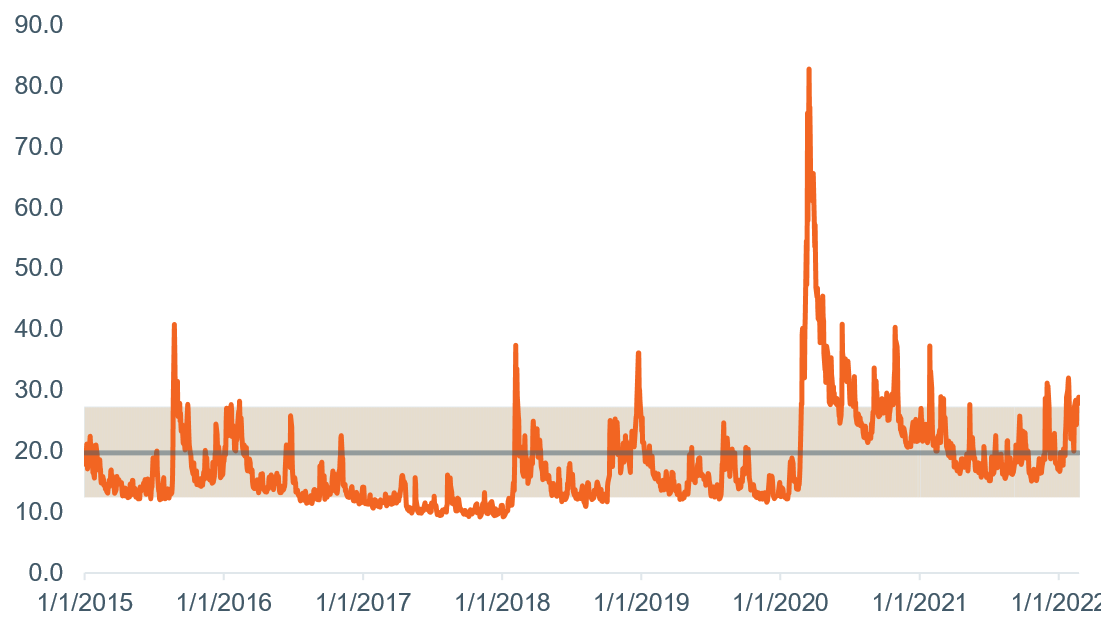

Geopolitical crises typically result in a near-term spike in volatility, and this month the CBOE Volatility Index increased to more than 2 standard deviations above the mean (Figure 1). However, an unintuitive reality is that this volatility almost always recedes with equity prices ending higher 12 months later. History is riddled with significant events that did not have a lasting impact on the market. Some exceptions include the 1956 Suez Canal Crisis, 1973 Arab oil embargo, and 9/11, each of which had unique, economic-related considerations to go along with the geopolitical issues. Timing the proper exit and entry points from a volatile, headline-driven market is also nearly impossible and could erode long-term capital appreciation versus a more patient approach.

Figure 1: Volatility elevated on fears of invasion

Chicago Board Options Exchange Volatility Index for S&P 500

As of February 22, 2022. Source: Macrobond. Shading shows 2 standard deviations above and below the VIX mean over the period.

Barring a full-scale military conflict and weaponization or sanctioning of Russia’s energy exports, we anticipate this pattern will play out yet again, with markets experiencing heightened volatility in the short term but resulting in positive returns over a 9–12-month timeframe. The key risk lies in a more significant military incursion (than the market is currently pricing) spilling over into the global economy.

An economic lens

If there are economic risks from the Russia-Ukraine conflict, we see them as coming through two channels: high energy prices that pinch consumers, and non-energy commodities that could further roil global supply chains. The risk from high energy prices is straightforward. Russia is the third-largest oil producer after the U.S. and Saudi Arabia, contributing 11% of global supply in 2020. Prices could be triggered higher by disruptions to production or sanctions, which could then impair U.S. and global consumers that are already dealing with the highest inflation in decades. We view consumers to generally be in good shape with high levels of savings, job growth, and rising wages, but if the conflict led to persistently higher prices, it could weaken the global recovery.

The second channel is more complicated yet possibly more significant. Russia and Ukraine are important suppliers of many commodities, including the familiar and the obscure. On the familiar side, Russia exports about 9% of global aluminum and 8% of copper. The two countries combined export nearly 30% of the world’s wheat. Possibly less well known is Russia’s status as the second-largest and largest producer of potash and urea, respectively, both of which are fertilizer ingredients. The country also supplies 43% of palladium, a necessary component of catalytic converters. The world is already struggling with semiconductor supply and may face more challenges if Ukraine (a key source of multiple necessary gasses used in production) were to be disrupted. A sustained, large-scale conflict could have ripple effects for already-challenged global supply chains.

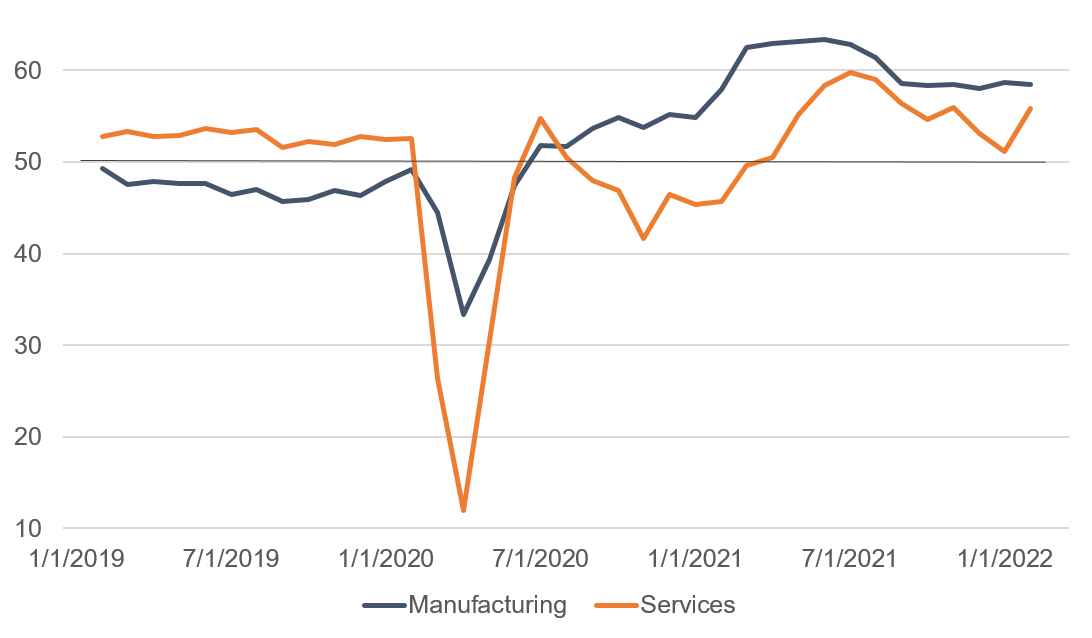

Figure 2: Eurozone economic activity in good shape

Eurozone purchasing manager indices (above 50 = expansion)

Sources: IHS Markit, WTIA. Last data point: February 2022.

Stepping back from the possible impacts of the conflict, we started the year with a positive outlook for the global economy, including for those of international developed nations. The European and Japanese economies were set up for stronger performance than the U.S. by some measures. Bloomberg consensus forecasts for eurozone real economic growth of 4.0% in 2022 would be a deceleration from last year (5.1%), but much less so than the U.S. and still well above the 20-year pre-COVID average growth rate of just 1.4% per year. We expect the $900 billion European Union recovery fund to boost growth later in 2022 and the most recent high frequency data showed those economies shaking off the negative effects of Omicron (Figure 2). The service sector bounced back in February 2022 with the strongest expansion in five months while the manufacturing sector continued to chug along with strong growth.

Elsewhere, Japan’s government is deploying that country’s largest stimulus on record and is forecast to post an acceleration in growth this year to 2.9%, more than triple the 20-year average. Not to be left out, China recently moved back into pro-growth mode. Leaders there spent much of 2021 cracking down on specific sectors and companies with regulation, while also reducing the flow from the monetary and fiscal spigots to slow the economy. By year end, a combination of weaker growth and COVID challenges pushed China back to rate cuts and economic support. The optimistic international outlook accompanies our expectation of solid economic growth in the U.S. of 3%. We maintain a positive economic outlook and continue to monitor challenges to that outlook emanating from the conflict.

Core narrative

Geopolitical events are likely to keep volatility elevated in the short term, but our base case does not include a material deterioration in the global economy. In the U.S. we expect solid, above-trend GDP growth of 3% in 2022. We have similarly constructive economic outlooks for regions like Europe and Japan, and we see valuations as relatively more attractive outside of the U.S.—offering potentially greater upside should tensions recede. Today’s focus is on the conflict between Russia and Ukraine, but we cannot take our eyes off the outlook for inflation and monetary policy. We are maintaining a modest overweight to equities across major asset classes, funded mainly through an underweight to investment-grade fixed income. Diversification remains paramount in these markets, and we stand ready to adjust portfolios as the situation warrants.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

S&P 500 index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today