Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

Equal Housing Lender. © 2026 M&T Bank. NMLS #381076. Member FDIC. All rights reserved.

April 9, 2021

Supply chains have gone from an under-the-radar topic of discussion amongst corporate executives in corner offices to front-page news as of late. GM’s halting of production at a number of auto plants due to a shortage of semiconductor chips is the latest to hit the headlines. A series of unexpected events—trade wars, the COVID-19 pandemic, extreme weather (February winter freeze in Texas), and most recently, the blockage of the Suez Canal—have all followed one another in jolting the international trade system. As a result, they have slowed the production and delivery of a wide range of goods (and services that depend on them) across the economy—everything from new cars and homes to ketchup packets and beer. As we noted in our 2021 Capital Markets Forecast article “Supply Chain Rethink,“ this series of shocks may result in long-term shifts in decades-old patterns of globalization, as companies reconsider supply chain decisions that had previously prioritized low-cost overseas production over the resilience of their networks.

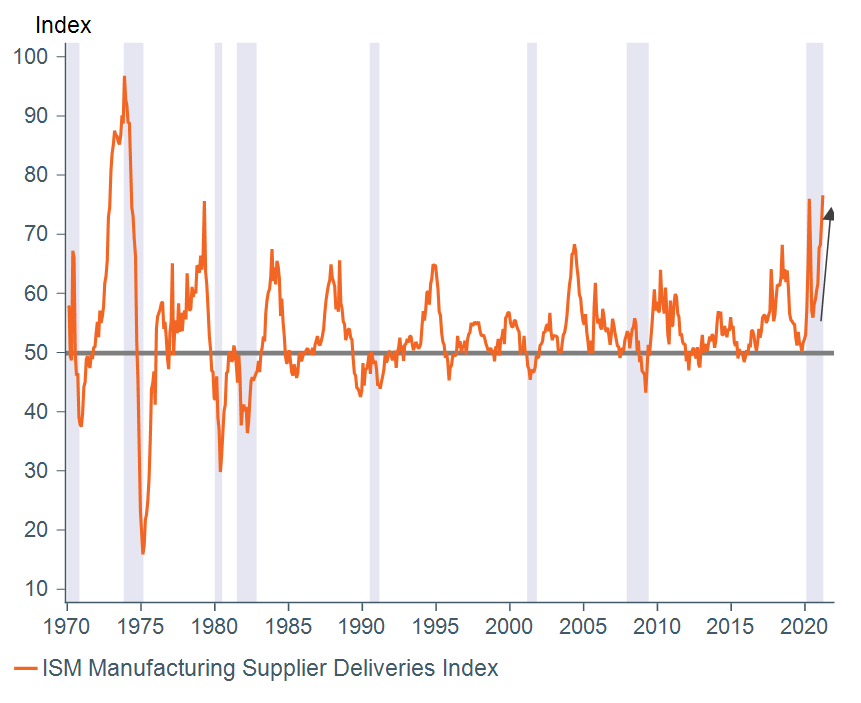

These disruptions could also have another important, though nearer-term impact, on inflation. Slower deliveries of goods (Figure 1) are constraining supply in the economy. At the same time, consumer savings boosted by fiscal stimulus and pent-up demand for services are set to be unleashed as the economy reopens more fully (assuming vaccine distribution continues, and virus counts can be stabilized). We expect this combination of lower supply and stronger demand to boost prices this year.

Figure 1: Supplier delivery times at their longest since 1974, post oil crisis

Data as of March 31, 2021. Sources: Macrobond, Institute for Supply Management®.

Demand rebounding

The most recent signal of surging demand comes from a closely followed survey of business activity from the Institute of Supply Management (ISM), which showed U.S. manufacturing activity growth in March at its strongest since late 1983. Virus concerns and restrictions have shifted consumer demand away from services and toward goods with households substituting gym memberships with home fitness equipment, dining out with kitchen appliances and groceries, public transportation with new and used cars. Demand was further boosted by the massive influx of pandemic fiscal stimulus, with nearly $1.3 trillion going directly to consumers through direct checks and unemployment insurance benefits since the start of the pandemic.[1] Recent progress on vaccinations, stabilizations in virus case counts, loosening restrictions, and warmer weather in the U.S. have also allowed services to begin reopening, with the March ISM survey showing activity in the sector at its highest on record going back to 1997.

Supply is constrained, boosting prices

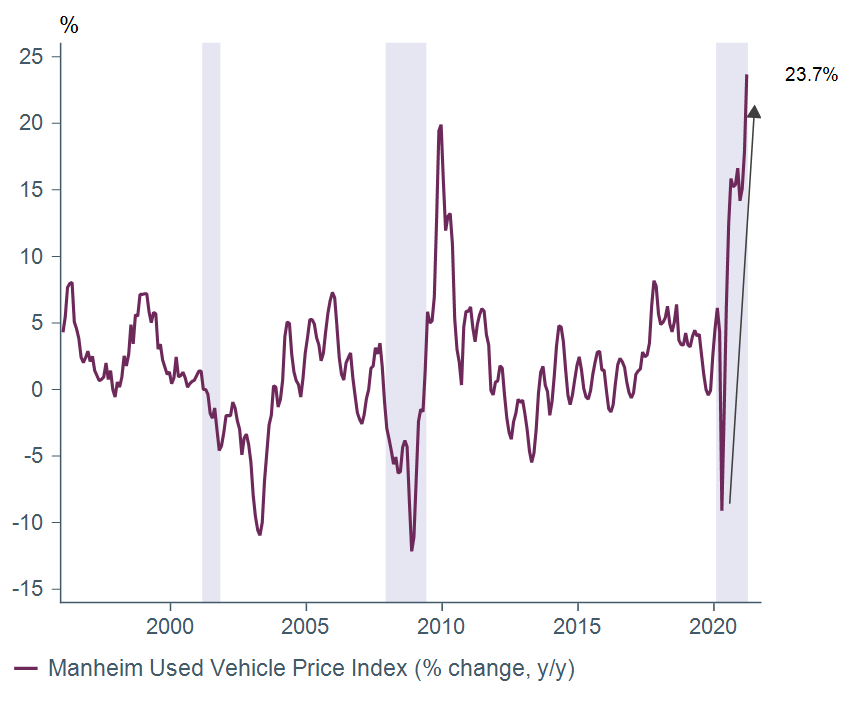

Meanwhile, manufacturers have noted difficulty in meeting demand due to supply chain disruptions. Firms have cited shortages and extended lead times for materials and challenges with transportation and port backlogs. In the auto industry, for example, a shortage of semiconductors (a key input for new vehicles, as well as for consumer electronics, both in high demand due to the pandemic), has forced automakers across the globe to reduce production or shutdown plants in recent months. This, in turn, has pushed strong demand for cars (as individuals remain wary of public transportation) into the used car market, boosting prices by 24% year over year (Figure 2).

Figure 2: Used car prices soaring in part due to supply chain disruptions

Data as of March 31, 2021. Source: Macrobond.

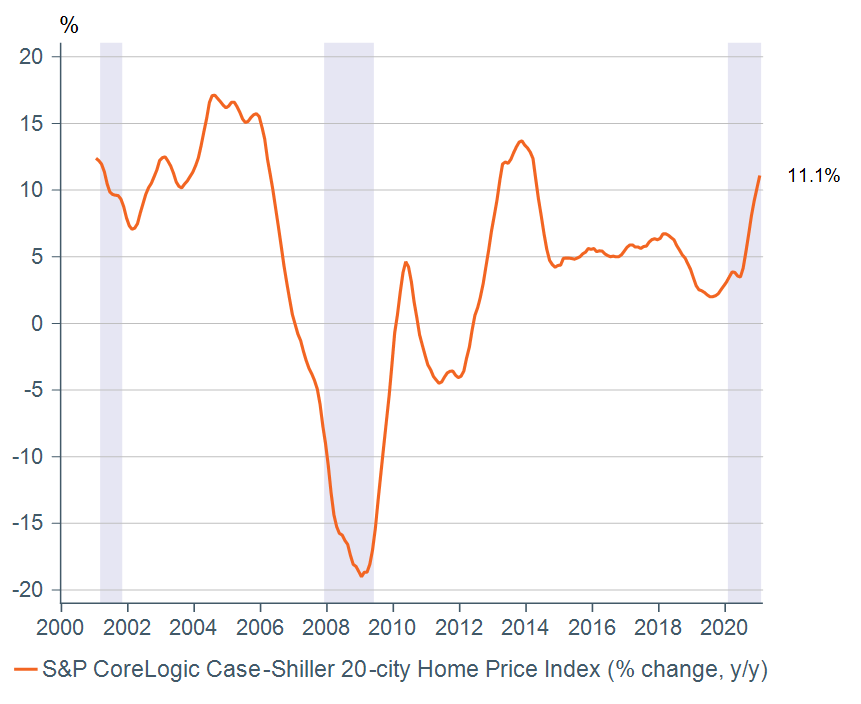

The construction industry is another example. Lumber mills cut production at the start of the pandemic on health concerns and were then caught off guard in subsequent months as demand for new housing and home improvement boomed during the recession, contrary to initial expectations. Subsequent mill closures in response to virus resurgence have made it difficult to keep up with demand. Lumber prices are now up nearly 95% since the lows of the pandemic, with the National Association of Homebuilders noting that the surge has added roughly $24,000 to the price of an average new home. Higher prices and shortages of lumber have slowed the construction of new homes, where supply was already low going into the pandemic. As a result, strong demand for housing has spilled over into the existing home market, with prices now up 11% year over year as of January 2021 (from 3.5% year over year in February 2020, Figure 3).

Figure 3: Existing house prices soaring as low supply of new homes pushes up demand

Data as of January 31, 2021. Sources: Macrobond, S&P CoreLogic Case-Shiller.

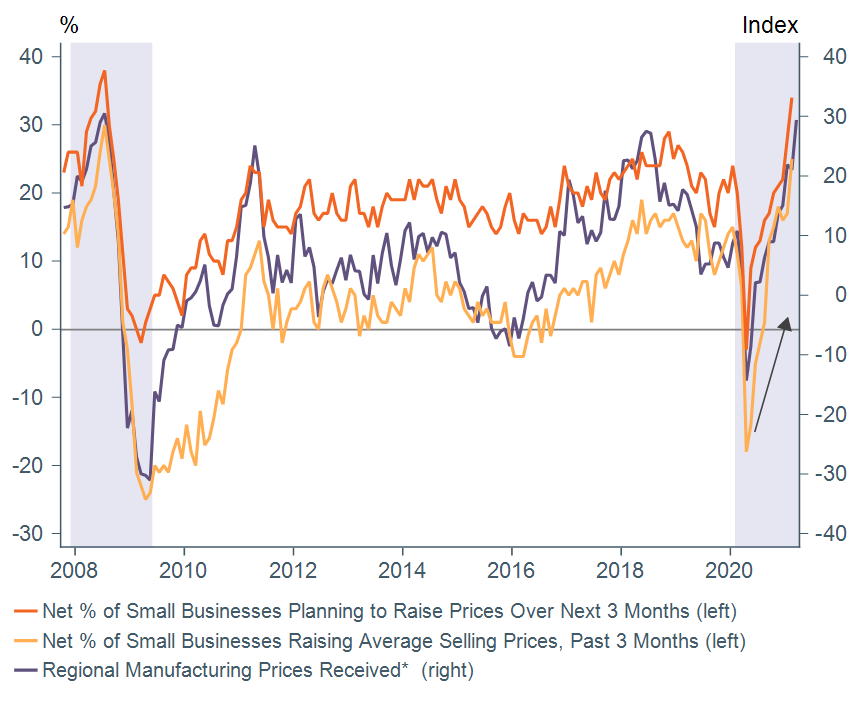

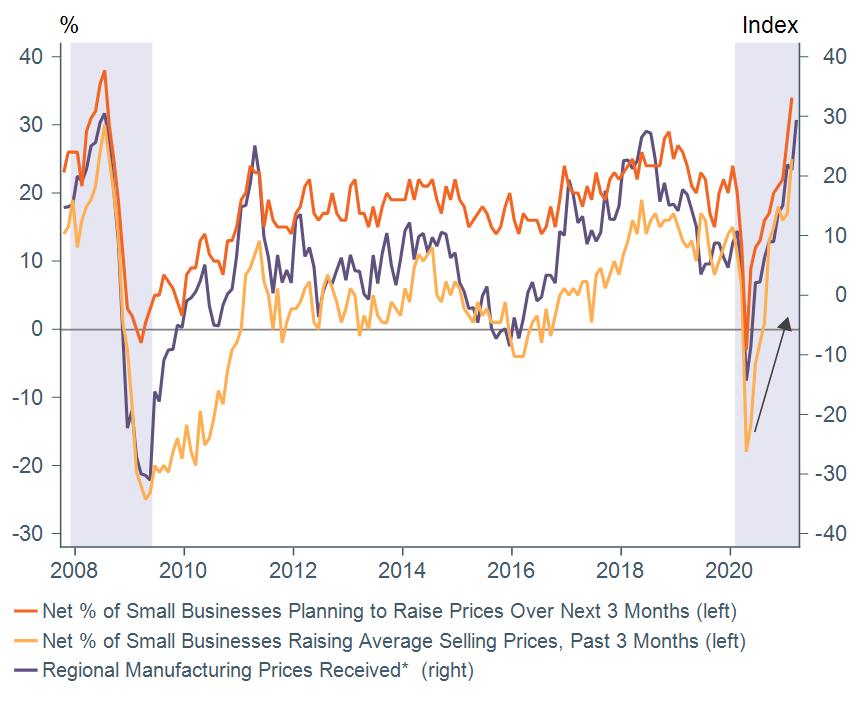

The combination of strong demand and supply disruptions have been pushing overall input prices higher for companies, with 72% of manufacturing and 52% of services firms noting input prices were higher than the prior month according the latest ISM survey. Regional manufacturer and small business surveys suggest that the strength of demand and low inventory levels have allowed firms to pass on some of their increased costs to customers (Figure 4). Plans to increase prices going forward have strengthened as well. According to the National Federation of Independent Business, a net 25% of small businesses report being able to raise selling prices over the past three months (up from 11% in February 2020), and a net 34% plan to hike prices in the coming three months (up from 20% in February 2020).

Figure 4: Manufacturers and small businesses have been able to raise prices in recent months, with small businesses planning further hikes

*Regional manufacturing prices received are an average of prices received index from the Philadelphia Fed, Empire and Dallas Fed manufacturing purchasing manager indices. Data as of March 31, 2021 for regional manufacturing prices, February 28,2021 for small business prices. Sources: Macrobond, National Federation of Independent Business, Federal Reserve Banks of Philadelphia, New York, and Dallas.

Expect inflation to moderate after near-term spike, but risks remain to upside

We expect inflation readings in March, April, and May to spike on a year-over-year basis, but for technical rather than fundamental reasons, given very low readings in the comparison months during the pandemic last year. Beyond that, the combination of surging demand at a time of constrained supply is likely to contribute to near-term inflation as well, but these should dissipate over time as virus concerns ease, allowing production capacity to fully recover and as the economy adjusts to balance supply and demand. In the longer term, we expect inflation to settle back toward pre-pandemic levels given that we do not expect runaway inflation (as discussed in our “Inflation Dynamics” 2021 Capital Markets Forecast podcast).

However, we note that risks for inflation remain to the upside. As we note in “Stimulus and Inflation Jitters Lead to Stock Market Volatility,” and in our CMF and a podcast, longer-term inflation is dependent on the interaction between consumer and market expectations and the Fed’s new approach to policy. The upside pressures coming from supply disruptions are an important indicator to watch in the event that they start to feed into longer-term inflation expectations. In addition, the unprecedented magnitude and nature of fiscal stimulus (much of which sits directly in the hands of consumers), extraordinary monetary policy stimulus, and the Fed’s new average inflation targeting framework (which will allow inflation to run higher than 2% for some time, to make up for past undershoots of its target), also point to more upside risks to inflation relative to the previous cycle.

Core narrative

We remain overweight equities, as our base case is that the delicate dance between the Fed and inflation expectations will keep the economic recovery on its feet, assuming the Fed is able to keep inflation expectations in check and markets and consumers believe the Fed’s ability to do so within its new framework.

But we have rotated portfolios further into cyclical and value-oriented positions while paring back exposure to growth and low volatility factors to reflect our expectations for higher inflation and interest rates in 2021, as well as a steeping yield curve. We expect the Fed to remain on hold through 2022 despite our expectation for higher inflation, as its new policy framework allows it to tolerate a short-term overshoot of its 2% inflation target. This should keep the shorter end of the yield curve anchored, as longer-term interest rates adjust higher to reflect stronger growth and inflation expectations. See our March and April 2021 Capital Perspectives for more details on our portfolio strategies.

We are closely watching for risks in the event that markets and consumers start to expect short-term price pressures to persist. This could trigger a steady rise in longer-term inflation expectations, potentially forcing Fed rate hikes to come earlier.

[1] Committee for a Responsible Federal Budget, COVID Money Tracker, as of April 5, 2021.

Disclosures

Facts and views presented in this report have not been reviewed by, and may not reflect information known to, professionals in other business areas of Wilmington Trust or M&T Bank who may provide or seek to provide financial services to entities referred to in this report. M&T Bank and Wilmington Trust have established information barriers between their various business groups. As a result, M&T Bank and Wilmington Trust do not disclose certain client relationships with, or compensation received from, such entities in their reports.

The information on Wilmington Wire has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The opinions, estimates, and projections constitute the judgment of Wilmington Trust and are subject to change without notice. This commentary is for informational purposes only and is not intended as an offer or solicitation for the sale of any financial product or service or a recommendation or determination that any investment strategy is suitable for a specific investor. Investors should seek financial advice regarding the suitability of any investment strategy based on the investor’s objectives, financial situation, and particular needs. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will succeed.

Past performance cannot guarantee future results. Investing involves risk and you may incur a profit or a loss.

Indexes are not available for direct investment.

Third party trademarks and brands are the property of their respective owners. Any reference to company names mentioned in the podcast should not be constructed as investment advice or investment recommendations of those companies.

Stay Informed

Subscribe

Ideas, analysis, and perspectives to help you make your next move with confidence.

What can we help you with today