Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Wilmington Trust's business leaders in corporate trust and agency services provide their perspective on the structured finance market, which includes findings from S&P's European Structured Finance Outlook 2025.

Europe's structured finance market is shaped by its cross-border nature and the variety of players involved, including originators, investors, servicers, and regulators. This includes both EU-based participants and those in the UK, which remains a major centre for structured finance activity. This environment has led to a market defined by tailored approaches rather than uniform standards.

Although recent EU policies have hinted at greater alignment, and the UK continues to evolve its own regulatory stance, firms have responded by developing deal structures that reflect local rules and specific needs. Across many transactions, we have seen a clear pattern. Market fragmentation and differing regulations are ongoing realities, such as variations in risk retention rules between EU member states or the divergence in regulatory timelines between the EU and the UK. As a result, they demand thoughtful, flexible solutions.

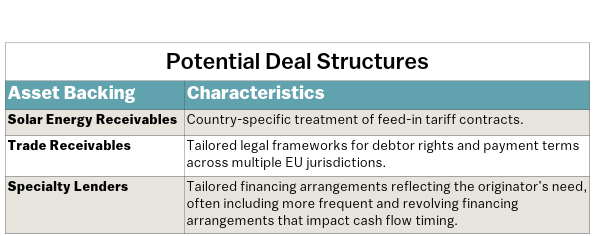

This environment has led to a strong showing of private, bespoke securitisations as a way for participants to operate. Customisation offers the flexibility needed to manage the different legal, structural, and regulatory challenges across markets. Rather than avoiding complexity, many are using it to create value in unique and specialised asset classes, such as trade receivables, renewable energy projects, and fintech-related assets.

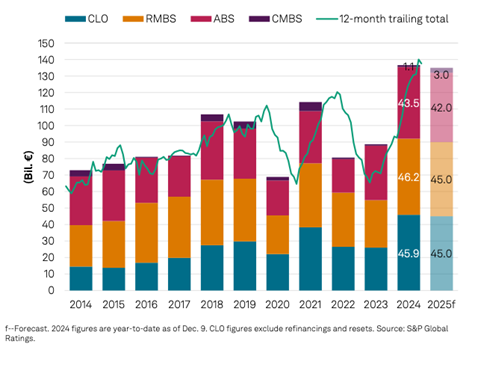

Figure 1: European investor-placed securitization issuance, S&P Global.

In this landscape, success hinges on the capacity to orchestrate tailored solutions within a fragmented framework. Early-stage alignment between issuers and trustees on cash flow structuring, role clarity, regulatory treatment, and data protocols is critical to deal execution. The winners are those who can work nimbly with complexity, using it to shape deals that fit each situation and to find new ways to get transactions done while ensuring safe and trusted servicing.

Europe's structured finance spans multiple jurisdictions, each with its own legal and regulatory framework. While there is significant standardisation at the EU level, national laws and practices still shape the specifics of each deal and, in some cases, roles. This includes navigating distinct legal environments such as the UK’s post-Brexit regulatory framework alongside EU jurisdictions.

The complexity comes from combining EU-wide rules with local variations, requiring careful attention to detail in each transaction. Luxembourg and Ireland are widely recognised as key hubs for structured finance within the EU, contributing to the complexity of the market by adding distinct, yet influential, legal and regulatory frameworks that attract cross-border securitisation activity.

Sources of Complexity

|

Firms that can handle these challenges at every step can turn complexity into an advantage, such as faster deal execution, better risk management, and stronger client relationships. The market is not moving towards simplification, but rather towards a deeper skill in managing detailed, hands-on processes that define European securitisation today.

Private securitisations show how firms are adapting to complexity, using practical approaches that fit the varied realities of the market. They have become a practical response to the unique demands of the European market. These deals thrive because they offer flexibility that public transactions often cannot, making it easier to manage local legal differences, asset-specific needs, and investor preferences.

These transactions allow arrangers and asset originators to meet investor demand for investment options designed to reflect distinct market, legal, and asset conditions. To do so, they typically involve extensive negotiations over deal terms and require documentation that is crafted to suit the needs of both investors and originators. Such documentation often includes detailed structuring around jurisdiction-specific legal considerations, unique asset classes, and unique servicing or reporting needs. As these bespoke characteristics become more common, we are also seeing the emergence of Loan Markets Association (LMA) wording within securitisation structures.

The UK's depth in financial services and legal expertise continues to attract participants, with recent growth in private credit and structured transactions reinforcing London's role as a central venue for complex deal structuring, particularly for multi-currency deals involving sterling tranches and cross-border structures. Luxembourg and Ireland play a central role in housing many of the entities and legal structures that support private securitisation transactions, particularly for pan-European and multi-currency deals. |

Because these deals are not subject to the same public ratings processes or standardised disclosure requirements, they provide more room to adjust for complexities such as varying regulatory capital treatments or atypical cash flow characteristics. While they can require more time and effort, private securitisations continue to attract interest because they allow deals to reflect the specific conditions of the assets and participants involved.

One of the clearest signs of how structured finance in Europe has evolved is the shift in how deals are documented and agreed. Public transactions often relied on standard templates to streamline documentation. In contrast, private securitisations increasingly use tailored agreements based on Loan Market Association (LMA) standards, which are negotiated to reflect the specific needs of each transaction.

Rather than relying on minor adjustments to standard templates, arrangers and advisors take the lead in building today's private deals through detailed, ground-up negotiations, with investors influencing terms during the structuring process. The old practice of blacklining (marking changes from standard documents) is now rare, as each agreement is expected to be crafted specifically for the asset class, jurisdiction, and risk profile in question.

This change in documentation has also raised expectations around how deals are managed operationally. Arrangers, issuers, and service providers need to bring practical experience and sound judgement, responding quickly to changing deal terms and anticipating challenges early. New entrants to the market can succeed by engaging early with experienced partners, who can help identify issues before they arise and adapt to evolving deal terms effectively.

Examples of potential questions to address early with trustees, agents, and other administrative service providers include:

A full-service provider can offer an end-to-end approach to these questions. In Wilmington Trust’s discussions at these early stages, clients tell us that it helps to be able to address these questions and potential interdependencies with a streamlined provider. Moreover, operational excellence alone is no longer enough; what matters now is a collaborative approach combining experience, regulatory knowledge and hands-on structuring skills can help shape deals from the outset.

Regulation continues to play an important role in shaping the structured finance market in Europe and the UK. EU-level efforts, including the European Commission’s High-Level Task Force on EU Capital Markets led by Mario Draghi and the joint report on financial stability and capital markets from Christian Noyer and other central bankers, have aimed to promote securitisation as a tool for funding growth. Further changes are on deck in areas such as the evolution of the European Capital Markets Union, Capital Requirements Directive VI (CRD VI) provisions coming into force in the next 12 months, and the eventual final contours of Payment Services Directive 3 (PSD3) for payment flows and servicing that should emerge by 2026.

These regulatory shifts will continue to set boundaries on what is possible. Requirements around due diligence, risk retention, and capital treatment, including those for insurers under Solvency II and banks under Basel III, still present challenges. These rules do not necessarily hinder deal-making, but they do require careful attention and flexibility in how deals are structured.

Private securitisations allow participants to respond more effectively to these varied regulatory demands. While public deals often follow more prescriptive paths, private transactions give issuers and investors room to address specific legal and operational challenges without being bound by some of the more rigid requirements faced in public deals.

As the market evolves, complexity remains a defining feature. We are seeing more hybrid transactions that combine elements of public and private deals, as well as continued interest in a wider range of asset classes. These developments reflect a practical truth: in a market where no single model fits all, success depends on experience, adaptability, and the ability to manage complexity thoughtfully.

Complexity is not something to eliminate or overcome. It is a fact of the market. Firms that have embraced this reality by developing adaptable and bespoke approaches are already showing how effective navigation of this landscape leads to tangible results. Understanding how to work with complexity rather than struggle against is a market advantage. A flexible trustee and agent can give firms an edge as the environment changes.

Wilmington Trust can help you navigate current and future complexities. We work collaboratively with you to ensure each transaction is executed and administered properly from beginning to end. Contact us today to discuss your transaction and needs.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today