Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

Equal Housing Lender. Bank NMLS #381076. Member FDIC.

May 16, 2022—Investors continue to be whipsawed by equity market volatility. The S&P 500 dropped 4.8% last week through mid-day Thursday before bouncing 4% to finish the week down just 1%. The S&P 500 has now logged six straight weeks of declines.

In our client webinar last week, we explored whether the market volatility is the result of a growth scare or a prelude to a recession. On the economic side, our assessment is that inflation has peaked, and U.S. GDP growth will slow to a still respectable 2.4% in 2022. On the market side, some measures of investor confidence have hit such bearish levels that they may represent a contrarian “buy” signal.

At the end of the webinar, our Chief Investment Officer Tony Roth posed the question, “If our base case is that market volatility represents a growth scare and not an impending recession, why not add to equities?” The answer lies in the balance of risks. Though recession is not our base case in the next 12 months, risks of an economic contraction have certainly risen. To achieve the desired moderate slowdown, or “soft landing” consumers need to pull back on spending enough to slow inflation, but not so much that economic growth contracts. This is doable but with obvious risks of an overshoot. We have already received one negative GDP print in the first quarter—even though this was entirely due to both net exports and inventories and masked underlying strength in the consumer and capital expenditures.

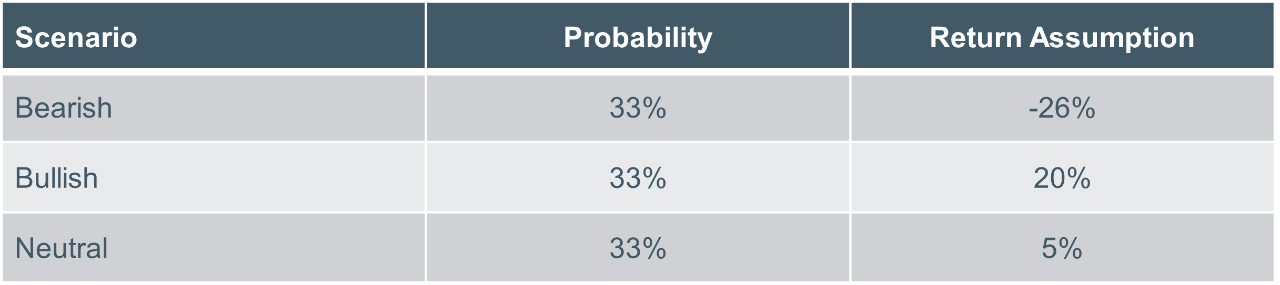

A scenario exercise can illustrate the balance of risks and why it is prudent to remain fully allocated to equities but patient in adding to risk (Figure 1).

For argument’s sake, let’s place a 33% probability on a recession occurring in the next 12 months. This is higher than estimates from most Wall Street economists but accounts for the difficulty in predicting recessions and the narrow runway for a soft landing. The average peak-to-trough loss in the S&P 500 during the last three recessions was -42%, which would represent -26% additional downside from Friday’s close.

The remaining probabilities could reasonably be split evenly between two other scenarios:

Figure 1: Scenarios for S&P 500 over the next 12 months

Source: WTIA. Scenarios above are solely for illustrative purposes.

Altogether, these probabilities and return assumptions yield an expected return of 0% for the S&P 500. We recognize that each of these assumptions can be debated, but they are reasonable based on what we know today and support patience in moving to a more aggressive risk position.

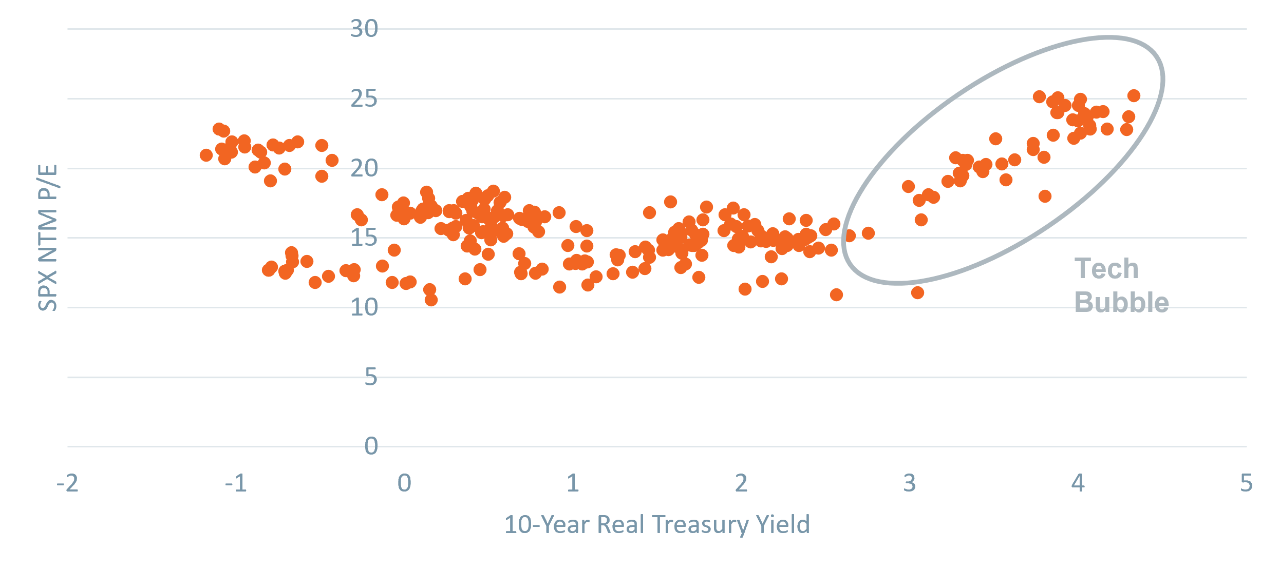

Figure 2: Real yields suggest S&P 500 price-to-earnings multiple to remain under pressure

S&P 500 P/E vs. Real Yields

Data as of May 13, 2022. Source: Bloomberg.

The example above may appear somewhat bleak, particularly for investors sitting on higher-than-normal levels of cash obtained from a liquidity event. However, few have an investment horizon of just 12 months. Long-term investors should continue to deploy cash in a planned fashion over a three to six-month horizon. Timing the bottom in the market is impossible, and any attempt to do so risks staying out of the market too long, potentially missing some of the market’s best days. We have analyzed cash deployment strategies using a long historical data series. The evidence supports deploying cash into an equity allocation over a reasonably short timeframe.

Core narrative

Our Investment Committee is continuously discussing investment risks and opportunities, particularly during volatile markets like we are presently experiencing. A recession is not our base case, and we are attuned to some sentiment indicators suggesting a contrarian buying opportunity. However, the downside risks are of sufficient probability and magnitude that a patient approach is warranted. Most importantly, investors should remain fully invested, as selling equities makes it very difficult to get back in at an opportune time. It is always easier to identify downside market risks, but upside catalysts are often obvious only when they are well in the rear-view mirror.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Reference to the company names mentioned in this blog is merely for explaining the market view and should not be construed as investment advice or investment recommendations of those companies. Third party trademarks and brands are the property of their respective owners.

S&P 500 index measures the performance of approximately 500 widely held common stocks listed on U.S. exchanges. Most of the stocks in the index are large-capitalization U.S. issues. The index accounts for roughly 75% of the total market capitalization of all U.S. equities.

Real yield is calculated by subtracting expected annual inflation from a bond’s nominal yield, so a negative real yield means that inflation expectations are higher than bond’s nominal yield.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today