Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

It’s been over 16 months since Russia’s tanks rolled across the Ukrainian border. In that time investors have grappled with commodity shocks from oil—Brent crude eclipsed $120/bbl last March—and wheat prices that reached all-time highs just weeks after the invasion. As fighting grinds on, the conflict has become a secondary focus for investors who remain fixated on the Federal Reserve’s (Fed) battle with inflation and tighter monetary conditions. Recent developments have brought the war back into headlines and shown how quickly geopolitical events can evolve and threaten the stability of powerful regimes.

Details on the advance

Last weekend, one of the most surprising geopolitical events of the year occurred when Russia’s paramilitary forces, known as the Wagner Group, launched a mutiny on Russian soil. The timeline of the Wagner Group’s advance into Russia was short lived with the campaign unfolding in just 36 hours. It was reported that Yevgeny Prigozhin, the leader of the mercenary group, led around 8,000 troops north from Ukraine into Russia, shooting down six Russian helicopters and killing several dozen Russian soldiers. Initially, Wagner forces took the southern city of Rostov-on-don, a known staging area for the Russian military before heading into Ukraine. The people of Rostov welcomed Wagner troops with water and were seen celebrating in the streets, a potential sign that the people remain ready for a change of leadership in Russia.

Prigozhin and his troops were met with little initial resistance and quickly advanced to within 120 miles of the capital city of Moscow. However, in an abrupt turn of events, Wagner forces abandoned the mutiny after the dictator of Belarus, Alexander Lukashenko, brokered a deal between Putin and Prigozhin. It is unclear why Prigozhin abandoned his offensive. Many in the intelligence community believe that once reaching Moscow, Wagner forces were not widely supported by Russian elites, and may not have had enough power to hold the city. Regardless, the rapid advance of the Wagner Group has been likened to what the invasion of Ukraine was supposed to look like from Putin’s perspective.

Triggering the mutiny

It was reported this week that the objective of Wagner forces was to capture Russia’s Secretary of Defense Sergei Shoigu, and General Valery Gerasimov, but the plan was accelerated after Russian intelligence services became aware of Prigozhin’s intentions. While the motive behind the mutiny is unclear, there are several theories as to what led to the attack.

It’s no secret that Prigozhin has been critical of Shoigu and Gerasimov over the handling of the war, mobilization efforts, and general incompetence. Recently, Prigozhin has stepped up his criticisms of the two leaders and even questioned the rationale for the war itself. One possible reason for the mutiny is that Shoigu angered Prigozhin after he ordered all military detachments to sign contracts with Russia’s defense ministry. According to the order, the Wagner Group would be folded into the Russian army, or risk disbandment. Another potential cause is that Prigozhin repeatedly claimed that Russian leaders failed to sufficiently supply Wagner troops with the necessary ammunition and supplies to capture the Ukrainian town of Bakhmut, a battle that lasted over nine months and caused heavy casualties for both sides.

Implications for Ukraine

Recent events could certainly boost morale for the Ukrainian military, but it will ultimately change little on the front lines. While Ukrainian forces have made slow progress in their offensive efforts, Russia’s air superiority has caused major problems. While Putin is in charge, a ceasefire seems unlikely, meaning the war will likely grind on. Wagner forces have been Russia’s most effective combatants, but have not played a leading role in the recent defensive and counter-offensive operations. Regardless, there will be a loss to Russian forces on some level as Wagner troops—who took place in the mutiny—are forced to relocate to Belarus, Africa, or risk being decommissioned. Next month North Atlantic Treaty Organization (NATO) leaders will convene in Vilnius, Lithuania. The goal of the meeting is to increase the level of support for Ukraine, although it is unlikely that Ukraine will be invited to join the NATO alliance.

Implications for Russia

The attempted mutiny makes Putin look weak and could open the door for his political opponents to prepare for a post-Putin era in Russia. There will likely be more instability in Moscow as Putin could conduct a purge or deliver repercussions to top military leadership in an attempt to appear stronger. Russian forces could also deploy tactical nuclear weapons or destroy the Zaporizhzhia nuclear plant to reassert the perception of strength. The risk may be losing further support from countries like China and India that, until now, have been ambivalent toward the war.

Implications for China

China is in a difficult position as the country needs grain exports from the Black Sea, depends on cheap Russian oil and gas, and prefers Putin’s allegiance. In addition, China-Russia relations have strengthened, with President Xi describing Putin as a “dear friend,” causing blowback from countries across the western Pacific. In response, countries such as Japan, Australia, and South Korea, have all increased defense spending and deepened ties with the U.S.

Market reaction

The bottom line is that this event has weakened Putin’s grip on power, but it’s too early to tell whether this will lead to the end of Putin’s reign. Interestingly, since the Wagner offensive the market’s reaction has been relatively muted with price action lacking even the short-term volatility typically experienced during geopolitical turmoil. On Monday, European natural gas jumped +10% at market open but ended the session down about -3%. Brent crude oscillated between modest gains and losses before ending +0.3% on Monday. Crude prices have edged up slightly this week but have had dismal returns year-to-date and have been driven lower by demand expectations rather than geopolitical headlines. Wheat prices were also in focus as Russia and Ukraine account for a significant portion of grain exports to countries across Africa and the Middle East. Wheat futures surprisingly have traded down about 12% this week as the commodities markets continue to look past this event.

Figure 1: European natural gas prices have dropped precipitously in the last year

European natural gas benchmark price (Dutch TTF, EUR/MWh)

Source: Bloomberg. Data as of June 30, 2023.

Core narrative

We anticipate that the conflict is likely closer to the beginning than the end. The war in Ukraine has largely receded into the background this year, but it remains an important consideration for international developed equities, where we are underweight versus our long-term strategic benchmark. The Wagner offensive increases the risk that Putin will up the stakes in the war, and a material escalation—such as the use of nuclear weapons—would most likely get investors’ attention. For now, China remains a more important geopolitical driver, given its importance for the global economy.

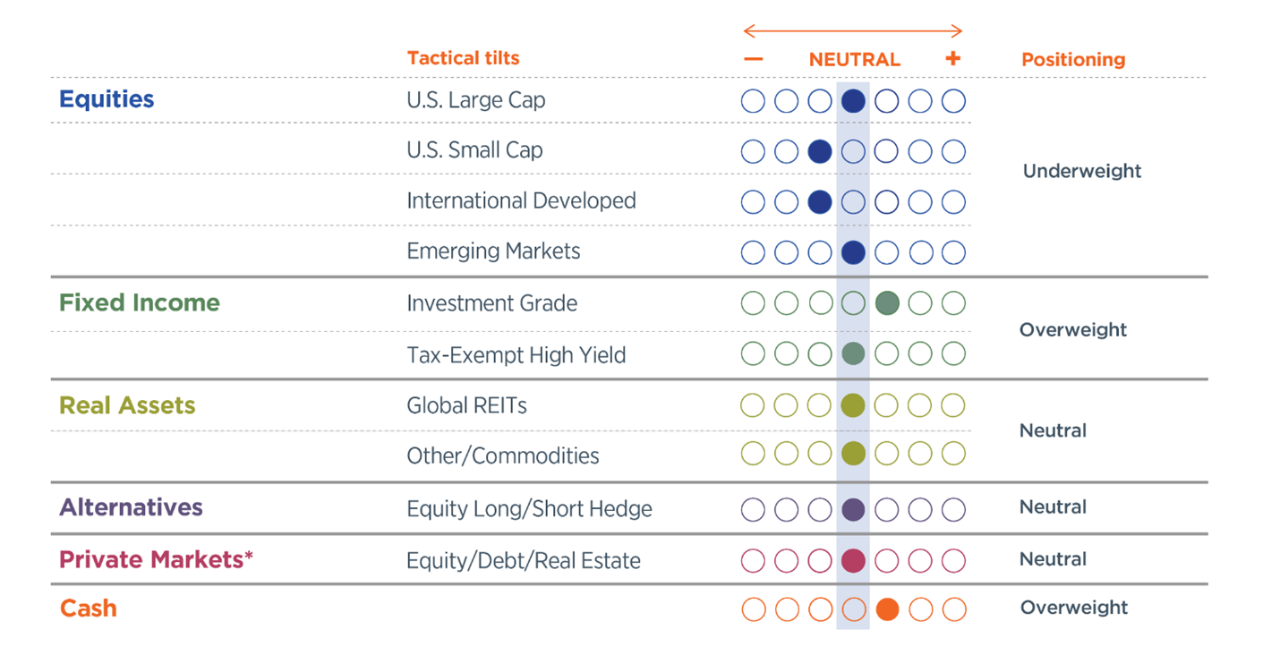

We are positioning portfolios defensively in anticipation of a weakening U.S. economy, with a roughly 50% probability of a recession over the next 12 months. Within equities, we continue to prefer the quality factor, which has held up well this year and would be expected to outperform if equity volatility returns. We hold an overweight position to fixed income and cash and remain neutral across other asset classes.

Figure 2: Current positioning

High-net-worth portfolios with private markets

Data as of June 1, 2023. Positioning reflects our monthly tactical asset allocation (TAA) versus the long-term strategic asset allocation (SAA) benchmark. For an overview of our asset allocation strategies, please see the disclosures.

* Private markets are only available to investors that meet Securities and Exchange Commission standards and are qualified and accredited. We recommend a strategic allocation to private markets we do not tactically adjust this asset class.

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment. Investment in a security or strategy designed to replicate the performance of an index will incur expenses such as management fees and transaction costs which will reduce returns.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

Any investment products discussed in this commentary are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by M&T Bank, Wilmington Trust, or any other bank or entity, and are subject to risks, including a possible loss of the principal amount invested.

Some investment products may be available only to certain “qualified investors”—that is, investors who meet certain income and/or investable assets thresholds.

Alternative assets, such as strategies that invest in hedge funds, can present greater risk and are not suitable for all investors.

Any positioning information provided does not include all positions that were taken in client accounts and may not be representative of current positioning. It should not be assumed that the positions described are or will be profitable or that positions taken in the future will be profitable or will equal the performance of those described.

Wilmington Trust offers seven asset allocation models for taxable (high-net-worth) and tax-exempt (institutional) investors across five strategies reflecting a range of investment objectives and risk tolerances: Aggressive, Growth, Growth & Income, Income & Growth, and Conservative. The seven models are High-Net- Worth (HNW), HNW with Liquid Alternatives, HNW with Private Markets, HNW Tax Advantaged, Institutional, Institutional with Hedge LP, and Institutional with Private Markets. As the names imply, the strategies vary with the type and degree of exposure to hedge strategies and private market exposure, as well as with the focus on taxable or tax-exempt income.

Model Strategies may include exposure to the following asset classes: U.S. large-capitalization stocks, U.S. small-cap stocks, developed international stocks, emerging market stocks, U.S. and international real asset securities (including inflation-linked bonds and commodity-related and real estate-related securities), U.S. and international investment-grade bonds (corporate for Institutional or Tax Advantaged, municipal for other HNW), U.S. and international speculative grade (high-yield) corporate bonds and floating-rate notes, emerging markets debt, and cash equivalents. Model Strategies employing nontraditional hedge and private market investments will, naturally, carry those exposures as well. Each asset class carries a distinct set of risks, which should be reviewed and understood prior to investing.

Allocations: Each strategy group is constructed with target policy weights for each asset class. Wilmington Trust periodically adjusts the policy weights’ target allocations and may shift from the target allocations within certain ranges. Such tactical allocation adjustments are generally considered on a monthly basis in response to market conditions.

The asset classes and their current proxies are: • Large–cap U.S. stocks: Russell 1000® Index • Small–cap U.S. stocks: Russell 2000® Index • Developed international stocks: MSCI EAFE® (Net) Index • Emerging market stocks: MSCI Emerging Markets Index • U.S. inflation-linked bonds: Bloomberg US Treasury Inflation Notes TR Index Value Unhedged* • International inflation-linked bonds: Bloomberg World ex US ILB (Hedged) Index • Commodity-related securities: Bloomberg Commodity Index • U.S. REITs: S&P US REIT Index • International REITs: Dow Jones Global ex US Select RESI Index • Private markets: S&P Listed Private Equity Index • Hedge funds: HFRX Global Hedge Fund Index • U.S. taxable, investment-grade bonds: Bloomberg U.S. Aggregate Index • U.S. high-yield corporate bonds: Bloomberg U.S. Corporate High Yield Index • U.S. municipal, investment-grade bonds: S&P Municipal Bond Index • U.S. municipal high-yield bonds: 60% Bloomberg High Yield Municipal Bond Index / 40% Municipal Bond Index • International taxable, investment-grade bonds: Bloomberg Global Aggregate ex US • Emerging bond markets: Bloomberg EM USD Aggregate • Cash equivalent: 30-day U.S. Treasury bill rate

©2023 M&T Bank and its affiliates and subsidiaries. All rights reserved.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today